Commodities in a perfect storm

Summary: Supply shortages and production disruption have resulted in higher commodities prices.

Key take-out: Copper, oil, uranium, zinc and aluminiuim are all benefitting from tigher supply.

Supply shortages, not demand, have returned as the driver in commodity markets today.

It's likely to stay that way for the next few years as the effects of production disruption are compounded by four years of under-investment in exploration and project development.

Copper is the best example of what's happening, with the threat of a strike by workers at the giant Escondida mine in Chile the key factor in the price of the metal rising to a four-year high of $US3.28 a pound last week, up 10 per cent over the past month, and 70 per cent higher than three years ago.

Even if the Escondida strike does not proceed, which is the current expectation as unions and management get closer to settling a wage claim, there are other copper mines threatened with disruption, including the giant Grasberg mine in Indonesia where an ownership shuffle is underway as Rio Tinto prepares to sell its stake in a controversial project.

Another supply-related event affecting the copper market is the forced closure of India's second-biggest copper smelter in the southern town of Tuticorin, where 24 protestors were killed by police last month during demonstrations over plans to expand the plant operated by the big Indian-based mining company Vedanta.

Beneficiaries of the copper squeeze include BHP and Rio Tinto, both of which have extensive copper exposures. Other winners include a large number of smaller copper stocks such as OZ Minerals, which has seen its share price rise by 17 per cent over the past two months, and Sandfire Resources, which is up 18 per cent.

For investors the copper situation can be seen as a proxy for the wider resources industry, with the supply of most commodities being impeded in some way even as demand remains strong, albeit not booming.

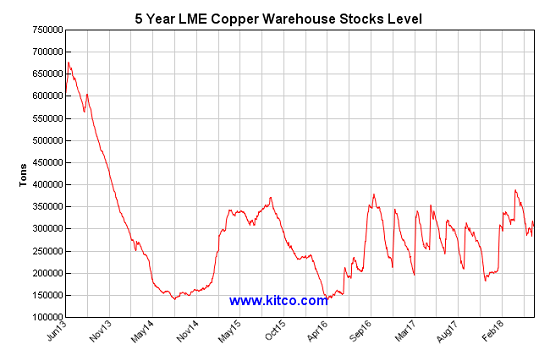

The net result of the changing dynamics in copper's supply and demand is best measured by declining stockpiles of the metal, with 50,000 tonnes leaving the warehouses of the London Metal Exchange (LME) over the past two months, taking the level of surplus material down to 307,000 tonnes, less than half the 660,000 tonnes of five years ago.

Across the commodity spectrum there is hardly a mineral (or fuel) not affected in some way by supply disruption and the related effect of low-levels of investment in new sources of production.

Oil, arguably the most important commodity, is being affected by a supply squeeze being orchestrated by members of the Organisation of Petroleum Exporting Countries and Russia, which have been limiting exports to support the price.

Less oil reaching the global market has helped double the price over the past two years to around $US76 a barrel, and while extra supply is expected to hold the price around that level for the rest of the year, there is growing concern that no major new oil projects have been approved since mid-2014 – a drought which is expected to see a sharper oil price in future years.

Influenced commodities:

The list of commodities being influenced by supply cuts, production disruptions or a lack of new investment includes:

- Coal, which has been under consistent attack on environmental pollution grounds for a decade, but which has been enjoying a solid price revival. Jeffries, a U.S.-based research firm last week increased its price forecasts for both thermal (electricity producing) coal and metallurgical (steel-making) coal, saying that: “We have increased our seaborne coal price forecasts to reflect supply constraints and positive demand outlook”.

- Uranium, another fuel in the cross-hairs on environmental grounds, has enjoyed a strong start to the year with the price rising by $US3 a pound to $US23.25/lb. Several significant supply events have developed, led by the creation of a uranium-investment fund, Yellow Cake, which is buying 8 million pounds of uranium from the government of Kazakhstan because management believes the nuclear fuel is being “mispriced”. Two Australians sit on the board of London-based Yellow Cake, Alan Rule, a former director of Paladin Energy, and Alexander Downer, a former Australian Foreign Minister and former Australian High Commissioner in London.

- Nickel, a metal being squeezed by rising demand from stainless steel producers/battery makers, alongside falling supply thanks to mine closures in Australia and, more recently by the closure of the Birchtree mine in Canada. The result can be measured by a 112,000 tonne (28 per cent) fall in the level of stockpile nickel held in the LME over the past eight months, during which time the price has risen by 40 per cent.

- Zinc, a metal once in chronic over-supply, has seen its price more than double over the past three years from US65 cents a pound to $US1.46/lb following the closure of several big mines, including Century in Queensland. Although Century is returning as a tailings retreatment operation to capture the higher price, few new mines are being developed.

- Aluminium, where the price has risen by 60 per cent over the past three years to $US1.04 a pound with a significant (US20c/lb) rise earlier this year when the U.S. Government said it would apply sanctions on the big Russian aluminium producer, Rusal, threatening to eliminate a major source of metal from the global market.

Other commodities affected by supply disruption include mineral sands (Iluka halting operations at several its mines), iron ore (small mines forced out of production), and manganese with a number of small Australian mines closed, but now re-starting.

The perfect storm

What's happening in the commodity sector is a process that started with a prolonged period of low prices after the onset of a downturn in 2012, caused in part by excess investment in new capacity in the years leading up to the 2008 global financial crisis.

But, six years after the start of the downturn a different picture is emerging, one being painted by a lack of investment in new capacity, even as the global economy continues to grow at a respectable 3 per cent a year.

Significantly, a shift back to re-investment is not expected for at least another two years with mining companies keen to complete essential repair work on their once debt-laden balance sheets, and investors clamouring for more generous rewards for their years of patience.

PwC, an accounting firm, said last week in a report into mining sector profitability, that there had historically been a two-year lag between increased profits and a lift in capital expenditure.

If history repeats it could be another 12-to-18 months before mining companies resume investing in new projects, by which time the supply squeeze should have tightened with a corresponding effect on prices.

According to PwC's analysis of the world's top 40 mining companies, combined revenue rose by 23 per cent to $US600 billion last year while pre-tax earnings rose by 38 per cent to $US146 billion.

Capital expenditure, however, totalled just $US48 billion, the lowest since 2006.

PwC mining leader, Chris Dodd, said while miners were cashed up they were also afraid to remake mistakes of the past with ill-timed acquisitions and over-investment in greenfield (new) projects.

“Perhaps the most significant risk currently facing the world's top miners is the temptation to acquire mineral-producing assets at any price in order to meet rising demand,” Dodd wrote in the introduction to the PwC report titled Mine 2018, tempting times.

“In the previous cycle, many miners eschewed capital discipline in the pursuit of higher production levels, which set them up to suffer when the downturn came,” Dodd said, “While we expect capital expenditure to increase next year as companies implement their long-term growth strategies, miners must be careful to maintain discipline and transparency in the allocation of capital.”

“They need to resist the urge to pursue projects or acquisitions at any price, and instead, focus on mining for profit, not for tonnes. Miners may also find themselves tempted to give in to stakeholder demands for a share of the success…Indications are that this current cycle has several more years to run.”

The key point in that observation from PwC is that the impact on commodity prices can be broadly the same in a supply squeeze as in a demand crunch.

|

Adviser Q&A: Deadline time - Are you ready for June 30? Thu 14 Jun 2018 (12:00 PM - 1:00 PM AEST) Financial advisers Bruce Brammall and Max Newnham will answer your general tax and financial planning questions as the countdown clock to June 30 ticks down. Please send in your questions beforehand so they can provide their considered responses. |