Eureka's Week: Recession deferred, market manipulation, US jobs, Slack, politics and the CRB

Last Night

Dow Jones, up 0.6%

S&P 500 up 0.6%

Nasdaq, up 0.9%

Aust dollar, US76.8c

Recession deferred

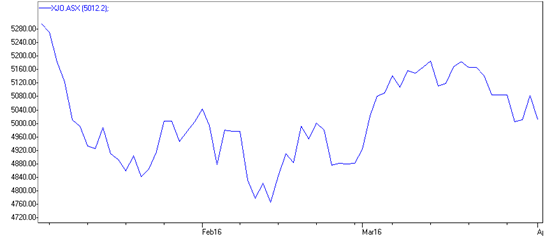

Here's a reminder of what the ASX 200 index did in the first quarter, just ended:

Panicky January, wary February, all better in March. Down a bit more than 5 per cent for the quarter, with banks down 13 per cent, resources up 3 per cent.

So what was it all about? Well, China and America, as usual.

The January panic was caused by a bout of pessimism about China's economy, and in particular fear of a big devaluation of the Renminbi, and related concern about tightening US monetary policy. As discussed here previously, the Chinese currency did indeed devalue, but only enough to rekindle its exports.

Now it turns out that the Chinese economy is actually doing OK and the Fed has gone “dovish”, and probably won't increase rates much this year. What happened in March, essentially, is that markets repriced (lowered) the risk of global recession. In fact recessionary risk is probably now out of the market entirely, although whether that is entirely appropriate is another matter. But for the moment this combination of things has seen equities, commodities and the AUD all rally.

The two key events for markets have been the signals out of Beijing that they prefer growth to reform for the time being and the signals out of Washington that the Fed is in no hurry to tighten monetary policy.

In fact it's not just the Fed that's in easing mode: in the past couple of months the Bank of Japan, the European Central Bank, Reserve Bank of New Zealand, the Norwegian central bank, the Bank of Indonesia and the People's Bank of China have all actually eased monetary policy. Central banks are pumping up economies that are already doing OK.

Why are they doing this? Well regular readers will know this is a favourite theme of your correspondent: it's because they are targeting inflation and they think it's weak because of a lack of demand. Or else they don't care what's causing low inflation, they just want to get it up, even though it's caused by excess supply so that easing monetary policy won't help. This is all good for investors: supply, particularly of oil and other commodities, isn't going to tighten in a hurry so central banks will keep flailing away trying to get inflation up and in the process give economic growth more of a boost than it needs.

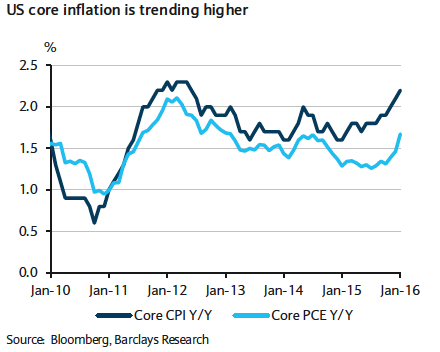

At some point, of course, inflation will rise (in fact it's already starting to rise in the US – see chart below) and given the amount of stimulus in the system will probably get away from them, so interest rates will be tightened in a hurry and recession will ensue. Or perhaps I'm being too cynical.

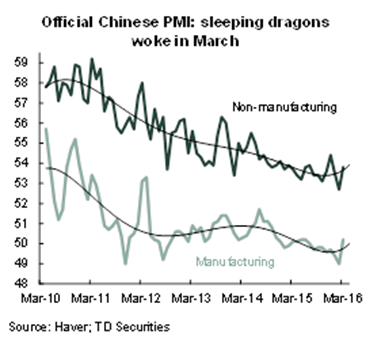

For the moment, the key for us is that China's economy is looking OK: Yesterday's PMI was strong (up from 49 to 50.2, finally indicating expansion), Macau gambling revenue is rising once more, money supply is rising and the bond market is anticipating a strong recovery.

Here is a chart of the March purchasing managers index (PMI) in China:

And China hasn't entirely given up on reform either, it's just that the 6.5 per cent GDP number in the five-year plan issued recently was not expressed as a target, but as what China “needs” – in fact it said a minimum of 6.5 per cent growth is needed for the next five years. Nothing in life, or China, is a certainty, but when the Communist Party puts it like that, it's close. There will be a flood of subsidies for high technology businesses, with the Government's venture capital fund having raised an amazing $US240 billion, which they won't stint on handing out, and they are continuing to subsidise private housing and mortgages.

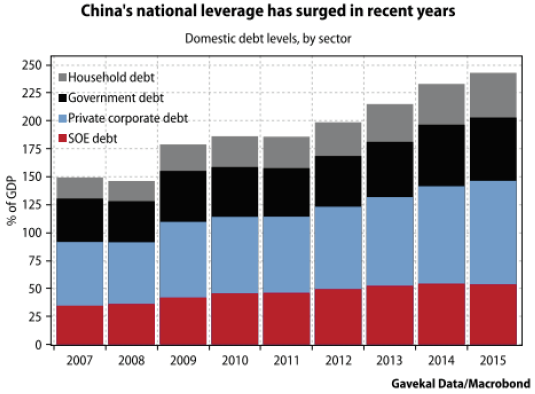

Working against that growth minimum that China “needs” is the big corporate debt overhang, the huge oversupply of apartments in major cities (and not so major ones too) and the excess capacity of the steel industry.

So not all sweetness and light, but on balance China's economy should be supportive of a continued trend rally in commodity prices (with ups and downs of course) and therefore Australian equities.

The great manipulation of markets

All of which leads me to the other bee that's been buzzing around in my bonnet for a while: that the markets are basically impossible to follow these days, especially short term.

It seems to me that market forces have been subsumed by a combination of manipulators and followers – the “too smart by half” brigade and the "dumb and dumber” brigade. Price discovery? Free market capitalism? Forget it.

The manipulators are the central banks and the long/short hedge funds. They're not evil, just either misguided or self-interested. The dumb and dumber mob are the rapidly growing ETFs, index-tracking funds and algorithmic traders, none of which make decisions or put a value on anything, they just follow the crowd and/or arbitrage where they see a chink of light. Who are they following and what are they arbitraging between? Doesn't matter, don't care.

Investors like you and I who try to buy an undervalued asset for long-term growth are in such a tiny minority now, and the markets for these assets are so dominated by central banks, in particular the Fed, that the relationship between price and value no longer exists. Might as well buy an ETF and go to the golf course.

For the likes of you and I, the markets can be seen as a cauldron into which we might occasionally dip our ladle, but otherwise stay well clear of.

That's how I'm feeling at the moment anyway, which possibly has something to do with my day job of reporting daily market moves on TV. The more I do that, the less meaning it all has. The daily moves are almost entirely crackers, devoid of sense. The market has been so twirled around and around that it is now quite giddy and doesn't know where it is.

For those of you in the business of day trading stocks or currencies, good luck to you. You are a braver man or woman than I am, Gunga Din.

US Jobs

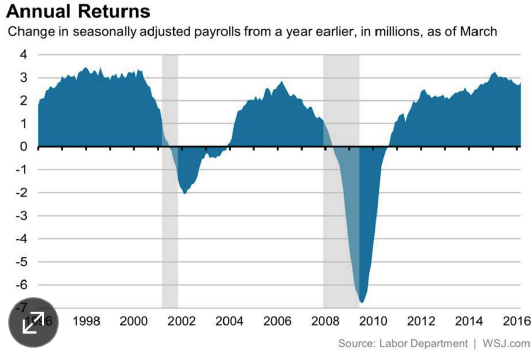

US employment continued improving in March, with 215,000 new jobs announced this morning. The unemployment rate ticked up to 5 per cent because the participation rate increased to 63 per cent. So the US recovery remains intact: about 14 million jobs have now been created in the US since the Great Recession, including 2.4 million in the past year. Manufacturing remains fairly weak, with a drop of 29,000 in March, but that was more than made up by increasing construction jobs.

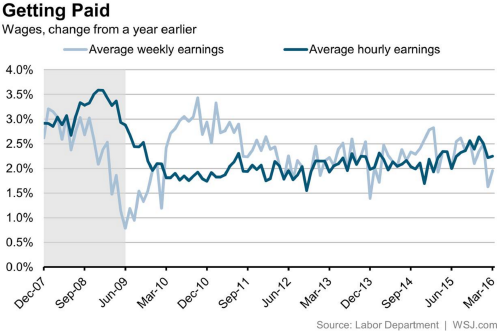

What does it mean for you? Although in some ways the strength of the US job market provides a contrast to the cautious speech by Janet Yellen earlier in the week, it actually reinforced the Fed's go-slow strategy. That's because rising participation, plus other factors, are keeping wages under control.

Employment growth is back to where it was before the recession…

…but wages growth is not

Wages growth and inflation are rising, that's for sure, but the whole thing is in slow motion.

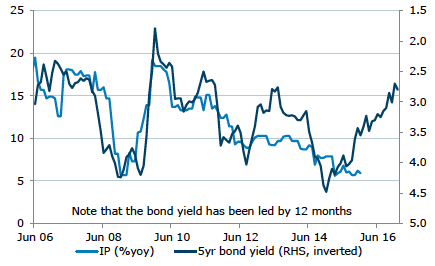

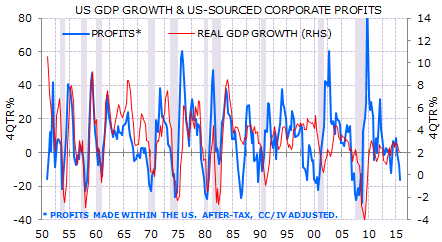

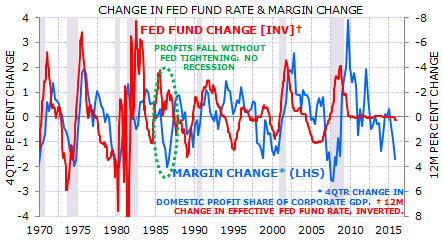

You might think this means US profits would still be rising – reasonably solid GDP growth and slow wages growth keeping monetary policy loose. But in fact Gerard Minack reported this week that profits are falling, which he says usually signals an imminent recession:

He commented: “I don't think that the domestic profit decline signals imminent recession. Profits are falling for the usual reason: real unit labour costs are rising. But real unit labour costs are not rising for the usual reason. Real unit costs are rising more because corporate price increases are slowing than because labour costs are rising. Consequently, there is another big difference: typically the Fed is tightening as profits are falling and that is the recession trigger. This time the Fed seems reluctant to tighten, or will tighten very slowly.”

“Exhibit 8 (below) shows that typically margin declines have been associated with Fed tightening. Historically it was Fed tightening, not profit weakness, that presaged recession. The one example where profits fell but the Fed was not tightening – in 1985, like now a period of oil price decline – was the one example where a profit fall did not signal recession. Similarly, I don't think profits now signal recession.

Slack

On the subject of US employment and the economy, I had dinner the other night with Stewart Butterfield, one of the founders of a Silicon Valley business called Slack. I didn't tell him this, but before that night I'd never heard of Slack, but it is one of America's celebrated “unicorns” – unlisted start-ups worth more than $1 billion. In fact Slack's most recent valuation was $2.8 billion. Most of them, by the way, have strange names (like Slack).

It's simply an enterprise messaging system that allows corporate teams to communicate with each other – an alternative to email – for a price per user. Stewart and his partner created it when they were building a business making computer games, just to communicate with each other, and gradually their business became the messaging system rather than the games.

Anyway, the point is that this is where America's strength lies: the Chinese government is spending trillions of yuan trying to get an innovation culture happening, but in the US it is bursting out all over – still.

Slack is one of the new breed of SAAS businesses (software as a service), which in one way are just subscription businesses like Eureka Report. But in fact they are a whole new type of very profitable service business – fixed, low cost and very profitable once they hit break even. Slack is valued at $2.8 billion, but it hasn't made a profit yet. The reason Stewart was in town is because he has opened his Asia Pacific HQ in Melbourne, where he'll employ 70 people. I think he said he has 400 in San Francisco and Vancouver, mostly in customer service.

So traditional manufacturing might be struggling but SAAS is taking off. Watch this space.

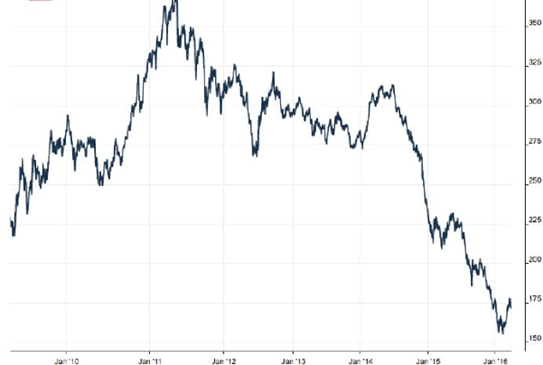

Confused about politics? Watch the CRB

The recent volatility of tax reform and Federal-State relations can be seen as more or less tracking the CRB commodity price chart.

When Julia Gillard signed the National Health Reform Agreement with the states in August 2011, and promised to fund 50 per cent of health costs, whatever they were, after 2017-18, the CRB index had just peaked and tax revenue forecasts were then six months old, based on previous rosiness. That is, everything still looked rosy.

Six months later, on budget day in May 2012, still rosy. The first two headings in the overview document of Wayne Swan's 2012 budget were “A return to surplus” (in that fiscal year, no less) and “Spreading the benefits of the boom”, which included an increase in the family tax benefit and a “schoolkids bonus”.

Reading that budget is like reading The Great Gatsby, or the history of Pompeii before the lava. The boom, that of which the benefits were to be spread, was over, but Treasury didn't know that then and Wayne Swan certainly didn't.

By the end of 2013, the commodity price recovery in mid-2012 was a distant memory and the CRB had fallen 25 per cent, although iron ore was still $US135.

In the 2013 MYEFO – Joe Hockey's first statement as Treasurer – terms of trade forecasts were slashed, the deficit for that year had blown out from $18 billion to $47 billion and there was no return to surplus at all.

There was a kick up in commodity prices in early 2014, but Hockey and Tony Abbott had a tough first budget to bring down and were in no mood for revenue optimism. They scrapped the National Health Reform Agreement and knocked off the 50 per cent funding promise. Instead Hockey and Tony Abbott promised to only fund CPI increases in health costs after 2017-18, a cut of $80 billion and the fiscal equivalent of blunt force trauma.

That 2014 kick in commodity prices was a false dawn of course: the CRB then proceeded to fall off a cliff, and more importantly for Australia, iron ore went from $US140 to $US40.

During this national catastrophe, Hockey and Abbott commenced a new tax reform white paper process, brought down a more generous budget in 2015 to try to save their jobs, failed to save their jobs, and by the time the 2015 MYEFO came around were replaced by Malcolm Turnbull and Scott Morrison.

The iron ore price collapse forced deficit projections to be increased again, and the febrile politics that resulted from yet another sacking of a sitting PM resulted in all efforts at tax reform (increases) being abandoned.

And so we come to Malcolm Turnbull's “Penrith Park Proposition” (PPP) this week, which is 180 degrees from Julia Gillard's 2011 National Health Reform Agreement – it's a switch from from “we'll fund it” to “you fund it”.

The reason for this switch is perfectly simple: the commodities boom, which swells Commonwealth tax revenue, has ended and has been replaced by a real estate boom, which swells state revenues.

As a result, the Federal budget is in far greater structural deficit than the aggregate state budgets. Therefore: “you fund it”.

This is an oversimplification since Turnbull's PPP involves giving the states a share of national income tax and then taking it away again, which therefore funds nothing.

But in any case, the PPP won't happen. The states believe, no doubt correctly, that it was only designed to force them to agree to accept more of the health and education funding burden – somewhere between the Gillard and Abbott extremes – and to pay for it by increasing land taxes, not by imposing a state income tax.

Increased land taxes are the obvious alternative to increasing the GST, which is sitting with higher super taxes in the pile of Malcolm Turnbull's tax “reform” (increase) debris.

The only things left to fund the massive health and education costs in the future are income tax bracket creep and state land taxes. In the Penrith park this week, Turnbull was basically saying to the states: “you choose which one”.

It'll be bracket creep – politics always tends towards silent tax increases and loud tax cuts. Land tax increases would be far too loud.

The nation's conservative politicians have consistently argued that “we don't have a revenue problem, we have a spending problem” and resisted tax increases while talking about spending cuts.

But the commodity price collapse has forced them to confront the fact that they are both a problem. Unless there are tax increases as well as spending cuts, there will be no surplus, ever, for the simple reason that health and education costs are rising at about twice the rate of CPI.

The 2011 Health Reform Agreement, excellent though it was, was only half the answer. It introduced activity-based funding, which is the only way to restrain spending in what is essentially a demand-driven business, but it did nothing to fund the spending – because commodity prices were forecast to keep rising, which they sort of did until 2014.

The commodity collapse of 2014-15 removed the comfortable illusion of both sides of politics that tax increases can be avoided, and now, having achieved that very worthwhile aim, commodities have rallied!

In February/early March the CRB index rose 15 per cent; iron ore has surged 40 per cent. Politicians are necessarily behind this curve because they can only work on plodding Treasury revenue forecasts. But there'll be another one of those in a few weeks and the assumed iron ore price will presumably be lifted from the US$39 number that so crushed revenue in last year's MYEFO.

But Treasury will have learnt humility and caution after a decade of damaging forecasting errors and won't be jumping aboard the commodity rally in the (early) May budget.

Health and education will have to be credibly funded in the forward estimates without a forecast commodity rally, and in this budget those forward estimates will include the 2019-20 fiscal year – which is well into the never-never period that was improperly dealt with by both Gillard and Abbott.

The other thing we learnt this week was that the Coalition appears to have maintained its policy of sidelining the Treasurer.

Treasurers are usually at the heart of Government economic policy, and in many cases almost solely responsible for driving it. That was certainly true of John Howard in the early 80s, followed by Paul Keating, Peter Costello and Wayne Swan over the past 30 years.

Joe Hockey was sidelined by the obsessive and destructive pairing of Tony Abbott and his chief of staff Peta Credlin. To some extent, it was also due to his own inadequacy. Enter Scott Morrison, fresh from a triumphant time at the heart of Government policy as Immigration Minister. But far from driving economic policy, Scott Morrison doesn't seem to know what's going on.

He denied that this week, of course, telling Leigh Sales on 7.30 that he and Turnbull have been “part of each other's inner circle for a long time”, and explaining that the reason he seemed out of the loop is that he's a “cautious fellow” and that “you would expect on some reform issues that different members of the Government will take different advocacy positions”.

Right. Bill Shorten and Chris Bowen then had some fun putting on a vaudeville act of extravagant unity (“after you, no I insist, after you…”).

But really, it does seem reminiscent of the miseries of Ralph Willis and John Dawkins between 1991 and 1993, and for much the same reason: a Prime Minister who is both economically literate and keen on economic policy.

As PM, Paul Keating had been a dominant Treasurer and remained so as PM; Turnbull just thinks he should have been Treasurer, and is making up for lost time.

Does it matter? Well, the best governments, and companies, always have at their heart a strong partnership between CEO and CFO, PM and Treasurer. Think Brian McNamee and Tony Cipa at CSL, Paul Anderson and Chip Goodyear at BHP, Hawke and Keating, Howard and Costello.

Turnbull needs to fix this, and quickly.

Banking feedback

Some feedback from subscriber Tony Hoare about my piece two weeks ago on banks, which I thought was worth reproducing, with his permission. Thanks Tony…

"Re banks, let's face it you have never been a fan and overall, with respect, that has been a mistake.

"Having managed Melbourne Credit Union for 30 years, what most analysts fail to appreciate is that banks/credit unions are one of the few, very few businesses that generally control both input prices and output prices. There is competition but if they all have the same pressures, as they would in your property crash scenario, (if provisions are not sufficient, which they now should be), they all increase margins, so maintain profit. I have been through this, lived through Pyramid B S/property crash and it was really, really scary but banks and credit unions remained profitable and came out the other side stronger.

"Plus banks are too big to fail, so government props them up, even small ones … public support and if needed financial support. How many businesses will the government do that for these days, but they will for banks.

"Finally … seriously, to look at the banks in isolation is unreal, they are at the end of the food chain: if banks get into trouble, the rest of economy/businesses are already stuffed. If property crashes or turns down significantly our whole economy is in serious trouble and banks are better placed to maintain profitability than all other businesses.

"General rule of thumb, if banks are doing poorly, the rest of economy is worse and reverse. They reflect the state of the economy.

"Now as self-funded retiree, running my own SMSF, investing in banks suits me fine.

"Really appreciate the Charles Gave piece, first time seen any commentary supporting dividend imputation, even if it is indirectly, good to read as obviously in my position it is really valuable.

"What worries me most in these volatile times is the impact of short selling. In my view shorting is greatest threat to markets. Really upsets me listening to hedge fund managers in media talking companies/economies down and shortening at same time. I listen to justifications of allowing shorting and the main one is ‘adding to liquidity'; well most large caps have liquidity and long-term investors don't need liquidity. Don't have to stop shorting altogether but governments should manage/restrict shorting."

Readings & Viewings

Ronnie Corbett died this week, at a good age. He left behind good memories and a wonderful body of work. Here are two of the best bits – first, the classic Mastermind sketch.

…and “My blackberry's not working”.

2016: the end of the global debt super cycle. The credit markets are signalling that the debt fuelled expansion that began in 2010 is turning to bust. This is the most precarious moment in financial market history…

From February, but still relevant – Ambrose Evans-Pritchard: Negative interest rates are a calamitous misadventure.

Modelling explains why the Premiers rejected Malcolm Turnbull's state income tax idea.

Seriously, is Turnbull trying to lose this election?

Larry Summers: Corporate profits are near record highs. Here's why that's a problem.

A magnificent piece on the rise of China: its “staggering ascent seems to promise an almost messianic escape from decades of declining growth: the mirage of a new America, complete with a ‘Chinese Dream' and the moral zeal of its Puritanical CCP-Confucianism.”

Qantas has paid Christopher Walken to do an ad for health insurance. It could be the stupidest ad in history, or maybe the best…

What the rise of Donald Trump means, or “culture and politics in the age of Trumpery”.

Can he be stopped? (Yes of course he can, I think).

The rise of American authoritarianism.

And my last Donald Trump thing this week – the transcript of his meeting with the Washington Post's editorial board.

And another ripper from the New York Review of Books – China's worst mistake: the story of the one-child policy.

Happiness is hard to measure, but there's been an interesting attempt at it in China.

Powerful speech (on video) by a British journalist and commentator, about Islam in England.

Surveillance has reversed the internet's capacity for social change.

A new footy show on YouTube, with Rohan Connolly and Mark Fine. It's good! (If you like footy shows of course)

I know Easter's a week ago, but here's a pretty good obituary of Jesus by the New York Times' obit writer.

Amazing snooker trick shots!

This is a beautiful video story about fathers and sons.

There may be a time and place for “helicopter money”.

The future of money depends on busting fairy tales about its past.

Extreme Altruism: Peter Singer asks why many people are uncomfortable that others devote their lives to the wellbeing of strangers.

“Are we heading into recession now?” asks Lakshman Achuthan, co-founder of the Economic Cycle Research Institute.

Short termism makes no sense at all.

We will build machines with IQs in four figures, even though we have no idea what that will mean for us. “Learning is our fate. It's impossible to stop. Our best bet is to discover all that we can and to move forward with our eyes wide open”. How will we fare in a world of superhuman robots? Best-case scenario: They treat us as we treat butterflies or houseplants; decorative, innocuous, even worthy of study, but trivial.

Inside Apple's fight with the FBI.

Central banks are getting nowhere. The solution is straightforward. The problem of deficient demand should be fixed not by further loosening of monetary conditions, but by boosting public spending.

I found this piece quite interesting, and horrifying, in “Cracked”. The six biggest lies that were used to start wars.

We all own too much stuff. I, for one, just managed to cut two self-storage units down to one. This book review is about how the world became a consumer society.

About six miles from Maastricht, in the Netherlands, lie buried 8,301 American soldiers who died in “Operation Market Garden” in the battles to liberate Holland in the fall/winter of 1944. Every one of the men buried in the cemetery, as well as those in the Canadian and British military cemeteries, has been adopted by a Dutch family who mind the grave, decorate it, and keep alive the memory of the soldier they have adopted. It is even the custom to keep a portrait of "their” soldier in a place of honour in their home. Annually, on “Liberation Day”, memorial services are held for “the men who died to liberate Holland”. The day concludes with a concert. The final piece is always “Il Silenzio”, a memorial piece commissioned by the Dutch and first played in 1965 on the 20th anniversary of Holland's liberation. It has been the concluding piece of the memorial concert ever since. A few years ago the soloist was a 13-year-old Dutch girl, Melissa Venema, backed by André Rieu and his orchestra (the Royal Orchestra of the Netherlands). This beautiful concert piece is based upon the original version of taps and was composed by Italian composer Nino Rossi.

Happy birthday to John Butler, one of Australia's most talented musicians – 41 yesterday – yes, April the 1st. Here he is doing some very fancy guitar picking, with a 12-string.

And here he is again doing Funky Tonight, in front of a whole lot of people.

And today there are two big birthdays:

1. Marvin Gaye. He'd be turning 77 today if his father hadn't shot him on April 1st 1984. Here he is doing Sexual Healing live - perhaps the greatest soul song ever.

2. Leon Russell. I saw him with Joe Cocker at Festival Hall on the Mad Dogs and Englishmen tour. Astonishing. Here they are on that tour: it's not a good video, but you get the idea. Leon R. is still alive, and turns 74 today.

Oh and Emmylou Harris turns 69 today. This video isn't her, it's the wonderful Swedish duo, First Aid Kit, doing a song about her, with a very happy Emmylou in the audience.

Last Week

By Shane Oliver, AMP

The ‘risk on' rally fired up again in some markets over the last week, helped by dovish comments from Fed chair Janet Yellen that pushed the US dollar and bond yields down and US and Eurozone shares higher. However, Chinese, Japanese and Australian shares fell with worries about more bank bad debt charges weighing in the case of the latter.

The weaker US dollar saw the Australian dollar rebound, making it above US77c at one point, although oil prices were flat and metal prices down.

For March shares had a good rebound, ranging from 2 per cent in Europe to 9.9 per cent in China, with Australian shares up 4 per cent, after the rough start to the year in January and February as global growth worries receded, the US dollar and Renminbi stabilised and commodity prices improved. Historically, April has been a good month from a seasonal perspective but the period from May can be rough.

The key message from Janet Yellen remains that the Fed will be cautious in raising interest rates reflecting global risks, weak US inflation expectations and the asymmetric ability of the Fed to respond to downside as opposed to upside threats.

Quite clearly Janet Yellen would rather risk being too easy than too tight because the Fed's ability to respond to lower growth and inflation is more limited than its ability to respond to higher growth and inflation.

In this sense she doesn't want to do anything to exacerbate global risks because of the potential blow back to US growth and inflation. While some regional Fed presidents lean hawkish as we heard immediately after the last Fed meeting, it's likely Yellen has the support of a clear majority, including the Fed governors and the New York Fed President.

An April hike looks very unlikely and a June hike remains our base case but the probability is only around 55 per cent in my view, particularly with the Brexit vote coming a week after the June meeting, so the next hike could even be delayed till the July meeting if there is much market tension ahead of the Brexit vote.

Bad debt worries are clearly weighing on Australian banks and the Australian share market generally. While the extra $100m in bad debt charges announced by one bank due to the resources slump is small, investors naturally worry that the bad debt cycle has now bottomed and, like cockroaches, if there is one downgrade there are likely to be more. So the concerns could linger for a while. Putting it all in context though, resources-related loans are only around 2 per cent of total loans for the big four banks.

Major global economic events and implications

US economic news was mostly good. The goods trade deficit expanded in February and household spending data for January and February were soft, but against this pending home sales rebounded, consumer confidence improved in March, labour market indicators were solid and regional manufacturing surveys continued to show an improvement in conditions in March. No signs of recession here.

While the Atlanta Fed's data tracker points to just 0.6 per cent annualised growth for the March quarter just passed, it is noteworthy that over the last 20 years March quarter GDP growth in the US has averaged just 1 per cent, only to bounce back to an average 3 per cent in the June quarter. (Looks like a seasonal glitch that the Bureau of Economic Analysis is failing to adjust for. Maybe they are still to work out that it's usually cold in January and February!) Meanwhile, the core private consumption deflator, which is the Fed's preferred inflation measure, slowed again in February leaving annual inflation at 1.7 per cent.

Eurozone economic confidence fell in March but remains at levels consistent with reasonable growth and private lending growth picked up in February, which is a positive sign given pressure on banks at the time.

Japanese economic data was mostly favourable, with a surprise gain in real household spending, solid jobs data and a rise in small business confidence. Industrial production fell sharply in February but this mainly appears to be related to lunar New Year distortions and a temporary shutdown at a car plant. March quarter business conditions and confidence readings were disappointing though.

There was also some good news out of China with the official and Caixin business conditions PMIs in March lifting by more than expected and consumer confidence rising to its highest since September last year. It's looking like Chinese growth is stabilising and policy stimulus measures are starting to impact.

Australian economic events and implications

Australian data was mostly good. Credit growth remained moderate in February, with housing lending to owner occupiers continuing to accelerate but lending to investors continuing to slow. New home sales fell 5 per cent in February and remain in a downtrend consistent with slowing building approvals, home prices rose modestly in March with ongoing confirmation of a loss of momentum compared to last year but job vacancies continue to run around levels consistent with solid employment growth and the AIG's manufacturing conditions PMI rose to a booming reading of 58.1. In fact, the Australian manufacturing PMI is among the highest in the world, testament to the boost provided by the fall in the Australian dollar since 2011. The qualifier though is that it's likely dependent on the Australian dollar remaining low in contrast to its recent rebound.

The loss of momentum in national average house prices is clearly due to Sydney, which has really come off the boil. A further slowing is likely ahead with a modest cyclical decline in prices likely around 2017-18. In the absence of significant rate hikes or a recession it's still hard to see a property crash though.

Thought bubbles and tax kites. While I can understand where the Federal Government is coming from in suggesting states could levy their own income taxes (it could help promote accountability at a state level), reverting to the multiple state-based tax rates of the past would not be good if we want to promote tax efficiency across the economic union that is Australia.

Next Week

By Savanth Sebastian

The Reserve Bank dominates the economic calendar in the coming week. The Reserve Bank Board meets on Tuesday, while the data to watch includes retail trade and job advertisements, due out on Monday. In the US, the focus is on the minutes of the March Federal Reserve meeting, released on Wednesday. And in China, Europe and the US the services sector purchasing manager indexes will be watched closely.

In Australia, the week kicks off on Monday with four data releases. Melbourne Institute releases the monthly inflation survey, while the ANZ job advertisements series is also slated for release. In addition the Australian Bureau of Statistics (ABS) will release figures on retail trade and building approvals.

Consumer spending certainly lifted over the tail end of 2015, providing a boost to December quarter economic growth. In addition retail trade rose by 0.3 per cent in January and we expect that retail trade lifted further in February, gaining 0.5 per cent.

Building approvals have been volatile, over the past few months. Dwelling approvals fell by 7.5 per cent in January, driven by a 9.1 per cent fall in apartment approvals. Over the past year 231,752 new homes were approved, easing further from the record high 237,242 in the year to October 2015. Clearly a modest consolidation is taking place.

Also on Monday, ANZ issues its job advertisements report for March and on the following day teams up with Roy Morgan to issue the weekly consumer confidence data. Given the sizeable amount of hiring that took place over 2015 it is understandable that employment has eased modestly over the past couple of months. Importantly the labour market remains in good shape. The trend job advertisements series has been rising for 27 straight months.

The consumer confidence results have been decidedly more optimistic in the past couple of weeks — particularly when it comes to the outlook for family finances over the next 12 months. However confidence may be more volatile in coming months as a Federal Budget and possible double-dissolution election adds uncertainty.

The Reserve Bank Board meeting on Tuesday should be treated as a dead rubber. Rates are unlikely to move in any direction over the next couple of months. Recent commentary from the Reserve Bank makes it clear that while there is an “implicit” easing bias, the focus is on getting better readings on timely economic data.

Interestingly the statement following the interest rate decision will be closely scrutinised for any views on the Australian dollar. Despite recent comments for a lower Aussie dollar, the Reserve Bank may have more to say given the currency is comfortably holding above US76 cents.

Overall, we don't expect the Reserve Bank to shift rates over the rest of 2016. Inflation remains well contained but stronger activity and growth should result in the Reserve Bank keeping its powder dry.

Also on Tuesday, data on international trade is issued with the Performance of Services index and new car sales figures for March.

On Wednesday, Reserve Bank Assistant Governor Christopher Kent (economics) delivers a speech at the Reserve Bank in Sydney titled “Economic Forecasting at the Reserve Bank of Australia” (AEST 5pm).

On Thursday, data on tourist arrivals is released. Interestingly tourists to Australia from mainland China have lifted to record highs. Tourists from China and Hong Kong combined exceeded 1.3 million in the past year, up almost 24 per cent over the year and closing fast on the 1.32 million visitors from New Zealand.

Overseas

It's not often that you can say it — but a relatively quiet week lies ahead in the US. And the focus across China and Europe is likely to be the services sector purchasing managers indexes (PMIs) released on Monday and Tuesday. There are also five Federal Reserve policymakers scheduled to speak over the week.

On Monday data on factory orders and the regional ISM New York survey are released. Economists expect factory orders to have eased by around 2 per cent in February while the New York ISM survey should continue to show a healthy expansion. Also the final revisions on durable goods orders — proxy for business investment — for February are released.

On Tuesday, trade data (export and import prices) is released together with the Services sector PMI and the Job Openings and Labour Turnover survey (JOLTS). The trade deficit is likely to hold around $46 billion while the services sector will continue to expand.

On Wednesday, usual weekly data on home purchase and refinancing is issued alongside minutes of the March Federal Reserve meeting. The minutes should provide investors with a little more information on the ‘hot button' issues for Federal Reserve members.

On Thursday, the usual weekly data on claims for unemployment insurance is released together with data on new lending — consumer credit. Economists tip a lift in new credit from US$10.5 billion to $12 billion — a sign of improving confidence.

On Friday, data on wholesale sales and inventories is released.