Ideas Lab: No sugar coating for EBOS

There aren't many century-old businesses on the ASX with $7bn in revenue that you've never heard of. EBOS Group, however, might be a contender.

EBOS is a distributor and wholesaler of medical and pharmaceutical products to pharmacies and hospitals. The largest in Australia and its homeland, New Zealand, in fact, with a 40% share in the former and 60% in the latter.

Key Points

-

Australia's largest healthcare distributor

-

Government regulated prices and barriers

-

Price doesn't compensate for the risks

What's more, EBOS will surely be a beneficiary of the 'ageing population' that's powering companies like ResMed and Cochlear. The Bureau of Statistics expects one in four Australians to be over 65 by 2050 - with more people over 85 than today's total population of Western Australia. Demand for medications is likely to grow in the low- to mid-single digits for several decades, so EBOS has a formidable tailwind.

EBOS isn't your typical healthcare stalwart, though. In fact, you might argue it's barely a healthcare stock at all. When you get to its core, EBOS bears more resemblance to a logistics operation like UPS or DHL than to healthcare stocks like ResMed and Cochlear.

Aside from a few branded products that we'll touch on later, what Cochlear and ResMed have that EBOS doesn't is intellectual property.

Cochlear and ResMed do the research, get the patent and manufacture their products. They're the ones that put the value into their respective value chains. In contrast, EBOS is merely a distributor. The value it adds is in moving a boatload of pills from a big warehouse to stand-alone pharmacies, and doing so reliably and cheaply. While that process is essential to the healthcare supply chain, it's also replicable by competitors, making competition intense.

Government mandates

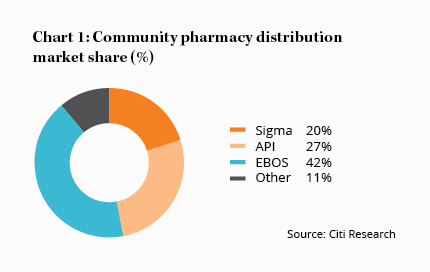

Nonetheless, there are significant barriers to any upstarts wishing to enter the pharmaceutical distribution industry, which is an oligopoly between EBOS, API and Sigma.

Pharmaceutical wholesaling is highly regulated. Most of EBOS's revenue is derived from the Pharmaceutical Benefits Scheme (PBS), which is the Government's program of subsidised prescription medicines.

The mechanics of drug pricing is more than you need to know for this review, but to summarise: the cost of a drug is negotiated between its maker and the Department of Health. This cost then becomes the basis for the dispensed price, which includes a mark-up for wholesalers, as well as for the pharmacist. The price of prescription medicines is essentially set by the Government, with wholesaler margins fixed at 7%. And that's why, after you factor in other operating costs, EBOS earns a pitifully low profit margin of 2%.

If that wasn't bad enough, the Government has been reducing PBS prices in recent years to help contain the healthcare budget. In 2018, PBS spending fell 3% despite a 1% increase in prescription volumes, suggesting average price cuts of 4%.

If that wasn't bad enough, the Government has been reducing PBS prices in recent years to help contain the healthcare budget. In 2018, PBS spending fell 3% despite a 1% increase in prescription volumes, suggesting average price cuts of 4%.

That makes EBOS's economies of scale not only a competitive advantage but a necessity for survival. Due to the significant fixed costs associated with running a distribution operation - trucks, warehouses and the like - EBOS has an edge over its competitors. Because EBOS has a dominant market share, the company's average 'unit costs' are lower. It can spread fixed costs over a higher volume of deliveries.

We saw this advantage in action when EBOS won the $1bn a year contract to supply PBS drugs to Chemist Warehouse's 450 stores, which starts on 1 July. This contract adds around 10% to the company's market share (we've already factored it into the figures mentioned above) but it also carries risks.

For one thing, it was Sigma who decided against renewing the contract, rather than Chemist Warehouse, with the company saying that the contract didn't meet its hurdle rate of return.

We don't know the fine print, but this suggests it's probably an ultra-low margin contract and will contribute a lot less growth to EBOS's bottom line than the 14% kicker to revenue. EBOS does have lower operating costs than Sigma, so that's not to say that the Chemist Warehouse contract can't offer the company satisfactory returns on capital, but this apple won't have a lot of juice.

Animal Care

EBOS has also built a highly profitable Animal Care division, which delivers animal care products to specialty retailers. It includes the Black Hawk pet food manufacturer as well as a 50% stake in the Animate pet care chain.

Unlike EBOS's pharmacy business, the Animal Care division doesn't have fixed prices or a lot of regulation. The company mostly owns respected pet brands and can charge a premium at the checkout counter. Operating margins are substantially higher and have been expanding as the division grows, thanks to operating leverage. So while Animal Care only contributes around 5% of revenue, it delivers 17% of earnings before interest, tax, depreciation and amortisation (EBITDA).

Unlike EBOS's pharmacy business, the Animal Care division doesn't have fixed prices or a lot of regulation. The company mostly owns respected pet brands and can charge a premium at the checkout counter. Operating margins are substantially higher and have been expanding as the division grows, thanks to operating leverage. So while Animal Care only contributes around 5% of revenue, it delivers 17% of earnings before interest, tax, depreciation and amortisation (EBITDA).

Better yet, Animal Care has been growing faster than the Healthcare segment. Sales of the company's branded pet food products are increasing rapidly - at more than 15% a year - but they are still a small slice of total revenue, in the low-single digits. Overall, the division is likely to continue outpacing the rest of the company in sales growth, so we expect overall margins to expand slightly in the short term.

Conclusion

EBOS has a good track record of acquisitions - having bought 20 or so smaller competitors since 2000 - and growing its branded and animal care products. These two factors combined with growing demand for prescription medicines make it easy to imagine profit growth of 5% or more if margins remain stable.

That's a big 'if', though. EBOS faces two main dangers, one from within the industry and one from without. The first is Government pressure on PBS pricing. Regulation and controlled pricing has its perks but the company has no negotiating power against its main supplier. Zilch. That introduces risk and small pricing changes can have a large impact on EBOS's profitability given its paper-thin margins and fixed costs.

The second danger isn't an immediate one, but still needs to be considered: the possibility for manufacturers to bypass EBOS altogether. Large drug makers may eventually choose to distribute directly. Pfizer, for example, made the switch a few years back. Amazon, too, has suggested pharmaceutical distribution is an industry in its sights - at least in the US - buying a large online pharmacy last June.

EBOS's valuation doesn't look demanding for a company with stable revenues and decent growth prospects, having a forward price-earnings ratio of 23 based on consensus estimates for 2019 earnings. Nonetheless, we think the healthcare wholesale and distribution industry is ripe for disruption or deregulation. Those risks are hard to quantify - and when you have a business that earns a 1-2% profit margin, there's little room for error. We'll be watching EBOS from the sidelines.