How China is losing its crown as the world's factory

Over the past two decades China has earned a reputation as the world’s factory. An impressive array of statistics is testimony of the country’s transformation from an agrarian economy to an industrial powerhouse: China is the largest producer of steel, cement, glass, fridges and TVs and more.

In 2012, the value of China’s manufacturing plays on a gross value-added basis was 28.1 per cent, higher than that in the US. According to the 2013 Global Manufacturing Competitiveness index, Deloitte ranked China as the most competitive place to manufacture in the world. The consulting firm predicts the country will most likely to remain in first place for the next five years.

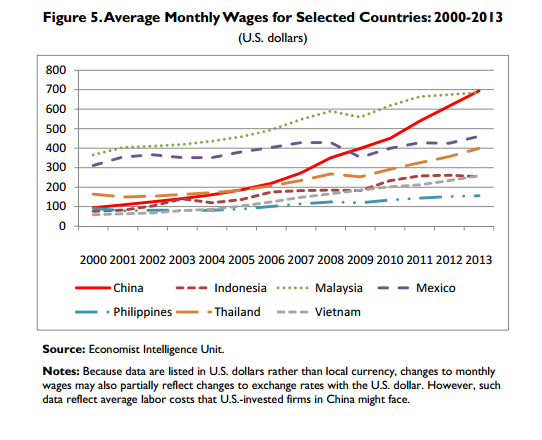

But it is clear China’s comparative advantages as a manufacturing powerhouse are slowly eroding. This is especially true in the labour-intensive light manufacturing industry. While many people still think Chinese workers are sweating away on the mystical $2 a day, the country actually has one of the highest wages among developing countries.

From 2000 to 2013, the average real wage in Chinagrew at an annualised rate of 11.4 per cent. As a comparison, at the beginning of the century, Chinese workers’ wages were only 30.2 per cent of their counterparts in Mexico. By 2013, Chinese monthly wages were 50.5 per cent higher than their Mexican counterparts. And closer to home, Chinese wages were 168 per cent higher than Vietnam’s in 2013, according to the Congressional Research Service of the US.

The rapid rise in Chinese wages can be easily explained by Sir Arthur Lewis’s economic theory, laid down more than 50 years ago. He argued that a developing country with “surplus” or underemployed labour could expand the industrial force for years without causing wage inflation.

This is reversed when a labour shortage emerges as wages increase rapidly. And China has reached the so-called “Lewis turning point”. If China continues to grow at 7 per cent a year, its per capita income will reach $10,000 a year in five years’ time.

This has already had an impact on companies' decisions to manufacture items in China. In 2000, China made 40 per cent of all Nike shoes, while Vietnam made 13 per cent. Fast-forward to 2013, and China’s production share was 30 per cent, Vietnam’s increased to 42 per cent.

There are those who argue that factory owners can take advantage of disparity between wages within China. For example, they can relocate their manufacturing to poorer and under-developed regions in central and western parts of China. But this can only be a temporary solution because income disparity within China is narrowing. According to the National Bureau of Statistics data, the wage differential between prosperous eastern seaboard provinces and western China is only between 5 and 6 per cent.

So a manufacturer’s cost advantage by relocating inland could disappear within a year or two.

As China transitions from a low-cost production to middle-to-higher income country, we are likely to see the third great industrial migration in Asia since the end of the World War II, according to Sun Ming Chong, a senior partner and chief economist at Broad Capital, an investment fund based in Shanghai.

The first wave took place during the early 1970s, when labour-intensive industries were relocated from Japan to East Asian tiger economies such as Singapore, Hong Kong, Taiwan and South Korea. The second phase of the industrial migration happened in the 1990s, when these industries moved to China. After more than two decades of the largest industrial expansion in history, we are standing at the cusp of the third wave.

Though China’s superior infrastructure, integrated supply chain, and better educated workforce will make swift relocation difficult, the large trend is unmistakable. In 2012, China’s annual wage was $US6,500, 30 per cent more than Thailand and the Philippines, two to three times more than Vietnam and Indonesia, and five to six times more than Cambodia.

So both foreign and Chinese investors will have to relocate their factories to cheaper countries in the future. The ASEAN countries and India are likely to be beneficiaries of this migration. This will present both challenges and opportunities for Chinese policymakers.

On one hand, it means Beijing must speed up its industrial upgrade to reduce the country’s reliance on labour-intensive industries to absorb millions of new jobseekers every year. At the same time, China can leverage its extensive experience in building infrastructure to extend its economic influence abroad. These industrialising economies could also help China soak up excessive capacity in steel, cement, construction machinery and railway freight stocks.

The third wave of industrial migration is likely to have a huge impact on developing countries in Southeast Asia and the Indian subcontinent as China moves up the technological ladder. China will eventually lose its crown as the factory of the world, but this may not be a bad thing. At the same time, more cashed-up and innovative Chinese companies will take on their more established players in the West, creating disruption in more technologically advanced sectors.