Ideas Lab: PWR Holdings

The difference between first and tenth place in Formula One is mostly about money, technology, and team management. The difference between first and second, however, could be as meagre as the engine being a few degrees too hot.

Formula One (F1) is a sport where success is measured in tiny increments. Milliseconds, milligrams and a fraction of a degree Celsius make all the difference.

Some of the world's top brands and engineering talent are involved in building an F1 car; Ferrari, Pirelli, and Brembo are household names and boast a cult-like following among enthusiasts.

Key Points

-

Specialist supplier of cooling systems

-

Dominates F1; potential in new markets

-

Quality business, enthusiastic price

To that illustrious list, we can add a small Australian business: Queensland based PWR Holdings provides cooling systems for 90% of teams in F1 and is expanding into other areas.

From humble beginnings in Australian Supercars, PWR has built a glittering global client list and a highly profitable, impressive business. Before we delve into the business itself, we need to know a little about the products they make. Prepare yourself for the exciting world of radiators, intercoolers and oil coolers.

How cooling works

Even the most modern and hi-tech internal combustion engines are inherently inefficient machines. Only about 30% of the power made by exploding the air-fuel mixture inside the engine will make its way to the wheels.

The rest of the energy generated is lost at many points in the process - through the transmission, exhaust and through sound, for example. Most of the energy, however, is lost as heat.

At the point of combustion, engine temperatures can reach over 2,500 degrees Celsius - about half as hot as the sun. Water, oil and gases all need to be cooled to avoid car engines ending, like the sun, in a fiery blaze.

To do this, a series of cooling systems are used; radiators help cool the engine, intercoolers cool compressed air used in turbochargers and oil coolers tame soaring oil temperatures.

The basic design for most cooling systems is the same. It involves moving coolant around hot areas to absorb heat, then moving that coolant around a radiator to expel heat.

Although this sounds simple, the design of the radiator and the small details such as its shape, size and associated 'fins' (used to expel heat) are all complex design and must be built meticulously to fulfill multiple, often competing, aims.

High speed, high skill

For high-performance cars, cooling is made more complex because heat levels are higher and because there emerges a trade-off between cooling efficiency and effective aerodynamics.

The most effective cooling requires large, open faces in the car's design. Yet cavities in the body of a car will harm aerodynamics and limit performance. Managing that trade-off - between cooling and aerodynamics - generates a unique opportunity for a small, nimble business.

In consumer car fleets, a single radiator design is used and replicated millions of times. Success depends mostly on manufacturing scale, while low costs win contracts.

In racing, particularly F1, radiator designs are different for every car and every track. Some tracks may involve long straights and need better aerodynamics; others generate higher corner speeds that need more effective cooling. Cooling systems for race cars are bespoke.

Each has to be built specifically for a single car and a single circuit. PWR is embedded into teams at the start of the season so that its designs can be integrated into the car.

PWR's customers don't require volumes of radiators built at scale. Cost offers no advantage. Instead, customers demand innovative designs that can be quickly tested and turned around.

A small, innovative and nimble business will hence outdo a large, low-cost maker of standard cooling systems. That's how PWR is able to outfox bigger competitors and collect high margins even when their unit costs are higher.

The business won its first F1 contract just ten years ago but has been so effective that its older, established rival, a UK-based aerospace business that cools the space shuttle, has exited F1 altogether. PWR now has an effective monopoly on third-party cooling in the sport.

Mission critical

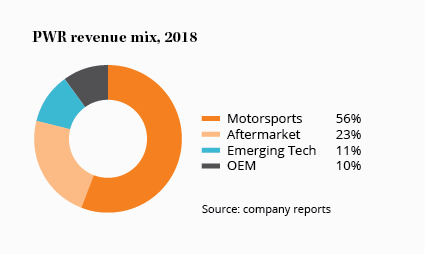

Motorsports, and F1 in particular, is key to the business. Not only are the bulk of profits made here (see Chart) but the technical demands and marketing renown allows it to enter other sports. The company has recently entered the NASCAR market while World Rally has been another target.

| 2014 | 2015 | 2016 | 2017 | 2018 | |

| Revenue ($m) | 22.5 | 32.5 | 47.3 | 48.1 | 51.9 |

| EBITDA ($m) | 9.2 | 13.0 | 16.8 | 14.7 | 17.5 |

| EBITDA margin (%) | 41 | 40 | 36 | 31 | 34 |

| NPAT ($m) | 5.8 | 8.9 | 8.7 | 9.2 | 11.0 |

| NPAT margin (%) | 26 | 27 | 18 | 19 | 21 |

| Net Assets ($m) | 6.7 | 5.2 | 36.7 | 41.0 | 46.5 |

| Net debt ($m) | nil | 22 | (8) | (8) | (12) |

| ROE (%) | 87 | 171 | 24 | 22 | 25 |

There are over 80 motorsports that could potentially benefit from PWR systems. Then there are high-end amateur sports where modified cars need to be matched with enhanced cooling, while boat sports use the same technology.

All counted, the potential market size is likely in the billions. PWR's revenue is less than $60m and it has already built a formidable reputation.

A key attraction of the company is that it supplies critical components that are relatively low cost. Effective cooling can be the difference between winning and losing. Designs don't get awarded on cost and customers are willing to pay for tiny incremental changes.

A top F1 team will spend less than $1m a year on cooling systems - peanuts against team budgets in the hundreds of millions of dollars. Ferrari alone has a team budget of over US$400m. Even the lowliest ranked team spends more than US$50m a season.

Racing ahead

Revenue has grown strongly in motorsports. This is partly because the business has pushed into new sports - it entered NASCAR in only 2015 - but mostly because F1 itself has grown.

Now in private equity hands, the number of teams and races in F1 has grown relentlessly, and each car now utilises more cooling systems than ever, especially as hybrid systems are introduced.

The potential of the business, however, doesn't end in Motorsports. The company also supplies the hypercar market where exclusive cars in limited numbers sell at outrageous prices.

Think limited edition Aston Martins, Ferraris and Bugattis that cost over US$1m apiece. These cars come with contracted production runs and PWR is the supplier of choice.

There is also potential, however, to use decades of learning in new applications. The business has set up an Emerging Technology division working on battery cooling for electric vehicles, cooling for military applications and even for data centres. It's an area of the business that could yield huge growth over time and where revenue is already being earned.

There are several risks to consider as well. Primary among them is that designs aren't protected by patents and, because the business survives on its smarts, a smarter competitor could one day usurp it.

For now, that seems a distant risk. Its substantial research efforts are underwritten by motorsport revenues and its reputation is good enough to attract young enthusiast engineers. Graduates in fluid dynamics and mechanical engineering want to work on Ferraris, not on Fiats.

Management appears well incentivised and sensible. The founder, Kees Weel (fitting for an automotive business, isn't it) retains 29% of the company and key management have longevity and strong track records.

A founder-led business that creates best in class products and generates outstanding returns with no debt ought to be a strong candidate for buying now. Yet valuation is hard to ignore.

Is the price right?

PWR trades on a heady enterprise value to earnings before interest, tax, depreciation and amortisation (EV/EBITDA) multiple of 23 and a PER of 35. Those are large numbers for a business with limited operating leverage and where every dollar of revenue is contestable.

It's worth noting that, because of the highly customised nature of its work, margins are unlikely to expand with revenue. This business won't scale well and, as it grows, it may in fact face higher costs in new manufacturing facilities.

Margins are, however, extraordinarily high. EBITDA margins of 30% are twice those of peers that supply the automotive sector and returns on capital exceed 20%. While these are exceptional, low inventory turn and bespoke products probably justify exceptional economics.

This is a high-quality business with excellent management and an outstanding track record. Within ten years of winning its first F1 contract, they now supply 11 out of 12 teams and have credible growth plans in huge new markets.

It's a business we would love to own, but not at any price. PWR is on our watchlist and we await a lower price before making our move. Running too hot, after all, can be calamitous.