Crown's high-stakes punt

PORTFOLIO POINT: Crown’s notes issue is complex and has risk for investors. But there’s good value in floating-rate notes and inflation-linked bonds.

Casino group Crown announced a new $400 million hybrid issue to the market this morning. These sorts of issues are becoming increasingly complex, while still targeting retail investors, probably because wholesale investors would not find the coupon attractive enough for the risks involved.

Pricing is based on a six-year maturity date but there’s no incentive for Crown to call at that point and we think the likely term could be longer. All three credit rating agencies have given Crown equity credit for the transaction (this should all tell us something) but S&P is the only rating agency that will drop that equity credit after the six years.

There’s no guarantee that credit rating changes (if any) will be published, leaving investors with little understanding of how risk is perceived in coming years. I’d consider this issue complex, high risk and not providing investors with enough return to compensate the risks involved.

The key features of the notes issue include:

- Final maturity in 60 years, with a first call in six (Crown has the option to repay at this point), but the call date has no step-up, so there is no incentive for Crown to repay, which I consider is equity-like as opposed to debt-like. The step-up does not occur until 2038 and is 100bps.

- While these are legally notes they rank as preference shares in a wind up.

- The coupon margin is BBSW 5.0% p.a., deferrable at Crown’s discretion subject to a dividend stopper and mandatory deferral subject to a dividend pusher. This is new. It is not the hard stopper on ordinary dividends as is usually seen but a pusher that is much weaker. If Crown pays an ordinary dividend while interest is mandatorily deferred, it is required to pay the interest on the notes within five years. The result is ordinary equity payments made in priority to the notes. This is preferential to shareholders and increases the risk of non-payment of coupons for a period on these securities. There is also a mandatory deferral of interest if financial ratios are not met (Leverage ratio > 5.0x and Interest Cover Ratio < 2.5x).

- Investors are pricing this as a six-year security, but given the lack of incentive to call at the first opportunity, I would expect the term to be longer.

- There are no investor redemption rights.

- There is no investor call on a change of control. The investor will receive a 5% step-up in margin if the issuer does not redeem.

- The notes are not convertible into ordinary equity

Why no rate change means change

Meanwhile, last week the Reserve Bank kept the cash rate on hold, but did you know that the market’s perception of future rate movements changed?

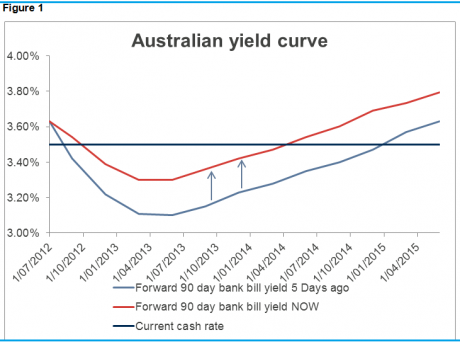

They actually moved higher, so that the expected benchmark 90-day BBSW (the bank bill swap rate) as at December 16, 2012 is 3.39%, up 17 basis points from 3.22% prior to the announcement. At December 16, 2013 the market now expects swap to be 3.42% and at December 16, 2014, 3.69% (see Figure 1 below).

I measure the market’s expectation of future rates by considering the BBSW for the coming 12 months, then swap for periods beyond a year to show the market’s expectations of future rates.

The swap rate is a proxy for the rate at which a bank is indifferent between receiving a fixed and a floating rate of return. It also incorporates a banking sector risk premium over and above the risk-free rate (i.e. government bonds) to reflect the chances of a bank going into wind-up and being unable to meet its obligations on the swap.

BBSW is the benchmark for coupons (interest payments) on floating-rate notes.

Essentially the changing curve means the market thinks interest rates will not be as low as they were expected prior to the rate announcement. Instead of pricing in a 50bps cut in the coming 12 months, BBSW is now signalling less than a 25bps cut. We’d call this a flattening of the yield curve. You can see in Figure 1 that the red line, or current expectations of BBSW is very close to the cash rate and we’d take this as a sign that we are approaching the bottom of the interest rate cycle.

What’s also interesting is that the future rate, beyond mid-2014, is only marginally above the cash rate – so this is a sign that possibly we’re in for a period of low growth (this is general only and doesn’t account for growth in some sectors, as there will always be exceptions). But why is this important to investors and how can they use the information?

Broad implications of the Australian yield curve

The interest rate cycle is possibly reaching the low point. The yield curve tells us to expect low interest rates in coming years, with no significant upswing in growth expected, so it is not a time to jump back into equities wholeheartedly.

Term deposit rates are unlikely to move higher in the next few years, although I expect special rates in select maturity buckets due to bank funding requirements.

Hold on to your fixed-rate bonds as there’s no imminent signal that rates will move higher quickly in the coming years, thus there will be no dramatic loss in the price of the bonds.

I see current value in floating-rate notes that are trading at a discount to face value, meaning investors lock in a capital gain if they are held to maturity. But they also receive higher coupons, as buying the bonds at lower than face value increases the coupon (which is just the coupon divided by the purchase price) to investors. Also, when interest rates start rising again (all markets are cyclical and this will happen eventually), floating-rate notes will capture any upswings in higher BBSW.

Inflation-linked bonds are also trading at discounts to face value. While the RBA has successfully contained inflation in its target 2% to 3% band, and there seems no imminent risk, inflation remains a risk to any retiree’s savings. Further, in low-growth scenarios the fixed margin these bonds pay over the consumer price index (CPI) can be very attractive. I have bonds paying over 4% above CPI, which is very attractive in this environment

While there’s no hurry to sell your fixed-rate bonds, if you’ve had a good rally it may be a good time to take the gain and invest in discounted securities to again lock in another gain if you hold the securities until maturity. Remember fixed-rate bonds and floating-rate notes will only return the $100 face value back to you at maturity.

The Westpac and Telstra fixed-rate bonds maturing in 2020 are two bonds that have outperformed, which investors may consider cashing in. These bonds have benefitted by being long-dated and fixed, so that expectations of lower yields have driven the bond prices higher. The Westpac bonds are trading at circa $113.00 and Telstra at around $117.50. While there’s still quite a while until maturity, the premiums at which they are trading offer good compensation in return for the discounts being offered by some floating-rate notes and other securities.

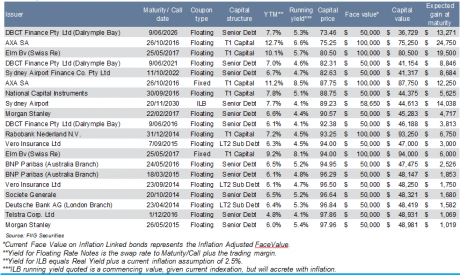

Table 1 shows a sample of Australian dollar bonds which are trading at a discount. Dalrymple Bay Coal Terminal Finance Limited, a floating-rate note (FRN) with a very long maturity date at June 2026, shows the greatest discount of $26.54 trading at $73.46. The list is slanted towards the FRNs, with investors still preferring fixed-rate bonds and hence the opportunity from uneven demand and supply. There are two fixed-rate securities that make it onto the list: AXA SA and Swiss RE, which still offer some value. But the floating-rate equivalents are trading at greater discounts.

The table below shows one inflation-linked bond, the Sydney Airport 2030, although there are others, trading at a discount, which are available.

There are a lot of international banks on the list: Morgan Stanley, Rabobank, BNP Paribas, Societe Generale and Deutsche all feature.

The list tells us that discounts are being applied to:

- Long-dated securities - as uncertainty increases with time.

- Floating-rate notes - investors and the market still expect interest rates to move lower.

- Foreign banks - uncertain markets mean Australian investors have a preference for investing in names that they know and understand.

- There are a lot of securities still trading at a discount and with a change in interest rate expectations this week, I continue to think floating-rate notes and inflation-linked bonds offer good value.

Deciding how to allocate your investments will depend on your individual views that take into account many factors. This article is meant to give you an insight into how you can use the 90-day BBSW / swap yield curve to assess current markets and prospective value.

Elizabeth Moran is director of education and fixed income research at FIIG Securities.