GREEN DEALS: Yallourn's rain check

Yallourn, EnergyAustralia

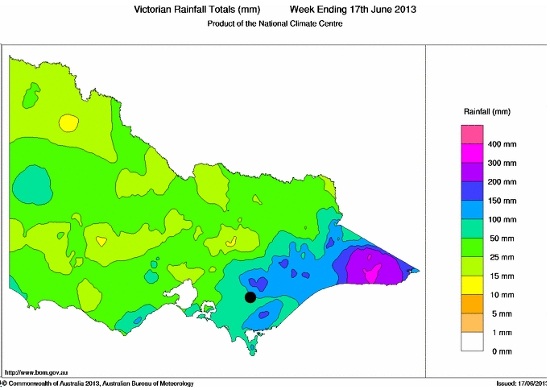

The Yallourn coal mine in Victoria’s Latrobe Valley has been impacted by heavy rain – again. It is the second flooding of the site in around a year. Last June, the Morwell River Diversion collapsed, reducing the power station’s output by 75 per cent.

The latest episode is not quite as damaging, with only one coal conveyor out of action (for at least three weeks) while all generating units remain operational.

It will, however, prove a setback in plans to complete repairs to the Morwell River Diversion, which were started in the wake of last year’s flooding. EnergyAustralia had hoped to complete this by September, but the latest rainfall will see this timetable altered.

“We have always been clear that this work is weather dependent,” EnergyAustralia’s Group Executive Manager, Michael Hutchinson, said.

“Wet weather makes vehicle movements and work conditions difficult and this will impact the exact timing of opening up the diversion.”

Given the 2007 debacle and last year’s failure however, it does pose the question: at what point does it become untenable?

Rainfall near Yallourn over past week (black dot represents its approximate location)

Source: BoM

Macarthur wind farm, CEFC

The Clean Energy Finance Corporation could make a debt offering for the Macarthur wind farm its first point of business, according to Reuters. As reported previously on Green Deals, 50 per cent owner Meridian Energy is looking to offload its stake in the country’s largest wind farm in an endeavour to boost cash reserves ahead of a planned IPO.

The Reuters report suggested Meridian would increase its debt by $170 million, with $100 million coming from the CEFC. Meanwhile, it has reportedly shortlisted bidders for its stake in Macarthur, with Macquarie Bank advising on the sale.

Waterloo wind farm

The Clare and Gilbert Valleys Council has given the all clear to an extension of the 111 MW Waterloo wind farm.

As a result the development will have a further six 3 MW turbines added.

Last month, Energy Australia offloaded 75 per cent of Waterloo to infrastructure investors Palisade Investment Partners and Northleaf Capital Partners for over $200 million. It has retained 25 per cent and will continue to be a long term off-taker for both energy and Large-scale Generation Certificates produced by the wind farm.

Ratch Australia

Ratch Australia is considering building a 20MW solar farm in north Queensland, according to The Cairns Post.

The planned $45 million development in Collinsville will follows the decommissioning of its coal-fired power station in the region.

Ratch is hoping to start building the solar PV plant next year, before assessing a new facility in the Far North, the report said.

Carnegie Wave Energy

Carnegie Wave has formally taken over control of the onshore development site at HMAS Stirling on Garden Island, the location of its flagship Perth Wave Energy Project.

The control of the site comes following a handover from the Australian Department of Defence.

“This is a significant step in the implementation of Carnegie’s Perth Project, indicative of the significant amount of work by both the Department of Defence and Carnegie,” Carnegie’s Project Development Officer, Tim Sawyer, said.

Last year, Carnegie signed power supply and grid connection agreements with the Department of Defence for power from the project to be supplied exclusively to Australia’s largest naval base (HMAS Stirling).

Carnegie has also continued progress in purchasing key elements for the project, with six of the 10 now acquired.

Dyesol

It is now clear just how far oversubscribed the Dyesol share purchase plan was, with the company reporting applications for $22.53 million worth of stock – 10.5 times that planned. As a result, Dyesol lifted the size of the offering to $4 million, with shareholder applications scaled back accordingly.

Siemens solar

The last of Siemens’ solar businesses, Solel, will be shut down within a year after the German group failed to find a buyer for the subsidiary.

Solel, bought by Siemens for around $400 million in 2009, was put up for sale in October last year but failed to attract much interest in the current depressed market.

Solel will close with accumulated losses of over $1 billion for Siemens, according to Reuters.