Enviro markets update - May: energy efficiency credits

Victorian Energy Efficiency Certificates (VEECs)

The Victorian Energy Efficiency Certificate market has been dominated in recent times by creation from standby-power controllers. Speculation surrounding the removal or alteration of that abatement methodology had led the spot market to bottom out and even recover slightly, despite the growing oversupply. Yet with no such changes announced and certificate creation going from strength to strength, recent weeks have seen the spot market soften in dramatic fashion.

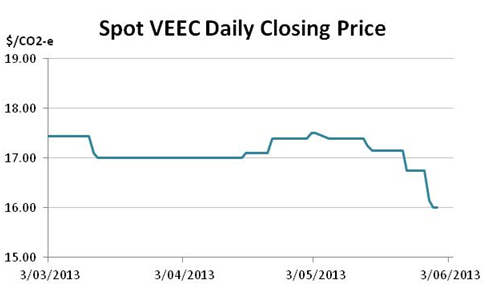

Having begun the year at the $20.00 level, oversupply concerns saw the spot VEEC market soften across the first quarter, reaching the $17 mark by mid March. Having then witnessed horizontal trade for close to a month the market subsequently improved to the mid $17s by late April. Interestingly, this improvement came despite particularly stable rates of both overall VEEC creation (circa 600k per month) and creation from the dominant Standby Power Controller (SPC) methodology (circa 400k per month) across the year.

The principal explanation for this recovery appears to be the expectation that the days of the SPC’s involvement in the scheme were numbered. It is important to note that this expectation was not predicated upon a belief that the scheme’s Regulator should intervene to support the market price. Instead it was because of questions over the actual energy efficiency savings delivered by SPCs given the ease with which the technology can be removed, and the number of less risky alternative methodologies that are only just beginning to make a mark on the scheme.

In the absence of any changes, the supply/demand equation is fairly stark: 5.3 million VEECs are registered with another million submitted and currently awaiting registration against a total 2013 target of circa 5.4 million. Hence if VEEC submissions were to stop dead today there would still be a healthy surplus of certificates for the 2013 compliance year. As it stands however, submissions continue to power on with 700k submitted in May with roughly 400k coming from PSCs.

The corollary of the raging success of the SPC is a falling spot market. In mid May the market began to fall from the mid $17s. By late in the month it had reached $16 and in recent days the bid/offer spread has indicated a sub $15 price could occur at any moment.

Given the prevailing expectations of future VEEC supply the forward curve remains very flat, with little escalation above the spot being paid.

Reflected in the increased creation numbers has been an increase in the rate of creation from sources other than SPCs. These include slightly higher numbers coming from lighting, and a healthy increase from a number of quite varied, though still small creation methodologies including weather sealing, shower roses and destruction of pre 1996 refrigerators.

In recent days the resolution of a long running issue of the definition of who will be liable under the scheme has been resolved. Previously the threshold was 5,000 customers, though concerns had been raised about the equity of such an approach. Instead, late last week legislation passed the Lower House that will alter the threshold to a total customer load of 30,000 MWh for electricity retailers and 350,000 GJ for gas. The changes have no impact on the overall target but instead alter on whose shoulders the obligations lie, with large established retailers receiving a decrease and smaller ones previously not covered picking up the slack.

Last week also yielded the Greenhouse Gas Reduction Rates (GHGRR) and the forecast of acquisitions which underpins them. The GHGRR for electricity has been set at 0.13974 and for gas at 0.00831. The forecast for electricity acquisitions is 30,663,562 MWh and for gas 152,166,393 GJ. The importance of these developments is that liable parties (known as Relevant Entities under the scheme) can now more accurately compute their obligation for 2013.

New South Wales Energy Savings Certificates (ESCs)

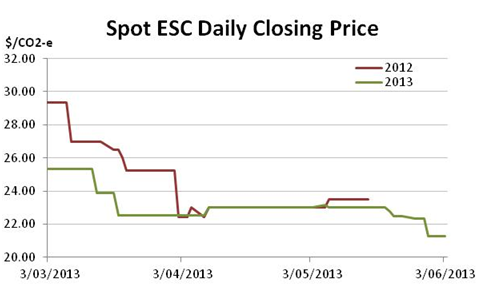

With a temporary reprieve from market softness witnessed across April, recent weeks have seen the weakness return in the ESC space with the market plumbing new lows on expectations of ongoing increases in supply. In many ways the softening spot market says more of the height of prices in recent years than the lows reached recently.

For years now the ESC market has defied the trends seen in other markets with supply and demand remaining in close balance across the early years of the scheme. In a reflection of this tight balance, ESC prices spent much of the early years trading above the nominal penalty rate which has gradually increased from the low to the mid $20s (2013 penalty being $25.45).

However with 2012 having yielded the first healthy oversupply, the spot market has again lost ground in the early part of 2013. The market did experience a reprieve from the downward trend across April when spot prices rose from the mid $22s back to $23. Yet as both ESC registrations and future supply expectations mounted the market has once again lost ground. Late May saw the spot market fall rapidly to $21.25, with forward transactions providing most of the liquidity on the way down.

The forward curve in the ESCs has also been particularly flat with only minimal rates of carry being paid. The most recent transaction being a September 13 to March 14 strip at $21.35.

Given how frequently the market has traded in the high $20s or low $30s in recent years (reflecting buyers’ preparedness to purchase ESCs above the nominal penalty level rather than to pay the penalty), it is no surprise that with the spot now in the low $21s there are many on the creation side who are now feeling less than optimistic. Yet this is simply a reflection of expectations about the 2013 supply/demand reality.

As it stands, there remain 1.2 million ESCs which are un-surrendered or ‘live’. Technically, liable entities have until 30 June to surrender ESCs against the 2012 liability without paying the penalty, meaning it is possible that some of those certificates may yet be surrendered. Should there not be any further surrender (which appears the most likely outcome) then the market is already roughly 45% of the way to meeting the 2013 target (of circa 2.5-2.6m). Given the lag in creation which saw creation of 2013 ESCs only begin in earnest in March, there is plenty of time to come.

Yet there are also those who believe that the falling prices will make creation from some methodologies significantly less attractive. This would slow down future supply and perhaps lead to a recovery in prices in the second half of the year, similar to what was seen in 2011 and 2012.

Whether the recent price moves are just an exaggerated example of the ESC market’s normal cycle, or whether 2013 will be the year the ESC market ‘normalises’ to trade across the year below the penalty reflecting a surplus will be the issue on which traders will earn their keep this year.

Marco Stella is Senior Broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services, across all domestic and international renewable energy, energy efficiency and carbon markets.