How nuclear would impact the Australian economy

Our future choice of electricity mix will have a significant impact on the Australian economy. Greenhouse gas abatement cost, health damage from burning fossil fuels, electricity cost and the capital investment needed can all have economic consequences. With politicians like federal energy minister Gary Gray supporting a nuclear debate, now is the time to consider the financial implications of using nuclear power.

In late 2012, two government agencies produced models of Australia’s future electricity generation mix out to 2050. DRET released the Energy White Paper (2012) and CSIRO released eFuture. The EWP reflected current government policy and did not include nuclear power, while the CSIRO web-based modelling tool had provision to include nuclear.

The features of these models, and the scenarios from which they are drawn, made it possible to assess their respective impacts on the economy out to 2050 and hence to determine the specific impact of including nuclear energy in the mix.

By comparing the proposed energy mix in the EWP and eFuture we can analyse the generating capacity required for each technology and the costs differences between the two models. This analysis was first presented at the Australian Academy of Technological Sciences and Engineering (ATSE) conference in July 2013. The full paper can be found here.

For consistency in the comparison, the same carbon costs, electricity costs, capital costs, capacity factors and emissions intensities were used in both the EWP and eFuture models. The source for these data was the Bureau of Resources and Energy Economics (BREE) Australian Energy Technology Assessment (AETA 2012).

The greenhouse gas emissions produced and the volume-weighted average LCOE were calculated from the total electrical energy generated by each technology for each five year period between 2015 and 2050. The energy mixes in each model can be found here.

The eFuture model required building approximately 25 GW of nuclear power stations by 2050. Based on BREE capital costs this would cost $83 billion. These costs would, of course, be offset by not building the geothermal and coal and gas CCS plants required for the EWP model.

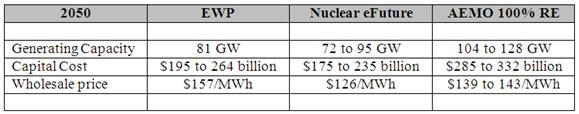

The total investment cost out to 2050 for the eFuture model was estimated at $175-235 billion. The EWP estimated investment was $195-225 billion. Given the margin of error in these costings, the investment cost of both these models are very similar.

If the capital costs for both models are very similar, where are the cost savings?

The continued use of fossil fuels generates greenhouse gas emissions and health costs. The EWP looked to reduce the fossil fuel mix in electricity generation from 86 per cent down to 42 per cent by 2050. The eFuture model reduced the fossil fuel mix down to 12 per cent by introducing nuclear power. Both models included significant amounts of renewable energy.

GHG emissions from electricity generation are primarily caused by burning fossil fuels. Nuclear power has the ability to replace most of the fossil fuels that are still required within the EWP technology mix out to 2050.

The assessed accumulated abatement cost from burning fossil fuels for the EWP mix was $290 billion out to 2050. The eFuture model reduced the accumulated abatement cost to $160 billion.

Treasury modelling shows that Australia will need to purchase almost half its abatement permits from overseas. This means that any additional reduction in domestic electricity emissions over and above those in the EWP will save the economy the cost of purchasing overseas permits. The nuclear eFuture model could save $130 billion in overseas permits.

Pollutants from burning fossil fuels can create health hazards (illness and death). The most common of such emissions from electricity generation are small particulates (such as PM10), sulphur dioxide (SO2) and nitrogen oxides (NOX).

The ATSE report The Hidden Costs of Electricity analysed externalities of power generation including costs attributable to health. Using the health costs from this report, the total health cost out to 2050 of the EWP technology mix came to $60 billion. For the CSIRO nuclear model the total health cost was lower at $42 billion. The difference represents a health cost saving to the economy of $18 billion.

So the combined cost savings on abatement and health could total $148 billion by 2050.

The anticipated rising carbon price in the BREE report necessarily leads to increases in the cost of electricity from those technologies that produce GHG emissions. Replacing more fossil fuel technologies with low-emission technologies will reduce future increases in electricity prices. Nuclear power, with a carbon price, has one of the lowest costs of any technology.

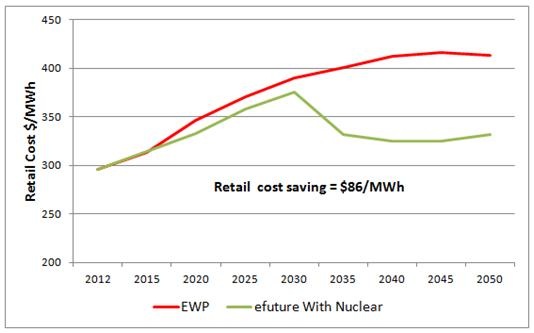

The rising carbon price increases the wholesale cost of electricity each year in both the EWP mix and eFuture mix up to 2030. After 2030, nuclear power grows in the eFuture mix to be 54 per cent of total electricity by 2050. This results in a significant drop in the wholesale price which is reflected in the retail electricity prices shown in Figure 1. The retail cost saving is around $86/MWh by 2050. How the retail price was assessed from the wholesale price is described in the full paper.

Figure 1: Estimated Average Retail Electricity Prices out to 2050.

Some may ask: ‘Why not just replace the fossil fuels with renewable energy rather than nuclear power?’ This prospect was evaluated by the Australian Energy Market Operator in its 100 per cent renewable electricity supply report released in July 2013.

It is difficult to directly compare the AEMO modelling with the EWP or the eFuture models as the AEMO report only considered two timeframes being 2030 and 2050. It included two scenarios for each timeframe with the second scenario, moderate technology transformation and high economic growth, being closest to the other two models.

The AEMO analysis stated that a 100 per cent renewable system is likely to require much higher capacity reserves than a conventional power system. It anticipated that generation with a nameplate capacity of over twice the maximum customer demand could be required.

Table 1 below compares several aspects of the three models in 2050 including generation capacity, capital costs and wholesale electricity prices. All costs are in 2012 dollars. AEMO clearly needs significantly more capacity to maintain network reliability which leads to higher capital costs.

Table 1: Comparison of each model for 2050.

If we assume that all the nuclear power in the eFuture model was replaced with clean energy, it is likely that the abatement and health cost for the nuclear model and the AEMO model would be similar.

However, it is clear from Table 1that the nuclear model will be significantly cheaper to build than the 100 per cent renewable energy option and deliver lower electricity prices. This may be a shock to those that have dismissed nuclear power as being too expensive.

Before someone asks about nuclear decommissioning and waste costs, I recommend reading the full paper.

Martin Nicholson published a peer-reviewed book on low-carbon energy systems in 2012 titled The Power Makers’ Challenge: and the need for Fission Energy published by Springer UK.