Eureka's Week: Resources party, banks wake, helicopter money, the election, television

Last Night | Resources party | Banks wake | Helicopter money | The election | Television | Readings & viewings | Last week | Next week

Last night

Dow Jones, up 0.12%

S&P 500, 0.00% change

Nasdaq, down 0.8%

Aust Dollar, US77.0c

Resources party

It really is quite striking that central banks and economic elites are continuing to brood over low growth, and even “secular stagnation” as discussed here last week, including a brooding speech during the week by Glenn Stevens (see below) and yet resources stocks are having a party.

The Resources 300 index is up 21 per cent in two weeks and 41 per cent since January 20. BHP and Rio Tinto have jumped close to 50 per cent each and Fortescue, which was supposed to go broke last year, has popped 150 per cent.

The big question now for investors large and small is: have I got enough resources in my portfolio? The subsidiary question is: have I got too many banks (they've gone nowhere this year and are down 22 per cent on average from the peak – more on them below).

In the seats of power, central bankers and economists are still wringing their hands about low growth and low inflation. The only question that seems to matter to them is: have we got interest rates low enough? And – what next?

Yesterday the European Central Bank resolved to keep its deposit rate at -0.4 per cent. President Mario Draghi defended the ECB's loose monetary policy against German attacks. He said risks remain and promised to keep interest rates where they are “for an extended period of time”.

As he was speaking, over in the real world the iron ore price was shooting up to $US70 a tonne.

So which is the real world? Maybe the dark one that Mario Draghi and Janet Yellen inhabit is the real one.

I don't think so. In my first epistle to you after long service leave in March (to read more, click here), I declared that the key theme for 2016 would be a resources bull market, for three reasons: the mining stocks are cheap, China won't crash and interest rates are the lowest in history.

Rates are still low, and probably going lower, China still won't crash and miners are still cheap, especially Fortescue and Rio. FMG is up 150 per cent, as I mentioned, but its forward PE is still under five. Rio's PE is still under 10, and that's probably for iron ore alone. The rest of its business – copper and aluminium – is free.

Rio's dreadful Alcan acquisition has been restructured and is now producing cheap hydro power, cheap bauxite and cheap alumina, and is ready to take full advantage of the aluminium upcycle, when it comes. Copper mines in Chile, Mongolia and Indonesia are also going nicely.

And just take a look at FMG's 10-year price chart:

Yes, it's doubled this year but having got costs down to $US15 per tonne, FMG's leverage to the iron ore price has been dramatically improved.

As for BHP, this week it cut production forecasts for iron ore out of Pilbara by 10 million tonnes to 260 million. The share price went up 3.4 per cent. Next day, the company said it expected the iron ore price to fall. The share price went up 3.5 per cent. When the rally is on, the market won't be denied.

The reason is that both BHP and Rio are tightening production now to get the price up.

OPEC's meeting failed this week to get an agreement on lower oil production to get the oil price up. BHP and Rio don't need to meet: they have understanding; they are twin souls.

The Chinese pips (iron ore mines) are squeaking, with big capacity reductions, so the Pilbara miners can take their feet off their throats a bit. Iron ore supply can only tighten from here.

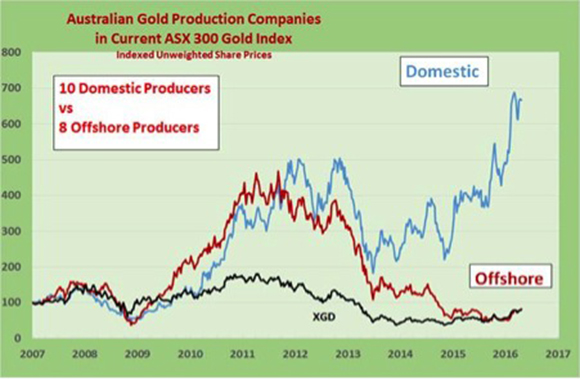

And don't forget the gold miners.

This chart from Barry Dawes of Paradigm Securities is very interesting:

The domestic producers are having stellar run and have been consolidating their gains this year.

It should be borne in mind that Barry's firm, Paradigm, is raising a lot of money for gold producers, and he's a big-time bull, but nevertheless he's been right. FYI, his favourite gold stocks are Northern Star and Evolution, as well as Ausgold, Stonewall Mining, Ark Mines and also BLK, DRM, GOR, OGC, MML, SBM and RSG.

I pass those on for what it's worth, but I can't recommend them myself. You'll need to do your own work or perhaps talk to Barry – I simply don't know enough about them.

Banks wake

The political hoo-hah around the banks this week has been mostly just that: hoo-hah. But there is a serious element to it.

After all, the bank chief executives have emerged, one by one, from their burrows and fired defensive press releases into the air, hoping they land somewhere good.

And then the Australian Bankers Association coughed up a big statement on how the banks are all going to change their behaviour.

“The banks will immediately establish an independent review of product sales commissions and product based payments, with a view to removing or changing them where they could result in poor customer outcomes.”

“Banks will also improve their protections for whistleblowers to ensure there is more support for employees who speak out against poor conduct.”

So will this all be window dressing, or will it actually benefit customers, and therefore shareholders in the long term? Hard to say.

The ABA, on behalf of the banks, has been working on this plan for a few months, before the ALP announced its royal commission wheeze and well before the government came up with its response this week (which was all spin, by the way – read my piece on the subject in The Australian today – click here ($)).

It seems to have started when Andrew Thorburn of NAB took over from Brian Hartzer of Westpac as chairman of the ABA late last year.

They commissioned research firm Crosby Textor to do some work on community attitudes towards banks and found – Shock! Horror! – that they are not well liked at all.

Then there was Malcolm Turnbull's speech to Westpac's 200th anniversary lunch (read it here: Westpac address) on April 6, in which he specifically urged them to do something about remuneration practices, galvanised them into action.

So they brought in Gina Cass-Gottlieb, a lawyer with Gilbert and Tobin, to run the review and establish new “governance arrangements” and to help choose an independent expert to oversee the thing (not her apparently).

“Each bank commits to ensure it has overarching principles on remuneration and incentives to support good customer outcomes and sound banking practices.”

The question, of course, is whether they really mean it or whether they're just trying to use it as cover while the squall blows over. After all, it was the banks that lobbied hard against the banning of sales commission for financial advisers in Labor's Future of Financial Advice legislation and they would have succeeded if the cross-benchers in the Senate hadn't blocked the Coalition's repeal.

That whole “anti-red-tape” push from the industry and the Coalition has now gone into full reverse, with the Government now all in favour of regulating advice and the banks now trying to regain some initiative with their own proposals.

Says the ABA press release: “Building on the ‘Future of Financial Advice' reforms” (er, which we lobbied against ferociously, but let's not dwell on that) “we will immediately establish an independent review of product sales commissions and product based payments with a view to removing or changing them where they could lead to poor customer outcomes. We intend to strengthen the alignment of remuneration and incentives and customer outcomes.”

The problem is, of course, that they are well behind the curve, as is the Government for that matter. They are all in reaction mode.

As Ian Rodgers, publisher of Banking Day newsletter wrote this week: “No amount of fair recognition for the merit of the sector's collaboration over the recent past and the credibility of the proposed banking industry actions can offset the impression that the Australian banking industry and its association are late responders.”

Will any of it matter to you, as a bank shareholder? Well yes, it matters a bit, but nowhere near as much as the levels of employment and house prices.

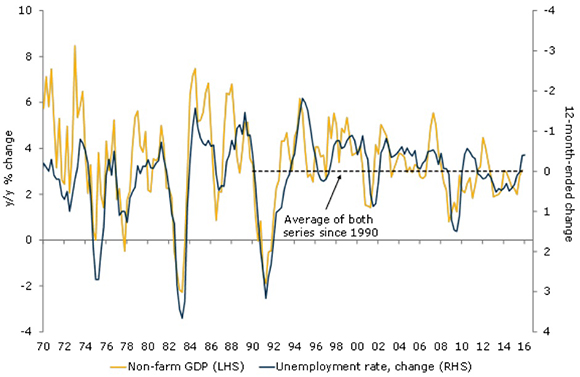

And on those scores, it's a sort of one-all draw. Employment and economic growth are fine:

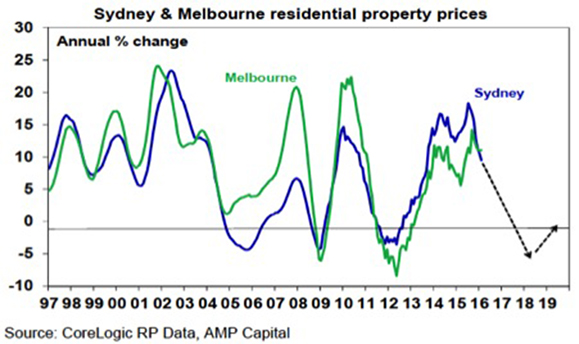

But house prices have tipped over…

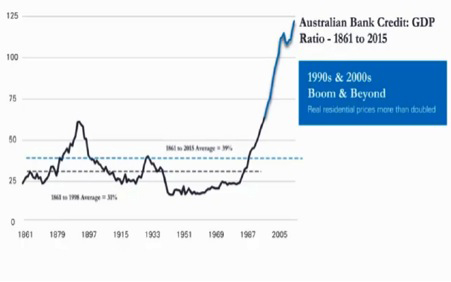

and largely as a result of the rise in house prices, bank credit is at an extreme (this remarkable chart comes from Lazard Asset Management):

None of the measures to improve the banks' standings in the community, and clean up their remuneration practices, will matter a jot if there's a recession and/or the housing market cracks in a big way.

But they should do it anyway.

Helicopter money

RBA Governor Glenn Stevens gave an important speech (read it here: Observations on the current situation) in New York during the week, in which he said – once again – that we are reaching the limits of monetary policy, evidenced by the fact that anyone is even talking about “helicopter money”.

That's where central banks simply deposit money in peoples' bank accounts, rather than cutting interest rates and hoping they borrow more.

Apart from anything else, as Stevens points out, this would really be fiscal policy, not monetary policy, or else monetary-fiscal co-ordination, if it involved the central directly funding government spending by printing money.

But as he said, surely diminishing returns are setting in. “In the end we will collectively have to face up to the question of whether trend growth is lower and, if so, what is to be done about that.”

My discussion on secular stagnation last week laid out some of things behind low growth, including demographics and high levels of debt.

Glenn Stevens takes the next step: “If trend growth is lower and we can't or don't want to do anything about that, then expectations about future incomes, tax bases and so on will have to be reconfigured.”

That is a big statement from a central banker. He's not entirely giving up, but you don't come away from reading his speech all that optimistic.

He says there are a few things that could be done, such as improving productivity and risk-taking. “If we could engender a reasonable sense that future income prospects are brighter, that there is a good return to innovation and ‘real economy' risk taking, and so on, then people might use low-cost funding for more productive purposes than just bidding up the prices of existing assets.”

But helicopter money? “Are we that desperate?”, asks Glenn Stevens.

The election

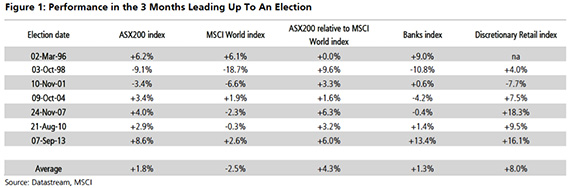

David Cassidy, the investment strategist at UBS, has done a detailed and interesting analysis of how the economy and share market perform before and after elections, as we grind our way towards a July 2 double desolation, I mean dissolution.

To skip to the conclusion, he finds that the commonly accepted wisdom that consumers and investors go into a holding pattern as a result of pre-election uncertainty is not supported by the facts.

“While we would be careful not to draw any overly strong conclusions from our limited sample of seven election periods, we believe our results at least draw into question the common assumption that the equity market and the economy shift (or indeed downshift) into a "holding pattern" in the run up to an election. Simply, we see little evidence of this pattern.”

Here's the evidence:

Leaving that aside, will the outcome of the election matter to investors, beyond the fact that if Labor wins negative gearing will be restricted to new houses?

Probably not. At a guess I'd say the American election and the British referendum matter more.

Television

The big non-business story of the week has been the botched attempt by Sally Faulkner to get her two children back from their father in Lebanon, filmed, and apparently financed, by Channel 9's 60 Minutes.

It is really a business story. Apart from shining a light on the shadowy global industry of child recovery, this story also highlights the plight of free to air TV networks trying to maintain their audiences and revenue.

If anything, the structural changes to the industry – and traditional media generally – being brought by the internet are accelerating, not slowing down.

The decision by Nine's producers to go to Beirut and film the attempted re-abduction of the Faulkner children, and apparently pay for it, was an act of sheer desperation.

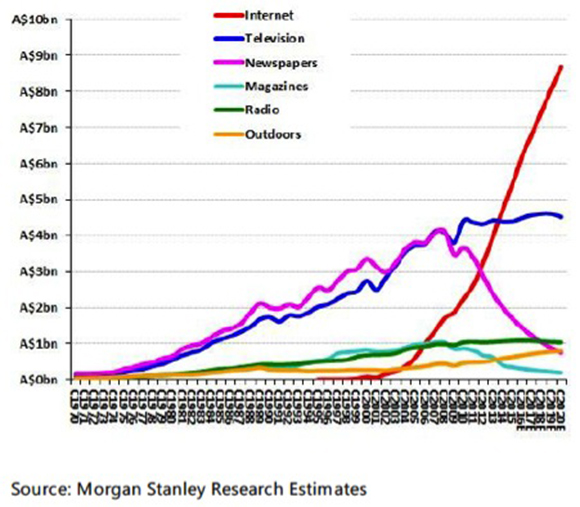

Morgan Stanley estimates that the leakage of ad revenue to Google and Facebook, and other smaller global players, increased 24 per cent, or about $1 billion in 2015 alone.

The total ad market increased by only $300 million, which means the revenue pool for domestic media actually shrank by $700 million.

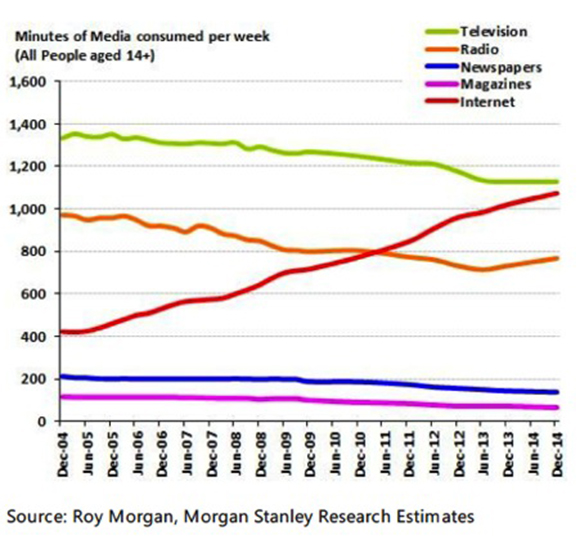

On top of that, the subscription service, Netflix, is also robbing the TV networks of viewers, or rather viewers' time. Estimates of the subscriber numbers range from 1 to 2 million, but the real key is – what's happening to the time spent watching the three commercial networks?

My kids are watching shows on Netflix, but also a lot of YouTube, where you can get virtually anything you want, including full-length TV shows and movies. And then there's illegal downloads.

Here's a chart of ad spend estimates:

And time spent:

Note that the time spent graph stops at the end of 2014 – the internet would definitely have passed TV by now.

There are no internet advertising companies in Australia. You could invest in Google, Facebook and Netflix, but you'd be taking currency risk and those stocks look expensive (although Google looked expensive a year ago at $US550, and now it's $US750, and Facebook looked expensive at $US80 and now it's $US113. Netflix has only gone from $US80 to $US95.)

Anyway, these are profound structural changes and as Morgan Stanley's analysts say: “…if the addressable market is shrinking in perpetuity, as we believe it is, these stocks warrant valuations at a substantial discount to historical and market multiples”.

Are they at those discounts yet? Short answer: no. The market is underestimating the risks to ad revenue, for all media businesses.

A new grandpuppy!

Deb and I became “grandparents” this week – a grandpuppy arrived into the family in the form of our daughter Phoebe's new dog, Nelly: as cute a Bernese Mountain Dog as you'll ever see.

Here she is:

Readings & viewings

(some stuff I've read and watched this week)

I was a bit old for Prince, but I get it. He was a genius. Here he is doing the song he wrote for Sinead O'Connor – Nothing Compares to You.

And a second Prince video – with Tom Petty, Steve Winwood and Jeff Lynne doing While My Guitar Gently Weeps.

By performing so lustfully, Prince granted everyone permission for pleasure.

Blockchain technology will revolutionise far more than money: it will change your life. Here's how it actually works.

I'm not sure I understand this piece, but it's interesting. It's about military spending - "bloated military budgets no longer bear much relationship to actual defense, at least not for the big spenders.”

Google's parent, Alphabet, disappoints with its first quarter earnings.

What's happening in Brussels after the terrorist attacks (called 3/22).

Good video of three fine fund managers talking about food and beverage stocks they like (and don't like). They are calling Wesfarmers a sell.

Good piece by Simon Hoyle of Professional Planner magazine: it's time for financial planners to stand up.

US earnings forecasts are being cut, but that's what always happens.

Donald Trump saying “China” set to a bass guitar.

If you think Republicans will rebel against a Trump nomination, think again.

Boris Johnson on the efforts to prosecute a German comedian for saying something quite rude about the Turkish President. “This is what the EU has wrought” (he's using it to argue for Brexit).

The untold story of Magic Leap, the world's most secretive startup (it's to do with virtual reality).

Narayana Kocherlakota, former President of the Federal Reserve Bank of Minneapolis, says the discredited policies of Donald Trump and Bernie Sanders make some sense.

This 61-year-old Italian hotel has never had a single guest. The story provides a window into Italy's crazy real estate sector.

Terrific piece by my mate Bob Gottliebsen about the Defence Department ($ paywall).

Day one of the 2016 election campaign was an unexpected disaster for Malcolm Turnbull ($).

As each day passes the prospect of another hung parliament and recalcitrant Senate appears more likely.

Wonderful speech by Philip Hofflin of Lazard Asset Management. The first 13 or so minutes about Australian real estate are especially good. You might have noticed one of the charts on the ABC news, and above.

How First Solar is pushing the limits of solar technology.

George Soros says China's debt-fuelled economy looks like America's before the crisis, which he has said before, and not just once.

LeEco, the Chinese smartphone company, has produced a self-driving electric concept car.

Obama: we can't let the truth come out about Saudi Arabia's involvement in 9/11 or else America's terrorism will be revealed.

Washington DC is facing the growing power of Silicon Valley.

The internet really has changed everything.

Fascinating paper from the St Louis Federal Reserve about the long rise of China.

The reading habits of very successful people (they read – a lot).

The high stakes of TPP ratification: Implications for Asia-Pacific and beyond.

Last week

Shane Oliver, AMP

Investment markets and key developments over the past week

Share markets mostly continued to move higher over the last week as growth fears from earlier this year continued to recede and the oil price managed to push higher despite the failure of OPEC and Russia in Doha to agree a production freeze. The pace of gains in US shares slowed but European, Japanese and Australian shares played catch-up with the Australian share market almost getting back to where it ended 2015. Chinese shares fell though on concerns that there won't be more policy stimulus. Reflecting the “risk on” tone bond yields continued to move higher, most commodity prices rose and the $A reached $US0.78. Even the iron ore price has now hit $US70/tonne – what happened to the global steel glut?

The ability of oil and share markets to rally despite the failure of key producers to agree an oil production freeze is a positive sign. The Doha meeting was mainly about appearances anyway with Saudi Arabia and Russia already at capacity, Iran never likely to participate and many other factors driving the rebound in oil and growth assets since the panic of earlier this year. Regardless of the Doha debacle the oil market is gradually rebalancing as global oil demand slowly climbs and other producers, including the US, are slowing supply.

While we remain of the view that the broad trend in share markets is likely to remain up, the next scare is likely to come as Fed hikes return and bond yields continue to back up, pressuring equity valuations. Markets cycling back and forth between deflation/growth scares and then higher bond yields/Fed scares has been the story of the last few years now!

The New York presidential primary victories for Hilary Clinton and Donald Trump further cement the former as the Democratic presidential candidate but still leave Trump open to challenge at the Republican convention in July. Trump needs to win 53 per cent of remaining delegates to the convention to get a majority but so far he has only been winning 49 per cent so a contested convention could still occur. Interestingly so far he's only been getting 38 per cent of the popular vote at the primaries so he is still getting less than majority support. The next set of GOP primaries are on April 26, but the June 7 California primary with its 172 delegates may end up being key. So a long way to go yet.

Australia is another step closer to a July 2 double dissolution election with constitutional triggers now in place. Of course it won't be declared till just after the May 3rd Budget, but just like in 2013 when the election date was announced way in advance (albeit to be changed later) we are now in another longer than normal de facto election campaign. It's too early to talk precise policy differences between the two alternatives – but it is clear that the Labor Party will focus more on budget repair via various tax hikes (restricting negative gearing, super and the capital gains tax discount) and while the Liberal/National coalition will have a bit of that too it will mainly focus on spending restraint. However, in terms of the near term impact of the election itself the risk is that some spending decisions by households and businesses are put on hold through the election campaign - with a higher risk for long de facto campaigns like this one. Qantas has already suggested this may be happening. However, there is no clear evidence that election uncertainty effects economic growth in election years as a whole. Since 1980 economic growth in election years has averaged 3.7 per cent which is greater than average growth of 3.2 per cent over the period as a whole. That said, growth was below average at 2.3 per cent in 2013 which also saw a long de facto election campaign. In terms of the share market, there is some evidence of it tracking sideways in the run up to elections but on average it has gained 4.9 per cent in the three months after elections - so it's good to get them out of the way.

It's hard to disagree with RBA Governor Glenn Steven's view that there are limits to what monetary policy can do. Monetary policy can help offset cyclical fluctuations in growth but it can't solve the so-called “secular stagnation” phenomenon. There is a role here for government in removing impediments to growth (supply side reforms of the sort the G20 summit in 2014 supposedly committed too) and encouraging investment in productive assets. The trouble for central banks though is that their mandate is to achieve certain inflation targets over time - usually around 2 per cent - and when these look like being chronically missed on the upside or the downside they invariably have to intervene. Which is what they have been doing in recent times and why "helicopter money" (ie using printed money to directly finance government spending/tax cuts) is being talked about in some countries where other monetary policy options have been exhausted, Japan being a noticeable example. Fortunately we are a long way from that in Australia, where if inflation looks like coming in under target for a lengthy period (which is a risk now) there is still plenty of scope for conventional monetary easing.

Major global economic events and implications

US housing data was a mixed bag with falls in starts and permits but solid readings for home builder conditions and existing home sales. Other US data was also mixed with a fall in manufacturing conditions in the Philadelphia region, but gains in home prices, leading indicators and another fall in jobless claims. March quarter earnings results showed 82 per cent of companies beating on earnings and 59 per cent beating on sales with 25 per cent of S&P 500 companies having reported so far.

No surprise after its huge March effort to see the ECB on hold at its latest meeting, with President Draghi pushing back against German criticism and indicating that it remains ready to do more if needed. Meanwhile, the ECB's bank lending survey revealed little change in lending standards but solid growth in loan demand.Chinese property prices continued to increase in March led by Tier 1 cities. While this is consistent with other indicators of improved growth in China, it also warns of renewed measures to slow bubble fears in some Chinese cities.

Australian economic events and implications

It was a quite week on the data front in Australia. Skilled vacancies did fall in March though for the second month in a row suggesting jobs growth may start to slow but too early to read too much into this.

Next week

Craig James, CommSec

Inflation takes centre stage

The domestic economic data is limited in a holiday shortened week. In Australia inflation will dominate the calendar, particularly in light of the upcoming Reserve Bank Board meeting. A super low inflation result could be the trigger for another rate cut. In the US the data focus will be on the home prices and economic growth. While for investors and traders the focus will be centred on the Federal Reserve policy meeting (on Wednesday).

On Wednesday inflation data will be in focus, when the Consumer Price Index for the March quarter is released. The “official” inflation data only comes around once a quarter in Australia. There is private sector monthly survey on inflation from Melbourne Institute but the Australian Bureau of Statistics only publishes its inflation measures once a quarter.

The monthly inflation gauge suggests inflation should remain relatively tame over the quarter. The CBA Group is tipping a modest result. A lift of just 0.3 per cent is expected over the quarter with annual inflation to lift from 1.7 per cent to 1.8 per cent.

Over the quarter, the price of petrol plunged by 13 per cent and that alone should keep inflation curtailed. More importantly, investors will need to focus on the “underlying” measures that exclude petrol as well as the non-tradable price measures that focus on domestic price pressures.

We expect that underlying inflation grew 0.6 per cent in the March quarter and around 2 per cent over the year. A mild result such ensure that the Reserve Bank sticks to its easing bias, however a significantly lower inflation result would be needed to trigger a May rate cut.

Also on Wednesday the weekly consumer sentiment reading will be released alongside the Victorian State Budget. Consumer confidence rose 3.4 per cent last week in response to lower unemployment, a stronger sharemarket and higher Aussie dollar.

On Thursday the Australian Bureau of Statistics (ABS) will issue data on export and import prices for the March quarter.

And on Friday, the ABS releases the producer price indexes – key measures of business inflation. It will be important to see what impact the volatile Aussie dollar has had on prices of imported goods across the docks.

On the same day the Reserve Bank releases the “Financial Aggregates” report for March, which includes money supply measures and private sector credit (loans outstanding). We expect that credit rose by around 0.5 per cent in March to be up just over 6 per cent over the year.

In addition the Reserve Bank Assistant Governor Guy Debelle will deliver a speech at the ACI World Congress Conference, in Singapore (1:45pm AEST). A title for the speech has not been released, but the focus is likely to be on the subsequent Q&A session which is open to the media. The Assistant Governor will get questioned on his views on the Australian dollar but more importantly his views on the inflation result earlier in the week.

Big week for overseas economic events

While the focus is primarily on inflation in Australia, a broader array of events is scheduled in the US. Not only does the Federal Reserve policy making committee meet but ‘top shelf' economic data will be issued.

The week begins on Monday when data on new home sales is released. Housing activity has remained healthy and new home sales are expected to have lifted by 2.5 per cent after a 2 per cent rise in February.

Also on Monday the Dallas Federal Reserve releases a business index on the manufacturing sector.

Over Tuesday and Wednesday, the Federal Reserve Open Market Committee meets to decide monetary policy settings. The guessing game on when the Fed will next lift rates won't be resolved. However the text of the decision will be important in determining whether the Fed is on course to lift rates mid-year or whether it is likely to be delayed again.

Also on Tuesday data on consumer confidence is released together with the CaseShiller measure of home prices, influential Richmond Federal Reserve index, durable goods orders and the Markit organisation releases a “flash” (or early-warning) gauge for the services sector. Annual growth of home prices may have edged up to 5.8 per cent while consumer confidence may ease modestly. A further expansion in the services sector is expected. The preliminary data on durable goods orders will be closely watched as it provides some colour to the level of business investment. Orders are expected to have rebounded by 1.6 per cent in March after the 3 per cent slide in the prior month.

On Wednesday, pending home sales data is issued alongside the weekly data on mortgage applications.

On Thursday, the first reading (“advance” measure) of economic growth in the March quarter will be issued. Economists expect that gross domestic product (GDP) grew at an annualised rate of just 0.5 per cent in the March quarter, down from 1.4 per cent in the December quarter. But rather than signalling a slowdown, the data highlights the influence of harsh winter weather in constraining growth in the economy. The usual weekly data on claims for unemployment insurance is also issued on Thursday.

On Friday, data on personal income and spending are released in the US as well as the employment cost index, Chicago purchasing managers index and the University of Michigan Sentiment Index. Income is tipped to have lifted 0.3 per cent with spending up 0.2 per cent. And the employment cost index will be important in guiding views about when the Federal Reserve will next hike rates. No wage pressure – no rush to lift rates.

Share market, interest rates, currencies & commodities

The US earnings season cranks shifts into fourth gear in the coming week. A total of 957 companies will be issuing earnings results.

On Monday, 85 stocks are expected to report including Apple, Halliburton, and Xerox. On Tuesday there are another 222 companies listed including Barrick Gold, AT&T, Resmed and Proctor & Gamble. On Wednesday earnings results are expected from 248 companies including Boeing, Facebook, and Nasdaq. On Thursday 340 companies should issue profit results including ConocoPhillips, LinkedIn, and Domino's Pizza. And on Friday there are 62 companies listed including Exxon Mobile and Chevron.