Hooray! Things are getting worse, Farewell Mrs May, Budgets, Trump-China, more

Last Night's Markets

Hooray! Things are getting worse

Rhyming Budgets

Trump Vs China

Lynas and Wesfarmers

Farewell Mrs. May, At Least You Tried

Research and Diversions

Facebook Live

Next Week

Last Week

Last Night's Markets

| Name | Price | % Change |

|---|---|---|

| Dow Jones Industrial Average | 25,585.7 | 0.37% |

| S&P 500 | 2,826.0 | 0.14% |

| Nasdaq Composite | 7,637.0 | 0.11% |

| The Global Dow USD | 2,951.7 | 0.46% |

| Gold | 1,284.40 | - 0.08% |

| Crude Oil WTI | 58.91 | 1.73% |

| Australian Dollar / US Dollar | 0.6929 | 0.24% |

| Bitcoin / US Dollar | 8,087.80 | 2.97 % |

| U.S. 10-Year Bond Yield | 2.33 | 0.15% |

Hooray! Things are getting worse

Two cheers went up in the markets this week, first when President Morrison won the election and then again when RBA Governor Philip Lowe more or less promised to cut interest rates next month.

The Coalition won for many reasons, the main one being that it was up against an unpopular politician who was promising to increase taxes. But voters are also worried about the economy, and Morrison’s message on that score was clear and believable.

The Reserve Bank is worried about the economy as well, which is why it’s going to cut interest rates, probably more than once.

Yet as Evan Lucas pointed out in Talking Finance on Thursday, the Australian sharemarket has spurted ahead of America’s on a year to date basis, to become one of the best performing in the world this year. On this basis, the ASX200 accumulation index has returned 17.1% in less than five months, a world-beating performance.

So equity investors apparently aren’t worried, even if others are.

On Thursday, the 10-year bond yield broke below 1.6% for the first time. Bond yields decline (prices go up) when bond investors think things are getting worse and less inflation is expected in future.

Actually, on the sharemarket this week, it’s just the banks that are doing well – the bonds of the bourse.

The bank index went up 5.8% on Monday and 1.7% on Tuesday, but both the industrials and resources indexes fell on both days. Analysts were talking about a “rotation into blue-chip yield” as a result of the election result, but other blue-chip yielders like Coles, Transurban and AGL actually fell, so it wasn’t a general rotation, just into banks.

Also the performance of the banks this week needs to be put into context. This chart of the banks, industrials and resources since July 1 helps do that (banks, blue; industrials, red; materials, brown):

.png)

The rest of the market has regained last year’s peak, the banks have not. The main reason the Australian sharemarket has done so well this year is that the iron ore price is back above US$100 a tonne.

Here’s another way to look at the banks:

.png)

Industrials ex-banks are priced at a ritzy PE ratio of 20.7 times (one-year forward) while banks are on 13.1 – a 33% discount, which is well below both short and long-term averages.

So despite this week’s bank buying frenzy, they are still priced for trouble. What trouble? Answer: mainly, but not only, the property market.

The reason the banks’ prices were all adjusted upwards this week by between 8% (CBA) and 10% (Westpac) was that there were two strong positives for house prices and the property market: negative gearing won’t change, at least for a long time, and two interest rate cuts are on the way.

With a PE of 13.1 and an average yield of 6%, the major banks are not yet priced for the property market to bottom and start recovering this year. If clear evidence emerges of this, then banks have further to rise.

I don’t know whether house prices have bottomed, or will soon, but I do know that this is one of the two big issues for all investors in Australian assets, and not just bank shares (yes, I know that’s not the usual sort of blinding insight you’ve come to expect from me, but bear with me).

Consumption has been supported by a reduction in savings, as shown by this excellent chart from our friend Gerard Minack:

.png)

If not for that and population growth, Australia would be in recession.

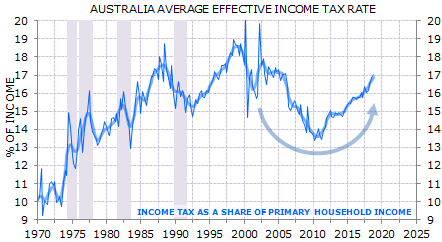

Real household disposable income growth has been running at zero for about five years because of weak wages growth and rising tax as a proportion of income.

Governor Lowe highlighted this in his speech on Tuesday, when he pointed out that last year tax paid by households rose 10% while income rose 3.25%, saying “that is a big difference and it is unusual.”

It’s not just last year: I showed this graph on the ABC the other night:

Wage growth is weak because of underemployment, not so much unemployment. This was highlighted in a chart in Lowe’s speech but he didn’t really give the subject the attention it deserves, in my view. Here’s the chart:

The unemployment rate has come down from 6.4% to 5%, but the underemployment rate has stayed the same. Lowe’s conclusion is that he now thinks the unemployment rate can fall below 5% without causing inflation to rise – which is why he and everybody else are ready to cut rates next month.

To cut through a fair bit of central banker waffle, he said that if they thought the unemployment rate wouldn’t fall below 5%, then “we will consider the case for lower rates”.

Yes, but the underemployment rate has been stuck above 8% for five years! In the last recession it was negligible – a fraction of the unemployment rate. What’s more, underemployment is now starting to rise in trend terms.

If house prices keep falling, so that households no longer are prepared to reduce savings (because their wealth has declined too much), and/or wages growth doesn’t pick up, there will probably be a recession, caused by a crash in consumer spending. Even bulk commodity exports and government spending wouldn’t save us.

It may be, in fact, that house prices have already fallen enough to cause savings to rise, with a lag.

The good news is that the RBA is on the job (it says), along with APRA (which has loosened the housing loan qualifying standards) and the Government, with its (fairly limited) support for first home buyers.

The next step is for the RBA to deliver on its rate cut promise and for the Government to come good with some fiscal stimulus, as requested by Philip Lowe this week.

As to the first of those, it seems to me that if the RBA is planning to do two cuts, it might as well do both at once, in June – 50bp.

And as for the second, the Government could bring forward the next round of tax cuts due in 2024, and also accelerate the infrastructure spending announced in the budget in April.

I’ll be interviewing the Treasurer, Josh Frydenberg, for InvestSMART on Monday morning, so look for that on Tuesday morning, and then I’ll be following up with a panel discussion with Philip Lowe over dinner on Monday night, although that’s unfortunately going to be Chatham House Rule (no quoting).

But as long as you don’t tell anyone, I’ll fill you in next Saturday.

As for the 10-year bond yield:

.png)

The decline in the yield since early November last year is extraordinary.

Basically the bond market pricing for big cash rate cuts, low inflation and economic weakness, if not recession.

The sharemarket, meanwhile, is priced for golden times.

The usual response to that situation is to say that one of them is right, and the other is wrong.

More likely is that they’re both half wrong, half right. It probably won’t be as bad as the bond market thinks, or as good as the sharemarket thinks.

Rhyming Budgets

On the subject of politics and budgets, I was swapping emails with Gerard Minack this week and I thought part of what he wrote was worth passing on (he said it was OK):

Gerard: “I think this chart tells an interesting story. The green bars show how cycle changes have affected the budget balance, and the red bars are discretionary policy changes, both shown as a share of GDP.

In the mining boom the budget balance routinely was improved by 3-4% of GDP. Talk about being smacked on the arse by a rainbow. That allowed for an enormous loosening of fiscal policy – the red bars shows that policy measures routinely worsened the budget balance by 2-3% of GDP through that time. The largest red bar is the fiscal stimulus around the GFC.

.png)

These bars only take account of the immediate impact on the budget in the year the measures were adopted, and the year after. Of course, a lot of the measures introduced through the mining boom have booby-trapped the fiscal outlook. The franking credit refund is one example. From memory the initial cost was ~$500mn. Now it costs over ten times as much.

Much of the political pain of the last 10 years has been both sides trying to defuse those booby traps. Labor just got blown up trying to continue that.

History is repeating, in a minor way now: once again the cycle is working to reduce the budget deficit (the green bars are positive). Once again the red bars – discretionary policy changes – are working the other way.

Once again the (temporary) cycle gains, largely reflecting the global commodity cycle, look set to just structural costs to the deficit. This time it’s the massive long-term income tax cuts.

History is rhyming.

Go Tigers.”

He was talking there about tonight’s “Dreamtime at the G” game between my team, the Bombers, and his, Richmond. Go Bombers.

Trump Vs China

Two weeks ago (“Trade war; what’s really going on”) I explained in detail why I thought it wasn’t a simple trade war between the US and China and that it was likely to get worse.

Since then it has become worse. President Trump has banned Huawei, the Chinese telecommunications giant, going much further than the Australian Government’s ban last year and opening up a whole new front in the conflict between the two countries.

Australia prevented Huawei from supplying 5G equipment in this country; Trump has banned US companies from supplying stuff to Huawei. Big difference.

There are two consequences of what is turning into a technology Cold War between America and China: first, the internet itself is splitting or has split into two distinct divides along Western and Chinese lines, and second, it will spur China onto greater efforts to do what the US is trying to stop and build technology independence, in line with the “Made In China 2025” programme that I referred to a fortnight ago.

On the first of those, there was a good quote in Bloomberg this week from a bloke named Alex Capri, a senior fellow at the Business School of the National University of Singapore and onetime U.S. customs official: “Long-held relationships between supplier networks and global ecosystems will fall apart,” he says. “Markets will fragment, and there will be a decoupling of China and the U.S. into two distinct tech supply chains.”

Trump subsequently said the dispute with Huawei could be resolved with a trade deal, but that seems highly unlikely. After all, he has declared a national security emergency and said Huawei was being blacklisted on national security grounds. Hardly a matter, you would think, that can be resolved by a trade deal, although anything’s possible with Mr Trump of course.

Apparently, Huawei has been stockpiling chips and other components from the US for a year to prepare for exactly what has now happened, so the US suppliers will be doubly hurt: their profits have been inflated by Huawei’s extra buying, and will shrink to nothing now that Huawei is banned.

As for specific retaliation from China, Ben Thompson of Stratechery says: “The truth is that China has only one real pressure point when it comes to US tech: Apple. Yes, many tech suppliers are exposed to China when it comes to manufacturing, but Apple is exposed not only in terms of manufacturing but also consumer sales.”

Anyway, it’s not just the US Vs China, but the West Vs China. In March 2012, the Australian Government excluded Huawei from tendering for NBN contracts and in October that year, the Canadian Government banned Huawei from supplying its own communication network.

India first started complaining about and excluding Huawei 10 years ago and the US NSA started operating against Huawei in 2014, eventually leading to the National Defense Authorization Act for Fiscal Year 2019, which contained a provision barring the U.S. government from purchasing hardware from Huawei or ZTE, under cybersecurity ground.

This week, Bloomberg’s technology opinion writer, Tim Culpan, declared that The Tech Cold War Has Begun.

He wrote: “We can now expect China to redouble efforts to roll out a homegrown smartphone operating system, design its own chips, develop its own semiconductor technology (including design tools and manufacturing equipment), and implement its own technology standards. This can only accelerate the process of creating a digital iron curtain that separates the world into two distinct, mutually exclusive technological spheres.”

The mutual dependency that is now being broken down is that American firms like Google and Apple rely on Chinese manufacturing to make their gear, while Chinese firms rely on American software and design.

If Trump and anti-China warriors in his administration really do want to break the US-China technology supply chain, and the interdependence of Silicon Valley and the Chinese manufacturers, then obviously each side will have to replace the capability it doesn’t have. China will have to design its own chips and US firms will have to move their manufacturing to other low cost countries (they’re unlikely to locate the factories in the US).

But stepping back, I wonder whether the cold war analogy is very helpful.

A cold war happens because neither side wants to attack the other because the consequences would be devastating, to itself – it used to be called Mutually Assured Destruction. I suppose to that extent, America is in a sort of cold war with North Korea: it doesn’t want to attack NK to remove the threat because it can’t destroy all the nuclear weapons, and it doesn’t really know how good they are.

Where the analogy works is that this is a conflict between an open democracy and a closed dictatorship, like the cold war between the US and Russia, it’s just that this time – so far – there is no talk of attacks, beyond the fear in US, Australia and Canada that Huawei could be used as a backdoor for cyber-attacks in future.

Except perhaps for money: in the past few days fears have started to pop up that China might be prepared to “weaponise” US Treasury bonds, of which it owns quite a few.

On Thursday, China sold US$20 billion worth of US bonds with maturities exceeding one year. It was China’s largest sale in more than two years.

The Financial Times quoted Mark Sobel, a former long time Treasury official: “If China starts dumping its Treasuries, it would cause huge financial instability,” although he added that he considered it unlikely.

We’ll see. Certainly this situation is the greatest source of risk for investors at the moment, if only because it is so unpredictable.

Lynas and Wesfarmers

One interesting sidelight to the US-China conflict is around rare earths, that group of 17 elements that are not actually very rare but for some reason China produces about 90% of the world’s supply. The only other producer is Australia’s Lynas Corporation, from a deposit at Mt Weld in WA.

The reason there are only two producers of “unrare” rare earths is that although there is plenty of the stuff, it’s usually well dispersed – there just aren’t many concentrations of it.

One of the few is Mt Weld, a unique, currently producing, global asset. Lynas decided to set up its processing in Malaysia because of a 14-year tax break, but that has turned into a bit of a regulatory mess, and the uncertainty surrounding Malaysia’s demands led to a decline in the Lynas share price from around $2.70 a year ago to $1.60 at Christmas time.

Enter Wesfarmers, looking for something to do post-Coles, with a bid at $2.25. “Opportunistic!” shouted the Lynas board, and they’ve since announced new growth plans to escape Wesfarmers’ clutches.

In addition, the price of its main product - NdPr (neodymium praseodymium oxide), which products 80% of the company’s revenue – has been rising strongly, as a result of the conflict between the US and China.

That’s because China, which is producing 90% of the world’s supply needed in a variety of high tech products, seems to be planning to restrict supply because it‘s one of the few points of leverage it has.

It was sparked a couple days ago by President Xi Jinping making a pointed visit to a rare earths hub in Jiangxi, leading to a flurry speculation that he was deliberately displaying some of the leverage China has over the US (of course he was).

So the Chinese price (in red on the chart) has been rising faster than the US dollar price that Lynas charges.

As a result of the rising price and the bid from Wesfarmers, Lynas’s share price has been on a tear – from $1.51 at the start of the year to $2.44 now, well above the Wesfarmers bid.

I rang Wesfarmers the other day to ask them what’s going on with the offer and the official answer is that it still stands, at $2.25. But obviously they will have to bid more if they want to succeed.

The advantage of Lynas is that it has the best deposit outside of China – one analyst I spoke said “it’s Mt Weld first then daylight second” – and also has a processing plant, which is very difficult to build.

There are six other junior explorers with rare earth deposits (see below), and the share prices of most of them have also been on the move lately. Arafura Resources, which has a deposit about 135km north of Alice Springs, is closest to production (it has an operating pilot plant), but the biggest rise in share price has been Greenland Minerals, which has some rare earths in, you guessed it, Greenland.

My view is that Wesfarmers is unlikely to just give up. The initial bid was a try-on and CEO Rob Scott clearly has a long term strategy to expand into supplying electric cars and other electronic products, since it’s also buying the lithium miner, Kidman Resources.

Lynas is central to that strategy, it seems to me, and is a globally unique business valued at just $1.6 billion, against Wesfarmer’s $42 billion capitalisation. Buying it would transform Wesfarmers for not very much money in the scheme of things.

Also, Lynas’s processing plant is very attractive so it’s unlikely to switch to one of others that only has a deposit, like Arafura.

In case you’re interested, here’s a list of the rare earth juniors trying to get a mine up:

- Arafura Resources (ARU)

- Greenland Minerals (GGG)

- Hastings Technology Metals (HAS)

- Northern Minerals (NTU)

- Peak Resources (PEK)

- Pensana Metals (PM8)

Farewell Mrs. May, At Least You Tried

Theresa May tried but failed to steer a softish Brexit deal through the British Parliament, but in the end she just wasn’t smart enough and has been taken out and shot. The 6/4 favourite to replace her is Boris Johnson. Will he succeed where she failed? That depends on what we mean by success.

For the hardliners in the Conservative Party, plus Nigel Farage, success simply means out of the EU, soon, deal or no deal. Is that where Boris sits too? That is going to be the big question. I suspect he might campaign for the job as a No-Dealer and then shift after he gets it.

May’s problem is that she also started with a very hard definition of Brexit, pandering to the right wing of her party and in the media, and got stuck there. She kept saying “no deal is better than a bad deal”, triggered Article 50 far too early, and disastrously called an election.

She put too much store in the result of the referendum, and not enough in the fact that Brexit was sold on a lie, that it would be easy, and lead to great prosperity. Also, the complications of leaving were deliberately withheld from the public.

Now May leaves Britain more divided than ever and at the mercy of the hardliners in the Conservative Party.

Up to now I have regarded a No Deal Brexit as a near zero possibility, and as a result have been bullish on the UK – both the FTSE and the pound – since No Deal is partly in the price and will come out once there is a deal, or no Brexit at all (now very unlikely). As each vote passed and extensions were sought and granted, I was looking pretty good, but I must admit the optimistic scenario is looking a bit sick now.

With jostling for the PM-ship just getting underway, it looks like a hardliner will become PM, probably Boris because they think he is best able to beat Jeremy Corbyn, although I could probably do that. As a result of it all, European Union leaders have ramped up their No Deal rhetoric, banks have raised their No Deal planning and analysts are shifting their forecasts—JP Morgan, for example, has upped its probability of No Deal from 15% to 25%.

Should the bulls capitulate? I don’t think so (but then again, I haven’t sold my BAF shares yet, so I have a bad habit of hanging onto positions way beyond their use-by date).

Hard Brexiteers like Farage are still assuring everyone that a No Deal Brexit will be a walk in the park – Britain will breeze through it, but that’s a bit like taking Alan Jones’ and Terry McCrann’s word for it that climate change won’t be a problem. Or Hank Paulson’s word that it was OK to let Lehman Brothers go broke in September 2008.

Maybe they are right and it will be OK, but is a new Prime Minister who is hoping for a long period at the top of a stable, successful Britain really going to take that risk? Are you really going to take the word of fanatics over experts?

I doubt it somehow. Clearly the chances of a No Deal Brexit have gone up with May’s departure, but I still don’t think the Poms won’t go into the library and blow their brains out, although I acknowledge that the odds of national self-harm have shortened.

Research and Diversions

Research

.jpg)

This is very good: eight charts that help explain why the Coalition won the election.

The Kouk’s take on why Labor lost.

That’s enough on the election. Let’s move on.

Theresa May – a premiership in six charts.

An interesting tweet stream from Bloomberg’s David Fickling, explaining why Adani’s Carmichael coal mine in Queensland doesn’t stack up financially.

Value investing isn’t just buying low PE stocks – it’s buying something for less than it’s worth. The question is: what’s it worth?

Pretty good comprehensive guide to the all the buy-now pay-later schemes. They’re all different, and competition is heating up now that Flexigroup has entered the scene.

Australia used to be out on its own with a ban on Huawei. Now Donald Trump has signed an executive order declaring a national emergency on information security, laying the groundwork for a US ban on Huawei. At the heart of this is China’s continued cyber espionage, which it refuses to give up. This is a good rundown of what’s going on.

The US government’s battle with Huawei, explained: “Huawei is the “emblem” of a variety of fears about China and its technological prowess packed into a single company.”

Why do people pay those crazy multiples for CSL? It’s long-term consistent organic earnings growth, industry-leading margins, high returns on capital, strong R&D investment (expensed), extremely high barriers to entry and long term visibility on industry disruption. Simply — it’s a Quality Franchise.

This is a quite a sharp (video) analysis of Tesla, from an Aussie “auto expert” named John Cadogan: “Tesla is, among car makers at least, what Scientology is among religions – you simply must suspend all rational thought before you are allowed to walk through the door. The company is little more than a confidence trick aimed at rich, green imbeciles, who are dumb enough to believe that you can actually spend and consume your way to a sustainable future.” Bang!

“One view is that (Elon) Musk is deranged. Seriously. He makes it easy to dismiss his grandiose — unhinged, even — descriptions of his product plans. But if we look past the hyperbole, we see a serious threat for legacy automakers who don’t know and love software.”

Tesla is going all in on self-driving cars. These robo-taxis will operate on the Tesla Network, which is basically a ride-hailing platform. Robo-taxis can be essentially any Tesla vehicle with autonomous-driving functionality. It’s a very key part of Tesla’s future business model.

Three key themes from the bank results.

If the robots come for our jobs, what should the Government do?

How Xi’s last minute switch on US-China trade upended it – a New York Times investigation. Problem is, they don’t really know. It’s an interesting piece, though – just don’t expect to find out what actually happened.

Madagascar produces 80% of the world’s vanilla. A tenfold rise in the vanilla price over the past five years has flooded impoverished villages with cash and crime. A crash seems inevitable.

A No-Deal Brexit Will Destroy the British Economy: The magical wing of the Conservative Party believes that Britain can crash out of the European Union painlessly. It is leading the country into a recession.

Eight Japanese infrastructure projects that could reshape the world.

Here’s a searchable, constantly updated, Trump twitter archive. Very useful.

Satellites are going to monitor the pollution levels of every power station in the world. The venture is non-profit and is backed by Google’s philanthropic arm, Google.org.

Diversions

I don’t know about you, but I’ve been very, very disappointed in the final season of Game of Thrones. This piece explains why: George R R Martin didn’t write it. “If the relentless mediocrity of Game of Thrones’ final season has clarified anything, it’s how desperately this show has always needed Martin’s imagination.”

John Lanchester writes about GoT: “It is fair to say that Season Eight has felt, to appropriate Wordsworth’s opinion of Goethe’s poetry, ‘not inevitable; not inevitable enough’. There is a sense that the showrunners wanted to get it over with, had had their fill of Westeros. You know what, though? I don’t mind, because I, too, am keen to get on with other things.”

And then there were the plastic water bottles left on the set…

And finally on the subject of GoT, here’s an interview with the No.1 loser (sorry if that was a spoiler) – Emilia Clarke who played Daenerys Targaryen.

How technology is changing the business of spying. “The world of espionage is facing tremendous technological, political, legal, social, and commercial changes. The winners will be those who break the old rules of the spy game and work out new ones. They will need to be nimble and collaborative and—paradoxically—to shed much of the secrecy that has cloaked their trade since its inception.”

What is a kilogram? Well, actually it’s a hunk of platinum-iridium alloy that's been housed at the International Bureau of Weights and Measures in Sèvres, France since 1889 ... The problem is that Big K (or Le Grand K, as it’s called) is not precisely constant – it changes, and when it does, everything else has to adjust. This has happened. Big K has lost around 50 micrograms (about the mass of an eyelash) since it was created. But when Big K loses mass, it's still exactly one kilogram, per the old definition. “The new kilogram debuts today. It’s a massive achievement, of mankind over chaos.

Can machines do all our remembering for us? Can we now forget stuff? “A new kind of civilization seems to be emerging, one rich in machine intelligence, with ubiquitous access points for us to join in nimble artificial memory networks.”

This is the story of a British woman who has a sleep disorder that causes her to go internet shopping in her sleep. So far she’s racked up around $5,000 in debt, including buying a full-size basketball court while she was getting some shut-eye.

So what might we eat in 2030? … our diets may be more veg and fruit, whole grains and vegetarian food or new alternatives (soya products, or perhaps insects or artificial meat), and less fried and sugary things. We'll still eat meat, but, perhaps more like our parents and grandparents, see it as a treat to savour every few days.”

Is democracy dying? Four new books on the decline of democratic politics. Needless to say, there’s a bit of focus here on Mr Trump, but also Europe and China. Perhaps books about the death of democracy should all be about China. Just sayin’

America’s Versailles moment. “You might be forgiven for looking at these pictures from the Met Gala, that annual gathering of America’s rich and famous, and wondering to yourself: “has America gone off the deep end?” Here’s what occurred to me: American just got its very own modern-day Versailles.”

Interesting, if subversive: is masculinity itself a terrorist ideology? It’s basically an essay about domestic violence. “Terrorism … is infrequent, far away, and visible, but in reality most violence is common, nearby, and hidden. In 2016, for instance, terror attacks claimed the lives of 68 people in the United States—but that same year, more than 1,800 women were murdered by men, and 93 percent of murdered women were killed by men they knew. That year wasn’t unique or unusual in this regard…”

Are we the last mortals? It’s an article and podcast about the fact (according to this person) that our “near descendants” could be immortal, the way life expectancy is going. Big claim. I’m not convinced, but she makes a decent point about how long people are likely to be living fairly soon.

The myth of advice. Successful people want to be helpful, but their advice is usually empty. “…one of the paradoxes of advice seems to be that those most likely to be asked for it are least likely to have taken anyone else’s: their projects of “becoming” are the most particularized of all.”

A village in Brittany, France, is offering a reward of $3,237 for anyone who can translate a message covering a mysterious rock. All the letters come from the French alphabet, but their combinations have proved unreadable.

Very funny election satire: Mark Humphries on voting below the line.

More election satire: Scomo PR – rebranding the PM.

This guy – Stuart Kells – is a good friend of mine. He has written about looking for Shakespeare’s Library (there isn’t one, but he must have had a big one). This is an excerpt.

Interesting account of the tensions and questions provoked by the abdication of Emperor Akihito of Japan. What’s the point of an Emperor in modern Japan? Can abdication even be a thing if he is a God?

Why your brain hates slowpokes – the high speed of society has jammed your internal clock. “Slow drivers, slow Internet, slow grocery lines—they all drive us crazy. Even the opening of this article may be going on a little too long for you. So I’ll get to the point. Slow things drive us crazy because the fast pace of society has warped our sense of timing.

The avalanche of anti-abortion bills in the US is the result of decades of Republican plotting,

Happy Birthday Bob Dylan, 78 yesterday. Which song to choose? So many. One of my favourites these days is Lily, Rosemary and the Jack of Hearts, from his masterpiece album, Blood on the Tracks.

But I could pick any song from that album, like Tangled up in Blue. And then there’s All Along The Watchtower, from John Wesley Harding.

And if Dylan hadn’t written it, Hendrix couldn’t have covered it – one of the greatest covers of all time, of any song.

And tomorrow would have been the 79th birthday of Levon Helm, drummer and lead singer of The Band. Here he is doing the The Night They Drove Old Dixie Down.

Virgil Caine is the name, and I served on the Danville train

'Til Stoneman's cavalry came and tore up the tracks again

In the winter of '65, we were hungry, just barely alive

By May the tenth, Richmond had fell, it's a time I remember, oh so well

.png)

.png)

.jpg)

.jpg)

.png)

.jpg)

.png)

#AskAlan Live

The weekly Facebook #AskAlan livestream is above, and has migrated to a new platform on the InvestSMART website which can be found here.

The new and improved #AskAlan not only broadcasts answers, but your questions in written format to improve accessibility.

You will be able to submit your questions through the new page moving forward, as well as still being able to email them to the askalan@investsmart.com.au inbox.

Next Week

By Ryan Felsman, Senior Economist, CommSec

Australia: Business investment and credit growth data in focus

In the coming week updates on business investment, building approvals and credit growth feature on the data docket. The figures on investment spending will help formulate views on economic growth for the March quarter.

The week kicks off on Tuesday when the weekly Roy Morgan-ANZ measure of consumer sentiment is released. Consumer reaction to the re-election of the Morrison government and new Reserve Bank commentary on interest rates and the economic outlook will be closely observed.

On Thursday the Bureau of Statistics (‘ABS’) issues the publication “Private New Capital Expenditure and Expected Expenditure” for the March quarter. In the December quarter new business investment (spending on buildings and equipment) rose by 2 per cent to be up 1.9 per cent over the year.

The report also includes estimates of future investment. The first estimate of spending in 2019/20 was $92.14 billion, up 11 per cent on the first estimate for 2018/19 and the strongest growth in seven years.

Commonwealth Bank Group economists forecast new business investment (spending on buildings and equipment) to fall by 0.7 per cent in the March quarter.

Also on Thursday one of the major leading indicators for home building - council approvals to build new homes - is released. Approvals fell by 15.5 per cent in March to be down by 27.3 per cent over the year.

In March, the total number of new council approvals on a rolling annual basis fell below 200,000 units for the first time since June 2014. While there is still a reasonably healthy pipeline of residential building taking place, dwelling commencements have fallen to three-year lows, reducing demand for residential construction workers.

On Friday the Reserve Bank releases its “Private Sector Credit” data (a measure of loans outstanding). Annual credit growth fell to a five-year low of 3.9 per cent in March due to the decline in housing finance and falling home prices. Annual investor housing credit growth is the weakest on record.

Also on Friday the Australian Prudential Regulation Authority (‘APRA’) releases credit card data. Bank lending to households by credit card fell by 4.8 per cent in the year to March – the second biggest annual decline since June 2002. Debit cards and ‘buy now, pay later’ platforms, such as Afterpay, are increasingly being used by younger Australians to finance their purchases of goods.

Overseas: US economic growth and inflation data released after Memorial Day holiday

The Memorial Day public holiday is observed in the US on Monday. Financial markets are closed. But over the week the second estimate of US economic growth, an update on US income and spending (including the US Federal Reserve’s key inflation measure) and China’s official factory gauge will dominate headlines.

The week begins on Monday in China when industrial profits data is released for April. Annual profits for China's industrial companies grew by 13.9 per cent in March. Profit margins, however, are being pressured by slowing domestic demand and US tariffs on imported Chinese goods. That said, the cut in the Chinese government’s Value Added Tax (‘VAT’) effective from April 1 may support profit growth for manufacturing enterprises.

On Tuesday in the US, data on consumer confidence and home prices are issued with the influential Dallas Federal Reserve manufacturing index. And the regular weekly reading on chain store sales is scheduled.

On Wednesday, the weekly mortgage applications data is released by the Mortgage Bankers Association. And the Richmond Federal Reserve manufacturing gauge is also scheduled.

On Thursday data on pending home sales is issued with the advance reading on goods trade and weekly figures on new claims for unemployment insurance.

Also on Thursday, the second estimate of economic growth (GDP) for the March quarter is released. The annual growth rate is forecast to be revised down by just 0.1 per cent to 3.1 per cent according to economists surveyed by Bloomberg. The composition of growth drivers will be of most interest to investors with household and government spending both slowing at the start of 2019.

On Friday in the US, the Chicago business barometer is tipped to lift by 3.4 points to 56 points in May. In April, business activity in the Chicago region registered its biggest slowdown since January 2017.

Also on Friday, the US personal income release includes a key inflation reading. The personal consumption deflator is the preferred inflation measure of US Federal Reserve policymakers. The annual growth rate of the core personal consumption expenditures price index is forecast to remain subdued at around 1.6 per cent in April.

US Federal Reserve Chair Jerome Powell has cautioned that low inflation in the US is likely be “transitory”. Chair Powell has cited categories including portfolio management and investment advice services, clothing and footwear, and air transportation for depressing prices. But rising gasoline prices and increased customs duties (such as tariffs) on Chinese imported goods are likely to boost US producer and consumer prices.

On Friday in China, the National Bureau of Statistics manufacturing and services purchasing manager indexes are scheduled for May. Factory activity expanded at weaker pace in April after a solid rebound in March.

Last Week

By Shane Oliver, Head of Investment Strategy and Chief Economist, AMP Capital.

Investment markets and key developments over the past week

- Global share markets fell over past week amid escalating noise around the US/China trade war and increasing signs that it may be impacting business conditions. However, Australia’s “miracle” election set off a surge in the Australian share market with investors pricing out the risk of a Labor Government which resulted in a surge in bank, retail and property shares more than offsetting weakness in resources and utilities. Demand for safe havens pushed bond yields lower, with firming expectations for RBA rate cuts pushing Australian 10-year bond yields to a new record low of 1.53%. Oil and metal prices fell on concerns about global demand, but the iron ore price continued to rise.

- The US/China trade war continued to worsen over the last week with the US ramping up bans on US companies trading with Chinese companies and commentary from the Chinese side becoming more strident in its resistance. By his recent actions – increasing tariffs on China, placing bans on trading with Chinese tech companies and tightening the screws on Iran – President has indicated that his appetite for risk is very high and that he believes that he will get a political boost from taking a tough stance with China and Iran. But he also indicated that he is still very sensitive to the message from the share market – by delaying bans on US companies selling to Huawei for 90 days after tech stocks fell in response to the bans. Our view remains that just as we saw last November - when he phoned President Xi and got negotiations going - there will come a point where he will realise just how great the threat to the economy is and backtrack yet again. The problem is that this will likely require further economic weakness and share market falls before we get to that point. So, the trade conflict will likely get worse before it gets better.

- Australian shares, having surged on the election result and expectations for a rate cut being validated by the RBA, are now a bit vulnerable to the worsening trade war and ongoing signs of economic weakness locally. While we see the share market being higher by year end there is a high risk of a short-term correction in line with global shares.

- Rate cuts are imminent in Australia, but how far will they go and will we see QE? RBA Governor Lowe has all but confirmed that rate cuts are on the way with his comment that “at our meeting in two weeks’ time, we will consider the case for lower interest rates” after observing that Australia needs lower unemployment to get inflation back to target. This follows the move to a neutral bias in February, significant downwards revisions to its growth and inflation forecasts and signs that unemployment has now bottomed and is starting to move up. All but one economist surveyed by Bloomberg now expect a cut in June up from just two only two weeks ago and two rate cuts are factored into market expectations by August. We continue to expect 0.25% rate cuts in June and August and that all or the bulk of these will be passed on to borrowers given the recent reduction in bank funding costs and that nearly 90% of bank deposits are on interest rates above 0.5% (and hence are able to be cut if the RBA cuts). However, the problem for the RBA is that it needs to get unemployment down but the slowdown in economic growth to around 2% points to a further rise in unemployment which we expect to reach 5.5% by year end. As a result, the odds are that the RBA will have to take the cash rate below 1%, which will see an increasing debate about whether it should use quantitative easing. QE is not our base – as we don’t think things are that bad - and if they were fiscal policy should really take over – but as has been the case at other major central banks the RBA is likely to prefer exhausting cash rate cuts before considering QE and this is unlikely until it gets the cash rate down to 0.5%.

- Four positives for the Australian residential property market that taken together are too big to ignore - but don’t get too excited. The Federal Government’s First Home Buyer Deposit Scheme on its own was not a game changer. But when it was followed in quick succession by the demise of the threat to restrict negative gearing and raise the capital gains tax discount, APRA moving to relax the 7% mortgage rate serviceability test and the RBA essentially confirming that rate cuts are on the way it’s all too much to ignore. These developments taken together are big. Particularly the removal of Labor’s threatened property tax changes which were likely scaring off investors. They suggest that property prices will bottom earlier than otherwise and we can see that later this year. As John Maynard Keynes once said “when the facts change, I change my mind”, so we have brought forward and adjusted upwards our expectations for the trough in property prices. But given still high house price to income ratios and poor affordability, still very high debt levels, tighter lending standards and rising unemployment a quick return to boom time conditions is most unlikely. After bottoming later this year, which we expect to leave capital city average prices down 12% from their 2017 high, we see broadly flat house prices for 2020.

.png)

Source: CoreLogic, AMP Capital

Major global economic events and implications

- US business conditions PMIs fell sharply in May. While the level is still okay the downtrend is a concern and highlights the negative impact the trade war is having with the PMI survey noting “reduced confidence..linked to global trade tensions.” Meanwhile, the minutes from the last Fed meeting provided nothing new with the Fed getting more confident on growth and seeing the dip in inflation as temporary and so happy to remain patient on rates. That said, the Fed’s staff see inflation staying below target and the return of the trade war since the meeting has added to downside risks suggesting a rate cut later this year is an increasing risk.

- The Eurozone composite business conditions PMI stabilised in May and is actually now higher than that in the US but the manufacturing and services components both fell slightly and the German IFO business survey also deteriorated with the return of the trade war likely not helping given Germany’s trade exposure to China.

- Japanese core inflation rose in May but only to 0.6%yoy which is way below the Bank of Japan’s 2% inflation target. Meanwhile, Japan’s manufacturing conditions PMI fell back below 50 in May although it’s still up from its February low.

- The re-election of the Modi Government is positive for economic reform and growth in India (assuming concerns about it lurching towards pro-Hindu nationalism aren’t realised).

Australian economic events and implications

- Australian data was mostly weak with another drop in contruction activity in the March quarter spread across mining, housing and public construciton providing another weak pointer to March quarter GDP growth. Whats more skilled job vacancies fell 1.6% in April and are down around 7% from a year ago pointing to slowing jobs growth. Against this though, business conditions PMIs rose in May but they are very volatilie in month to month.

What to watch over the next week?

- In the US, expect to see ongoing gains in house prices and a rise in consumer confidence (Tuesday), a rise in pending home sales (Thursday), modest gains in personal spending for April but core private final consumption deflator inflation remaining soft at 1.6% year on year (Friday).

- The outcome from the European parliamentary elections may see a lot of hype around Eurosceptics winning seats, but don’t read too much into it. The EU elections tend to see a higher turnout from motivated Eurosceptic voters, most Eurosceptic parties are not serious about leaving the EU and/or the Euro (the Italians and Eastern Europeans) or are irrelevant (those from the UK), the EU Parliament doesn’t have a lot of power and in any case popular support for the Euro across the Eurozone has been rising and is strong at 75%. On the data front, Eurozone economic confidence indicators for April (Tuesday) will be watched for signs of stabilisation after their falls since 2017.

- Japanese data to be released Friday is likely to show a continuing tight labour market thanks partly to the falling workforce but industrial production data will be watched for a rebound after recent weakness.

- Chinese business conditions PMIs for May (Friday) will be watched for any slippage particularly in response to the re-escalation of the trade war with US.

- In Australia, March quarter business investment (Thursday) is expected to remain weak but business investment plans are likely to show a further modest improvement. Meanwhile expect to see a small bounce in building approvals (also Thursday) after a plunge in March & ongoing soft growth in private credit.

Outlook for investment markets

- Share markets are likely to see a further pull back in the short term on the back of uncertainty about trade and mixed economic data. But valuations are okay, global growth is expected to improve into the second half and monetary and fiscal policy has become more supportive of markets all of which should support decent gains for share markets through 2019 as a whole.

- Low yields are likely to see low returns from bonds, but government bonds remain excellent portfolio diversifiers.

- Unlisted commercial property and infrastructure are likely to see a further slowing in returns. This is particularly the case for Australian retail property. However, lower for even longer bond yields will help underpin unlisted asset valuations.

- National average capital city house prices are likely to remain under pressure from tight credit, record supply, reduced foreign demand and price falls feeding on themselves. However, the combination of imminent rate cuts, support for first home buyers via the First Home Buyer Deposit Scheme, the relaxation of the 7% mortgage rate serviceability test and the removal of the threat to negative gearing and the capital gains tax discount point to house prices bottoming out earlier and higher than we had been expecting. We now look for a 12% top to bottom fall in national capital city average prices, up from 15%.

- Cash and bank deposits are likely to provide poor returns as the RBA cuts the official cash rate to 1% by year end.

- The $A is likely to fall further to around $US0.65 as the gap between the RBA’s cash rate and the US Fed Funds rate will likely push further into negative territory as the RBA moves to cut rates. Excessive $A short positions and high commodity prices will likely prevent an $A crash though.