Europe needs more than Draghi's hot air

The ECB left rates unchanged at its meeting overnight, but has once again indicated that it is willing to take rapid action, including quantitative easing, if necessary.

Strong words have been a hallmark of Mario Draghi’s presidency, but the reality is that greater action has been necessary for years.

Europe is now in its seventh year of economic crisis. The unemployment rate in the eurozone remains at around 12 per cent and inflation has pushed below an annual rate of 1 per cent. The recovery is, at best, fragile but also immensely slow; it will take years before real GDP in many eurozone countries reaches pre-crisis peaks.

How much worse does the ECB want conditions to get before it pulls the trigger?

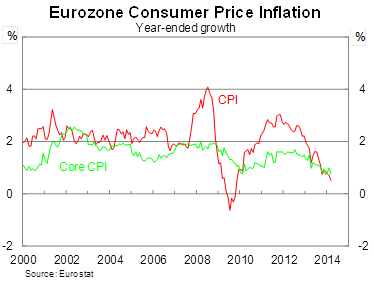

Pressure mounted on the ECB to act following a poor outcome for inflation in March. Inflation across the eurozone rose by 0.5 per cent over the year to March, according to advance estimates from Eurostat.

The core measure -- which removes volatile items such as food, energy, alcohol and tobacco -- has climbed by just 0.8 per cent over the year. Both measures remain well below the ECB’s target for inflation of around 2 per cent.

The ECB attributed the March weakness to a late Easter, which may have held prices down a bit in March. Easter has traditionally been associated with higher hotel and travel costs. But to dwell on this temporary issue distracts us from the fact that eurozone inflation is in a really bad way (Euro inflation enters the danger zone, April 1).

The ECB expects annual inflation to remain low before "gradually increasing during 2015 to reach levels closer to 2 per cent towards the end of 2016". But those forecasts seem awfully convenient.

It’s the type of forecast we often see from central banks. According to central bank wisdom, growth will almost always return to trend and inflation will always move towards target over the next couple of years.

It provides immediate validation of any policy position. It is also nonsense and, in the ECB’s case, incredibly unlikely.

Why would inflation return to the ECB target of 2 per cent towards the end of 2016?

Such statements seem to rely on measures of inflation expectations, but those expectations are unlikely to be realised. To understand why, we simply need to consider two driving forces of inflation: wage growth and the exchange rate.

Wage pressures are driven by a greater demand for labour than there is an available supply of workers. When the unemployment rate is low, firms will effectively compete for the best available candidates and push wages up.

But in the eurozone, the unemployment rate remains at around 12 per cent and as the economy recovers there will be plentiful workers to be found who will be willing to work at low rates. The reality is that the region is still years away from wage demands boosting inflation in any meaningful way. Even the US -- whose recovery is years ahead of Europe -- has yet to see genuine wage pressures (Four reasons the Fed won’t raise rates any time soon, April 1).

A depreciation in the euro is also unlikely to contribute materially to inflation, because most euro trade occurs internally. Its exposure to other currencies is relatively minor compared with most other countries.

The ECB is prepared to talk tough, but on available evidence they remain a reactive and conservative organisation. Despite modest growth, the eurozone recovery is pathetic. Unless the ECB and European governments change tack, they are looking at a crisis that could persist into the next decade.