How grubstaking is feeding a mining services revival

Summary: Ausdrill and mine-building engineer Lycopodium's share prices are lifting on fresh 'grubstaking' deals. |

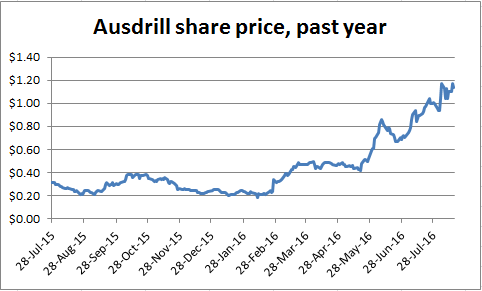

Key take-out: Mine service providers have started to be pushed along by favorable tailwinds, with Ausdrill shares up 550 per cent in six months. |

Key beneficiaries: General investors. Category: Commodities |

Selling pickaxes was once a better way to make money from mining than actually digging dirt. It still is, though the modern version of the pickaxe salesman markets 'mine services', such as those offered by drilling contractor Ausdrill and engineer Lycopodium.

Over the past six months, as the first whiff of a commodity-price recovery has wafted through the resources sector, most investors have focused on companies producing gold, or those exploring for lithium, graphite and zinc.

Many mining stocks have performed well, which has made it easier for them to raise fresh capital with the major beneficiaries of those new funds being the service providers, especially those able to be a little creative with the way they do business.

And when it comes to being creative to first survive the downturn that hurt everyone exposed to mining, and to emerge a winner as the recovery takes hold, no-one comes close to Ausdrill, which has applied a mining maxim as old as pickaxe selling; grubstaking.

The name itself says all that's needed to understand the simple but brilliant approach of the Perth-based drilling contractor, because grubstaking comes from an era when someone provided food (grub) and a few tools to a prospector in return for a stake in his discoveries.

Ausdrill's variation on that centuries-old theme is to offer its drilling rigs in return for an issue of shares in a transaction where everyone has a chance to win, and win substantially if a discovery is made or the timing is right, such as at the start of mining revival.

Five grubstaking deals have been done so far by Ausdrill, which calls them 'drilling for equity agreements'. The latest was announced two weeks ago when a Northern Territory explorer, Primary Gold, signed up for $3 million worth of drilling.

Payment to Ausdrill will be in the form of Primary shares with the number of shares calculated by an agreed but complex pricing mechanism, which is 90 per cent of the 30-day volume weighted average price of Primary shares against the value of each Ausdrill invoice.

The payment method makes it difficult to work out exactly how many Primary shares Ausdrill will eventually get, but another part of the deal is an understanding that the shares issued can be sold. Since the deal was signed on August 1 Primary's share price has risen from 13.5c to 15c, with a peak on Monday of 17c.

Earlier grubstaking deals have yielded handsome rewards for Ausdrill, which late last year contributed the lion's share ($1m) of a $2.1m capital by West African Resources. It has made a promising gold discovery in Burkina Faso using Ausdrill rigs, naturally.

New West African shares were issued at 6.5c each on December 14. Today, they're trading at 38c.

Other drilling for equity deals (and debt which can be exchange later for equity) have been struck with Azumah Resources, Vital Metals and Breaker Resources. Azumah is up from a 12-month low of 2c to 5.3c. Vital has risen from a low of 1c to 1.8c, and Breaker has shot up from a low of 4c to 24.5c.

But, as so often happened in an earlier era, the real winner from the grubstaking is the provider of the grub or, in this case, the provider of the drilling services. Since hitting a 10-year share price low of 18c in February, Ausdrill shares have risen by 550 per cent to $1.17.

Ausdrill founder and managing director, Ron Sayers, is delighted with the drilling for equity deals and wants to do more, which is hardly surprising as Ausdrill wins on several levels: it puts its rigs to work, it gets issued equity which has been increasing in value, it is confident of retaining a client for future work, and is well positioned to win conventional work such as the $157m contract won with mine developer Perseus Resources last week.

The recovery for Ausdrill from a horror run is largely a case of the company applying one of the oldest tools in the mining finance handbook and then being able ride the early stages of a recovery, which is seeing explorers get back into the field, and that means drilling.

Other arms of the mine services sector are also starting to wake after several years in survival mode, but they will mainly benefit from later stages in the resources recovery process as exploration turns to development – if a discovery is made.

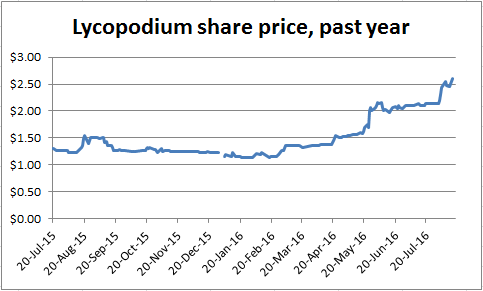

Lycopodium, a mine-building engineer, has enjoyed a strong share price recovery as work has expanded with the commodity-price recovery. This includes a fresh contract announced this week on the Sissingue gold project of Perseus in the African country of Ivory Coast.

News of the latest Perseus deal saw Lycopodium shares rise this week to a 12-month high of $2.60, an increase of 130 per cent on the low point of $1.13 reached in February.

Other mine service providers to be pushed along by favourable tailwinds include other drilling contractors such as Swick (up from 9c to 24c) and Boart Longyear (4c to 16c), engineers Monadelphous ($5.32 to $10.59) and NRW (4c to 46c) and second-hand equipment dealer, Emeco (3c to 6.3c).

Two other mining service providers to benefit are Mineral Resources, which is also directly involved in mining iron ore and lithium, and Seven Group, owner of the Seven television network as well as franchises to sell and service Caterpillar earthmoving equipment.

Mineral Resources is up from $3.34 to $10.04 and Seven has risen to $4.03 to $7.96, though in both cases it's not easy knowing which division is the real price driver – perhaps both.

For investors the challenge now is judging whether the early stages of the commodity-price revival will continue to deliver strong share price moves or whether the good news is already priced-in.

In earlier periods of recovery the best moves came early, followed by a pause as investors waited to see whether their optimism had been overdone.

There's no reason to assume that this recovery will be any different and while the entire mining sector – including explorers, producers and contractors – have enjoyed an uplift the next phase will require more discerning stock-picking.