Don't buy all the sell stories

John Addis

Don't buy all the sell stories

As I made my way to Sydney on Tuesday, sticking out of the seat pocket in front of me was a dog-eared copy of the Fin Review. I couldn't resist. It was the front page headline that grabbed my attention, just as intended: Sell everything - the great bond bull market reversal.

Yes, sell everything. There is a long record of the media doing the basics poorly, from announcing the wrong president (Dewey defeats Truman) to a German newspaper in 1973 reporting the death of three ABBA members in a plane crash, a mistake surely driven by wishful thinking.

.jpg)

In investing, this tendency has its uses. In August 1979, with the Dow Jones Industrial Average at under 900, an infamous BusinesssWeek cover predicted the death of equities. Over the next 20 years the index rose 12-fold.

In 2012, famed bond guru Bill Gross got huge media coverage for saying much the same thing, only for history to awkwardly intervene. The last four years have seen big market rises, although that hasn't stopped him from ringing the alarm bell again these last few weeks, although this time the advice is more sage. And in March 1999 when oil was trading at US$10 a barrel, The Economist wrote that the world was “awash with the stuff and it is likely to remain so”. That turned out to be a low for oil and The Economist.

So pronounced is this phenomena that Paul Montgomery, the inventor of the hemline indicator, reckoned that within a year of a Time or Newsweek financial cover story, the market moves in the opposite direction four out of five times. So, time to buy equities?

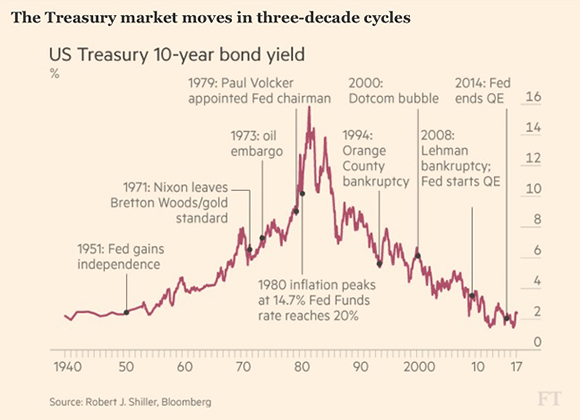

The market's reaction to this week's increase in US rates shows it's not that simple. Before getting to that, here's the chart that sums up the ‘sell everything' argument (note: the Fin Review piece was a reprint from the FT):

The first paragraph of the story sums up the argument:

“One of the longest and most important trends in world finance may be on the cusp of a reversal. US 10-year Treasury bond yields, used as a benchmark in transactions the world over, have been in decline since inflation came under control in the early 1980s.”

US Fed chair Janet Yellen has seen this coming for a while but each time she threatened an increase in rates the market wet its pants and she backed off. This week's 25 basis points increase, with two more forecast for this year, went through without a murmur.

So what's changed? The recovery may be weak but there's now good evidence it's real and sustainable. The US labour market is tight, wage inflation is at 2.7 per cent, business investment is firming and, supposedly, infrastructure spending and tax cuts are on the way. US growth is forecast at 2.1 per cent. Not great, but almost normal.

Elsewhere, as The Economist said this week, “In America, Europe, Asia and the emerging markets, for the first time since a brief rebound in 2010, all the burners are firing at once.” Yes, even in the Eurozone omnishambles, unemployment is at its lowest in eight years and economic sentiment is at an eight-year high. And normality needs normal interest rates.

So why sell everything? I'm blessed if I know. Stock prices might look a little expensive compared with the economic environment but not stupidly so. And if inflation is returning to the system, you want to be in real assets like shares, not paper.

Moreover, the bond market is hardly a good indicator of when to buy or sell shares. Bond yields are an expression of the macro environment, which is inherently harder to forecast because the variables are almost infinite and the interplay between them not fully understood. Estimating the value of an individual stock is child's play in comparison.

So, sell everything? Absolutely not. I'm putting the scary headline down to a subbing error. The original FT article did not make a connection between higher rates and lower share prices. Let's move on to an area where there is cause for concern.

Robert Gottliebsen has repeatedly warned members of the potential effects of an oversupply of apartments in Sydney, Melbourne and Brisbane, especially the latter two (with the possible exception of Ian Narev, no-one in Sydney can afford a house so they buy apartments instead). This week, the Reserve Bank and OECD got in on the act.

The RBA statement, issued by assistant governor (financial system) Michele Bullock was unusually blunt, warning of a “looming oversupply of apartments in Brisbane in particular, and possibly in some parts of Melbourne” She then linked this to the GFC, saying that “just because one institution doesn't look to be doing anything particularly risky, it doesn't mean that if you aggregate it with the others the end result won't look quite risky.”

It's reassuring to know someone is thinking about this stuff. Banks came unstuck in the GFC because their value-at-risk models accounted only for their own crappy products, not the systemic risk of everyone's. When they realised everyone was selling the same rubbish they were, credit markets froze.

If our banks recognise this possibility, they're not publicly acknowledging it. The Commonwealth Bank's Ian Narev told the parliamentary inquiry into banking that he is seeing “lending at levels we are comfortable with”. All big four banks were Profumo-like in their rejection of the notion of a bubble.

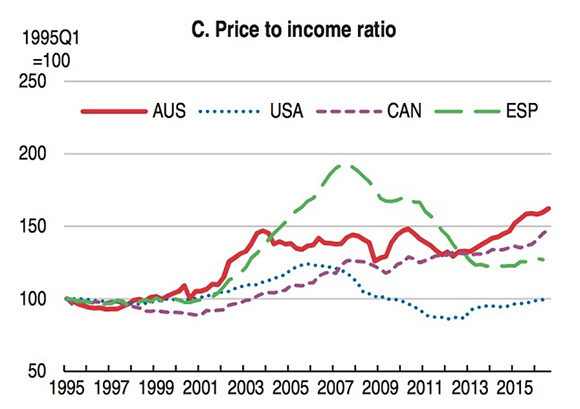

The OECD sees it differently, saying in its latest report on Australia that, “the market may not ease gently, but develop into a rout on prices and demand with significant macro-economic implications”. Here's their chart:

Not only do we have an exceptionally high house price to income ration but the ratio of household debt to GDP, at 123 per cent, is now the third highest in the world. House prices were up another 18.4 per cent over the past year. If you can resist the call of eggs benedict, the recent OECD report on Australia highlights the risks. If you can't, the quotes:

- “Low interest rates have fuelled high house prices and generated substantial mortgage borrowing”: (Translation: we're up to our ears in debt)

- “There is fiscal space available to support the economy if required” (Translation: government debt can but increased if we need to bail out the banks)

- “Banking remains highly concentrated, potentially compromising competition and making Australia vulnerable to “too big to fail” risk” (translation: as above).

That last point is the one that Michele Bullock was drawing attention to, especially targeted at bank shareholders. The report goes on to say that higher bank capital ratios offset these risks somewhat but I do fear that too many investors are downplaying these threats, carrying a higher portfolio exposure to the sector than they should as a result.

Reading between the lines of the OECD report, which also offers evidence of growing inequality, slowing productivity growth and poor wages growth, our recession-free quarter century is making us complacent. Not that our pollies are doing much to fix that. In 2014, the OECD urged us to “reduce banking sector privileges” but all we've had is the occasional enquiry at which the CEOs offer a chorus of Don't worry, be happy and then plug back up the Hume highway to deal with the latest customer rip-offs.

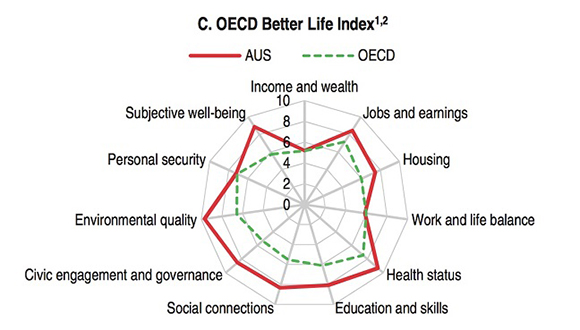

But we can't end on a note like that. Let's not forget that this a bloody great place to live, if you can afford the rent. The OECD's Better Life Index (see below) ranks each member country on 11 quality-of-life measures. We're out in front of the average on almost all of them, scoring especially highly on all those measures beyond income and wealth that actually make life meaningful.

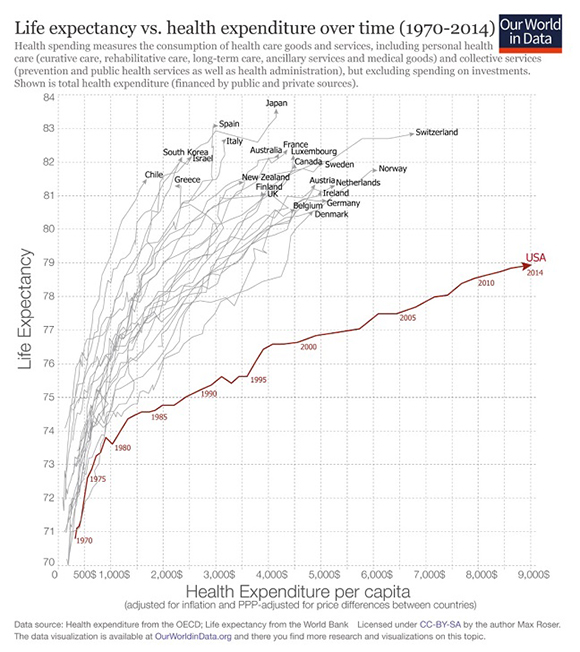

We're also living longer to enjoy them as the chart that I'll leave you with shows. Unlike the Americans, whose incredibly expensive health system exists to line the pockets of medical specialists and insurers, we get excellent value for money from ours. That's something to be grateful for if you're in the middle of a four hour wait in A&E getting that heart murmur checked out.

Have a good weekend and go easy on the hollandaise.

Last Week

Shane Oliver, AMP Capital

Investment markets and key developments over the past week

-

Global shares got a boost over the last week from a dovish rate hike from the Fed and relief that the Dutch election saw a rejection of far right Eurosceptics. Reflecting the positive global lead resources shares helped drive the Australian share market higher. Japanese shares slipped though partly in response to a rise in the Yen. The Fed's dovish hike also saw bond yields and the US dollar decline which in turn helped commodity prices and the Australian dollar.

-

The Netherlands election highlights yet again that the risk of a eurozone break up is exaggerated, with Dutch voters turning out in large numbers to support pro-euro parties. PM Mark Rutte's Liberal Party won 33 seats in the 150 seat lower house of parliament against Geert Wilders' Eurosceptic Freedom Party only getting 20. While the Liberal Party is down on 41 seats from the 2012 election it will lead negotiations to form a centrist coalition government (which usually takes months) and Rutte will most likely remain PM. This is a blow to the Freedom party which only a few weeks ago looked like it could get more votes than any other party. It's the third election in the eurozone in a row since Brexit – Spain, Austria and now the Netherlands – that has seen anti-euro populists bomb out. The Europeans look to have seen Brexit and Trump and decided that's not for them! Popular support for the euro remains high and this is clearly working against populist/nationalist parties and is likely to do so too in the French elections too. This is positive for the euro and leaves eurozone shares and peripheral bonds looking attractive.

-

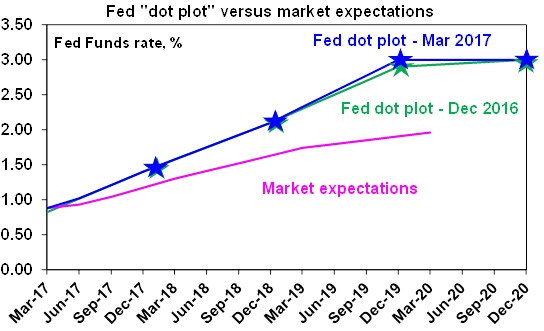

The Fed hikes but continues to signal that future rate hikes remain conditional on improving growth and inflation and will likely remain gradual. It does not want to do anything to upset the recovery. The median dot plot of Fed officials' interest rate expectations remained unchanged at three hikes for this year and another three hikes for next year and the Fed continues to expect that future hikes will be “gradual”. This does not mean that the Fed poses no threat. Market expectations still look remarkably complacent and at some point in the next year the focus will shift to the Fed allowing its balance sheet to start running down (by letting bonds roll off as they mature). This all points to a resumption of the bond bear market at some point.

Source: Bloomberg, Federal Reserve, AMP Capital

-

So far share markets are following the pattern of the last 20 years where the initial Fed hike in a tightening cycle causes share market weakness (eg, June 2004, December 2015) but subsequent hikes have little impact as they are seen as consistent with stronger growth and profits, until monetary policy eventually becomes tight. With rates starting much lower and the process being far more gradual this time around we still have a fair way to go before US monetary policy becomes tight enough to threaten the bull market in shares.

-

Of course the US wasn't the only country where interest rates were a focus in the last week. The People's Bank of China increased key money market rates by 0.1 per cent in a continuation of moves seen last month. However, the moves are very minor and look largely to be designed to stop growth from accelerating too far (given the commencement of a large number of infrastructure projects) rather than to slow the economy. The Fed's move added to the case to move in order to minimise downwards pressure on the renminbi.

-

By contrast both the Bank of Japan and Bank of England left monetary policy on hold. In fact the BoJ could be seen as being on autopilot having committed to quantitative easing and keeping the 10 year bond yield at zero until inflation exceeds 2 per cent. So the rest of the world still lags the US by a long way.

-

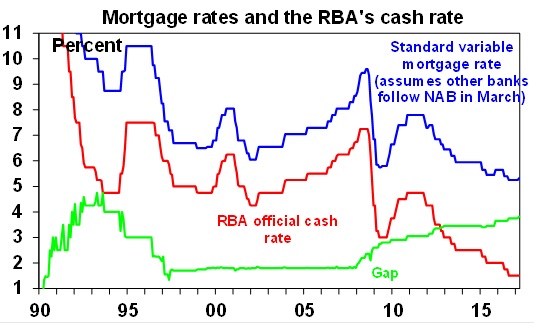

Finally, in Australia the National Australia Bank (maybe hoping to move under cover of the Fed) raised rates for property investors by 0.25 per cent and for owner occupiers by 0.07 per cent. With global funding costs for banks having increased on the back of higher bond yields, out of cycle rate hikes for owner occupiers seemed likely at some point and with NAB moving other banks are likely to follow. But while the move will cause agitation, a 7 basis point hike is unlikely to have much economic impact and like the out of cycle rate hikes seen in November 2015 is likely to be largely ignored by the RBA. That said if banks hike by 25 basis points or more then the RBA may have to consider offsetting it with another cash rate cut. While the NABs move will lead to the usual waffle about whether the RBA still has much influence over lending rates its noteworthy that out of cycle bank moves have been a regular occurrence since the GFC and yet this did not stop mortgage rates falling to record lows in response to RBA rate cuts. Changes in the cash rate remain the main driver of bank mortgage rates.

Source: RBA, AMP Capital

Major global economic events and implication

-

Most US data remains strong with small business confidence and regional business conditions indicators remaining robust, the NAHB's home builders' conditions index rising to its highest since 2005, housing starts up more than expected and labour market indicators remaining strong. Retail sales were softish though. Core inflation also remained stuck around 2.2 per cent year on year, the same level it's been around for the last year. Not enough for the Fed to speed up here.

-

While President Trump's budget proposals with massive spending cuts to pay for increased defence spending have caused much excitement, Congress drives the budget and will ultimately settle on a massively watered down compromise.

-

Chinese economic activity data for January/February indicated that solid growth momentum has continued into this year with industrial production and investment accelerating and real retail sales growth remaining strong.

Australian economic events and implications

- In Australia two things happened over the last week. First, RBA Assistant Governor Bullock added to the message that more macro prudential measures could be on the way to cool down the Sydney and Melbourne property markets. This could include tougher interest rate tests and a reduction in the 10 per cent growth cap for loans to property investors. Threats to the Sydney and Melbourne property markets are steadily building: state and Federal governments are shifting into gear to improve affordability; another round of macro-prudential measures looks on the way; the banks are starting to raise rates for owner occupiers out of cycle; all at a time when the supply of units is surging; and prices are ridiculous.

-

Second, economic data was mixed. Business conditions and confidence slipped but remain high according to the NAB business survey. Consumer confidence edged up but remains around average. Jobs fell in February but full time employment rose and leading jobs indicators point to solid jobs growth ahead. A rise in labour underutilisation to 14.6 per cent (i.e. unemployment plus underemployment) is a concern though.

-

Five reasons why the RBA won't hike this year: growth is still sub-par; labour underutilisation remains very high; underlying inflation is at risk of staying below target for longer; banks are raising lending rates out of cycle; and the $A has been going the wrong way. Another round of macro prudential controls to slow housing gives the RBA flexibility on this front. Our view remains no hike until second half 2018.

Shane Oliver is head of investment strategy and chief economist at AMP Capital.

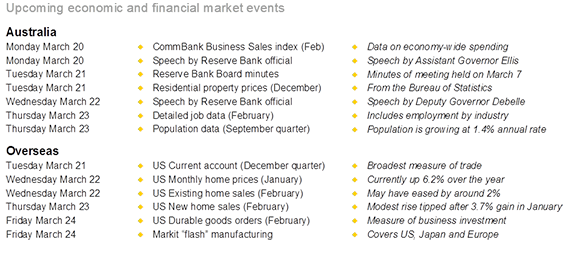

Next Week

Craig James, CommSec

Quiet week ahead in Australia

-

There are no ‘top shelf' indicators due for release in Australia in the coming week.

-

In Australia, the week kicks off on Monday with the release of the Business Sales index (BSI) from Commonwealth Bank. Unlike the retail trade figures from the Australian Bureau of Statistics (ABS), the BSI is a measure of economy-wide spending, including spending by government and business and including industries like airlines and automotive.

-

On Tuesday the Reserve Bank releases minutes of the Board meeting held on March 7. Investors and analysts always want as much guidance from the Reserve Bank as possible on interest rate settings and the outlook for sectors like housing. So the Board minutes will be scrutinised for clues on the policy bias.

-

In terms of economic data, the ABS releases figures on residential property prices on Tuesday. The figures may be perceived as a bit dated, being for the December quarter, but there are also estimates of the number of homes and the average number of people per household.

-

Also on Tuesday, Roy Morgan and ANZ release the weekly consumer confidence reading. Confidence is good without being great.

-

The Reserve Bank Assistant Governor (Economic), Luci Ellis, speaks on Tuesday at the launch of the ACT Women in Economic Network in Canberra.

-

On Wednesday there is another speech from a Reserve Bank official, this time from Deputy Governor Guy Debelle. The Deputy Governor addresses the TradeTech FX Asia conference in Singapore.

-

On Thursday, arguably the most interesting data for the week is published. The ABS will release the publication, “Australian Demographic Statistics”, a publication containing population estimates for the September quarter. Australia's population is growing at a 1.4 per cent annual rate – one of the fastest growth rates for advanced economies.

-

Also on Thursday the ABS releases detailed data on the job market. The February data will include quarterly estimates of employment by industry, with the surprise in 2016 being the sharp lift in job numbers at manufacturing businesses.

Quiet times also in the US and China

- Just like in Australia, US analysts and investors will also struggle to get fresh guidance on the economic outlook in the coming week.

-

The week kicks off on Monday with the release of the National Activity Index in the US. But also on Monday investors will have the first opportunity to react to Chinese data on house prices – released on Saturday. In the year to January, home prices were up 12.2 per cent on a year ago.

-

On Tuesday in the US, the broadest measure of the trade or external position of the US will be released – the quarterly current account data. A current account deficit of US$113 billion was recorded in the September quarter. Also on Tuesday the usual weekly data on chain store sales is issued.

-

On Wednesday in the US, the spotlight shines on the housing sector. The Federal Housing Finance Agency (FHFA) issues the monthly home price report with latest data showing that prices recorded a solid 6.2 per cent gain for the year to December.

-

Also on Wednesday, data on existing home sales is issued. In January, sales recorded a healthy increase of 3.3 per cent to a 5.69 million annual rate. Economists are looking for some of the gain to be handed back, with a 2 per cent fall expected in February. The usual weekly data on housing finance will also be issued on Wednesday.

-

On Thursday in the US the usual weekly data on jobless claims is released alongside new home sales and the Kansas City Federal Reserve survey on the manufacturing sector. New home sales were up 3.7 per cent in February and economists tip consolidation near a 559,000 annual rate in February.

-

Also on Thursday, Federal Reserve Chair Janet Yellen delivers a speech. Other district Federal Reserve Presidents deliver speeches on Monday, Tuesday, Thursday and Friday.

-

And on Friday in the US the February data on durable goods orders is released. Durable goods are things like cars and aircraft – goods that have a shelf life longer than three years. Generally durable goods orders are seen as a gauge on business investment. Orders may have lifted 1.5 per cent in February after a 2 per cent increase in January.

-

Also on Friday the Markit organisation issues “flash” readings on manufacturing activity in the US, Japan and Europe.

Sharemarkets, interest rates, exchange rates and commodities

- The first quarter of 2017 is drawing to a close. And the interesting point is that the Aussie dollar is one of the strongest currencies in 2017 when measured against the greenback. The Aussie dollar has lifted by 6.3 per cent against the US dollar (measured as units of currency per US dollar) since the start of the year – the fifth strongest currency of 120 currencies monitored.

-

The Malagasy ariary has been the strongest currency, gaining 9.7 per cent against the US dollar with currencies of countries like Mexico, Israel, South Africa, South Korea and Taiwan amongst the biggest gainers.

-

The UK pound has lost 0.4 per cent against the US dollar with currencies of countries such as Ghana, Turkey and the Philippines amongst those to have weakened most this year.

-

Of the other major currencies, the Japanese yen has gained around 3 per cent with the Euro up 2 per cent.

Craig James is chief economist at CommSec.

Readings & Viewings

What a week, as usual. Along with political power plays in Australia over energy supply, a US interest rate rise, there was a close election result in the Netherlands that narrowly avoided a win by the anti-establishment populist candidate Geert Wilders. Either way, the result has potential implications for the European Union.

Firstly, with US rates rising this week, Treasury yields set to rise, and the Dow Jones index set to crack 21,000, some analysts are now saying that US stocks are looking a tad expensive. But further analysis shows you shouldn't necessarily believe everything analysts tell you.

Former Fed governor Robert Heller believes the central bank is way behind the curve on rates, and they should be at 3 per cent now rather than just 1 per cent. Listen to his comments.

So should US homeowners be worried about an extra 0.25 per cent? Some may need to, but the average 30-year fixed rate mortgage in the US (yes, that's 30 years) is still sitting at 4.21 per cent.

Not to be out-trumped, the People's Bank of China has quickly moved to lift its official interest rates too.

Meanwhile, US President Donald Trump has hired another executive from Goldman Sachs for his team. A long-time Wall Street banker, Jim Donovan will take on the No. 2 role in the Treasury Department.

But in the UK, the government is distancing itself from banks -- at least in an ownership sense. It has just reduced its stake in Lloyds Bank.

Monsanto has long been a target by agriculturalists, environmentalists and ethicists over its push into genetically modified seeds. Now the chemicals company is the target of a major lawsuit over claims its weedkiller product Roundup causes cancer and changes human DNA.

But the European Union's chemical regulator says there's not enough evidence.

Energy bills going through the roof. Sound familiar? Well, we're not alone, as this UK report shows.

Should Australia's CPI include G&T? That's now the case in Britain, with Gin now included as an official ingredient in its national sales data.

This video has a go at answering why so many tech companies are valued at more than a billion dollars despite not making a cent.

American hedge fund billionaire Bill Ackman logged a $US3 billion loss this week on the pharmaceutical firm's plummeting share price. The Fin Review has the story on the Sydney trader (behind paywall) who has been shorting the company for a while, muck to Ackman's chagrin.

Betting markets are pricing in a greater chance of a Le Pen victory in France than the polls, after pollsters infamously missed the mark in the Brexit and Trump votes. But The Economist still says Le Pen can't win.

Comparing living standards in Mississippi and Bangladesh.

This 2014 ABC Radio Background Briefing on the then-looming gas crisis makes embarrassing listening for governments.

Meanwhile, the Wall Street Journal says the world faces a US-inspired gas glut.

The economics of Tesla's mooted battery for South Australia. ‘Deals hatched over Twitter generally don't work out that well. Elon Musk might have found an exception.'

Vale Murray Ball, creator of Footrot Flats. An NZ editorial writes, ‘Ball managed that tricky line between appealing to a wide audience and not sanitising farm life.'