How to play your investment Trump cards

The Trump effect has valuable lessons for investors

Ever felt you were stuck in an Escher drawing just before taking that final step, on the edge of recognition, a dawning sense of knowing you are not where you expected to be but without a clue as to how you got there?

As I watched the polling probabilities switch on the New York Times website, away from common wisdom and toward a random walk up Capitol Hill, that feeling came to mind. I can't imagine how Clinton or Trump, a man I'm not even sure wants to be President, must have felt as they emerged from a back-breaking 18-month campaign, both in a place they could not have reckoned on.

To say that the markets were fooled would be like calling Joseph Stalin a bit of a lad. The discombobulation was quite something.

Before voting got underway, Fairfax reported that US stocks were rallying on an expected Clinton win. Then, as results started to come in, at 10.22pm (US time) on election night Fortune published Stock markets are starting to freak out about a Donald Trump victory. Although US markets were closed, futures for the S&P 500 were down 4 per cent and the Nikkei had fallen 5 per cent in early trade.

So far, so rational. Wall Street had heavily backed a Clinton victory with hard cash, a point not lost on Trump voters. Not one Fortune 500 CEO had publicly supported him, despite the carrot of a huge cut in corporate taxes. Markets hate uncertainty and, with Clinton a known quantity and Trump perhaps too well-known for his own good, the finance academics would have sagely nodded as the early Florida vote counts rolled in. Clinton good; Is Don is bad.

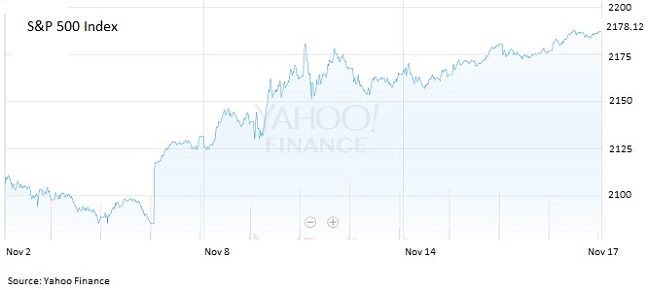

Not 12 hours later when the result was known, Bloomberg published US stocks surge as banks, drugmakers rally amid Trump victory. The US market ended the week up almost 5 per cent, the best performance since 2014. The Dow rose on each day of the week the election was held, on Monday and Tuesday when Clinton was expected to win and then on Wednesday, Thursday and Friday after she lost. That's rational markets for you.

Maybe the surge in bank stocks made sense – Trump intends to repeal regulations in the sector, which worked out really well last time, so why not? But surely not the rest of it. It turns out that a new US president is good, no matter who it is. We could have had Donald Duck rather than Donald Trump and it might have had no impact. Looking at the chart of the S&P 500 over the past two weeks, a flash crash seems a better explanation for it than a change in President.

There's little point trying to make sense of this. Trump wasn't one of Nassim Taleb's black swans but he was a dark horse, making entire professions, from the media to pollsters and the parties themselves, look foolish. And now all those that got their predictions wrong will spend the next few months telling us what Trump's election means for the future.

I have no idea what happens next, although the contributions from Callam Pickering and Robert Gottliebsen this week will have given members a better idea than most. But there are a few things investors should note, not in the results themselves but in the backwaters of the campaign and the bond market's reaction to the result.

The big take for investors

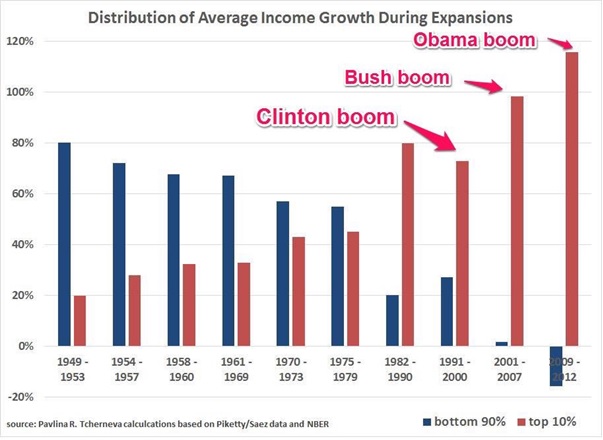

First, to the explanation for the Democrats' loss, which does have implications for investors. Much of the coverage suggests the blame lies with sexists, racists and anti-immigrants. This seems a bit superficial. What reason is there to believe there are more of these characters around now than when Obama was re-elected four years ago? This chart might offer a more thoughtful explanation.

For decades, middle America has watched the richest in society take most of the gains from economic growth. Inequality and a desire to wreck the joint could be a better explanation for swinging voters going with Trump than any inherent racism or sexism, although there was some of that, too.

Data from the Social Security Administration shows that 38 per cent of all American workers earned less than $US20,000 last year. The federal poverty level for a family of five is $US28,410. Incidentally, figures this week from the ABS show wages growth of 1.9 per cent over the past year, half what it was four years ago and the lowest on record. Without a middle class that has disposable income, countries don't grow by much, mainly because the rich tend to accumulate assets with their excess cash while the poor and middle class spend it. And you can't spend what you don't have.

This trend, repeated across the Western world but especially in the UK, is a reversal of what many members would have experienced in their youth. The post-war boom, which led to a huge and prosperous middle class, is now beginning to look like an outlier. It's possible Trump's appeal was in the implicit promise, sincere or otherwise, to reverse this trend.

These figures may be an expression of something bigger, a reversion to the mean that should cause all investors to reconsider their take on what makes for an acceptable return. In The Rise and Fall of American Growth: The US Standard of Living since the Civil War economist Robert Gordon makes the argument that recent technological advance hasn't boosted labour productivity in the way of earlier inventions like electricity and plumbing. To quote Peter Thiel, Silicon Valley venture capitalist and new member of Trump's inner circle, “we wanted flying cars but instead we got 140 characters”. You might like to retweet that.

Says Gordon, “Future growth in real GDP per capita will be slower than in any extended period since the late 19th century, and growth in real consumption per capita for the bottom 99 percent of the income distribution will be even slower than that.” Growing inequality is one reason why he expects real GDP growth to be less than we have come to expect. Slowing population growth (not here, obviously), higher education costs, lower student performance and a huge debt overhang add to the argument.

For investors, this a picture of an unfamiliar future world. In the long run, average asset price growth cannot outstrip real GDP growth by much. Unless each of these problems are addressed, we may have to get used to returns lower than we have come to expect.

The great bonds revival

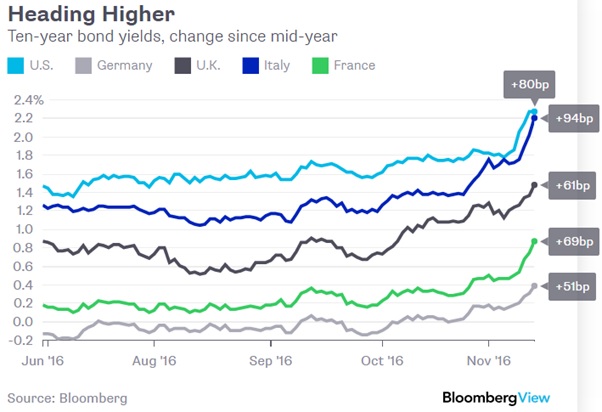

From a big picture issue to a small one: The bond market reaction to Trump's victory has been astounding. Even before the election 10-year bonds were heading higher, which is why bond proxies like AREITs and infrastructure stocks have been hammered. That theme took a surprise turn upwards in the days after the election, prompting calls that the days of ‘lower for longer' were over.

Well, we'll see about that. The US futures market estimates that there's a 92 per cent chance of a rate rise next month. A Trump government – blimey, never thought I'd write that – might engage in some deficit spending but at this stage, with conventional Republicans much less disposed to pump priming, no one knows. With inflation in Europe rising and the UK considering fiscal stimulus, the rise in bond yields might be simple relief at the receding threat of deflation.

Volatility to prevail

All of this is yet more supposition. Trump won't be inaugurated until January and we may not know what he'll actually do until months after. In the meantime, expect volatility. During the 1990s, US Treasuries yielded an average of 6.7 per cent a year. In the following decade the figure had fallen to 4.5 per cent. With yields still less than 2 per cent in most countries, a rapid return to rates of prior decades seems a bit of a stretch, especially if Robert Gordon is right. There's no need to panic about those mortgage rates just yet.

All of which is to suggest that much of the energy, intelligence and words devoted to predicting future economic performance, interest rates and stock prices are wasted. As the US election shows, we're kidding ourselves if we think we have a handle on what the future holds, although that doesn't stop careers being built on ex-post rationalisations of it.

Your protection against future adverse events is best achieved through buying good businesses at attractive prices, not in trying to predict what those events might be.

Readings and Viewings

After last week's shock US election result, the Trump dust is still settling. We don't want to become fixated on every move, but it can't be ignored either. So here's a few items from the week worth reading, and then we'll move on to some other interesting snippets.

Firstly, Fed chair Janet Yellen has made it clear her team isn't going to be pushed into a Trump corner on interest rates.

And nor are hundreds of major US businesses over climate change -- that is, the US commitments to combat climate change.

There's no doubting that Donald Trump has his business critics, and his avid backers. So two financial heavyweights went into the ring this week to fight it out.

There's a lot of anxiety over what Trump will do around US trade deals, and the talk is that a well-known trade critic is being courted.

The biggest fear, of course, is what will happen with the world's second-largest economy (by a smidgen), China. Starting a trade war with the Chinese is a really bad idea.

Anyway, enough on Trump for now. The fallout from the Brexit election result in June is still unfolding. Is a new UK alliance looming between Church and State?

Still in the UK, it seems UK property investors will face tough new mortgage affordability tests from next year. Not a bad thing, of course.

And RBS faces a settlement with the US Justice Department over claims it mis-sold toxic mortgage securities in the run-up to the financial crisis of 2008.

Separately, JPMorgan has been forced to pay $US264 million to settle a federal bribery case.

In other business developments, electric-car maker Tesla has been given the green light for the $US2 billion purchase of SolarCity Corp.

Telstra is in the firing line over the NBN.

During the week, Whangaparaoa (a town near Auckland) became the world's first destination for pizza deliveries by drone.

In the spirit of deliveries and innovation, Deliveroo has now formed a partnership with Heineken to offer home-delivered booze.

And in British Columbia, Canada, one can now get a beer and a shave at the same time.

Are things going to pot in Canada? Based on marijuana share prices, it seems so.

If your dream is just to be richer than society, South Africa and India are great bets.

Lastly, our recipe for this week is a Weekend Pleaser, leek and mushrooms on toast.

Last week

Shane Oliver, AMP Capital

Investment markets and key developments over the past week

- The past week saw most advanced country share markets, bond yields and the $US continue to push higher as investors continue to focus on prospects for fiscal stimulus and deregulation under a Donald Trump presidency. Australian shares gave up a bit of their 3.7% surge from the previous weak though, emerging market shares remained under pressure from the rising $US and commodity prices were mixed. The rising $US saw the $A fall below $US0.74 which is good news for the RBA.

- It's still early days but the past week provided a bit more evidence that we are more likely to see a pragmatic Donald Trump as president (focussed more on positive measures to boost growth - tax cuts, infrastructure spending and deregulation) rather than a protectionist populist. To be sure some of his appointments have raised question marks and some action on the trade front looks inevitable but his appointment of a Republican establishment figure as his Chief of Staff and his watering down of commitments around the Affordable Care Act, the wall with Mexico and deporting illegal immigrants suggest he is likely to be more moderate than his campaign rhetoric suggested. As such while risks on the trade front are high we remain of the view that his stimulatory policies on balance are likely to be neutral to positive for advanced country equities, positive for commodities, positive for the $US as the Fed is likely to tighten by more and negative for bonds and some emerging market shares (as a rising $US creates dollar funding concerns). Of particular note though:

- The last two big cyclical surges in the $US in 1981-85 and 1997-2001 were actually good for US shares with the S&P 500 index up 50% and 80% respectively.

- European and Japanese equities will be particular beneficiaries of a rising $US - maybe not so much Europe in the short term given short term risks around Italy and Austria (see below) but particularly Japanese shares which get the benefit of a falling Yen but are not seeing the same upwards pressure on bond yields because of the Bank of Japan's commitment to cap JGB yields at zero which in turn is amplifying downwards pressure on the Yen.

- Upwards pressure on bond yields (made worse recently by an unwinding of long bond positioning) is likely to become more gradual as the rise in the $US at a time when other central banks are a long way from tightening will help limit how quickly the Fed will raise rates.

- Cyclical share market sectors are likely to continue to outperform bond proxies such as REITs. This will remain evident in the Australian share market too.

- Will President Trump replace Janet Yellen? There is much talk he will replace her with a more hawkish “hard money” chairperson. However, she is answerable to Congress not the president and her current term does not end until the end of January 2018 (until which she has indicated she intends to stay) but by which time Trump may well conclude that it's in his own interest to retain a more dovish Fed leader for fear that a more hawkish Fed would offset the benefits of his stimulus program via even higher interest rates, bond yields and a $US. So it's premature to conclude he will replace Yellen.

- The geopolitical focus is now shifting back to Europe with the upcoming referendum on reducing the power of the Italian Senate and the Austrian presidential election both on December 4 refocussing attention on Eurozone break up risks. Opinion polls in Austria are pointing to the election of the Euro-sceptic right wing candidate - and although the president is largely ceremonial his election could add to anxiety about the threat to Europe. Italy is more significant though - the Senate referendum coming on the back of reforms to the lower house of Italy's parliament are designed to make Italy more governable and clear the way for long needed economic reforms. (Just what Australia needs!) Opinion polls are now leaning to a "No" vote. A "No" vote would probably see PM Matteo Renzi resign with fears that this will lead to an early election with the Euro-sceptic Five Star Movement (5SM) winning, calling a referendum on Italy's membership of the Eurozone which would then see Italy move to leave. As a result bond yields in Italy have blown out on fears that at some point Italian debt will be redenominated into a less valuable currency. These fears are likely exaggerated though: the referendum's failure would just mean messy politics as normal in Italy, it's unlikely there will be an election before the due date in 2018, even if there was it's not clear that 5SM would win (its poll support is no longer rising and its below support for the governing party) and even if it did and called a referendum on Italy's membership of the Euro a majority of Italians support staying in the Euro. That said markets may still worry about what would happen if there is a "No" vote. So it could cause short term volatility but I suspect another bout of share market weakness on Eurozone break up fears would prove to be yet another buying opportunity just like over the last five years.

Major global economic events and implication

- US data was mostly solid. Retail sales rose more than expected in October and were revised up for September indicating that the consumer is kicking into gear, while industrial production was soft in October regional manufacturing conditions indexes suggest little reason for alarm, solid home builder conditions and strong housing starts point to solid housing investment and jobless claims remain low. Meanwhile headline consumer price inflation continues to rise as the impact of the fall in energy prices falls out, but producer price inflation and core CPI inflation was softer than expected. Finally, Janet Yellen's testimony provided no surprises indicating rates will likely rise "relatively soon" but that the process of rate hikes would remain "gradual". Bottom line: US growth looks to be running around 3% in the current quarter consistent with the Fed hiking rates in December, for which the money market is now attaching a 98% probability.

- Eurozone GDP growth remained moderate at 0.3% quarter on quarter/1.6% year on year in the September quarter as widely expected. Business conditions PMI's and confidence readings point to some pick-up in growth ahead.

- Japanese GDP growth surprised on the upside for the September quarter with strength in exports, housing investment and public spending. Last year's volatility has given way to more steady growth this year with stronger consumer spending likely to help growth going forward.

- Chinese economic activity indicators were mixed in October with slower retail sales (albeit 10% yoy ain't bad), steady industrial production at 6.1% yoy and a pick-up in fixed asset investment helped by property investment. Having just returned from China the one thing that struck me is that it's as busy as ever. If you are waiting for the hard landing long predicted by the China bears it's a bit like "waiting for Godot".

Australian economic events and implications

- In Australia, the minutes from the RBA's last Board meeting offered nothing new and a relatively upbeat speech by Governor Lowe indicated that the Bank is happily on hold for now but labour market softness highlights that's it still too early to rule out another interest rate cut next year. Employment rose in October driven by a gain in full time jobs but left in place a very weak trend for full time jobs consistent with continuing very high underemployment. This in the September quarter resulted in a new record low for wages growth of just 1.9% yoy. The risk is that this in turn will result in lower inflation than the RBA is allowing for and combined with a slowing in the housing sector, upwards pressure on bank mortgage rates from rising funding costs and a still too high $A will drive another rate cut. Bottom line: while global bond yields are on the rise on prospects for stronger US growth and a tighter Fed and this will likely see the Australian interest rate cycle turn up in 2018, we are still allowing for another RBA rate cut in the first half of next year.

Shane Oliver is head of investment strategy and chief economist at AMP Capital.

Next week

Craig James, Commsec

Quiet week in Australia; Shortened-trading week in the US

A quiet week is in prospect in Australia. But despite Thanksgiving occurring on Thursday, there is plenty on the radar screen in the US.

The week kicks off in Australia on Monday when the Commonwealth Bank releases the Business Sales Index (BSI) – a measure of economy-wide sales. The index is derived by tracking credit and debit card transactions across the CommBank Group. And it is a broader measure of spending than the retail sales data from the Australian Bureau of Statistics (ABS). That is, it covers consumer, business and government spending and includes activities such as autos, hotels and personal services. In line with the retail sales data, spending has been lifting in recent months after a mid-year pause.

On Tuesday the weekly consumer confidence survey is issued by ANZ and Roy Morgan. Confidence levels remain healthy, with investors encouraged that the sharemarket has lifted following the recent US elections. The survey also includes a measure on inflation expectations – an indicator that the Reserve Bank is now tracking closely.

And the Reserve Bank also features on Tuesday with the Assistant Governor (Economic), Christopher Kent, speaking at the annual dinner of the Australian Business Economists group.

On Wednesday there are two indicators to watch. The first is the quarterly “Construction Work Done” release from the ABS. While the data covers both commercial and residential construction, it is the data on home building that is of most interest. The home building data serves as an input to the calculation of economic growth or annual growth of gross domestic product (GDP). The GDP data is slated for release on December 7.

The second indicator to watch on Wednesday is the monthly data on skilled vacancies. This data is produced by the Department of Employment and goes into some detail in highlighting the jobs that are in demand across the economy.

On Thursday, the ABS releases the detailed data on the job market. The “high-level” job market figures like job growth and unemployment tend to be released on the second Thursday of the month. And the more detailed regional and demographic estimates of the job market are released a week later.

Overseas: US & European “Flash” manufacturing in focus. Shortened-trading week in the US

In the coming week in the US, the Thanksgiving Day holiday is celebrated on Thursday. Still, there is plenty of data to watch. And the Federal Reserve releases minutes of the last policy-making meeting held November 1-2.

The week kicks off in the US on Monday when the National Activity index is released – a composite measure of the economy's performance.

In the US on Tuesday, data on existing home sales is released together with the influential Richmond Federal Reserve survey and the usual weekly data on chain store sales. Economists expect that sales of existing homes were steady at a 5.47 million annual rate in October.

On Wednesday, there is a raft of data released with vendors keen to publish before Thursday's Thanksgiving Day holiday. The Federal Reserve will release the minutes of the last policymaking meeting held on November 1-2. In terms of economic data, estimates of durable goods orders are released (measure of business investment) together with new home sales, the Federal Housing Finance Agency home price series and consumer sentiment. The usual weekly data on claims for unemployment insurance may also be released on Wednesday.

Economists expect that new home sales were little-changed at an annual rate of 593,000 in October. Durable goods orders are tipped to have lifted by 1.1 per cent in October after a 0.3 per cent decline in September. And home prices may have continued growing at a 6.4 per cent annual pace in September.

Globally, the Markit surveys of manufacturing and services sectors are due on Wednesday and Friday respectively. These surveys are released in the US, Japan and Europe and are “flash” readings or early estimates.

On Friday in the US, “advance” data on international trade is released with similar “advance” estimates on retail and wholesale inventories.

Financial markets

The US elections have come and gone. That is positive in its own right, especially the fact that a clear result was achieved – contrary to earlier fears of disputed results.

Encouragingly investors haven't wasted any time in focusing on the likely winners to come out of the election victory by Donald Trump. The expectation is that Trump will carry out his promise of cutting taxes and increasing infrastructure spending. Growth-focused stocks in Materials and Industrials sectors have done well in the election aftermath. Metals and mining prices have also soared.

The other key development is the lift in bond yields. The perception is that stronger economic growth could prove inflationary – a factor that could reduce the purchasing power of bonds over the medium-term.

And the lift in bond yields has proven a global, rather than local trend, serving to boost Australian bond yields to 7-month highs.

Craig James is chief economist at Commsec.