Doing a job on the Aussie dollar

While Chinese data grabs the limelight in Asia, it is the labour market that holds the key for the Australian dollar. Last week’s employment report saw the market increase the odds of another interest rate cut from the RBA, which in turn did a good job of pushing the Aussie dollar lower. The economy lost 31,600 full-time jobs in December, making 2013 the worst year for full-time losses since the recession in the early ‘90s. This sent the Aussie below 88 cents against the greenback for the first time in over three years.

It’s interesting to observe the currency market’s reaction not only to the recent Australian employment report but also the US employment report that came less than a week earlier. The US report added around two per cent to the value of the Aussie dollar, while the local equivalent took 1.4 per cent off the exchange rate. The exchange rate was sitting right on 89 cents prior to the release of both reports, so coming within such a short space of time it provides a good guide to the influence these employment reports have on the Aussie dollar.

Why does employment data move the markets like this?

A country's labour force is of course the engine room of an economy with job creation, stability and wages vital for everyone. Without money, a return for our labour, the economy cannot function. Now there is a little chicken and some egg in the relationship between the labour force and the economy, with many other factors in the mix - most notably interest rates.

Central banks are constantly monitoring trends in the labour force and the impact they may have on the economy. This helps inform policy and dictate interest rate settings. The fact there are less people employed on a full-time basis means less money is earned by households and hence less money will be spent in the economy. If this is seen as a persistent trend or threat, then it may cause the Reserve Bank to lower the interest rate to stimulate spending in the broader economy to compensate.

So it is the influence employment data can have on interest rates that moves the markets.

Employment trends provide a good guide on the currency

The Australian and US labour forces both have a dwindling participation rate, in part due to aging populations. However, at the moment they are different in many ways. One particularly striking point of differentiation is the trend, or should I say reversal of the trend, in respective unemployment rates over the last year.

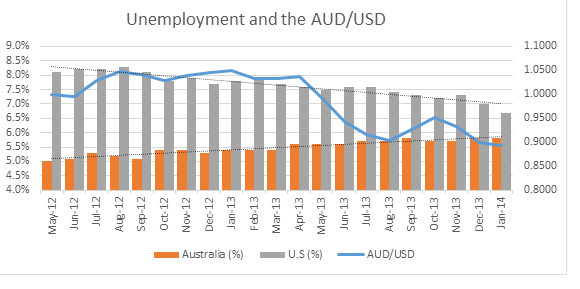

In 2013, the headline unemployment rate in Australia increased from 5.4 per cent to 5.8 per cent, while the US rate decreased from 7.8 per cent to 6.7 per cent. We know one economy is recovering from a recession, the other has peaked and is in decline. Early days yet, but if this trend continues and unemployment in Australia rises above six per cent in 2014 as many expect, we are likely to be faced with a higher unemployment rate than the US this year.

The currency certainly seems to be pricing in the interest rate impact of this labour market trend. The trend in unemployment was already in place, as is evident on the chart above, before the sharp drop in the AUD/USD exchange rate that occurred between April and August. It took the Fed to pledge low rates for longer and push back QE tapering for the currency to react – the impact of employment on interest rates being the catalyst for the sell-off.

Will the RBA cut rates again because of last week’s data?

Much of the interest rate reductions already in place are in anticipation of what is now occurring in the labour market. The challenge for the central bank is whether or not unemployment will increase to a higher level than forecast faster than anticipated. I believe they should wait for one more print on unemployment, so they can be more certain.

If we get another negative print next month then a rate cut in March or April will become more of a certainty -- pushing the Aussie dollar even lower, regardless of Wednesday’s inflation report or Monday’s Chinese GDP data.

Jim Vrondas is chief currency and payment strategist, Asia-Pacific at OzForex, Australia's leading international money transfer service. OzForex's cutting edge technology powers foreign exchange services for 100,000 private and institutional clients across six continents, and the company is a key provider of forex news.