China turns a corner

Summary: The Chinese property market is picking up. The chief economist at China's central bank says real estate sales have improved “significantly”. Prices are rising across the four largest cities and prices in some second-tier cities are also lifting, although the improvement is not completely broad-based yet. |

Key take-out: If recent signs of improvement in the property sector are maintained, this may do much to appease the incessant pessimism over China. |

Key beneficiaries: General investors. Category: Economy. |

In a sense, news that Chinese GDP moderated to its slowest pace since the GFC recently is old news. The authorities have been clear for some time that they want slower growth and they've got comparatively tight monetary and fiscal policy to prove it, albeit a little less tight following last Friday's rate cuts.

In any case, as I've argued before, it's not that growth around 7 per cent in real terms is weak. It's exceptionally strong for an $18 trillion economy (on a purchasing power parity basis). In effect, China creates a new Australia – bigger even – every single year.

What I'm left wondering is whether the Chinese economy may have turned a corner and passed peak pessimism. It's not an easy question to answer but there is some tentative evidence at hand. Namely, that the property market is picking up – rapidly in some cases.

As the chief economist at China's central bank (the PBOC) noted last week, most of the “downward pressure” on the Chinese economy comes from the property investment slowdown. So if the property market is starting to turn a corner, that's quite a material event. Indeed in his estimation, property investment growth may stabilise and rebound in the coming several months as real estate sales have improved “significantly”.

The backdrop, and one of the key reasons why long-term Chinese growth prospects remain strong, is because, for all its rapid growth, China still has quite low rates of urbanisation. At 54 per cent, China's rate of urbanisation is only a little above the low and middle income average. For high income economies, urbanisation rates are around the 80 per cent mark. Even North Korea has a more urbanised economy than China – apparently.

With that in mind, the slump in activity that we've seen over the last year or two was never going to last. It couldn't, given that, in contrast to popular mythology, the Chinese economy has very strong fundamentals. Government (including state/local government) and household debt is low, as are corporate leverage ratios. Otherwise, foreign debt is negligible, budget deficits are small and China runs a current account surplus. These metrics are better than nearly all western economies.

This rebound isn't inconsequential for Australia. More than half of China's steel consumption is used in the construction industry. So given that urbanisation rates are still very low, it's reasonable to expect construction to lift, and with it, the demand for iron ore.

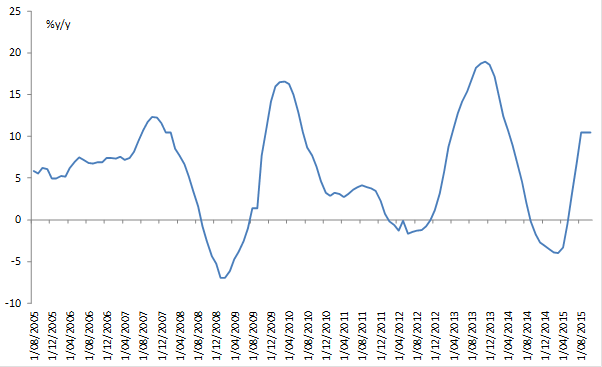

Chart 1: Tier 1 house prices surging again

Source: Bloomberg

It's certainly a good thing that property prices are showing signs of life. Chart 1 above shows price growth in the so called tier one cities in China. These are the big four cities of Beijing, Shanghai, Guangzhou, and Shenzhen. Having hit a trough earlier this year, prices are now rising by a rapid 10 per cent plus. Admittedly things aren't as good elsewhere and in some cities pries are still headed lower. But there is an improving trend and we're starting to see it in the so called tier two cities.

According to data released last Friday October 23, new home prices rose in 39 of 70 cities (for September) that are monitored by China's statistics agency. That's the fifth consecutive month of price gains. In annual terms, prices are up in 12 cities. In both cases that's an improvement from the prior month and it is all supportive of a rebound in the property space. Sure, it's not completely broad-based yet. But there doesn't seem to be any reason why these recent trends shouldn't continue, spread to other cities and even accelerate.

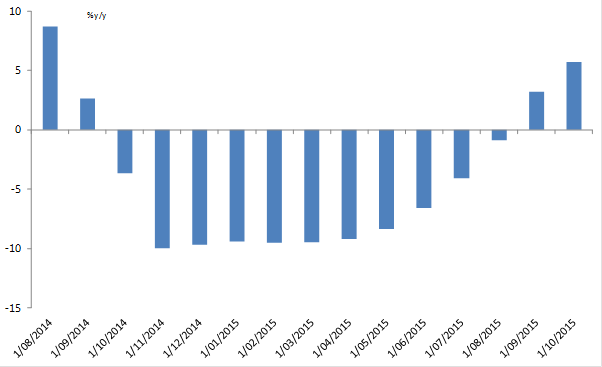

Chart 2: Residential building sales have turned

Source: Bloomberg

The second piece of evidence is shown in chart 2. It shows as prices have been rising there's been a bit of a demand/supply response. Naturally, if prices are rising, demand has picked up but that doesn't necessarily mean a transaction will be made. People have to be willing to sell, which they are, given the rise in prices. So, as the chart shows, residential building sales have lifted for the first time in about a year. That's a material turnaround from some of the huge falls seen late last year and early this year.

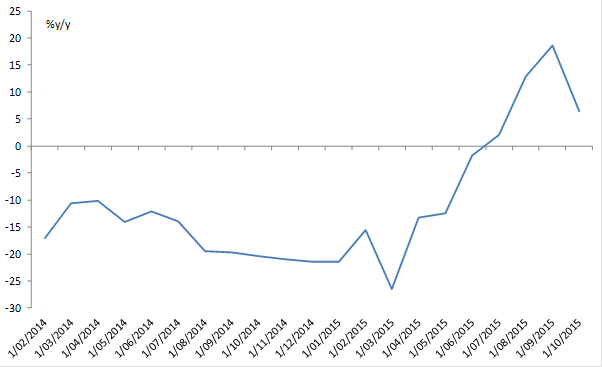

The property rebound isn't just about residential. Office sales have also started to pick up again after falling quite dramatically though most of 2014. At its worst in March 2015, annual sales were off nearly 30 per cent. Now, sales are materially higher than what the market was seeing this time last year – with annual gains that are in the double digits in some cases (chart 3).

Chart 3: Office sales are turning as well

Source: Bloomberg

All up that's not a bad state of affairs, and it's a good sign that the economy has turned a corner – the PBOC was worried that the main downward pressure was coming from property after all. That's especially the case when you note that consumer spending grew by 11 per cent over the last year and fixed asset investment in the urban space was up 14 per cent. If the recent signs of improvement in the property sector are maintained it may do much to appease the incessant pessimism over China.