Gold shines through in tough markets

Summary: Gold delivered a modest appreciation in 2015, making it a winner compared with the negative 34 per cent return delivered by mining stocks. The falling Australian dollar was behind the rise and local producers have had a strong 12 months. Investors should consider the debates about supply and their own views on the future of the Australian dollar. |

Key take out: It's unclear whether a sustainable revival will occur, but gold remains an asset that can provide a safety net against currency inflations. |

Key beneficiaries: General investors. Category: Shares. |

Gold was the “Stephen Bradbury” of the investment world in 2015. It beat other assets by not collapsing (which was how Bradbury won gold in 2002 when every other competitor in his speed skating race fell, making him the first, and only Australian gold medal winner at a winter Olympics).

On this day 12 months ago, an ounce of gold would have cost an Australian investor $1549. Today, that ounce is worth $1587, a modest appreciation in value of 2.45 per cent, but a Bradbury-like performance because it was better than the 8.8 per cent fall in the stock exchange All Ordinaries index, or the 34 per cent fall in the mining index.

The key to gold rising when other asset classes were falling lies in currency movement, because while the US dollar price of gold fell from $US1273/oz a year ago to $US1089/oz, the Australian dollar fell faster, from US82.2c to US68.6c.

That currency effect, rather than the US dollar price, was the reason I nominated gold as an asset to watch in 2015 in a story last year (see Golden moment: It's time to top up, January 21, 2015).

Interesting as a comparison is between gold and other assets, it is a look in the rear-view mirror. A more revealing question is whether gold can do it again this year and outperform either by not falling, or by rising as demand increases.

The answer is surprising, because the key to gold in the next few years might lie in a new factor in the equation – declining supply.

Gold might, or might not, hit a peak in production before declining but whatever it does it will take years for the market to fully understand what's happening and for geologists to unlock currently uneconomic gold deposits. During that time the gold price could rise quite sharply.

For Australian investors today, it's simply a case of understanding the developing debate about gold supply and overlaying that with a view on the Australian dollar, which might have further to fall as the country's terms of trade worsen courtesy of low prices for other commodities like iron ore, oil, coal and copper.

The latest survey of the gold industry by Thomson Reuters GFMS (formerly Gold Fields Mineral Services) includes the forecast for 2016 of a three per cent fall in worldwide gold production. If correct, it will be the first time in seven years that gold output will have declined. Last year's output was up one per cent to 3155 tonnes.

That survey has been supported by comments from a number of mining industry leaders, including Nick Holland, chief executive of South African-based Gold Fields, who said the days of rising gold output were probably gone.

Kevin Dushinsky, chief executive of Canadian-based Barrick Gold, told London's Financial Times newspaper that falling ore grades and the rate of production, coupled with a lack of discovery, were “bullish for the medium to long-term price of gold”.

Chief executives of gold companies are expected to say things like that but if the GFMS survey is correct and a seven year run of rising output is coming to an end, then supply will become an issue – especially at a time when demand appears to be reasonably strong.

Adding to a belief that gold could have a better year (in US dollar and Australian dollar terms) is the corporate side of the business, where gold company share prices have comfortably outperformed other equities.

Local gold leaders have all performed strongly over the past 12-months, led by the reborn St Barbara which has risen from a low of 16c to last sales at $1.66 (see Alan Kohler's interview with St Barbara chief executive Bob Vassie here: Eureka Interactive: St Barbara), Regis (up from $1.07 to $2.39), Newcrest ($10.55 to $13.04) and Northern Star ($1.79 to $2.94). Production numbers and all-in sustaining costs at Northern Star have pleasantly surprised analysts – see today's Collected Wisdom.

The gold price is one factor underpinning the outperformance of gold stock relative to the rest of the market, especially other mining stocks.

But there is another influence at work, and that's the early entry of gold into the cyclical correction, which is dogging all commodity-exposed equities.

Gold began its slide five years ago after its price hit an all-time high of $US1900/oz, with the fall back to just above $US1000/oz forcing gold miners to make significant cuts in their cost structures.

In effect, most gold miners have cleaned up their costs, booked losses that had to be booked, and prepared themselves for a period of low prices – a process which the iron ore and coal miners started more recently.

Gold mining, it could be argued, is three years ahead of the rest of the mining industry in terms of essential cost control - including a cutback in mine development and exploration, the factors which lie behind the GFMS forecast of a fall this year in gold supply.

Entry points for gold exposure remain the traditional direct ownership of shares in a gold mining company, gold in its bullion form, or gold via an exchange-traded fund – such as the world's biggest, the SPDR Gold Trust, where another hint of a revived interest in gold can be found.

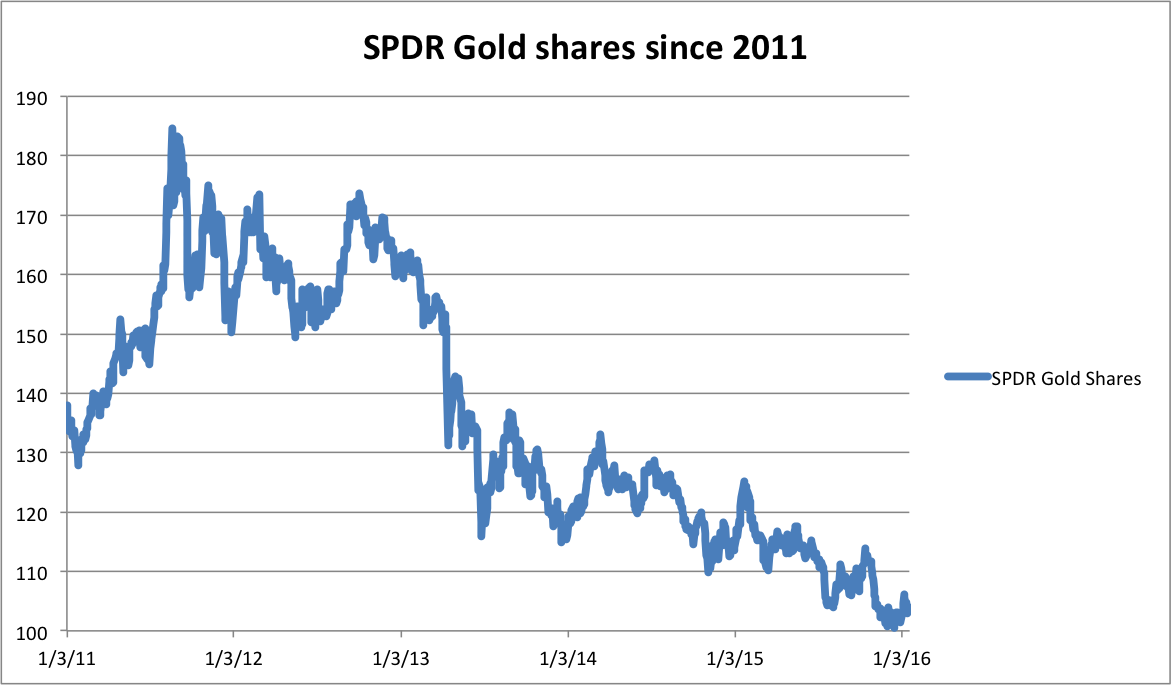

After three dreadful years when the gold price was tumbling from that 2011 high of $US1900/oz, around $US50 billion was withdrawn by investors from the SPDR Gold Trust.

Source: Bloomberg, Eureka Report

Last week, as most other asset classes were hit by uncertainty of China's growth rate and the falling value of its currency, the SPDR Gold Trust recorded an inflow of $US400 million in funds. Other gold-based funds, such as the iShares Gold Trust, also recorded healthy inflows.

Whether gold is in the early stages of a sustainable revival is uncertain, but what has been occurring in the various gold markets is a reminder that it remains a unique asset that can either act as a sheet anchor in an investment portfolio, or a safety net against currency fluctuations.