If recessions weren't abolished, we might have one

It’s rather ironic that the big miners are thanking the government for axing the mining tax by helping to drive the economy into recession in time for the next election.

Oh, did I just use the ‘R’ word? It slipped out, sorry. Australia has abolished recessions of course; they don’t happen here anymore.

Which is just as well, because if we did still have them, we might just have one.

The terms of trade have now fallen for three years without a rise. The last time something like that happened (but not quite) was 1989 to 1993, which was the last time there was a recession, and 1984 to 1986, when there was a foreign exchange crisis: the dollar hit US48c and the treasurer Paul Keating employed the John Laws megaphone to warn that we risked becoming a banana republic.

This time the dollar hasn’t fallen, even in the past two weeks as the US dollar has appreciated 4 per cent against its index, and GDP is doing quite nicely -- 3.1 per cent real growth, if you please, which is quite satisfactory.

But this time the terms of trade, and therefore national income and, to some extent, the fate of the government, are being caught in the crossfire of an apparent plan by BHP Billiton and Rio Tinto to enhance their iron ore market shares at the expense of Chinese miners.

As discussed a fortnight ago (Iron ore miners’ war of attrition, August 25) the big three iron ore producers -- BHP, Rio and Vale -- are responding to the falling price by increasing production, not cutting it as they normally do when prices fall, and as any self-respecting global commodity cartel would do.

Nothing is being said, but this appears to be designed to drive the high-cost, underground-mining, Chinese iron ore producers out of business, so that BHP, Rio and Vale can divide up their 30 per cent per cent of Chinese iron ore demand between them, and thence entirely control the market.

Two weeks ago the iron ore spot price was $US92 a tonne. Now it’s $US83 and not looking flash. The Chinese miners, along with the smaller high-cost Australian ones, are taking on water and listing to the side. One of them, Western Desert Resources, replete with a glittering board, has sunk, all hands lost.

This is perfectly sensible business bastardry by the big three miners, but the result may be that another gap opens up between demand and GDP in Australia, and this time it won’t be a nice gap.

Between 2002 and 2009, as the terms of trade were booming, domestic final demand growth averaged about 1.6 per cent a year higher than GDP – 5.1 per cent against 3.5 per cent.

The result was that Australians felt -- and were -- richer than economic growth would seem to indicate.

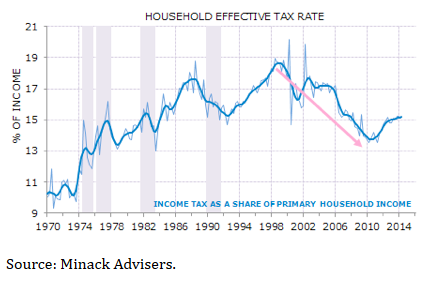

The main way the extra wealth was transmitted was through lower tax rates, as shown by this chart:

That has now reversed because of declining corporate tax revenue and the budget emergency.

More generally, as Gerard Minack puts it: “Australia faces an extended period of low-calorie growth”. That’s because, with a lower terms of trade it will need to produce a higher and higher volume of goods and services in order to maintain real income and consumption.

Moreover, we will need a higher rate of GDP growth to generate the same amount of employment.

So will Tony Abbott be the first Prime Minister since Bob Hawke to preside over a recession? (The last recession finished in September 1991; Keating took over as PM in December).

Probably not. LNG exports and immigration are likely to keep total GDP growth in the black.

But it might feel a bit like a recession next year, especially for consumers and local businesses.

Wages growth will be weak, taxes will continue to rise and government spending will fall, residential investment could weaken as well and, of course, the decline in mining investment is only going to accelerate from here.