Electric blues: Lithium takes a stumble

Summary: Plans for new lithium mines are being unveiled on an almost daily basis, with the unconventional metal already seeing price declines. |

Key take-out: The critical element of lithium is that it is not a rare element, it's just that no-one has really looked for it because a big market had not been developed. |

Key beneficiaries: General investors. Category: Commodities. |

Stock market bubbles do not always pop. Some recede gently as the hot air escapes, which is what has been happening in lithium, a metal that has been hot in too many ways, including being blamed for the batteries in Samsung mobile phones catching fire.

Samsung's crisis with the lithium-ion batteries in its Galaxy Note7 has been just one issue for investors in lithium to consider as the share prices of most Australian explorers exposed to the metal have steadily declined over the past three months.

Since Eureka Report asked a critical question on June 15 (Is lithium out of power?) much of the heat has gone out of the lithium boom, with little chance of a revival as fresh lithium supplies are rushed into the market to meet a surge in demand.

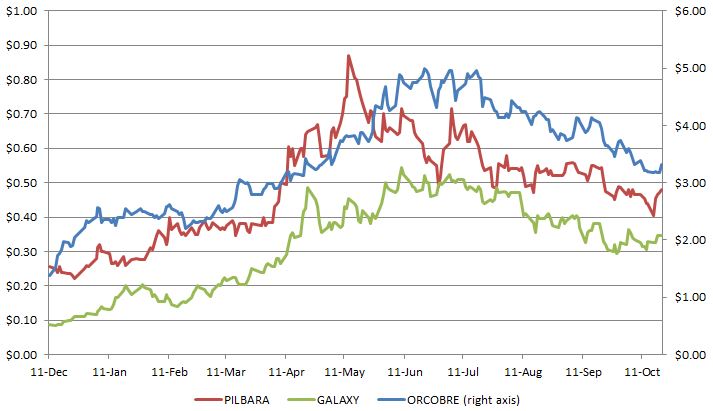

Some of the biggest share-price falls have been in the lithium leaders. Orocobre, an Australian business producing lithium in South America, is down by 31 per cent from $4.65 in mid-June to $3.19. Pilbara Minerals is down by 30 per cent from 64.5c to 45.5c. Galaxy Resources (which has recently merged with General Mining) is down by 35 per cent from 50c to 32.5c.

Chart 1: Australian lithium stocks, share prices (year to date)

Source: Bloomberg, Eureka Report

Samsung has withdrawn its offending phone from the market, but only after US airlines banned its carriage. This decision followed an earlier aviation issue with lithium-ion batteries in the early versions of Boeing's 787 Dreamliner, which was grounded until problems with its batteries were overcome.

Burning batteries are a sobering reminder that lithium is not a conventional metal. In its pure form it floats on water, and combusts on exposure to moist air, properties that makers of rival energy storage systems have been quick to point out, including the zinc-based Redflow ZCell.

Competing technologies aside, a more important challenge for lithium and its producers is that rising supply seems certain to satisfy – if not flood – demand over the next 12-18 months.

Plans for new lithium mines are being unveiled on an almost daily basis in many countries with Canada and Australia leading the way, but with Europe and Africa catching up.

Any new mines, or brine processing facilities based on the lithium in salt lakes, will have to compete with entrenched producers of the metal such as China's Tianqi and Albemarle of the US which control the big Greenbushes mine in Western Australia, as well as brine operations in South America.

Last week, as news of Samsung's burning batteries was being absorbed by investors, Tianqi started construction of a $400 million lithium processing facility at Kwinana, south of Perth, with the aim being to add value to expanded output from its Greenbushes mine.

The chief executive of Tianqi, Vivian Wu, said at a function to mark the start of work that she was not expecting a flood of new lithium to hit the market because producing the metal was actually a lot harder than is widely believed.

“People tend to assume that it's simple, but from past experience we know that with a lot of projects it's going to take a lot longer and be a lot harder to produce good quality stuff,” Wu said.

There's no doubt that Wu knows her lithium and her comments about there not being a flood could be seen as a positive for the sector – while her warning about how difficult it can be to achieve high quality lithium should be seen as a warning that not everyone is going to succeed.

Rounding off a week when lithium was in the news for good and bad reasons was a fresh alert from analysts at the international investment advisory firm Bernstein.

Three words sum up Bernstein's view of lithium: “The big short.”

If that wasn't enough to make investors with an appetite for lithium think twice the next comment should do the trick: “The lithium frenzy should all end in tears.”

Broken into three parts the Bernstein research paper looks firstly at what seems to be “an apparently very compelling bull case” based on rising demand for long-life electricity storage batteries in electric cars as well as for home and commercial use.

The second part of the research note is: “...an expanding supply side with no barriers to entry.”

“Lithium is not rare,” Bernstein said. “Quite the opposite actually: at the current production rate the reserve base equates to 431 years of supply. This compared with 39 years for copper and 15 years for zinc.”

Finishing off its sharply-worded attack on lithium is Bernstein's third point, technology developments: “Technology breakthroughs to take lithium prices down to the floor,” was the key comment on technology.

What Bernstein means is that technology developments will make lithium easier to produce as rival electricity storage systems are also likely to hit the market.

“While the supply base of lithium is already significant, we believe it can expand further with a number of technological breakthroughs being developed, as we write.”

Bernstein, of course, might be wrong with its gloomy prognosis but for me the critical element of lithium is that it is not a rare element, it's just that no-one has really looked for it because a big market had not been developed.

Greenbushes, for example, stockpiled its lithium for decades while it focused on tin and tantalum in the same ore-body. Today, lithium is on top – but those high-grade stockpiles are sitting on the surface waiting to be treated and they are some of the richest lithium material in the world, and already mined.

As has been said before; lithium burns, in more ways than one.