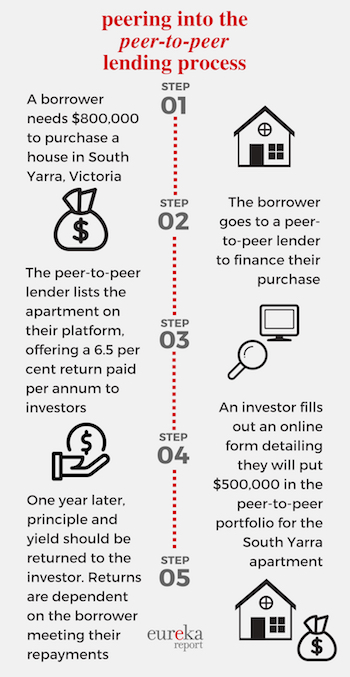

Does peer-to-peer lending pay?

Summary: Yield-hungry investors are funnelling more funds into the peer-to-peer lending space. Peer-to-peer loan products can appear similar to term deposits, where the investor can select loan terms and receive their principle and interest at a pre-determined date in the future. An eye-catching difference is the interest that peer-to-peer products are paying investors compared to term deposits.

Key take-out: Investors should understand the underlying investment — the guarantees and underlying assets — to better decide if risk is adequately priced in and it's worthwhile as an alternative investment.

With money treading water in many mainstream environments, more investors are seizing the opportunity of higher returns where risk looks to be priced in — and that's where peer-to-peer comes into the fold.

There's a lot of hype around the space, but if you're seriously considering a peer-to-peer investment, it's important to get to the core of the opportunity. While these products are offering more than double term deposits for the same investment timeframe — above 6 per cent per annum — higher returns almost always come with higher risk.

Eureka Report explored private lending a few months back when we looked into what commercial property funds were offering investors. But it's becoming increasingly clear that not all private and peer-to-peer lenders are created equal.

Some lenders have only unsecured loans on their books, without underlying assets protecting investments. Others are pooling investments together, so one peer isn't funding another peer, and instead lending capital in a collective to several borrowers in one transaction.

With the banks increasingly under tighter APRA regulation and pushing up against stricter aggregation and concentration limits because of how much they can lend to any one client and to a particular asset class or geography, some nonbank lenders appear to be enjoying quite a pay day.

Just like a term deposit?

Investors could be forgiven for thinking that investing with nonbank lenders is without real risk, given the language some use to promote their products. It's not uncommon for nonbanks to describe themselves as “just like the banks”, even though the Federal Government won't guarantee their deposits up to $250,000, as it does with authorised deposit-taking institutions.

Yet, putting money in a term deposit is vastly different to investing in a three-month unsecured personal loan, or a commercial property development with interest paid per annum over a period of five years.

La Trobe Financial, formerly La Trobe Permanent Building Society, is a non-bank regulated by the National Credit Code. It offers a peer-to-peer product where investors can start earning from 6 per cent per annum on a minimum investment of $1000. The lender has circa $400 million in funds under management provided by retail and sophisticated investors in its peer-to-peer portfolio of mortgage loans, which it has been growing for around 20 years.

Chris Andrews, chief investment officer of La Trobe, says ‘small ticket' residential constructions like townhouses and medium-density apartment projects are the big opportunity for his firm at the moment. This is an area the banks are not heavily focused on servicing, although La Trobe receives funding via the banks.

Andrews says La Trobe is a true peer-to-peer lender in terms of investors being able to choose their individual borrower — whether that's a rural retailer or an inner-city townhouse developer.

La Trobe mainly provides first mortgages and specifies on the rare occasions that it's offering a second mortgage to investors. A second mortgage is higher risk because the investor of a second mortgage doesn't receive any funds until those investing in the first mortgage have received all their entitlements.

“In the traditional sense, peer-to-peer is one investor funding another investor, rather than many investors funding many borrowers. To draw the analogy with the share market, a pooled investment vehicle is like investing in an ETF or a managed fund, and peer-to-peer would be like investing directly in BHP,” explains Andrews.

That said, the beauty of traditional peer-to-peer investment can also be to its detriment. Investors know exactly what they are funding, but as they are backing a specific borrower, the risk may not be spread the same way as a pooled investment scheme.

Once investors are locked into a peer-to-peer investment contract, the general rule is they can't break it. On a case-by-case basis, there's an early exit fee from 1.5 per cent-plus at La Trobe, where in cases of financial hardship the firm will try and find a substitute investor.

It's important to understand worst-case scenarios, especially when assessing alternative investments. When lending in peer-to-peer environments, if an individual loan goes into default, the investor won't receive any money until the financial intermediary has collected money from the borrower. In a worst-case scenario, the loan may be referred to an external dispute resolution scheme to seek a financial resolution. This option is only available if the financial institution is providing consumer, not just commercial, credit.

But the risk of this may be lower than some think, believes Andrews, as credit-impaired borrowers — typically more likely to default — would only make up a very small portion of La Trobe's loan book at any point in time.

“Borrowers instead come to us because they don't like the banks, they've reached a house limit with the banks, or there's something about their credit application which makes it difficult for the banks. Nonbanks exist to focus on borrowers that banks don't deal with very well,” Andrews adds.

Another group, Private Mortgages Australia, lends money to small-to-medium businesses that typically can't get finance from the banks. It's similar to La Trobe by way of securing loans against an Australian property, but vastly different as it operates a pooled mortgage scheme for sophisticated investors only. Nonbanks must register for a full Australian Financial Services Licence (AFSL) if they want to take retail investors too.

Tony Barbone, managing director of Private Mortgages Australia, describes the obligations for consumer credit providers — like La Trobe — as far more onerous. It's a costly process where the provider must tick boxes for specific financial services qualifications and a minimum number of years of experience. This all comes back to the baked-in assumption that sophisticated investors have greater decision-making capabilities than retail investors.

"There just aren't the same types of requirements to provide commercial credit. The reason is, when you're dealing with a business owner or sophisticated investor, they should really be able to rely on professionals advising them, whereas most mum and dad borrowers won't contact a solicitor or accountant before making a financial decision."

Regulation is creeping in

Nonbank lenders don't have direct depositors, so there is less regulatory oversight, and notably, no regulation by APRA. There's now a push by the Government for some of these lenders, which aren't accredited as authorised deposit-taking institutions (ADIs), to be registered under the Financial Sector (Collection of Data) Act (FSCODA).

The point is to get more comprehensive data on institutions lending out money in Australia, regardless of whether it's their primary business. A caveat — lenders with less than $50 million worth of loans, or those lending less than $50 million in any one financial year, would still be exempt from regulation.

Although they are different kettle of fish, both Anderson and Barbone make similar claims. They believe the fact their firms are dealing in mortgage-only secured loans, supported by Australian property, makes them all the more safer.

Borrowers can easily turn to peer-to-peer platforms to fund their small business needs, home renovations, medical expenses and car purchases. Sometimes peer-to-peer personal loans will be secured against Australian property, but more often they won't be, and that's a way some lenders are offering even higher returns.

Sizing up the investments

The Australian Securities and Investments Commisson advises investors to consider a number of things before buying into similar products. Chief among these for pooled mortgage funds is understanding the scheme's liquidity. Many funds fell victim to liquidity events as a result of the GFC, where some property investors had to wait several years for their money to be released from ‘frozen' schemes.

La Trobe's Andrews says the track record of the investment manager should rank paramount when making a decision. Like with any investment, understand where you stand in the creditor line — whether you're providing a first or second mortgage.

“It's important to look at the substance as you would with any investment decision and check whether the manager has offered their strategy when times are good and when times are bad.

“Some might claim they have a superior algorithm, but can you prove that? It's important not to be seduced by the hype and rather go straight to the track record of improving returns for investors. And if you don't understand how you could lose your money, the bottom line is, you probably shouldn't be investing in the product.”