Houses could be overvalued for a very long time

Now we know why the Reserve Bank is worried about the property market: according to yesterday’s minutes, it’s not because banks might get into trouble, but because if prices went up some more, that would increase the potential for them to fall later, and households could cut back spending if their wealth declined.

Could. If. Maybe. If house prices go up a lot, they might come down. Well, yes.

Have they gone up a lot already? Um, “(RBA board) members considered that the risks associated with this trend warranted ongoing close observation.” Well, yes, again.

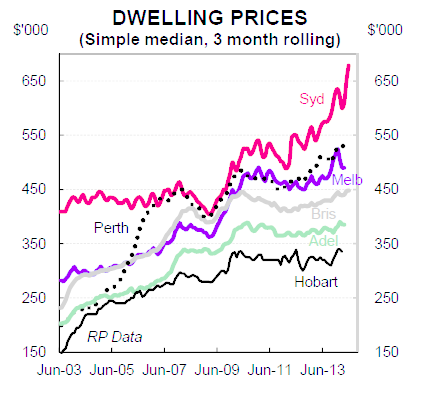

You decide.

Source: CBA Economics

Yep, it’s all about Sydney; nothing much going on anywhere else, and Sydney’s rise of about 30 per cent in two years probably has something to do with what Kelly O’Dwyer, MP, was talking about yesterday.

She told a forum in Sydney that the Foreign Investment Review Board was not properly policing the restriction on foreign investors (read: Chinese) buying existing dwellings.

“We … encourage foreign investors to invest in new dwellings because we see that as having a strong benefit for the country, both in terms of supplying new housing but also in terms of the economic output that flows from that," she said.

"But there are restrictions already in place for non-resident foreign investors wanting to purchase existing dwellings, and some of the evidence to date that has been presented to the committee is that the foreign investment restrictions on those people have simply not been enforced.”

(Kelly O’Dwyer is heading a joint Parliamentary committee considering ways to make it harder for foreigners to buy Australian real estate.)

But a large part of the foreign buying of local real estate is not from Chinese citizens flouting the local regulations in the apparently correct belief they won’t get caught, but because of “Business Innovation and Investment visas”.

There are three types of these (to quote the Department of Immigration fact sheet):

- The business innovation stream -- for people with a successful business career and a genuine and realistic commitment to be involved as an owner in a new or existing business in Australia

- The investor stream -- for people with a successful record of qualifying business or eligible investment activity who will make a designated investment in a state or territory of Australia and have a realistic commitment to continue to maintain business or investment activity in Australia after the designated investment has matured.

- The significant investor stream -- for people who are willing to invest at least $5 million into complying investments in Australia and want to maintain business and investment activity in Australia after the original investment has matured.

In other words, you don’t need $5m -- you just need to be in business or be an investor.

And you have to live somewhere: not Mudgee or Mildura, thanks very much, but Sydney or Melbourne, please. They are not ‘foreign buyers’ after they migrate, and therefore do not fall under FIRB rules.

At the same time as it has stopped the boats, the Abbott government has opened the airports – to business and investment migrants. There is apparently a quiet flood of it.

In either case -- foreign investors dodging the rules or business migrants and their families buying a home to live in -- the flow of Chinese money into Australian real estate, in fact into real estate all over the world, has only just begun.

The wave of money out of China, spurred in part by President Xi Jinping’s huge crackdown on corruption, could last for decades and raise property prices a lot higher than they are now.

And this has nothing to do with interest rates or the Reserve Bank.

There are three main effects of rising property prices, two of which are good and one is bad:

1. The ‘wealth effect’, as discussed by the RBA, lifts consumer confidence and encourages spending and boosts employment;

2. Under-funded retirees are able to sell their family homes and free up equity by downsizing into an apartment or ‘lifestyle community’; and

3. Young people can’t afford to buy a house and have to keep renting.

The reason No.3 is bad, and making everyone so upset about high house prices, is not that real estate is such a great investment (at these prices, it’s not!) but because it’s one of only two tax-free investments.

The other is super, once you’re in pension phase.

If you think about it, home ownership and superannuation are both, in reality, retirement plans. When most people retire, their two assets are super and their house, and most people cash both of them in.

It’s true that owning a home is enforced saving, with a very large ‘fee’ (interest) going to the bank. But rent is less than mortgage repayments, so a household that’s renting can theoretically save more in super and therefore lose less to the bank.

Of course, the problem is that super is only enforces up to 9.5 per cent of salary, and most young families will spend what they have over that if it’s not going on a mortgage, probably on education.

But then again they won’t have to support their parents, and in fact their parents can probably support them instead, because the houses that are too expensive will fetch a good price for their empty-nest parents when the kids move out and rent.

What’s more, the wealth effect on consumption and investment of rising house prices will help ensure they all have a job.

The point is that it’s not entirely clear that expensive housing is a bad thing, although I am talking my book, of course, as a home-owning, empty-nest baby boomer (with frustrated, renting children).

It is true that a bubble followed by a crash would be undesirable, to say the least, but is that what we have coming?

I doubt it. As a rule of thumb, if everything thinks it’s a bubble, it isn’t one. Bubbles occur when everyone is complacent.

There is a shortage of housing, especially inner city, and plenty of demand, augmented by foreign investment, business migrants and SMSFs. It looks to me like the market at work.

And the demand from foreign buyers, especially Chinese, has a long way to go.

Australian houses, especially in Sydney and Melbourne, could be theoretically overvalued for a very long time.