How the housing obsession is short-changing business

With an ageing population lowering trend growth, Australia’s obsession with housing – which crowds out more productive forms of investment – will continue to reduce our international competitiveness, starve innovation and cause living standards to stagnate.

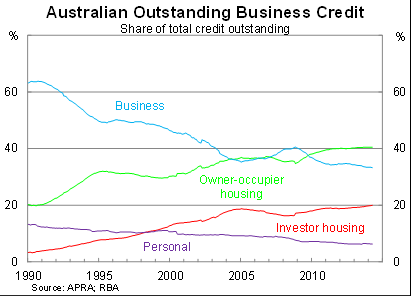

Business credit, as a share of total credit outstanding, fell to its lowest level on record in April. In fact over the past 25 years, the share of credit allocated towards Australian businesses has effectively halved.

In its place, housing credit – for both investors and owner-occupiers – has surged, reflecting strong house price growth from the mid-80s until the mid-2000s. Domestic lenders have increasingly preferred exposure to Australia’s now $5 trillion housing market rather than our business community.

Partially offsetting this trend is that businesses are better able to tap international financial markets. This has been most relevant for our mining sector – which is primarily financed from abroad – but many other large companies tap syndicated lending markets or to a lesser degree corporate bond markets for financing.

Both these markets have increased significantly over the past couple of decades, providing an alternative to domestic intermediation or equity. But lending from domestic banks remains the most important source of finance for most Australian businesses, particularly of the smaller variety.

Unfortunately the relative decline of business credit has important implications for the Australian economy and we are beginning to see the effects of two decades of neglect.

Our collective short-sightedness and obsession with housing has left Australia increasingly vulnerable to international competition, while a lack of innovation and foresight means that we have failed to even recognise several emerging industries.

Despite the obvious trend towards smaller and more fuel-efficient vehicles, Australian manufacturers continued to focus on larger vehicles that nobody wanted. A sign of short-sightedness perhaps, but the fact that rampant housing credit growth crowds out other forms of borrowing, pushing interest rates higher and squashing innovation and investment, doesn’t help.

The Australian financial community has largely ignored internet start-ups and our federal government has done everything it can to ensure that we don’t have the infrastructure to compete and innovate with the likes of Silicon Valley.

Rather than encouraging Australian businesses to innovate into more green technologies and then sell those technologies to the world, we are winding back the carbon tax, removing incentives and ensuring that some other country reaps the benefits of the green revolution.

Finally, I’ll be shocked if we aren’t among the last Westernised countries to embrace robotics.

While businesses can borrow more to innovate, expand, acquire other companies or increase output, household lending typically result in simply paying more for an asset. Housing loans chase other housing loans – which is great for real estate agents and property developers but of little benefit to Australians or the businesses that employ them.

In addition, lending to the housing sector has effectively pushed land prices so high than many Australian firms struggle to contain costs or compete effectively against international players. Our wages may be high by international standards but land prices represent one of the major differences between Australian firms and their international competition.

Despite two decades of unprecedented prosperity, Australia now finds itself in a precarious position as the mining boom continues to unwind. We have hitched our wagon to China, put our heads in the sand and simply hoped that it all turns out okay.

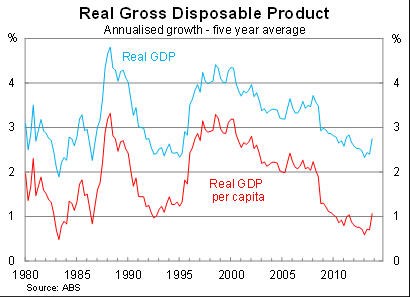

Our national economic plan mostly involves a mixture of mining, house prices and immigration (The Big Australia Illusion, April 22. The first has diminished, the second reduces productivity and business competitiveness, and the third is not an economic plan at all.

Instead we need a plan that puts productivity at the forefront, supports small businesses and encourages them to take risks and innovate. We need a plan that is based around improving our living standards rather than creating the illusion of growth. We need a plan that encourages resources to be allocated to where they can do the most good rather simply indebting a generation of Australians.

With the terms of trade set to decline and the ‘baby boomers’ heading towards retirement, the Australian economy needs productivity growth more than ever. But rather than promoting innovation our state and federal governments are more interested in pushing house prices ever higher and creating an immigration-based illusion of growth. Australia may be ‘open for businesses’ but it’ll take more than words to rectify the vast neglect that has squashed innovation and left Australian businesses feeling increasingly vulnerable.