Don't dwell on the myth of a housing construction boom

The Reserve Bank of Australia and many private sector analysts have put their faith in the housing sector to help offset the collapse in mining investment. Unfortunately, the current boom appears likely to be fairly short, with more in common with the 2010-11 ‘boom’ rather than growth in the early 2000s.

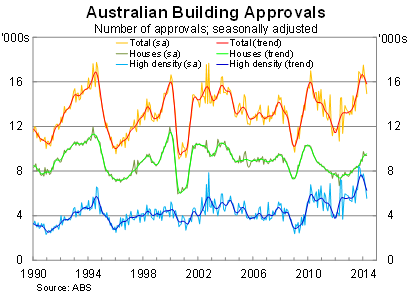

Building approvals fell by a further 5.6 per cent in April, much weaker than expectations, to be 1.1 per cent higher over the year. Over the past three months, approvals have fallen by almost 15 per cent, which has been largely driven by significant weakness in approvals for higher-density living.

Approvals for housing -- which has historically been less volatile -- continue to trend upwards at an increasingly slower pace. Approvals for apartments seem to be in free-fall and there is a considerable risk that many of these projects will not come to fruition.

On the upside, apartment projects typically take longer to complete, providing some support for residential investment and the Australian economy over the next few years. On the downside, these projects are far riskier and more likely to be postponed or even cancelled as economic conditions change.

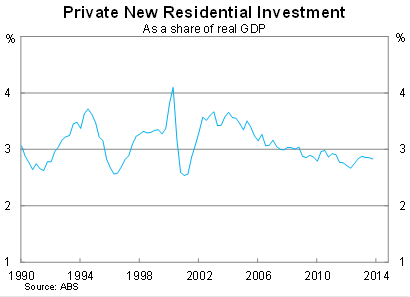

Based on strong population growth, housing investment should improve significantly over the next couple of years, but those expecting construction to drive the Australian economy should probably temper their expectations. The 2010-11 ‘boom’ -- which tracked in an awfully similar fashion to this episode -- resulted in around a 0.2 percentage point rise for residential investment as a share of GDP.

To put this into perspective, if the Australian economy grows at around 2.5- 3 per cent over the next two years, residential investment would need to rise by over 20 per cent for its share of GDP to rise by 0.5 percentage points. The unfortunate reality is that housing construction is hopelessly outgunned as we try to rebalance our economy away from the mining sector.

High-density approvals also provide a good indication of investor activity (on those rare occasions that investors purchase new rather than existing dwellings), so there are growing signs that investor optimism is subsiding. We will get a better feel for investor activity next week when the ABS releases its housing finance data.

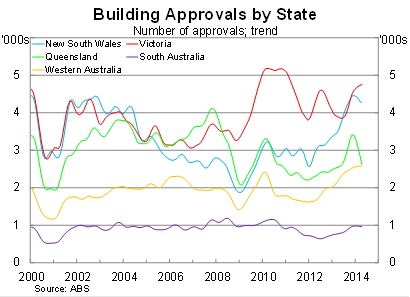

At the state level, the recent weakness has been largely driven by Queensland and, to a lesser extent, New South Wales. However, it is worth bearing in mind that state data can be particularly volatile in the higher density segment. A single large project can shift the data around significantly, making it difficult to interpret on a month-to-month basis.

Last week, the outlook for the Australian economy received a bit of a boost with investment intentions for the 2014-15 financial year a fair bit stronger than most analysts ( including myself) had predicted (Some good news amid Australia’s capex decline, May 29). If that eventuates, a relatively short boost to housing construction will not be so problematic.

But most of the risk to business investment continues to lie on the downside. With China slowing and the iron ore price falling sharply, I expect mining investment to decline at a faster rate than indicated by the investment intentions of mining firms.

Does the RBA need to consider cutting rates? Not yet -- and not necessarily.

There is no pressing need to cut rates based on the current outlook, but it is time the RBA acknowledged that housing will do very little (if anything) to support economic growth over the next couple of years. Residential construction is simply too insignificant to be the saviour that the RBA wants it to be and we will need incredibly strong exports and household spending to keep the economy afloat over the next few years.