Ideas Lab: Did you miss the cannabis craze? Check out this opium stock

This is the second time we've covered TPI Enterprises, both times with the stock ending up on the 'too hard to call' pile. So why are we putting you through this again? Simple - there just aren't many stocks out there that could conceivably go up 10 times.

Between 2001 and 2015, we occasionally drew your attention to special situations that, for one reason or another, didn't make the cut for our active coverage list. These oddball stocks were part of our 'Ideas Lab' series, but this was discontinued in 2015. It's time to bring back the lab coats, and reintroduce the category.

Key Points

-

Profitability will build rapidly

-

Large market, low-cost producer

-

High-risk operating model and outlook

TPI is an interesting business with what could be a long and profitable growth runway. The company, mind you, is loaded with risks and hurdles. If you dislike small companies with no history of profitability, feel free to stop reading.

If, on the other hand, you feel that speculative biotechs and small-cap miners don't offer enough adrenaline, TPI may be worth getting to know.

This review is not a recommendation to buy the stock and we don't intend to provide ongoing coverage. Nonetheless, we thought TPI made a fitting addition to our resurrected Ideas Lab.

Progress report

To refresh your memory, TPI is one of only eight licensed processors worldwide of narcotic raw material (NRM). The company buys dried opium poppy straw from Australian farmers and extracts a bounty of alkaloids, such as morphine, codeine and other base ingredients that are refined by pharmaceutical companies into drugs such as Panadeine.

| Year to 31 Dec | 2018 | 2016 |

|---|---|---|

| NRM (tonnes) | 41.0 | ~7.0 |

| Revenue ($m) | 46.2 | 10.5 |

| EBITDA* ($m) | (2.4) | (11.2) |

| Net profit ($m) | (5.8) | (14.0) |

| Net debt ($m) | 21.0 | 27.4 |

| Share price ($) | 1.00 | 2.30 |

| *2018 Q4 EBITDA of $1.7m | ||

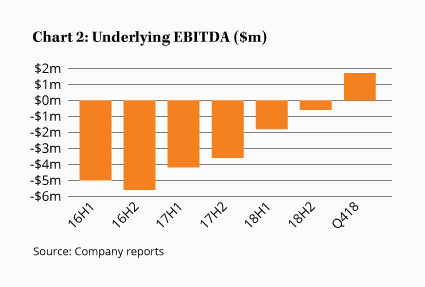

When we introduced you to TPI in early 2017, the company's financial statements were awash with red ink. TPI had revenue of $11m in the year to December 2016 but had double that in expenses - you can see the details in Table 1.

Two years later and the company is in far better shape: production of NRM has sped up; revenue has quadrupled; and, for the first time, the company broke even in the final quarter of 2018 with EBITDA of $1.7m.

The opportunity

TPI is the start of a global supply chain that produces $16bn a year of opiate painkillers. The industry has been growing in the low-single digits since the 1990s, with rapid growth in some countries offsetting declines in others - use of opiate-based medications has quadrupled over the past decade in Australia, for example, whereas it's down 25% or so in the US. The US remains the world's biggest opioid consumer, with per capita usage some 60% higher than any other country.

Current global demand is for around 1,100 tonnes of NRM a year. However, more than 5 billion people worldwide don't have access to adequate pain medications, according to the World Health Organisation, so there's a large market eager to get its hands on more NRM - at the right price.

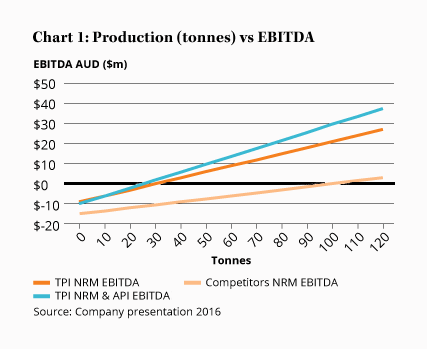

Here's where the bull case for TPI really starts to fire up. As we explained in Does TPI have the seeds of success?, the company has developed a low-cost, water-based process to extract the active ingredients from poppy straw. The cost advantage relative to the rest of the industry - which uses traditional solvent-based techniques - is significant: TPI estimates that it costs the company around $100 to extract a kilogram of NRM from raw poppies, compared to around $300 for competitors, the main two being Tasmanian Alkaloids and Indian-owned Sun Pharma, which together account for around half the industry.

TPI doesn't have an edge in the rest of its cost base, such as freight and labour, but we believe the cheaper extraction process still gives the company a 10-15% production cost advantage at current levels.

A further benefit of TPI's method is that it's the first and only NRM extraction process that doesn't require the dumping of harmful solvents into the environment.

Rolling, rolling, rolling

NRM is a 'commodity product' so there's nothing to distinguish the output of one manufacturer from another. Large pharmaceutical companies go after the lowest price, but they are usually locked into contracts of 3-5 years.

TPI's Melbourne factory opened in 2016 and is rapidly increasing production and becoming more efficient. Poppy straw throughput increased 70% in 2018, all while cost cuts and fewer staff meant overheads fell 16%.

TPI's Melbourne factory opened in 2016 and is rapidly increasing production and becoming more efficient. Poppy straw throughput increased 70% in 2018, all while cost cuts and fewer staff meant overheads fell 16%.

This snowball has only just started rolling. If TPI's low-cost extraction is all it's cracked up to be, the company could increase market share significantly over the next few years as pharmaceutical companies are released from old contracts and shop around for a new supplier. We're already seeing the start of that, with TPI signing two large multi-year contracts in 2018 that are collectively worth $24m.

Management's target - which is not the same as official guidance - is to produce 100 tonnes of NRM in 2019, up from 41 tonnes, and for sales of active pharmaceutical ingredients to rise 80%. Let's take a conservative stance and say the company falls short of that goal - it has a history of doing so - but achieves 60 tonnes of NRM and a 30% increase in revenue to $60m.

TPI's fixed manufacturing costs mean the income statement improves dramatically from here. That level of revenue might be expected to generate around $15m-18m in EBITDA; net profit could hit $10-13m in short order, or 12-16 cents in earnings per share. Return on capital would be around 20%.

The long-term flashes even more dollar signs. TPI's 2021 production target is for 200 tonnes of NRM - an 18% market share - which could garner $200m in revenue. Net profit of $30m and 36 cents of earnings per share wouldn't be surprising if it achieved that level - suddenly, a share price of $5.00 isn't as crazy as it sounds.

And if TPI eventually takes a third of the NRM market - remember there are only seven competitors and TPI is the lowest cost producer - production of 400 tonnes and a $10 share price is possible. TPI would then have a market cap similar to the rumoured $800m sale price of its larger competitor, Tasmanian Alkaloids, when it was sold to a private equity group in 2016. Tasmanian Alkaloids currently accounts for around a quarter of the NRM market.

The hazards

Before you get too excited, though, a lot can go wrong with that story. Indeed, it probably will. For one thing, there's a good chance demand for opioid drugs will decline in the next few years. Many countries, and especially those in North America, have experienced significant increases in opioid overdoses since 2015. In the US, opioid overdoses killed 70,000 people in 2018, double the figure from 2010.

In response, the US Drug Enforcement Administration announced cuts to production quotas for opioids last October. The plan seeks to reduce prescription fills by a third over the next three years, which - if successful - will reduce demand for NRM. The US accounts for three-quarters of global opiate painkiller sales by volume and even more by value. This is a big reason TPI's share price has fallen 30% since October.

In response, the US Drug Enforcement Administration announced cuts to production quotas for opioids last October. The plan seeks to reduce prescription fills by a third over the next three years, which - if successful - will reduce demand for NRM. The US accounts for three-quarters of global opiate painkiller sales by volume and even more by value. This is a big reason TPI's share price has fallen 30% since October.

Another threat to the company is its inability to manage supply and demand due to regulatory burdens. NRM production is tightly monitored by the International Narcotics Control Board, which tracks security and production. This United Nations body restricts companies from holding large stockpiles of NRM for fear that it could leak into the illegal market.

At its core, TPI is an agricultural company, but one that can't build a safety net for poor harvest years. This problem is partially mitigated by TPI's ability to import poppy straw from other countries, but it still sets the company up for a boom and bust cycle in profitability - in years of good harvest, the price of poppy straw will fall and boost TPI's gross margin, but in other years the company may experience supply shortages and rising raw material prices, which would kill profits due to the business's fixed costs.

What's more, the risk of obsolescence is real. We aren't experts on TPI's technology - as you might expect, security and trade secrets are taken seriously in this industry, so we mostly have to take the company at its word. TPI's competitors are no doubt researching cheaper extraction processes, too. TPI has a comparative advantage now, but the industry's large incumbents have research budgets far bigger than TPI's. It's only a matter of time before they create their own efficient technology - the question is how much market share TPI can build before they catch up.

The danger signs continue: at $21m, the company has significant net debt, while free cash flow, for the time being, is non-existent; there's an ongoing patent dispute over TPI's use of some high-codeine poppy strains; and TPI will probably need to raise capital again if it hits a speed bump or management wants to build another factory to meet demand.

TPI has made significant progress since we looked at it a couple of years ago. The share price has more than halved and, all things considered, the stock looks undervalued. However, TPI has a long list of risks and, if you choose to invest, it should only make up 1-2% of your portfolio - this is a stock that could easily end up being worth nothing.

As we mentioned earlier, with a market cap of only $80m, TPI is too small for us to publish an official recommendation and we won't provide continued coverage. However, for those prepared to do their own research and who are comfortable with high-risk stocks, it might be worth considering.