Demi Moore's Law gets time in the sun

John Addis

Demi Moore's Law gets time in the sun

Gordon Moore didn't set out to become a billionaire. Leaving Caltech with a PhD in chemistry in 1954, he interviewed with Dow Chemicals, where his interlocutor again proved the folly of forecasting. Moore was technically proficient but “would never manage anything”. As history records, he went on to co-found Fairchild Semiconductor and then chip maker Intel, which put the silicon in Silicon Valley, and is now worth about $US7 billion.

I knew none of this when, sometime in the mid-1970s as I was pulling on a pair of purple flairs to bewitch Eliza Triggs, my father came home with a pocket calculator. For years, I had watched him fiddle with slide rules and computer tape. The Hewlett-Packard HP-65 dispensed with all of that, for a price.

At a time when a pint cost 20 pence and a loaf of bread half that - the Poms have always got their priorities wrong in that regard - this futuristic machine cost £400, about 12 times average weekly earnings at the time; not that that bothered my father, a well lubricated public servant with an expense account and an unconventional approach to working hours (hey, give him a break. It was the 70s).

In today's money, the equivalent price for an HP-65 would be about $18,000 (as of November last year full-time average weekly earnings in Australia were about $1,500). But this morning you can stroll down to Officeworks, grabbing an eggs benedict on the way, and pick up the HP-35S, which does pretty much the same thing for $109.00.

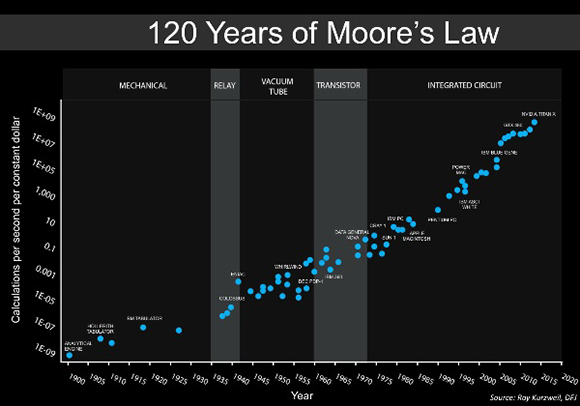

In a 1965 paper Gordon Moore foresaw this logarithmic increase in computing power, predicting that the number of components per integrated circuit would double every 18 months to two years for at least a decade. As it turned out, Moore's prediction - it isn't really a law - has lasted longer than that.

Around the time of Moore's paper, the Cray 1 computer (1997 cost: $US9 million) performed less than 10 calculations per second. The current NVIDIA Titan X, a graphics card preferred by gamers at the top right of the above chart, performs 4.5 trillion single precision floating-point operations per second. This card and accompanying paraphernalia needed to play World of Warcraft will set you back about $5,000.

These geeky details lie at the heart of what we have come to understand as the modern world, and the economic growth it has created. As economist Richard G. Anderson says, "Numerous studies have traced the cause of the productivity acceleration to technological innovations in the production of semiconductors that sharply reduced the prices of such components and of the products that contain them”.

A 2015 study from IHS Inc marking the 50-year anniversary of Moore's paper claims that if “Moore's Law had slowed to every three years, rather than two years, technology would have only advanced to 1998 levels: smartphones would be nine years away, the commercial Internet in its infancy (five years old) and social media would not yet have skyrocketed [no less there--Ed].”

The report goes on to note that, “the activity forecast by the law has contributed a full percentage point to real GDP growth, including both direct and indirect impact, every year between 1995 and 2011, representing 37 per cent of global economic impact.” Estimates of the impact of Moore's Law go as high as $US11 trillion in incremental GDP over the past two decades.

Moore's Law was something that engineers and semiconductor makers aspired to, requiring huge investments in research and development. Although there's evidence that investment is now tailing off, something equally astonishing is happening elsewhere that could have just as big an impact.

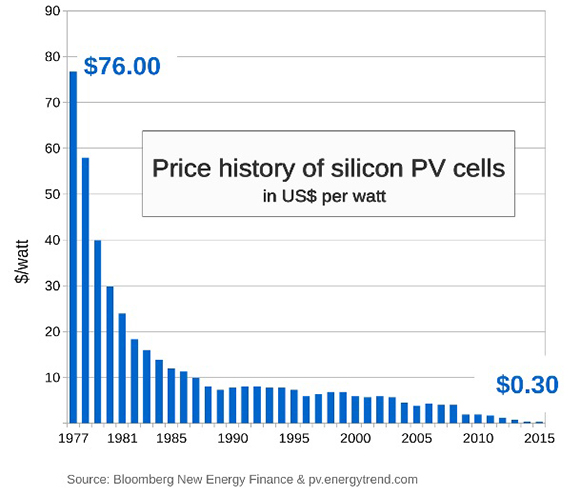

It turns out that Moore's Law works as well for solar power as it does for silicon chips; well enough for a climate sceptic like Cory Bernardi to put solar panels on his roof. Solar power is cheap and getting cheaper all the time.

Around that brief period when purple flares were popular (although, sadly, not with Eliza Triggs), it cost $US76 to generate a watt of solar power. Since then, the price has fallen by 99.6 per cent, making the argument about climate change moot, taking it out of politics and into household economics.

What else might Moore's Law apply to? Two economists - J. Doyne Farmer and Francois Lafond from the University of Oxford -tried to answer that question in a paper called How predictable is technological progress? Published in February 2015, it examined 53 different technologies from milk production and DNA sequencing to chemical and energy production, finding that many technologies do indeed follow “a generalized version of Moore's Law” in which “costs tend to drop exponentially.”

While the cost of producing household goods, chemicals and fossil fuels fluctuate randomly, the costs of DNA sequencing, transistors and solar panels drop steadily and predictably each year. According to the Institute for Energy Economics and Financial Analysis, this means that, “In the near future, it will likely be the coal industry that will need subsidies to compete with solar, not the other way around.”

But there's no point generating all that cheap solar power if you can't access it when the sun goes down. Does Moore's Law apply to battery production? Err, no. Here's Ashutosh Jogalekar of Scientific American:

“The reason there is a Moore's Law for computer processors is that electrons are small and they do not take up space on a chip. Chip performance is limited by the lithography technology used to fabricate the chips; as lithography improves ever smaller features can be made on processors. Batteries are not like this.”

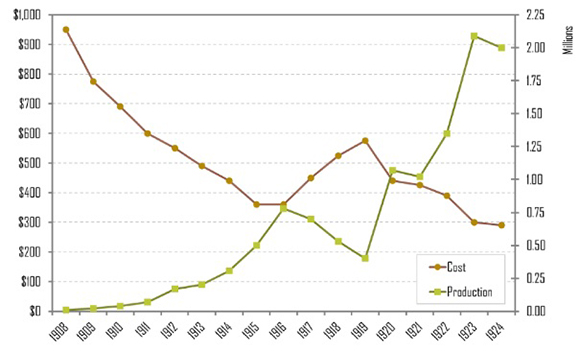

So, if Moore's Law is a consequence of fundamental physics and the cost declines in renewable technologies are not, why have unit cost declines in solar PV mirrored those of integrated circuits? Because almost everything can be produced more cheaply with scale. What looks like Moore's Law may in fact be a learning curve. Take this chart showing production increases and cost declines of Henry Ford's Model T production from 1908 to 1924:

Source: Case File of Henry Ford, Committee on Science and the Arts, 1928 Cresson Medal.

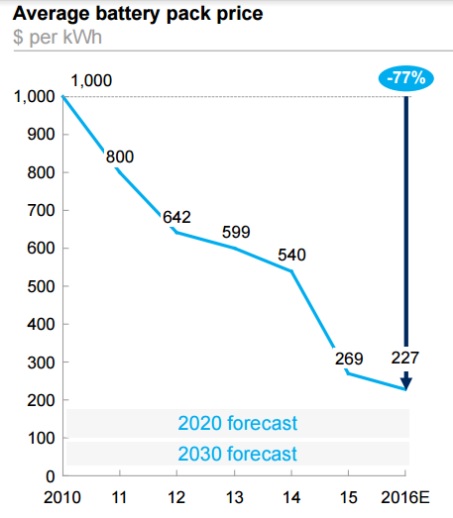

There is no particular term for the fall in unit costs as production increases, although chemical engineer and author Lindsay Leveen's suggestion of Demi Moore's Law sounds good to me. And it does seem to apply to battery production. In the US, McKinsey claims electric vehicle battery pack costs have fallen by almost 80 per cent in six years while Tesla claims to be producing at even cheaper prices.

Source: Electrek.co.uk

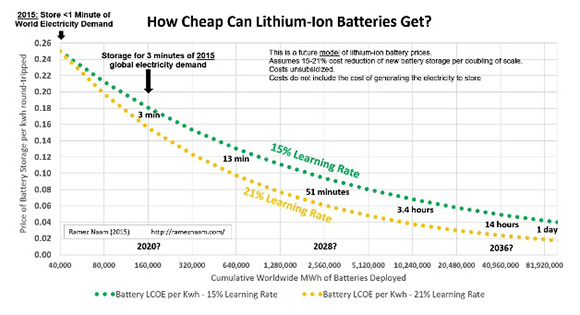

Elon Musk's Tesla doesn't need a breakthrough in battery technology to dramatically lower costs; it just needs to create a big enough market to produce at scale, something in which South Australia is assisting. How cheap can lithium-ion batteries become? This chart shows the possible future effects of learning rates of 15 and 21 per cent, per doubling of scale, on the costs of storing electricity:

Source: Ramez Naam, Renew Economy

Battery production might err on the side of Demi rather than Moore, but unit costs are falling to the point where batteries and renewable power will soon be cost competitive with fossil fuels. CSIRO estimates that point will be reached by 2030 and the ANU suggests that, as Australia's fleet of coal fired power stations will need to be retired by this date, a fully renewable electricity grid will be cheaper to build than a coal or gas fired network, with or without a carbon price.

What does all this mean for investors? Well, despite the best efforts of Australia's politicians, coal is dying. To invest in it is to bank on continued government support in the face of declining cost curves of competitive energy sources. There may be plans, driven by China and India, to expand the world's coal-fired capacity by almost half. But these projects are subject to the same economic forces. Already, for a brief period last month, 70 per cent of UK electricity came from nuclear, solar and wind. In short, the tipping point is near.

This is a good thing for investors, the global economy and the climate. The International Renewable Energy Agency found that doubling the share of renewables in global energy production by 2030 would add up to 1.1 per cent to global GDP and increase employment (directly and indirectly) in the sector to up to 24.4 million people (the switch to renewables is labour intensive).

Cheaper electricity, higher employment and more rapid economic growth are just some of the reasons why shares tend to go up over time. Nevertheless, picking winners in the renewables sectors will be tricky. In the early stages of any game-changing industry, new entrants compete for market dominance through ever-cheaper pricing and technological advancement. That's great for everyone except the investors in these businesses. Some will emerge as winners but picking them beforehand isn't recommended.

But the point I really want to leave you with is one of optimism. The switch to a renewables-based economy isn't far away. The economic benefits it will deliver are substantial. And it will be Demi Moore's Law that defeats the politics that stand in the way of it.

Capture some of that lovely winter sun if you can this weekend.

This Week

Shane Oliver, AMP

Investment markets and key developments over the past week

- Share markets were mixed over the last week with gains in the US helped by good earnings news, Europe and China but Japanese shares flat and Australian shares down a bit partly on the back of perceptions that the RBA has become more hawkish. Bond yields mostly fell. Commodity prices generally rose helped by further falls in the $US. This along with perceptions of a more hawkish RBA helped push the $A above $US0.79 before comments by RBA Deputy Governor Guy Debelle indicating that no significance should be attached to the RBA's recent reference to the neutral rate of interest helped push it back down again.

- It's still too early to write off Trump's tax reform agenda. The failure of US Senate Republicans to agree on either a "repeal and replace" or "repeal and delay" of Obamacare obviously adds to uncertainty around whether Republicans in Congress can agree amongst themselves on a budget, government funding to avoid a shutdown in September, an increase in the debt ceiling which is necessary by early October and most importantly on tax reform. Of course health care reform could make yet another comeback, but uncertainty around all of these could cause bouts of angst in investment markets in the next few months. However, as we saw in 2013 it's in neither of the major party's interest to allow a US government shutdown and neither party wants a debt default. More importantly though while the risks around tax reform have increased, Republicans are in general agreement on wanting lower taxes, they need a win prior to next year's mid-term elections and after the mid-terms it's unlikely they will be able to cut taxes because the Democrats are likely to have won control of at least the House of Representatives. So we still lean towards some sort of tax reform getting up. Interestingly though financial markets appear to have largely given up on it, but it hasn't stopped the US share market pushing new record highs.

- Noise around a US trade war with Mexico and China is likely to pick up with the renegotiation of NAFTA coming up and signs of some deterioration in relations between the US and China and little progress in their Comprehensive Economic Dialogue. Time will tell but the US' objectives for the NAFTA renegotiation suggest limited changes, US-China trade talks are continuing and we remain confident that despite lots of noise and partial moves (eg, US tariffs on steel imports) that cool heads will ultimately prevail.

- Not another attempt to come the raw prawn with us on Australian interest rates! The financial market reaction to the minutes from the last RBA meeting was way over the top. Don't read too much into them. I must admit to finding the periodic discordance between the post meeting statement and the minutes a bit disturbing - surely they relate to the same meeting and so should leave the same impression. It does make me wonder though whether the high level of RBA communications could just be adding to noise and confusion around interest rates at times. Mind you, this is a much bigger problem in the US.

- But back to where interest rates are headed ... the minutes certainty did sound a bit more upbeat than the initial post meeting statement about growth and wages. But the bit that caused most excitement was the reference to a 3.5 per cent neutral rate of interest, ie the rate of interest consistent with growth at potential, inflation at target and which neither causes the economy to accelerate or decelerate. Some have interpreted this as indicating that a series of eight quarterly rate hikes of 0.25 per cent are imminent. This is very doubtful.

- First, the neutral rate discussion looks to have been just a regular “deep dive” into a key issue and so as Deputy Governor Guy Debelle pointed out “no particular significance should be read into the fact the neutral rate was discussed” at the last meeting.

- Second, the neutral rate is a rubbery rather academic concept, a bit like the non-inflation accelerating rate of unemployment (NAIRU) and the “output gap”. In theory it should be around long run potential nominal growth, but it can move around a lot given attitudes to debt and debt levels, the gap between the rates bank lend at and the official cash rate, inflation expectations, uncertainty about what potential growth is, etc. At the Fed, they refer to a long term neutral rate (seen to be around 3 per cent at present) and a short term neutral rate with Fed Chair Yellen recently saying it was already close to neutral with the Fed Funds rate at just 1-1.25 per cent! So while a comparison to some neutral rate may be of use in assessing whether policy is easy or tight it's not a firm target that central banks head for.

- Third, for what it's worth our assessment is that because of higher household debt to income levels and higher bank lending rate spreads the neutral rate is around 2.75 per cent.

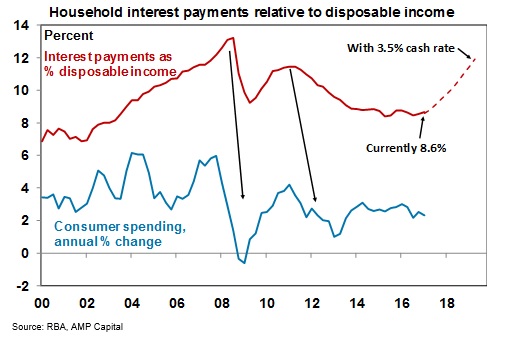

- Fourth, a rise in the cash rate to 3.5 per cent over the next two years if passed on in full would push the ratio of household interest payments to household disposable income from 8.6 per cent currently to around 12 per cent. This would be well above the average ratio of 9.6 per cent since 2000, above the 2011 peak of 11.4 per cent and towards the pre GFC peak of 13.2 per cent, both of which saw hits to consumer spending – see the next chart. The hit this time would likely be greater as unlike a decade ago households lack the optimism to take on more debt to cover higher interest payments (remember the ATM in the lounge room!). So, the 3.5 per cent of income hit to spending power would likely take a big chunk out of consumer spending. Of course, these numbers are averages - for those households with a mortgage the interest payment to income ratio would be around three times higher and in Sydney and Melbourne it would be even higher again. Which all suggests that in the absence of much stronger economic conditions rates won't be increased by 2 per cent.

- Finally, heightened rate hike expectations have already pushed the $A above $US0.79 and a cash rate of 3.5 per cent would likely see it soar, exacting another round of damage on the economy just at a time when we still need a lower currency to offset the impact of still falling mining investment.

- Reflecting all these influences, when it does come time to start raising rates the RBA won't be on autopilot on its way up to 3.5 per cent but rather will be incremental, ie hike 0.25 per cent and then wait to assess the impact. And as we have seen with the Fed the process is likely to be very gradual and we doubt that rates will be able to go as high as 3.5 per cent any time soon as the RBA won't want to crash the economy. As to the timing of the first rate hike, while the RBA's upbeat view suggests the risk of an earlier move, our view remains that it won't occur until late next year. While jobs growth and business confidence are good other indicators are far more mixed - particularly around the consumer, wages and underlying inflation.

Major global economic events and implications

- It was a bit of a quite week on the data front in the US, but housing data was okay with home builders' conditions still strong and housing starts bouncing back and jobless claims remaining low. New York and Philadelphia regional manufacturing conditions surveys fell but remain strong. Meanwhile, its early days with only 84 S&P 500 companies reporting so far, but the June quarter earnings reporting season is off to a strong start with 80 per cent exceeding earnings and revenue expectations. Earnings are likely to have increased 10 per cent over the year to the June quarter.

- As expected the ECB made no changes to monetary policy sounding more upbeat on growth but “not there yet” in terms of seeing inflation heading back to target. It still looks on track to announce a cutback later this year in its quantitative easing program to around €30bn a month for 2018 (from €60bn a month this year). I doubt this warrants recent euro strength though and if the euro continues to rise it's likely that the ECB will start to worry about its impact on growth and back off again. Meanwhile, the ECB's June quarter bank lending survey showed an ongoing improvement in the availability of credit and demand for it.

- Again as expected, the Bank of Japan made no changes to monetary having committed to continue quantitative easing and targeting a zero 10 year bond yield until inflation - which is currently around zero - reaches above 2 per cent which it doesn't now expect until 2019. The BoJ will remain a big laggard when it comes to monetary tightening resulting in a falling Yen.

- Chinese data was solid across the board - with June quarter GDP growth holding at 6.9 per cent year on year and industrial production and retail sales picking up. With growth stronger than expected there is a rising chance that the People's Bank of China will soon raise official interest rates. Don't expect an aggressive tightening though as inflation remains benign.

Australian economic events and implications

- Australian jobs data came in on the strong side again in June, with full time jobs again driving growth reversing the weakness seen up until a few months ago. If sustained this should help cut into underemployment - but it's not clear that it's enough to drive stronger wages growth. Meanwhile, APRA's long awaited determination that Australia's big banks will need Tier 1 capital ratios of at least 10.5 per cent by 2020 to be "unquestionably strong" saw banks rally sharply as it was less onerous than feared and removes one source of uncertainty for the banks.

Dr Shane Oliver is head of investment strategy and chief economist, AMP Capital

Next Week

Craig James, CommSec

Inflation takes centre stage

- In Australia inflation data will dominate the calendar in the coming week. And the data will be of particular importance in light of the global central bank discussion on normalisation of interest rates and ahead of the upcoming Reserve Bank Board meeting. In the US the data focus will be on home prices and economic growth. But for investors and traders the focus will be on the US Federal Reserve meeting on Tuesday and Wednesday.

- In Australia the week kicks off on Monday with CommSec releasing the quarterly State of the States economic performance report.

- On Tuesday, Roy Morgan and ANZ release the weekly consumer sentiment reading. Confidence levels have eased in the past fortnight from 12-week highs and sentiment is now down by 2.1 per cent on a year ago.

- On Wednesday, inflation data (the Consumer Price Index) for the June quarter is released. The “official” inflation data only comes around once a quarter in Australia so the figures are keenly awaited.

- For the record the CBA Group is tipping a modest result. A lift in prices of 0.5 per cent is expected over the quarter with annual inflation expected to hold near 2.1 per cent.

- Over the quarter, the price of petrol fell by 2.5 per cent, capping the headline result. But more importantly, investors will focus on the “underlying” measures that exclude petrol, as well as the non-tradable price measures that focus on domestic price pressures.

- We expect that underlying inflation grew 0.5 per cent in the June quarter and around 1.7 per cent over the year. Clearly inflation remains well contained. And despite recent media speculation of an imminent rate hike, the Reserve Bank has plenty of time to gauge how the economy is travelling before needing to lift interest rates.

- Also on Wednesday the Reserve Bank Governor delivers a speech entitled “The Labour Market and Monetary Policy”. In light of the inflation data and the new estimates of the “neutral” cash rate, most investors will want some guidance on how far off are interest rate changes.

- On Thursday, the Australian Bureau of Statistics (ABS) will issue data on export and import prices for the June quarter.

- And on Friday, the ABS releases the producer price indexes – key measures of business inflation. It will be important to see what impact the volatile Aussie dollar has had on prices of imported goods across the docks. Still, the impact of the recent surge in the Australian dollar will not be felt until the September quarter result.

US Federal Reserve to decide rate settings

- While the focus is primarily on inflation in Australia, a broader array of events are scheduled in the US. Not only does the Federal Reserve policy-making committee meet but influential economic data including economic growth figures will be issued.

- The data releases kick off on Monday, when Markit releases “flash” (or early-warning) readings on manufacturing activity for the US as well as Europe and Japan.

- Also on Monday in the US, data on existing home sales are released. Analysts expect annualised sales to rise further to 5.65 million in June after the 1.1 per cent lift to 5.62m in May.

- Over Tuesday and Wednesday, the Federal Reserve Open Market Committee meets to decide monetary policy settings (result released at 4am Sydney time on Thursday). Given that rates were only lifted in June, no rate hike is expected. However the text of the decision will be important in determining whether the Fed is on course to lift rates later this year.

- Also on Tuesday data on consumer confidence is released together with two home price measures (CaseShiller and Federal Housing Finance Agency) and the influential Richmond Federal Reserve index. Annual growth of home prices may have lifted to 5.9 per cent while consumer confidence may have eased modestly.

- On Wednesday, new home sales data is issued alongside the weekly data on mortgage applications, durable goods, wholesale inventories and the Chicago Fed National Activity index. The preliminary June data on durable goods orders will be closely watched as it provides some colour on the level of business investment. Orders are expected to have risen by 2.7 per cent in June after the 0.8 per cent slide in the prior month. In terms of new home sales, housing activity has remained healthy and June new home sales may have lifted by 0.3 per cent.

- On Thursday, the first reading or the “advance” measure of economic growth in the June quarter will be issued in the US. Economists expect that gross domestic product (GDP) grew at a solid 2.6 per cent annualised rate in the June quarter, up from the weather-affected 1.4 per cent growth in the March quarter. Of note though, the softness in consumer spending over the quarter has the potential to dampen the result.

- The usual weekly data on claims for unemployment insurance is also issued on Thursday together with the Kansas City Fed index. And on Friday, the final July University of Michigan consumer sentiment index reading is released.

Sharemarket, interest rates, currencies & commodities

- The US earnings season cranks up a notch in the coming week. And there is certainly hope for a good season of profit results. According to Thomson Reuters I/B/E/S, US S&P 500 earnings are expected to grow by 8 per cent compared with a year ago. And given the recent record highs across US indices, a lot of that growth in earnings is already priced in.

- On Monday, 71 stocks are expected to report including Alphabet, Hasbro, Moelis, and Haliburton. On Tuesday, there are another 194 companies listed including Caterpillar, 3M, Newmont Mining, and Domino's Pizza. On Wednesday, earnings results are expected from 263 companies including Ford, and GlaxoSmithKline. On Thursday, 425 companies should issue profit results including Amazon, Intel, ConocoPhillips and Dow Chemical. On Friday, there are 75 companies listed including Exxon Mobil, Chevron, and Merck.

Craig James is chief economist at CommSec.

Readings & Viewings

It's no secret that many women are retiring with much less superannuation than men. It's an issue we've written about many times, and generally speaking it isn't improving. This week, a new report was released showing Australian women are retiring with less than three years of modest retirement living. You can also click here to download the full report.

Meanwhile, separate analysis during the week by research firm SuperRatings showed that an estimated $140 billion was added to managed superannuation accounts last financial year as funds delivered positive returns to members.

Meanwhile, there's a lot to be said about jobs longevity these days, with new technologies potentially putting more of us out work. The imminent arrival of Amazon in Australia, while it will create jobs, is also likely to see other retailers downsize their locations and teams. This week we saw another sniff of this as Amazon's assault on home appliances in the US saw $US12.5 billion wiped of the share price of other retailers including Home Depot, the joint venture partner our Woolworths took on to launch the now-failed Masters chain.

Mega makeup store Sephora, an Amazon in its own niche, is experimenting with a boutique format to prepare for the 'retail apocalypse'.

It's been a while since the term Grexit was on the agenda. This week the International Monetary Fund approved in principle a $US1.8 billion standby loan arrangement for Greece. But there are conditions.

Over in the UK, which is heading towards Brexit, one property market research firm predicts house prices will rebound 6-7 per cent over the course of 2017.

You wouldn't pick it, but New York is among the most 'undervalued' housing markets in the US in 2017.

Exxon has just been fined over violations of sanctions against Russia, when now US Secretary of State Rex Tillerson was at the helm of the oil giant. But was it just one big misunderstanding?

Over in the UK, not even a letter from James and Lachlan Murdoch has been enough to deter the British Government from sending 21st Century Fox's £11.7 billion bid for Sky TV to the competition watchdog.

Is it a cause for concern when robots start inventing their own languages? Points for those who can understand Facebook bots Bob and Alice.

Top Silicon Valley investor Marc Andreessen gives some excellent tips in this off the beaten track article, as well as forecasts on where the next big business disruptions will come from.

And here's a different, yet similar, take on where we will be seeing Silicon Valley energy directed to in the future – from a design perspective.

Americans currently hate the healthcare industry more than anything else.

Listen up! Or don't. According to researchers writing for the Harvard Business Review, your brain can only take so much focus.

And here's another's educated take on why JPMorgan Chase CEO, Jamie Dimon, is really ranting. They're not buying it's about looking out for the 'average American'.

The co-founder of Pets.com, a dot-com darling, came back from the brink to create a winning business at 60 years old.

It had to happen sooner or later. Air France has just launched the first Millennials airline.

Lastly, this journalist has a knack for picking up business bull, and thinks you should too. She reckons Starbucks founder, Howard Schulz, is the king of using corporate jargon to win fans and influence people.