Drilling into the commodities spikes

Summary: This year has seen a solid revival in prices for metal commodities as well as energy resources, including oil. There are different disruptive forces at play, but one thing is certain: expect these forces to continue.

Key take-out: Commodities demand is increasing, which will help those companies in a position to supply. But with the prospect of mothballed operations coming back online, investors should expect some commodity prices will slip back over time.

Supply disruption is emerging as a major price driver, alongside demand growth, for an increasing number of commodities.

This is especially the case for oil, nickel, zinc, titanium minerals, and uranium – with oil the one to watch most closely over the next few months.

Higher prices over the past for those products, along with alumina, aluminium and rare earths, have been a factor in luring investors back to resources.

The trick now is judging how long supply cuts, such as those helping with oil’s revival, will remain in place. A sudden return of mothballed capacity could hit resource companies, whereas continued disruption could ensure that 2018 is an even better year for miners and oil producers than 2017.

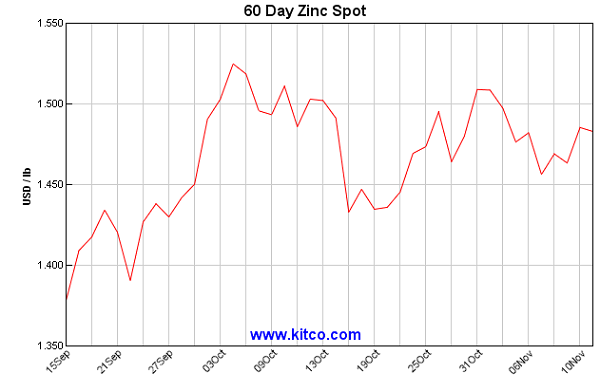

Zinc has been the best example so far of the effect of material being removed from the market, largely by a single producer, Glencore.

After the Swiss-based miner, and world’s biggest zinc producer, closed a number of mines two years ago, the price of zinc started to move higher. It gradually reclaimed a reasonable price of US80 cents a pound, before accelerating to a 10-year high of $US1.50/lb.

At the latest price Glencore’s suspended zinc operations would be handsomely profitable if in production, and it would be wise to assume that they will soon be re-started. Which is why London-based metal traders said in a Macquarie Bank survey last month that zinc was their preferred metal for short-selling, because they expect the price to fall next year as idled capacity is returned.

The supply of other metals has been affected in different ways, with China’s switch from an economic model focussed on rampant growth and little consideration for the environment, to a greater emphasis on protecting the environment, helping drive alumina, aluminium and rare earth prices higher.

Forced closures of the most polluting factories at home is leading to a rush by Chinese manufacturers to secure overseas supplies of raw materials, a disruption development which could be permanent, unlike zinc.

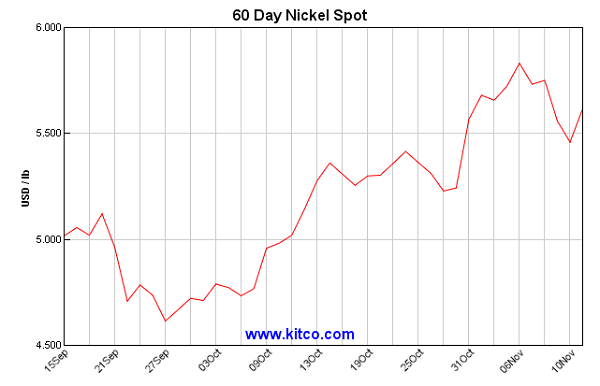

Nickel’s price has been rising thanks to a combination of disruption, such as last month’s closure of the Ravensthorpe mine in WA. The metal also has been aided by stronger demand for stainless steel, and increasing interest in nickel as a metal used to make batteries.

Uranium, the sick man of the broader metals complex, got a boost last week when one of the world’s biggest producers, Canadian-based Cameco, closed its big McArthur River mine for at least 10 months.

The short-term uranium price crept up by US30 cents a pound to $US20.25/lb, while the reaction on the Australian stock market was more pronounced with prospective producers outperforming the underlying metal. Vimy rose by 16 per cent, and Toro added 21.5 per cent.

China’s crackdown on polluting industries has driven the price of alumina (the precursor to aluminium) to a six-year high, while aluminium has risen by 24 per cent this year largely because of tighter rules on the use of highly-polluting petroleum coke in making the carbon anode essential in smelting aluminium.

Joining the list of metals disrupted is an Australian speciality, titanium dioxide, or beach sands as they were once called.

Iluka Resources, the biggest independent producer of titanium dioxide and its close relation, zircon, has received an unexpected boost from the closure of competitors in China, a process which started in October last year and which accelerated in February.

In a presentation to investors last week, Iluka said 76 ilmenite plants in the Yanbian district of China would close from next month and 13 more in the Panzhihua district would close by the end of next year as part of a countrywide emissions-control policy.

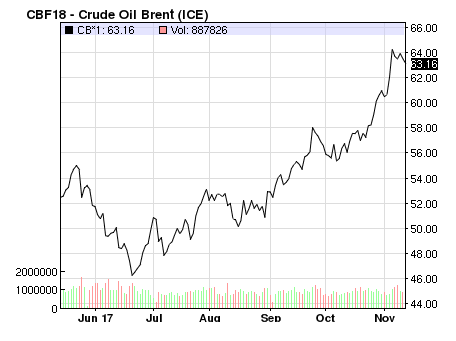

Oil, however, is the commodity worth watching most closely because it has undergone a dramatic change. This started with a price collapse in mid-2014, caused largely by over-production in the Middle East and the US, with that fall causing the lion’s share of the world’s oil and gas exploration to be put on ice.

A lack of exploration in any resource inevitably leads to a shortfall of project development. This fact is becoming increasingly apparent as the oil market moves closer to a better match between supply and demand, and to a reduction in the glut hanging over the price.

In the past few weeks the oil market has been sparking back to life, aided by strong demand (a function of the low price) and production cutbacks by the world’s major oil producing countries, including Russia and Saudi Arabia.

Recent events indicate that oil will continue to recover, and might even spike sharply higher if the ultimate form of supply disruption occurs, a fresh war in the Middle East with Saudi Arabia and Iran sparring in Yemen, Syria, Lebanon and Bahrain.

But even without a war, the evidence pointing to a continued recovery in oil can be seen everywhere, with events such as:

- Deal flow accelerating as producers and explorers become more comfortable with the outlook for oil. Beach Energy’s acquisition of Lattice Energy was an early sign of deals to come, followed by Oil Search acquiring exploration assets in Alaska.

- Royal Dutch Shell successfully selling most of its residual stake in Woodside, an exit which might seem like a negative. But it could only occur because buyers had emerged for its holding since the oil price started to recover.

- A sharp decline in floating storage vessels off Asian oil refineries, a reliable sign that the oil glut is being absorbed. Off Singapore alone, the number of tankers holding surplus oil has dropped in half, from 30 to 15 in four months.

- A report in London’s Financial Times newspaper that a giant tanker, Seaways Laura Lynn, which has been anchored off Oman for two years holding three million barrels of oil owned by oil trading firm Vitol, has finally unloaded its cargo. It was probably acquired for around $US35 a barrel and sold last week for $US60/bbl.

- A fresh report from analysts working for the Organisation of Petroleum Exporting Countries (OPEC), which points to stronger than previously expected oil-demand growth, and

- Growing interest in the proposed float of a small stake in the world’s biggest oil producing business, Saudi Aramco.

Next cab off the oil rank will be a full meeting of OPEC members at the end of the month, when production cuts are expected to be agreed. However, there is a view that it would be best if the oil price did not rise too quickly, because it would encourage high-cost material back into the market.

The key message for investors is that commodities are enjoying a combination of demand pull from an improving global economy and a supply push from a variety of disruptive forces.

The net result likely to be a continuation next year of the strong conditions enjoyed this year.