Domain's listing bonanza

Question: What type of business can lift prices by 20% and barely lose any customers? Answer: A very, very good one. Domain Holdings Australia, the property listings business being demerged from Fairfax – see Fairfax Media does the splits – is just such a business.

Earlier this year, Domain lifted prices by 20% in Sydney and Melbourne, two of its strongest markets. What's more, the company is just getting started. This pricing power is one of the reasons why online property listings businesses have produced great returns for shareholders. In fact last year we named market leader REA Group, Domain's fierce rival, one of Australia's top ten businesses.

The quality of property listings businesses – and the growth they are producing – has not been lost on the market. REA Group trades on prospective 2018 and 2019 price-earnings ratios of 33 and 28 respectively. These multiples might be high but they're deserved.

Key Points

-

Domain is a very good business

-

Attractive two-player market

-

Higher growth than REA Group

Ironically, REA's success has helped Domain grow. Back in 2014 REA's former chief executive Greg Ellis – now a Domain director – was fond of telling shareholders that REA intended to take a larger share of the real estate transaction pie over time. Real estate agents sensed a threat to their commission income and were, as you might imagine, unimpressed.

It was left to Ellis's successor Tracey Fellows to smooth things over with the real estate industry, but the damage had been done. Agents wanted a stronger number two player in the online property listings market to restrain REA – and Domain has taken advantage.

Dangling carrots

Perhaps Domain's cleverest strategy to counter REA has been its ‘agent ownership model'. In return for placing premium advertisements – which, not coincidentally, feature the agent's branding more prominently – agents can effectively share in a portion of Domain's earnings. Like a teenager's relationship status on Facebook, it's complicated; but the key point is that agents have a greater incentive to place more premium ads with Domain. Everyone wins (except REA of course).

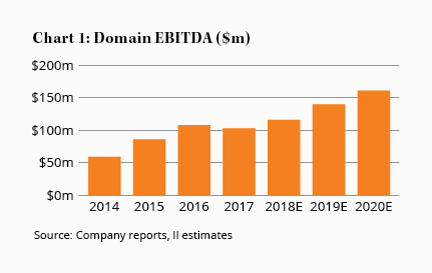

Over time the shift to premium ads (known in the industry as ‘depth products'), combined with price increases and geographical expansion has helped Domain's revenues and earnings soar. In 2018, Domain's earnings before interest, tax, depreciation and amortisation (EBITDA) should be almost double what they were in 2014 (see Chart 1).

The two-player market for online property listings has precedent elsewhere in the world too. In the UK, Rightmove plc is to REA Group what ZPG plc is to Domain. Even the margins for the first and second-ranked players are similar (see Table 1). The difference is that Domain shouldn't need to operate a cut-price strategy in Australia like ZPG, the owner of Zoopla, does in the UK. There's room enough for two players to co-exist.

| 2017 EBITDA margin (%) | |

| No. 1 player | |

| Rightmove plc (UK) | 73.4 |

| REA Group (Aust) | 63.8 |

| No 2. player | |

| ZPG plc (UK) | 32.5 |

| Domain (Aust.) | 32.1 |

| Source: Capital IQ, company reports | |

While Domain is a very good business, it's not quite in REA's league. As much as Domain has narrowed the gap with REA – more than 90% of Australian properties for sale are now listed on both sites – it's still the second-ranked player. It's also likely to remain that way. While there's no credible third player in Australia, if one were to emerge Domain's market share would be under greater threat than REA's.

Quelle horreur

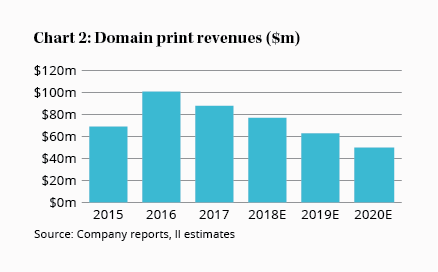

Then there's that Domain will still derive around 20% of its revenue from print advertising in 2018. Publications include lifestyle magazines in Melbourne as well as lift-outs in various Fairfax newspapers (which Fairfax will continue to print on behalf of Domain following the demerger). Domain's print revenue fell 13% in 2017 and will surely continue declining (see Chart 2).

Domain is also much less diversified. Unlike REA it operates solely in Australia, where it is the market leader in Sydney and Canberra (where it owns Allhomes). Domain is second-ranked elsewhere, although Fairfax's geographical origins mean it's also reasonably strong in Melbourne.

However, the fact Domain remains behind REA Group elsewhere is a source of future growth. For example, Domain now has 40 sales staff in Queensland and it's the company's highest growth market.

Like many online classifieds companies before it, Domain has been investing heavily in staff, marketing and product development. In fact, this is the reason why Domain's EBITDA fell slightly in the 2017 year (see Chart 1).

We're confident, however, that this investment will produce significant earnings growth in the years ahead. Indeed, earnings per share growth should exceed 20% over the next three years – faster growth than even REA.

So what price should you pay for Domain?

The current financial year will be a transitional year, so we're looking out to 2019. Based on our expectations of 11 cents of earnings per share and future growth potential we'd pay up to 29 times earnings, or $3.20 a share. It's a high multiple, we'll admit, but Domain is an impressive – and fast-growing – business.

Stronger growth

It's also slightly above REA's current multiple, and reflects Domain's stronger earnings growth over the short to medium term. Based on enterprise value, Domain's $2.0bn (at $3.20) looks reasonable next to REA's $8.0bn (if we exclude the latter's international operations).

A weakening in the housing market – see REA welcomes the slowdown – won't necessarily cause listings to plummet. But there is some relationship between prices and volumes, and the worse the downturn, the more listings could weaken. Perhaps our biggest concern is that slower property development activity will mean less developer advertising in the years ahead. REA flagged weaker developer advertising in the 2017 financial year due to lower project commencements.

A risk more specific to Domain is its future relationship with Fairfax Media. While Fairfax will own 60% of Domain, the future relationship between the companies could be a source of tension down the track.

Domain managing director Antony Catalano is keenly aware of the value of the mastheads to the company and, indeed, the private equity firms who bid for Fairfax Media earlier this year preferred to keep them together. The relationship between the two independent but related companies will need careful management after Domain lists.

At $3.20 the multiple – 29 times 2019 earnings – reflects the latent potential from states excluding New South Wales and Victoria. That will be Domain's main strategy over the next few years – selling premium advertising in those states. It's why we're willing to pay a higher multiple than REA, even though the latter is ostensibly the better business.

Fairfax shareholders will vote on the demerger at the annual general meeting on 2 November. Assuming it is approved, Domain will list on the ASX on 16 November. Look out for our review that day – if the stock lists below $3.20, then we expect to upgrade it. Stay tuned.

Disclosure: The author owns shares in Fairfax Media.