Eureka's Week: NIRP and the Bezzle, Arrium and steel, global warming

Last Night | NIRP and the Bezzle | Arrium and Steel | Global Warming | Readings & Viewings | Last Week | Next Week

Last Night

Dow Jones, up 0.2%

S&P 500, up 0.28%

Nasdaq, up 0.05%

Aust dollar, US75c

NIRP and the Bezzle

Since 2007, global debt has grown by $US57 trillion, or 17 percentage points of GDP. No major country has managed to reduce its debt-to-GDP ratio, and certainly not Australia or its trading partners. The debt has essentially been created by central banks attempting, in my view misguidedly, to do their jobs. Central banks say they are pursuing ZIRP and NIRP (zero interest rate policy and negative interest rate policy) in the name of growing jobs. In reality they are trying to inflate the debt away and prevent defaults. The cost of this falls squarely on private savers who are being effectively taxed to support the public and private debtors.

A new analysis by Kroll Bond Rating Agency says the European Central Bank's embrace of negative interest rates and asset purchases suggests that the financial and economic situation in Europe is far more serious than is appreciated by most investors.

“The idea that the ECB needs to pay banks via negative interest rates to borrow in order to make new loans strikes KBRA as confirmation that excessive debt is a serious problem in Europe.” Providing a subsidy in the form of negative interest rates only increases the moral hazard already present.

“Negative numbers do not exist in the natural world of mathematics, economies, companies and people, only in the theoretical realm inhabited by economists. Negative interest rates are deleterious to the wellbeing of financial institutions, commercial enterprises and consumers. Negative interest rates suggest liquidation, destroy the private capital stock, and ultimately cause a shrinkage in the amount of credit creation – precisely the opposite of what ECB Governor Mario Draghi is trying to achieve.”

But basically KBRA reckons the ECB's actions are unavoidable because of the refusal of the EU's political leadership to try anything else: “Since Merkel and the other political leaders lack the fiscal resources and political support to deal with Europe's debt problems directly, the ECB has been left with the task of monetizing the bad debts on the books of EU banks.”

And that, in a nutshell, is the problem around the world. Politicians are simply out of their depth now – the debts are too high, whether it's public debt, bank debt as in Europe, state-owned corporate debt as in China, ballooning car loans as in the United States, or household mortgage debt as in Australia. There are only two ways out of it – inflation or depression. Central banks, God bless them, are trying hard for the former.

On the subject of US car debt, Jim Grant had a nice piece on that this week, which I think has broader appeal, and relevance: he calls it the “automo-bezzle”, after JK Galbraith's coinage of the term “The Bezzle" in his book, The Great Crash. It means undetected embezzlement.

Grant quotes Galbraith: “In good times, people are relaxed, trusting and money is plentiful. But even though money is plentiful, there are always many people who need more. Under these circumstances the rate of embezzlement grows, the rate of discovery falls off, and the bezzle increases rapidly.

“In depression all this is reversed. Money is watched with a narrow, suspicious eye. The man who handles it is assumed to be dishonest until he proves himself otherwise. Audits are penetrating and meticulous. Commercial morality is enormously improved. The Bezzle shrinks.”

To cut to the nub of the matter, cars are sold in the US on very keen incentives, called the "stair-step structure". If you sell 80 cars in a month, the manufacturer will give you $100 per car. If you sell 100, you get $200 per car. If you sell 120 it's $300 per car. The difference in wages for selling just a few more cars is very significant, and as Charlie Munger says: “Show me the incentive and I'll show you the outcome.”

Thus, car loans have replaced real estate mortgages as American banking's excess of choice. Another bust awaits.

On a similar subject, I note that the Prime Minister, Malcolm Turnbull, had the poor manners to complain about Australian banking remuneration habits when celebrating Westpac's 200th anniversary on Wednesday this week:

“…remuneration and promotion cannot any longer be based solely on direct financial contribution to the bottom line,” he said.

With the amazing Panama Papers leak, the disclosures of bribery and corruption by Australian companies overseas and the apparently endless revelations about banks behaving badly, the posse seems to be closing in – that perhaps the audits are now getting more penetrating and meticulous, that morality is improving and money is being watched with a narrower eye.

We must all hope that The Bezzle comes to an end as a result of that, plus some inflation courtesy of central banks, rather than a depression, as it normally does.

Arrium and steel

Apparently the reason Arrium didn't close the Whyalla steel plant years ago was that the environmental clean up would have (and still will) cost anything from $2 billion to $3 billion. Otherwise it probably would have closed 10 years ago. Instead they decided to run it for cash break-even, so they wouldn't have to spend that money, or rather to leave it for someone else. That someone else is now the blokes from Grant Thornton.

The board should have spent it. Now the shareholders have lost everything, and will get no value for the good bit of Arrium, which is the Moly-Cop grinding balls operation. And that happened because the board was wrong to think Whyalla and the iron ore mine could be run for cash break-even.

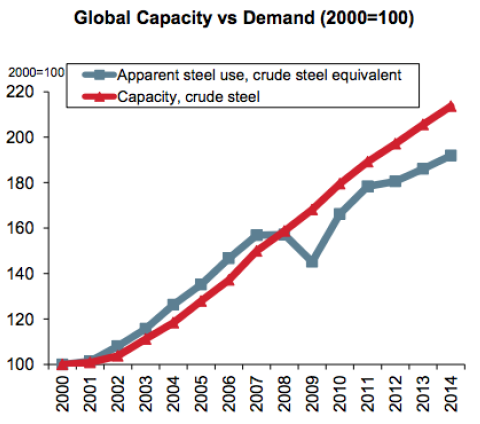

To be fair, when they were making this decision, Arrium was still called OneSteel and the share price was $5-$6 and everything looked fine. Running the steel mill at a profit seemed like a piece of cake. But then the GFC hit and two things happened: steel demand fell, and China boosted its economy by building steel-making capacity. The result is displayed in this graph:

And this:

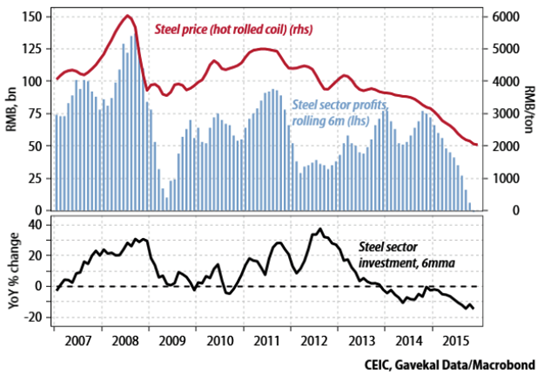

As you can see, China's steel sector investments actually accelerated between 2009 and 2012, and peaked at almost 40 per cent year-on-year growth rate – a ridiculous number given the decline in demand – and then this happened:

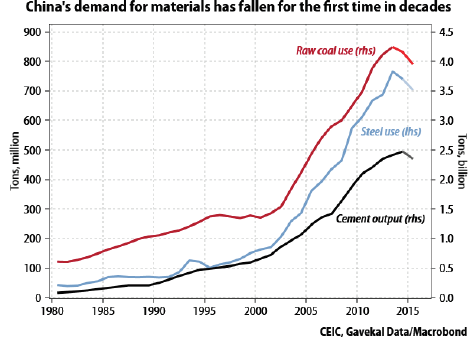

Chinese demand for steel (and coal and cement) started to fall as the horrendous overcapacity started to bite.

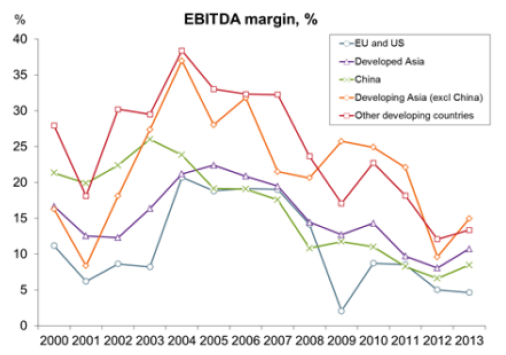

As a result, steel industry profit margins are falling everywhere around the world, because of dumping from China:

Source: World Steel Association

In the circumstances Arrium never had a hope – it is a mouse on the dance floor.

I think part of the problem is that this business has always had a big emotional element to it. Apart from the environmental clean-up cost, the board always knew that closing the Whyalla steel mill would mean the death of the town, so they were more reluctant to do it than directors normally would be with a loss-making plant.

Also, the banks were, and are, totally unsecured, which is an amazing situation and the sort of thing that always leads to emotional decisions. Thus, they held back for a long time, since they had no security to take possession of, knocked back the recapitalisation plan involving the Blackstone unit called GSO Capital because they felt blindsided and betrayed, and the board gave them the single finger salute by bringing in Grant Thornton. After that decision was made by the board, a journalist I know got a call from an investment bank adviser who was actually sobbing down the phone in distress.

And of course, the town's future and that of everyone who lives in it, is now on the line – the steel mill will have to close, just one more casualty of the global steel glut.

China's steel industry is also in a complete shambles: 47 per cent of the mills are losing money and mills are closing all over the place. Many more should have closed already and probably will. It could take years for the glut to clear because the Chinese are desperately trying to keep as many plants open as possible to maintain employment, and as a result are dumping steel wherever they can.

In a recent interview, the chairman of the World Steel Association, Wolfgang Eder said: "A solution to the problem can only come from the reduction of capacities. According to OECD (countries in the Organization for Economic Cooperation and Development ), there are 600 to 700 million tons of overcapacity (worldwide), the largest part in China. That means permanent pressure on margins and prices.”

Note he said “permanent”. Nothing's forever, of course, but obviously in the steel industry at the moment, it feels like it. And for the people of Whyalla, and shareholders of Arrium, it IS forever.

Global warming

This week the Queensland Premier, Annastacia Palaszczuk, put on her hard hat, stood in front of some earth-moving machinery, and solemnly announced final approval for the Carmichael coal mine, repeating the word “jobs” a few dozen times. She might have even said it's a great day for Queensland.

At roughly the same time, a group of Oxford University academics issued a paper in which they have worked out that no new coal power generation can be built after next year.

It's clear that a new coal mine the size of Carmichael is a white elephant, or a dead duck, take your pick, and cannot possibly go ahead unless Australia and India both tear up the Paris climate change agreement. In other words, the Carmichael go-ahead announcement by the Queensland Premier was an empty photo-op.

More importantly for investors (although we can't invest in the Carmichael mine even if we went mad and wanted to) the Oxford University paper clarifies for the first time what the Paris agreement on climate change actually means.

Now I know a lot of people regard all this global warming stuff as a left-wing conspiracy and/or simply unproven ( the planet isn't warming, and we didn't cause it) but the fact is that 195 countries signed up last year to actions that would keep global warming to 2°C, and to aim at 1.5°C. Turning climate change into a left/right ideological issue has been a triumph for the fossil fuel industry.

The paper by the four academics from Oxford – Alexander Pfeiffer, Richard Millar, Cameron Hepburn and Eric Beinhocker – defines what they call the “2°C capital stock”, which is the stock of global infrastructure that implies a 50 per cent probability of meeting the Paris agreement goal of 2 degrees of warming. Note that it's only a 50 per cent probability. They conclude that assuming existing plants are operated to the end of their normal lives, any new ones built after 2017 would break the legally binding carbon emissions budget.

Separately a new report from the London School of Economics published this week tries to come up with the cost to investors of not implementing the Paris agreement.

It estimated that about $US2.5 trillion in financial assets would be at risk if temperatures rose by 2.5°C, mainly from insurance. And there's a 1 per cent chance (ie not much) that the cost of that sort of temperature increase would be $US24 trillion.

If the increase in temperature is limited to the Paris agreement goal of 2°C, then the value of financial assets at risk reduces to $US1.7 trillion, which is still rather a lot – about a third of the total market value of all fossil fuel companies.

To have just a 50 per cent chance of keeping the loss to that figure, according to the Oxford University paper, no new fossil fuel power generation can be built after next year and all other sectors – mainly transport – must also transition to a 2°C pathway.

And if the other sectors stay on business as usual, then even if the entire global fossil fuel generating capacity were closed down at once, next year, it wouldn't be enough to limit global warming to 2°C.

The paper outlines two “critical inertias” that govern climate policy. First, energy infrastructure is characterised by long lifetimes. In the EU, 29 per cent of thermal power capacity is over 30 years old and 61 per cent is over 20 years old.

Second, carbon dioxide emissions remain in the atmosphere for centuries, so “it is the stock of atmospheric CO2 that affects temperatures, rather than the flow of emissions in any given year”. In other words the economic damage from climate change results from cumulative carbon emissions, not the annual total. Nevertheless it's still common practice for policymakers to focus on annual targets.

To achieve the necessary transformation of the electricity industry, according to the Oxford academics, will require some combination of the following four things: new generation assets are zero carbon; existing fossil fuel generation are retro-fitted with carbon capture; existing fossil fuel assets are stranded early; technologies are quickly introduced that remove carbon from the atmosphere.

They conclude that large-scale deployment of zero carbon capacity, including renewables, hydro and nuclear, appears inevitable: “the question is not if but how fast”.

As for the last of the four things, they say that given the current trajectory of the global energy system, the probability of overshooting the 2°C capital stock is significant, so some combination of carbon capture and storage (CCS) and carbon dioxide removal (CDR) may be necessary. But the costs and technical challenges of those things are enormous, and we can't rely on them.

The one very encouraging development this week – as opposed to the Queensland Premier's announcement of a huge new coal mine – is the flood of orders for the new Tesla Model 3.

With 276,000 orders in two days for the $US35,000 car, that won't be ready until late next year, the new Tesla is beginning to look like a game-changer. One analyst responded with: “Adios gas-powered cars.” What Tesla has done, apart from send its own share price up nearly 20 per cent, is expose the huge latent demand for electric vehicles. Others will now quickly follow, and so will the service infrastructure needed to support them.

As with electricity generation there is a lot of inertia in transport infrastructure because of the life of existing assets, but unlike power generation assets, cars have a resale imperative.

If car buyers lose confidence in the resale value of petrol and diesel-driven cars because of the popularity of electric vehicles, then there is likely to be a “tipping point” – a very rapid changeover as car-owners try to protect the value of their assets.

Whether that will happen soon enough to take the pressure off fossil fuel power generation is another matter.

In any case, people who have bought an electric car to do their bit for the planet are hardly going to be happy using coal-fired electricity: defeats the purpose somewhat.

So Tesla's Model 3 could be a game-changer for the power industry as well as the car industry.

Readings & Viewings

Further on Arrium and steel, here's a revealing interview with Cai Rang, chairman of the China Iron & Steel Research Institute.

Arrium's collapse shows Australia must get a lot smarter about steel.

Excellent letter to his investors, by my friend John Abernethy, especially the bits on real estate and bonds.

Why people rushed to order the Tesla Model 3 (video).

This is a wonderful recipe for hummus, one of my favourite substances.

Xi Jinping: chairman of everything.

Xi Jinping's anti-corruption initiative has morphed into a neo-Maoist-style mass purge of political rivals.

Graham Richardson's story of battling cancer – grim, fascinating, moving.

Bob Ellis died during the week. He and his wife Anne Brooksbank were the subject of the first “Two of Us” in Good Weekend magazine – here it is.

Roger Montgomery: why index investing is dumb (and no, he's not just repeating my similar comments last week).

You've read about the Panama Papers, well here's the website for them, set up by the International Consortium of Investigative Journalists.

A nice analysis of the political battle by Quentin Dempster.

Anatole Kaletsky: it's time to rethink the institutions of democratic capitalism.

At $US46 billion per month, company share buybacks dwarf every other source of demand in the stockmarket.

A Harvard Law School paper on buybacks – it finds they are often insider trading.

What is consciousness? How does the electric and chemical activity in your brain produce your subjective experiences; the redness of red, the taste of chocolate or the pain in your back?

My friend Jonathan Green's interview with my favourite prison psychiatrist, Theodore Dalrymple, aka Anthony Daniels. Is society broken?

Virtual reality is going to be big. In fact, industry should immerse itself in virtual reality technology to get ahead, according to this article.

A powerful editorial in Charlie Hebdo about the Brussels bombing.

Richard Werner, the inventor of the term ‘quantitative easing' argues in this video that the way QE has been implemented recently is failing at stimulating the real economy. Instead, quantitative easing should be targeted to transactions contributing to productive investments such as renewable energies, sustainable industries, infrastructure, education, research and development.

When mobsters meet hackers – the new, improved bank heist.

Bernie Sanders' great answer when asked “what do believe in?”

Economists are warming to Government intervention.

A nurse in a Syrian hospital, quietly saving lives from under ISIS's nose – an example of the heroism in Syria.

I often suffer terribly from restless leg syndrome. This piece explains it – “It's difficult to sleep when your legs are tap dancing under the sheets.”

This is remarkable, and beautiful: Beethoven's Fifth, with an animated graphical "fisheye" score.

Are robots job creators?

Panama Papers reveal the inadequacy of Australia's tax laws.

Here is the meaning of life … don't say I never give you anything.

Last Week

By Shane Oliver, AMP Capital

Share markets fell over the last week as global growth worries seemingly returned despite mostly okay economic data and the minutes from the Fed's last meeting affirming that it will be cautious in raising interest rates.

Japanese shares were hit by a rise in the value of the yen and worries about banks continued to weigh on the Australian share market along with falls in energy and consumer stocks. The growth worries and risk off tone also saw bond yields fall, the yen rise and the Australian dollar fall to around US75c. Metal prices fell sharply but oil rose slightly in the lead up to an April 17 OPEC meeting to discuss freezing oil supply.

While comments by the IMF's Christine Lagarde about global growth being too slow and fragile added to investor nervousness, there was nothing really new in this. IMF forecasts for global growth of 3.4 per cent this year are still too optimistic and likely to be revised to around 3 per cent.

While her comments are likely aimed at encouraging governments to undertake more supply side economic reforms, it is noteworthy that a broad based gain in business conditions PMIs in March suggest global growth momentum may have improved a bit lately, or at least stabilised.

The rise in the value of the yen ( 14 per cent against the US dollar since last year's low) is worth keeping an eye on. Not only is it bad for Japanese growth but it can also be seen as a negative sign for the global economy to the extent that it may signal unwinding carry trades (where investors borrow cheap in Japan and invest elsewhere) and hence less risk taking in capital flows.

The flipside though is that a rising yen is just a normal phenomenon of periods of investor nervousness and in any case the higher the Yen goes the greater the pressure on the Bank of Japan to undertake more monetary stimulus.

In the US, Donald Trump's loss in the Wisconsin primary suggests his campaign may be finally starting to falter under the weight of his “open mouth approach”. To reach the 1237 majority of delegates to the Republican convention in July he needs to win 56 per cent of the delegates in remaining primaries but so far he has only been winning 47 per cent of delegates. This is a particular challenge with big states like New York (April 19) and California (June 7) ahead where he is not polling so well.

It's also virtually impossible for Ted Cruz to win the 1237 majority as he would need to win 82 per cent of remaining delegates against a win rate so far of just 33 per cent. So a contested convention looks highly likely – better than putting up a bad candidate.

On the Democratic side Hilary Clinton remains on track to win her party's nomination requiring only 32 per cent of remaining delegates against a win rate so far of 62 per cent. Common sense could yet win out in the US presidential election!

In Australia, the RBA left interest rates on hold as expected but expressed discomfort at the rise in the value of the Australian dollar indicating it “could complicate the adjustment under way in the economy”. The clear implication is that the rise in Australian dollar has increased the chance that the RBA will act on its bias to ease interest rates again.

With growth set to slow a bit as mining investment continues to unwind and the contribution to growth from housing slows, unemployment likely to remain around a relatively high 6 per cent, inflation likely to remain low, the banks likely to raise mortgage rates again independently of the RBA (the Bank of Qld already has) and the bounce in the Australian dollar threatening growth in globally focussed sectors like tourism and higher education our view remains that the RBA will cut interest rates again. A soft March quarter inflation report due April 27 could drive this in May - but it may not occur until the June quarter.

Major global economic events and implications

In the US the trade deficit expanded in February, but job openings, hirings and the quit rate (a guide to worker confidence in the job market) remain strong, jobless claims remain low and the non-manufacturing conditions ISM improved in March. The Atlanta Fed's GDPNow data tracker now puts March quarter GDP growth at just 0.4 per cent annualised but recall the seasonal pattern over the last 20 years that has seen growth average just 1 per cent in the March quarter but 3 per cent in the June quarter so this and the improvement in March PMIs suggests there is no reason to get fussed.

Meanwhile, the minutes from the Fed's last meeting affirmed that it would be cautious in raising interest rates with Fed officials overall having little inclination to raise interest rates again at its April meeting. Comments by Fed Chair Janet Yellen that she still sees some labour market slack are consistent with this.

Eurozone data was mixed with weak German factory orders and a fall in the services conditions PMI in March, however the level of the services conditions PMI still remains consistent with moderate growth and unemployment fell again in February (albeit the level remains high).

The worse could be over for Chinese capital outflows. Chinese foreign exchange reserves rose in March for the first time in five months. After adjusting for valuation effects the pace of decline in reserves has slowed to $US42bn in March from $US142bn in December, suggesting capital outflows are slowing. Maybe there is more confidence that the Renminbi and the Chinese economy are not going to crash after all. In terms of the latter, China's Caixin services conditions index improved in March adding to confidence that growth momentum improved.

The Reserve Bank of India cut interest rates again, highlighting yet again that global monetary conditions are still becoming easier.

Australian economic events and implications

Australian data was on the soft side. Building approvals bounced 3 per cent but this followed a 6.6 per cent decline and the trend is clearly down pointing to slowing housing investment in the year ahead (see the next chart), retail sales were weaker than expected in February and look to have lost momentum, the trade deficit widened in February, services and construction conditions PMIs softened in March (in contrast to manufacturing sector strength) and the Melbourne Institute's Inflation Gauge for March showed both headline and underlying inflation running below 2 per cent year on year.

Next Week

By Craig James, CommSec

In Australia there is a healthy offering of new economic data in the coming week. Overseas the highlight is Chinese economic growth figures on Friday.

In Australia, the week kicks off on Monday with data on housing finance (new home loans). Supported by low interest rates and improved affordability, loans for owner-occupiers (those who want to live in the homes) may have lifted by 2.5 per cent in February. And the total value of all new loans may have lifted by 2.0 per cent in the month.

On Tuesday, Roy Morgan and ANZ release the results of the weekly consumer confidence survey. The Budget and upcoming election are hogging the radar screen at present.

National Australia Bank also releases the March business survey results on Tuesday. The NAB business conditions index rose from 5.4 to 8.3 points in February. And the rolling annual average rose from 7.8 points to a 7-year high of 8.3 points. And the business confidence index rose from 2.7 points to 3.4 points.

And also on Tuesday, the Reserve Bank releases February data on credit card and debit card transactions. Plastic cards are being used more often, especially for smaller transactions.

On Wednesday, the Westpac/Melbourne monthly survey of consumer confidence is issued together with data on dwelling starts from the Bureau of Statistics (ABS).

Also on Wednesday, the ABS releases data on lending finance — broader data on new lending across the economy — including business, personal, lending and lease loans. The business and owner-occupier housing sectors are the key drivers at present.

On Thursday, the monthly employment report is released. In mid-to-late 2015 employment was going gangbusters. A period of consolidation was necessary and this appears to have been what we've seen in the past three months. But we expect that the below-average growth will give way to above-average growth in March and we are tipping job growth of around 30,000 in the month. The jobless rate should remain near 5.8-5.9 per cent.

And on Friday the Reserve Bank releases its bi-annual Financial Stability Review. While primarily designed to check the health of the financial system, a big focus in Friday's report will be comments on the home building markets in various capital cities, notably Brisbane and Melbourne.

China economic growth data; US retail sales; IMF forecasts

Chinese and US economic data compete for top billing in the coming week. The highlight is probably Chinese economic growth data on Friday. The International Monetary Fund will also update its economic forecasts.

On Monday the week kicks off with Chinese data on consumer and producer prices. Producer prices are down 4.9 per cent over the year while consumer prices are up by 2.3 per cent.

On Tuesday, US data takes centre-stage with data on export and import prices to be released together with the NFIB Business Optimism index — a gauge of small business sentiment. The usual weekly data on chain store sales is also issued.

On Wednesday in the US the usual weekly data on home purchase and refinancing is issued alongside data on retail sales and producer prices. Excluding cars, retail sales may have lifted by 0.5 per cent.

Also on Wednesday, March trade data is issued in China. Data from previous months has been complicated by the timing of holidays.

On Thursday in the US the usual weekly data on claims for unemployment insurance is released together with data on consumer prices. Inflation must show signs of perking up for the Federal Reserve to become more gung ho about lifting interest rates.

On Friday, production figures are released in the US. And in China, economic growth data is issued with the usual monthly readings on retail sales, production and investment. The Chinese economy expanded at a 6.8 per cent annual pace in the December quarter. Predictably growth will ease further in coming years to reflect maturation of the economy's development.

Sharemarket, interest rates, currencies & commodities

US earnings season gets underway in the coming week. That is, the time when quarterly profit reports are released. Overall, the US economy has been performing well with the first rate hike in nearly a decade delivered in the December quarter. But that is unlikely to have helped corporate earnings.

According to Thomson Reuters I/B/E/S, earnings from S&P 500 companies are expected to have fallen by 6.9 per cent over the year to the December quarter (or a decline of 1.8 per cent if the energy sector was excluded).

Alcoa kicks off the earnings season on Monday with earnings per share expected to be down from 28c to 3c.