Economic serenity now, but for how long?

The global economy will likely experience steady, broad-based growth in 2014 thanks in no small part to the extraordinary expansion in central bank balance sheets in 2013. Rising asset prices in combination with fading near-term fiscal uncertainties will drive global aggregate demand growth forward, adding stability to what has thus far been an on-again, off-again global recovery from the financial crisis of 2008.

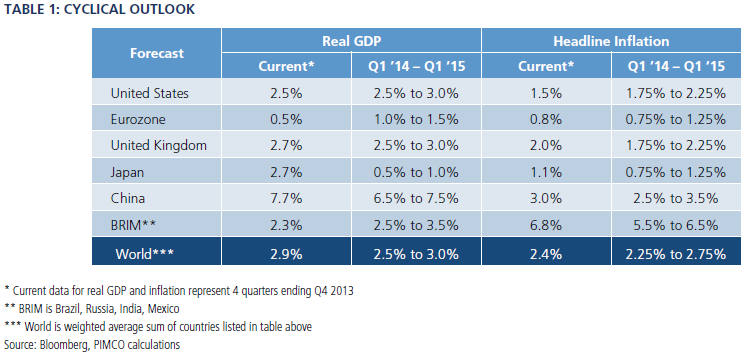

In the United States, our baseline expectation of 2.5 per cent to 3 per cent real growth marks the likely transition of growth from consumer to corporate and the anticipated broadening of growth from private to public.

Rising consumer optimism, fuelled by higher asset prices, steady job growth and gradually easing credit conditions, will likely drive a further fall in household savings rates this year, leading to faster consumption growth. Corporates, which are sitting on record levels of liquidity, might for the first time this cycle raise the growth rate of capital spending, especially as the market value of enterprises exceeds book value by a substantial amount.

The public sector, having endured a difficult period of significant spending cuts over the last three years, will no longer be a drag on aggregate demand growth as revenues expand rapidly thanks to higher asset prices and faster consumption and investment growth.

Risks to our US outlook are evenly balanced. On the upside, a rapid easing in household credit standards could turbo-charge the ‘wealth effect’ to drive savings rates lower – and faster than expected. On the downside, the poor quality of job creation could dent the current growth trajectory of residential investment and home prices by delaying the growth rate of household formations in the year ahead.

In the eurozone, our baseline expectation of 1 per cent to 1.5 per cent real growth calls for a broad-based cyclical improvement in domestic demand amid steady external demand.

We expect the reduction in fiscal drag in the eurozone periphery will reinforce gradually improving credit conditions to drive aggregate demand growth from well below potential to up toward potential in the year ahead. Increasing global confidence in the sustainability and efficacy of the ECB’s policy framework is likely to push global excess liquidity into eurozone assets, leading to further improvements in valuations during 2014. Rising asset valuations should drive the positive feedback loop forward, resulting in a steady outlook for consumer and corporate spending in the year ahead.

Risks to our eurozone outlook are also evenly balanced. While several smaller economies within the eurozone have made significant progress toward raising competitiveness via internal devaluations, a few major economies (namely France and Italy) have not yet done so.

Further, while overall labour mobility within the eurozone has improved markedly in the last year, the external valuation of the euro currency has increased to offset the relative impact this may have on overall eurozone competitiveness vis-à-vis the US and Japan.

In Japan, growth is likely to slow from a roaring 3 per cent in 2013 to only 0.5 per cent to 1 per cent in 2014.

We anticipate Japan will be the only major developed economy experiencing a slowdown this year. The reduction in Japan’s extraordinary fiscal stimulus of 2013, due to less growth in spending and higher tax rates, will drive the economy to contribute far less to global aggregate demand in 2014. However, at a 0.5 per cent to 1 per cent growth rate, Japan’s economy will perform close to its long-term potential. If sustained, it will ultimately reduce the risk of overshoot and contribute to the steady passage in 2014.

Risks to our Japanese outlook are balanced as well. While we may experience less fiscal drag than anticipated due to supplemental budgetary spending later in the year, Japan’s economy may improve less than expected if the improvement in real exports demand resulting from a substantial depreciation in the yen is offset by an increase (not decrease) in real imports demand in the price-inelastic energy sector.

Finally, in China, growth is likely to continue to slow. Our outlook is a wider range, at 6.5 per cent to 7.5 per cent, to reflect rising uncertainty. While that is a manageable range, China’s outlook poses increasing downside risk to the global outlook in 2015 and beyond. The pace of structural reforms in China appears too slow, while runaway credit creation at the local government level funded by off-balance-sheet wealth management products threatens to distract Chinese policymakers away from accelerating much-needed reforms.

While we strongly believe China has the financial resources to manage what is likely to be a period of credit digestion in the year ahead, we feel less certain as to whether the Chinese economy is robust enough to continue generating 7 per cent growth while doing so. Expect China to feel like a much slower growth economy in the years ahead, especially if one observes it as a commodity or capital goods exporter to the rest of the world.

Risks to our Chinese outlook are tilted to the downside. We are paying very close attention to Chinese debt dynamics, credit conditions and policy reactions. A gradual increase in default rates will be a good sign of improving robustness of the Chinese economy. Continued ignorance of negative debt dynamics will only serve to lower the overall return on capital in China, thereby lowering the potential growth rate further and more than necessary in the year or two ahead.

The key question global investors will ponder in 2014 is whether the global economy can maintain this period of tranquility for more than just one year. The odds have improved substantially, but the difficult transition from assisted growth to self-sustaining growth is now immediately ahead on the horizon.

© Pacific Investment Management Company LLC. Republished with permission. All rights reserved.