Ideas Lab: Webster - a cracking story

Despite what's said about declining birth rates, the Earth remains an epic human factory. Taking sunlight, oxygen, water and an appropriate climate, it's churned out a prodigious number of people: 7.7 billion at last count. There's no end in sight, either. A net 83 million are added each year and, within fifty years, the global population is expected to reach ten billion.

Key Points

-

Southern Hemisphere's largest walnut producer

-

Trading below replacement value

-

Not cheap enough

Each of those humans will need energy - a recommended 8,700 kilojoules per day. That means food - a lot of it. By 2050, global meat consumption is tipped to double, with vegetables, fruit and cereals also seeing increases of over 50 per cent.

That extra food needs to come from somewhere and - whether it be meat, grains or vegetables - it's going to require a lot of water.

Nuts to the world

Webster, the Southern Hemisphere's largest walnut producer, is well placed to meet some of that need. The company was founded by Alexander Webster almost two hundred years ago as a humble pastoral house in Tasmania.

Since then it has had a diverse range of agricultural interests: onions, farming equipment, engineering, salmon and wool to name a few. But today it holds a number of properties in New South Wales's Riverina district, employing one of Australia's largest private hoards of water entitlements to grow walnuts, almonds and cotton.

It boasts a collection of hard assets that provide downside protection: 20,000 hectares of prime irrigated farmland; 350,000 hectares of grazing land; 3,600 hectares of planted walnut and almond orchards - and a further 1,500 hectares that will be the home to orchards in the future. Roaming these lands are 6,000 head of cattle and 40,000 sheep, too.

But the biggest prize of all is Webster's portfolio of water entitlements. Totalling over 150 gigalitres, in a good year the company can quench its thirsty lands with the equivalent of a third of Sydney Harbour.

Rather than buy water on the temporary market like other irrigators, Webster has certainty over its supply by owning the entitlements. This means it's less exposed to spikes in short-term water prices and ensures that even when allocations are low, it has enough water for its orchards. And when allocations are high, it's able to earn bumper profits by using surplus water to grow cotton, or by selling allocations.

Treading water

These water rights are an esoteric asset - but it's worth knowing something about them. Around two-thirds of Australia's agricultural output comes from the Murray-Darling Basin. The water in the basin is important to a range of interests, such as fishing, tourism and environmental and indigenous concerns, and these must be balanced with the needs of irrigators.

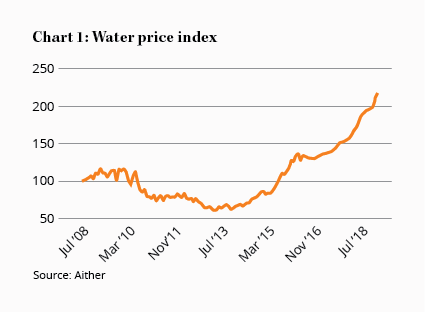

To decide who gets what, water entitlements are traded in a free market; the theory being that scarce water will thereby flow to its best use. But relying on the temporary market can be risky as prices can spike when water is scarce.

The trouble is that it looks like too many entitlements have been issued. Recent mass fish deaths in the Murray-Darling basin have been one result, with dry weather being compounded by excessive upstream diversion. These conditions allowed blue-green algae to proliferate; and when a cold snap finally arrived, killing off the algae, water oxygen levels fell to deadly levels.

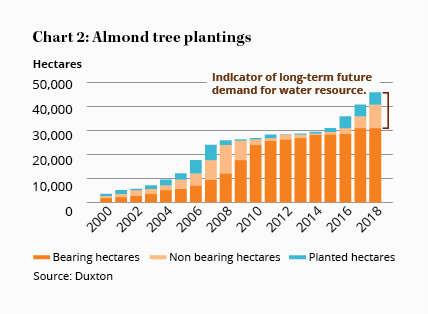

Unfortunately, it's hard to see an easy solution, because demand for irrigation is only going one way. That's not just because demand for food is increasing. It's also because of the type of crops being planted.

Permanent crops like walnuts offer better returns than annual crops such as rice and onions, prompting a wave of walnut and almond orchard plantings. As these trees grow, they become more thirsty. An orchard will use ten times as much water by the time it reaches maturity, eight years later. And unlike traditional annual crops, these trees live for thirty years - so they need water even in times of drought.

Growing demand and poor water flows mean that something has to give. It's looking likelier that the government will act - with the odds of a Royal Commission into the basin rising. We don't claim to be experts, but if they want to restore water to the basin, it seems they only really have two options.

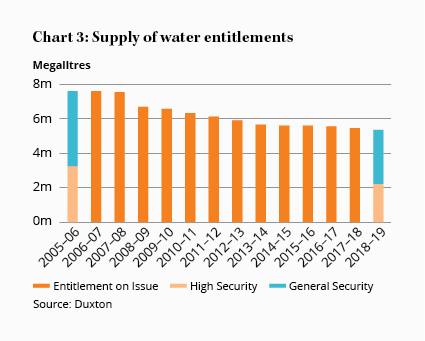

The first is that they confiscate water rights, or permanently set allocations to zero. But irrigators have stumped up big money to buy these rights, and in a capitalist society like Australia, it's an option of last resort.

The more palatable option is that the government uses taxpayer money to buy back water entitlements. In fact, the Commonwealth and state governments have already bought back 28% of all entitlements on issue. It could also be a combination of the two: the equivalent of an 'offer you can't refuse'.

Either way, all signs point to a reduced supply of water entitlements over time. Those that remain are likely to be more valuable - which should be good news for Webster.

Nuts and bolts

Which brings us to where there may be some value. For starters, the company accounts for its water entitlements at cost. So although they're carried on the balance sheet for $160m, at current market values they would cost around $400m to purchase. That's roughly 70 per cent of Webster's market capitalisation.

Then there are the walnut and almond orchards. These orchards are carried at their original cost and depreciated over their life - and they're valued at $61m in the company's accounts. The company owns 3,600 hectares of developed orchard, and bringing virgin land to production requires around $33,000 per hectare in capital investment. We estimate the cost of replicating these assets to be around $120m.

But there's additional value in the orchards beyond their cost. Once the grounds are levelled, water pumps built, the piping and irrigation systems installed and the trees approach maturity - similar transactions have seen these properties sell for around $55,000 per hectare, or $90,000 inclusive of water rights.

As a sanity check, the orchards also earned $11m in operating profit in 2018, and $15m in 2017, on roughly average yields. Taking a simple average of the two, and making a downward adjustment for the price of temporary water (to avoid double counting the value of water) - the $61m of book value implies an operating profit multiple of about 6, which appears cheap, although we should note that the trees will need to be replanted every 30 years or so. That's especially the case given that 1,000 hectares of newly planted trees at the company's Avondale orchard will begin producing this year. Over the next five years, they'll boost Websters nut output by around 50 per cent.

All told, we'd estimate the orchards are worth $150m-200m. Taken together with the water rights, the two might fetch $500m-600m if sold on the market today - roughly the same as Webster's market cap. That means we're getting the rest - 20,000 hectares of developed cotton-growing farmland, $80m worth of cotton and nuts in inventory, farming equipment, infrastructure such as dams, buildings and processing facilities and the cattle and sheep - for free. So, should we load up?

Tough business

Webster has quality locations, a few barriers to entry and some moderate economies of scale. But when most think of quality businesses, agriculture companies don't tend to spring to mind.

That's for good reason - nature doesn't like to make farming easy. Bad luck in the form of hail or diseases like blight can see profits wiped out at random. A severe drought could see Webster's cotton fields and livestock operations lay idle. And the common cockatoo combines above-average smarts with a rapacious appetite for walnuts to wipe out crops if given the chance.

It gets worse for Webster, though, because there's no brand loyalty, constant capital expenditure is required to keep up with competition and it has no choice over its selling price. It's also required to make a lot of upfront investment, with an uncertain payoff in any given year.

And there's also the problem of banking on the water rights. Management believes using them to grow walnuts offers better returns, so a sale is highly unlikely. That means their value is tied to the crops they help produce, not their resale value, although in theory the two should track one another.

The fundamentals appear good for entitlement prices, but should rain once again become plentiful, then entitlement prices could fall as quickly as they've risen. They could also rise, of course - but there is a natural ceiling for these water rights. Should prices get too high, growers will realise it's more profitable to sell the rights than grow anything with them. This all assumes they aren't tampered with by the government, too.

In a nutshell

These risks are offset a little by Webster's ability to earn large profits during periods of good rainfall. But Webster's feast and famine model makes it difficult to forecast. Our best estimate once the Avondale orchards reach maturity in a few years' time is that Webster will earn an average of $40m in net profit. And as the orchards mature, they become less capital intensive, so depreciation should outpace capital expenditure. That means free cash flow should be a little higher than that. These are only averages, though, and it's worth noting that actuals profits will oscillate around this figure - sometimes wildly - depending on weather conditions, commodity prices and water availability.

The stock now trades on a forecast dividend yield of 1.8 per cent and a forward price-earnings ratio of 45. Although if our assumptions are correct, this should come down to around 15 over the next few years. That's not bad given that earnings should grow over time and with the downside protection provided by the assets. However, given a lengthy list of worries, we'd need a very attractive price to compensate us. At the moment, Webster doesn't quite make the grade, and we won't be starting formal coverage.