China syndrome. Readings and viewings. Last week. Next week.

John Addis

Keep calm and think of China

Let's start the weekend by lining up the skittles. On the front two rows are the usual suspects, headed by the distortive effects of historically low interest rates on asset prices and the worries about what happens if and when rates rise. (This concern ignores the fact that rising rates would probably reflect rising GDP, which would be good for markets – but anyway.)

The second-row pins are geographic. Europe remains economically stuffed and, with elections due in Italy, France and The Netherlands, risks political schism as well. As for China, well, who knows (we'll get to it). But a vast credit boom, a shadow banking system, corruption and a property bubble are far from a heavenly mix.

Lined up behind are a series of problems not exclusive to Australia but growing in local significance. The largest is our net debt, almost doubling in the last three years. Put that pin in the middle of row three, between a worsening trade and growing budget deficit. Up the back are poor wages growth, GDP growth (not bad at 3.3 per cent per annum but a percentage point less than in 2012), poor productivity growth and financial stress, due to world-beating levels of household debt.

So, plenty to worry about. And yet oddly, Australian investors appear unconcerned. Since 1980 the market-cap weighted price-to-earnings ratio for all ASX listed stocks has averaged about 15. Right now it's close to 17 (for reference, it hit a peak of 23 in the dotcom bubble and fell to eight in January, 2009). This also explains why our Buy List has just 17 stocks on it. It's a conundrum alright.

The logical explanation would go something like this: with interest rates at historical lows, term deposits and bonds aren't paying the kinds of yields investors want, so they've headed into equities, pushing prices up. The behavioural finance boffins might point out that research indicates investors dramatically overstate their knowledge and appreciation of risk, making the move from term deposits to shares an easier decision than it should be. And the pragmatist would say, darn the both of you because, either way, the investor moves higher up the risk curve.

Can I offer you any reassurance we're not perched on the edge of this many-faceted precipice, waiting for the pins to fall? With no wish to ruin your Saturday, I'm going to give it a go.

In January I made the mistake of taking three kids and their grandmother on a New Zealand driving holiday. Travelling, if that's the right word for an alternating series of shouting matches and long silences, between Queenstown and Christchurch, we stopped a few nights in tranquil Lake Tekapo, or at least it was until our arrival.

At our accommodation, I noticed the house guide had a well-thumbed Mandarin version. “You get many Chinese visitors?”, I asked our host. “We have 24 houses in town and almost all of them are occupied by Chinese tourists. They arrive in Christchurch three times a week, direct from China,” he said.

This conversation came to mind when reading Andrew Legget's report on Sydney Airport's investor day this week. It revealed that six years ago the airport had four airlines serving three mainland Chinese cities. Now there are seven airlines serving 13 cities, delivering 1.5 million passengers in the last 12 months at 14 per cent yearly growth.

That hints at one of the problems when considering China. Every stat is so mind-bogglingly large that it's hard to grasp, like visualising the number of bananas it would take to reach Pluto.

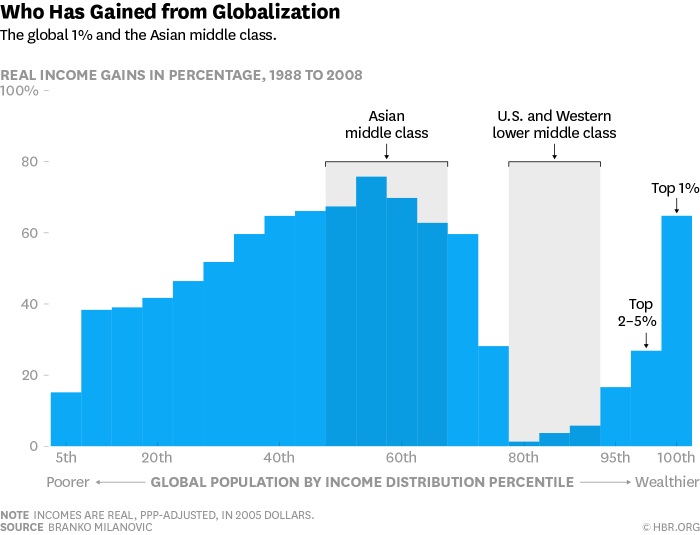

By 2030, China is expected to be the world's largest economy, a position that it once occupied in 1820, after inventing toilet paper, pizza, mechanical clocks, silk, gunpowder, moveable type, paper money, rockets and the toothbrush. When China began the reforms in 1978, GDP per capita was less than two-thirds of the African average. By 2014, per capita GDP had risen 49-fold, from $US155 (in current dollars) to $US7590, lifting an incredible 800 million people out of poverty. Along with the top 1 per cent of the world's population, it's the Asian middle class, primarily Chinese, that have benefited from globalisation.

Chinese industrialisation began, as in England, with a plentiful supply of cheap labour moving from the fields to the cities. There followed huge investment in housing and infrastructure. In China, this process is now slowing. The country's population peaked in 2012, moving from its traditional position as the "world's preferred subcontractor" to domestic innovation. Management theorists call it moving up the value chain.

Foxconn, for example, which assembles Apple products in Shenzhen, is rumoured to employ between a quarter and a half a million people – in one factory. Labour and land is now not that much cheaper than in the United States. Recruiting the 9000 engineers needed to run the plant is the problem. In the US it was estimated to take 18 months. In Shenzen it took nine days.

The next stage – moving away from simple assembly, which is moving to places like Vietnam – is now in train. Young people aren't much interested in factory work and, with labour costs rising, Foxconn recently installed 40,000 robots, allowing it to cut 60,000 workers.

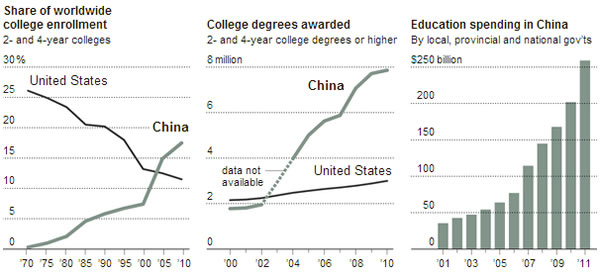

These workers won't be left on the scrap heap. Spending on education and training is growing rapidly, as the chart below shows. China also has the world's fastest growing research and development budget, expected to pass the US in a few years, a huge pool of science, technology, engineering and maths graduates that generate 30,000 PhDs each year in science and engineering.

A technology transfer program helps China acquire skills in high technology industries like high-speed trains and aircraft manufacture and the country now leads the world in patent applications. The country is also replacing foreign-owned high technology used in its banks, state owned enterprises and military with domestically developed products.

Source: New York Times, Unesco, CEIC data

Not much of this news makes it through the mainstream media. Instead, we get wall-to-wall coverage of last year's Shanghai stockmarket collapse, warnings of an alarming rise in private sector debt and the slowdown in GDP growth. All of these are genuine concerns, but they mask the bigger picture. China is making the transition to a consumer-driven society, and for Australian investors this is a very good thing indeed.

Take mobile phone usage. About 600 million Chinese access the internet via their mobile phone and the average Chinese internet user has 4.1 connected devices. This isn't just driving the country to the frontline of online commerce, it's also leading to segregated footpaths for mobile and non-mobile users.

As the World Economic Forum recently noted, urban households now spend “40 per cent of their consumption on services such as education, health care, entertainment and travel, up from 20 per cent 20 years ago. Meanwhile, consumption's share of GDP has now risen for five years in a row and services now account for more than half of GDP.

The shift to a consumption-led economy is happening. For Australian investors getting to grips with this tectonic shift in global economic power through the share prices of Bellamy's and A2 Milk is a mouth-watering prospect, but one readily obscured by short-term concerns that miss this bigger picture.

Of course, much can go and may well go wrong. But once a country industrialises it tends not to go back. Iron ore shipments through Port Hedland are near record highs, as are Chinese tourist and student numbers. But the chances are we're only at the beginning. Instead of worrying ourselves with the pins that might fall, occasionally we should look up to see the bowling ball that could knock them out of the way.

Readings and Viewings

The year shows no signs of slowing down. Here are some interesting items we came across during another busy week.

The London Telegraph's Ben Wright on why central bankers need to read Goethe's Faust.

An interesting piece: ‘The flawed logic of inflation'. “Keynesians ... tend to overlook the dire situation that prompted the birth of (stimulus) theories.”

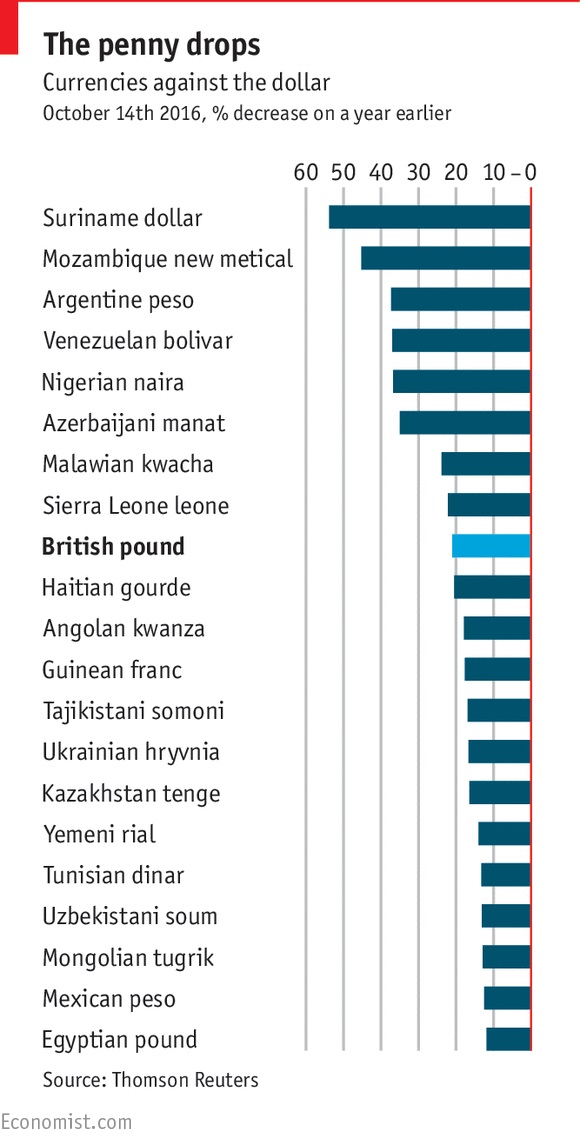

The pound is one of the worst performing currencies in the world this year. So which Brits suffer…?

Hedge funds have reset their positions on oil, Reuters says, helping to lift the price and making further upside unlikely.

Intelligent Investor analyst Phil Bish on Bayes' Theorem, cracking the Enigma code and investing: “Consistency is highly valued and, in most cases, it's in our best interests to be consistent. As a result, we fall into the habit of being consistent all the time, even when it would be better to modify our approach.”

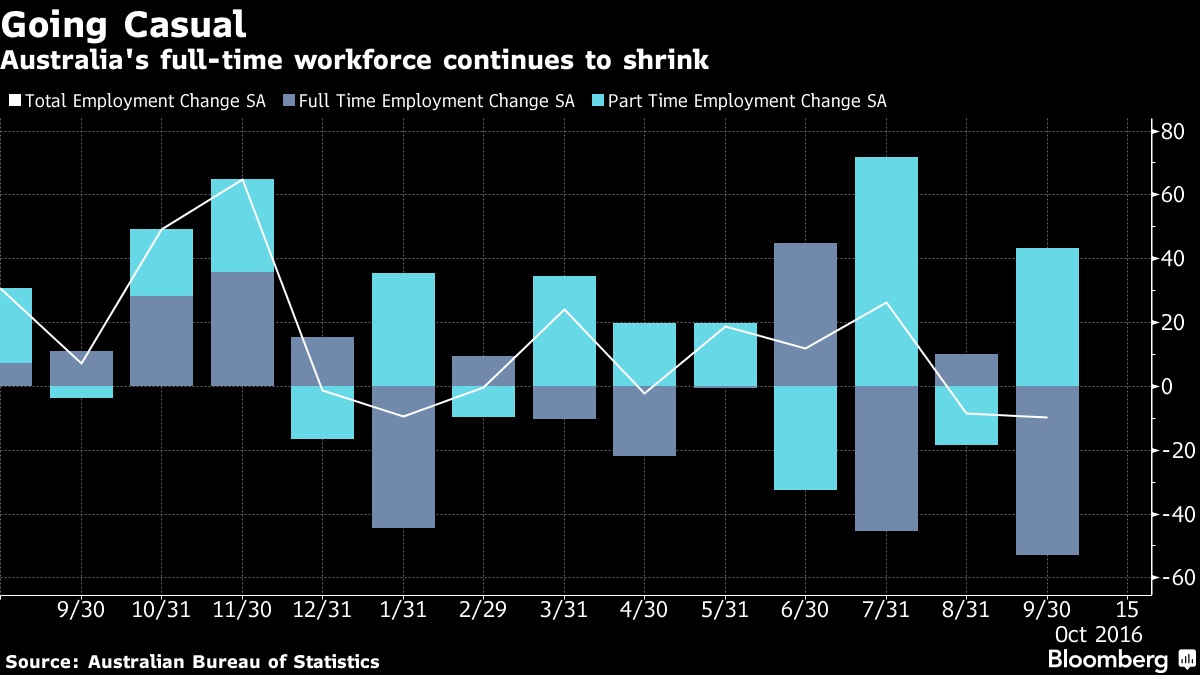

After this week's job numbers, Bloomberg on the casualisation of Australia's workforce:

Time to check back in with Rolling Stone's Matt Taibbi on the US campaign trail. The fury and failure of Donald Trump: “The first symptom of a degraded aristocracy is a lack of capable candidates for the throne.”

Meanwhile, as the election slips away for the Republicans, people are already asking who could be ‘Trump 2.0'. The Washington Post on one possible heir.

The long-awaited move on Mosul began this week. British journalist Hassan Hassan says it's a battle for Iraq itself.

The UK Spectator's Rod Liddle says the West should stop this stupid sabre-rattling against Russia: "I fervently hope Putin's belligerence is just an act for international consumption, and that he is nowhere near as stupid as Andrew Mitchell or Boris Johnson."

The future is not quite here: English man spends 11 hours trying to make a cup of a tea with a wi-fi kettle.

In architecture, Brutalism is back. “There's no question that Brutalism looks exceedingly cool ... but its deeper appeal is moral.”

With screens consuming our lives, this article argues that what happens online increasingly shapes how we feel offline.

The long coming out of the NBA's first openly gay male referee.

Hartnell and Winx are set to go head to head in the Cox Plate today, arguably the best race on the Aussie calendar. May they reproduce, if even only in part, Bonecrusher and Our Waverley Star's famous battle exactly 30 years ago.

Mitchell Sneddon's recipe of the week: "There are a million different ways to make a vegetable lasagna. This one's pretty cheap and I knocked this up last weekend for an easy lunchtime reheat throughout the week."

Last Week

Shane Oliver, AMP Capital

Investment markets and key developments over the past week

Most major global share market rose over the past week helped by generally good economic data, more evidence that US earnings have bottomed, confidence that the Fed will be gradual in raising interest rates and dovish comments from ECB President Draghi. Australian shares fell slightly though. Bond yields generally fell helped by Draghi's comments, the oil price was little changed but metal prices fell and the US dollar rose further. While the Australian dollar did briefly make it above $US0.77 it fell back after the release of softer than expected jobs data.

Three big differences compared to last year's Fed scare. While expectations for a December Fed rate hike are continuing to build investment markets seem to be taking it a bit better than was the case in the run up to last December's eventual rate hike. At its core there are three big differences between now and last year: the global and US growth outlook is more positive now; US earnings now look to have bottomed whereas a year ago they were falling; and the uncertainty around where the Renminbi will go and Chinese capital outflows is a lot less. While event risk is high at present – with the Fed, the US election, Eurozone risk and the ECB – and this could drive short term volatility or a correction in global and Australian shares – the broad trend in shares is likely to remain up.

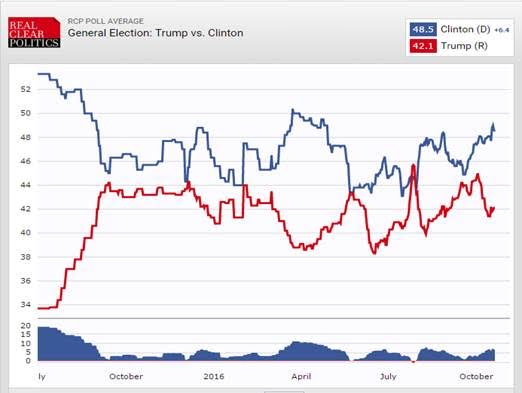

Clinton maintaining her lead but Democrats still unlikely to take the House. While Trump's performance in the final presidential debate may have been his best for the three debates it was not a knock out and polls had Clinton the winner (e.g. the CNN poll had Clinton at 52 per cent, Trump at 39 per cent). According to the Real Clear Politics average of major polls Clinton is ahead by 6.4 points and the Mexican Peso (perhaps the best guide to market expectations regarding the election outcome) is up 6 per cent since the first debate. However, there's still no evidence of a huge wave of support flowing to the Democrats that will be sufficient to see them pick up the necessary 30 seats to win a majority in the House of Representatives. So my base case remains a 70 per cent probability of a Clinton victory but with the Republican's retaining control of the House (with maybe a loss of 10-15 seats). Meanwhile, Trump's comments that the election is rigged (yeah right!)and that he may not accept the result unless “… I win” coming on the back of his comments about women, Hispanics, China, invitations to Russia to hack into America, etc, along with his short fuse and erratic nature add to the concern that he is not fit to be president.

- In Australia, a speech by RBA Governor Lowe along with the minutes from the RBA's last Board meeting add to expectations that the RBA is not in a hurry to cut rates again, with Lowe more comfortable with the growth outlook and not wanting to push inflation quickly back to target if it risked financial instability. While his comment about the importance of September quarter inflation data for the interest rate outlook and the need to guard against inflation expectations falling too far leave the door to another rate cut open, the hurdle to do so at this stage looks to be relatively high.

Major global economic events and implication

US data was generally OK. Jobless claims remain very low and existing home sales, the leading index and industrial production all rose. However, manufacturing conditions in the New York and Philadelphia regions were mixed. While housing starts fell sharply in September this was all due to volatile starts of multi-dwelling buildings and permits to build new homes and home builder conditions were strong indicating that housing activity will remain solid. Meanwhile the Fed's Beige book continued to point to “modest to moderate” economic growth, “tight” labour market conditions but “modest” wage growth and “mild” inflation. The latter was confirmed by the September CPI which showed rising headline inflation as the oil price plunge falls out but a slight fall back in core inflation to 2.2 per cent year-on-year. All of this is consistent with the Fed hiking in December (with the money market attaching a 68 per cent probability) but remaining gradual thereafter in raising rates.

It's still early days in the US September quarter profit reporting season but so far so good. Of the 106 S&P500 companies to report so far, 81 per cent have beat on earnings and 65 per cent have beat on sales. Profits are likely to have risen for the second quarter in a row and are likely to be up slightly on year ago levels.

ECB leaves monetary policy on hold, but looks on track for some sort of extension to its quantitative easing program. President Draghi's comments were mostly dovish setting up for a likely extension (and widening of the assets it can buy) at its early December meeting. However, it may opt to move towards a more flexible approach where the amount of monthly QE is varied depending on bond yields and expectations regarding inflation. Meanwhile, the ECB's September quarter bank lending survey showed strong demand for loans across the board which is a good sign, but while lending standards eased for households they were unchanged for corporates.

Chinese growth remains stable, with September quarter GDP growth unchanged at 6.7 per cent year on year and improvements in September growth for retail sales and investment. While industrial production slowed slightly this may be due to G20 factory shutdowns and one less working day this September. Meanwhile growth in money supply and credit was generally strong adding to confidence that growth has stabilised although the problem of high debt growth (flowing from too much saving) remains.

Australian economic events and implications

- Soft Australian jobs data likely payback for unbelievably strong growth last year. Employment fell for the second month in a row in September, full time employment is now negative year on year, hours worked are weak and only falling participation is stopping unemployment from rising. The soft jobs data keeps alive the prospect of another RBA rate cut, but the monthly jobs survey remains of dubious quality and the recent weakness could be just payback for last years too good to be believed jobs surge. In other words more noise than signal and so the RBA is likely to look through it.

Shane Oliver is head of investment strategy and chief economist at AMP Capital.

Next Week

Craig James, CommSec

Inflation in focus

A raft of inflation (price) measures are expected in Australia in the coming week with the figures on consumer prices of most interest. Overseas the focus is on another bumper schedule of economic data releases in the US with economic growth data on Friday.

The week kicks off in Australia on Monday with the release of the latest State of the States report from CommSec. The report highlights the relative economic performances of state and territory economies.

Also on Tuesday Roy Morgan and ANZ will release the weekly consumer sentiment survey. Aussie consumers are feeling OK at present – not irrationally optimistic nor pessimistic.

On Wednesday the Australian Bureau of Statistics (ABS) releases the Consumer Price Index (CPI) for the September quarter.

We believe that price pressures are generally contained. The “headline” CPI probably rose 0.4 per cent in the quarter and 1 per cent over the year, replicating the June quarter results. Petrol prices fell by between 2-3 per cent in the quarter, keeping inflation at modest levels.

Clearly, the “headline” CPI can get affected by volatile elements like petrol. The “underlying” price measures attempt to dig a little deeper to get a better sense of price pressures. We expect that “underlying” prices rose by 0.5 per cent in the quarter and 1.7 per cent over the year.

Results in line with our forecasts don't provide the “smoking gun” needed to justify another rate cut. But if the underlying estimate of inflation lifts by less than 0.4 per cent then another rate cut will be on the agenda at the November 1 Reserve Bank Board meeting.

The question for Reserve Bank Board members is whether there is value in cutting rates again.

On Thursday, the ABS releases data on export and import prices. And on Friday the producer price indexes are issued. In both cases results are pivotally affected by prices of oil, iron ore and coal as well as the Australian dollar.

Other events of note include a speech by Sarv Girn, Chief Information Officer, at the Reserve Bank on Wednesday. And data on new home sales is released on Friday together with the complete national accounts data for the 2015-16 year.

Overseas: US economic growth and “flash” manufacturing to dominate attention

Another bumper week of US economic events lies ahead including the first estimate of economic growth for the recently-completed September quarter.

The week kicks off on Monday in the US, with the release of National Activity Gauge. In addition Markit releases the “flash” readings (or early estimates) of manufacturing activity is the US, Europe and Japan.

On Tuesday, the influential Richmond Federal Reserve survey results are issued with the usual weekly data on US chain store sales. In addition both the Federal Housing Finance Agency and CaseShiller release estimates of home prices for August. CaseShiller estimate that home prices are up 5 per cent on a year ago while FHFA believe prices are up closer to 5.8 per cent.

Also on Tuesday the Conference Board issues its October estimates of consumer confidence. The index stands at 104.1, signifying that there are more optimists than pessimists.

On Wednesday, there are three US indicators for release – new home sales, the “flash” estimate of services sector activity and advance data on the trade balance – exports and imports. In addition, the usual weekly data on housing finance is issued.

On Thursday, there are another three US economic indicators on the agenda – durable goods orders (proxy for business investment), pending home sales and the Kansas City Federal Reserve survey. In addition the usual week data on claims for unemployment insurance (jobless claims) is issued.

And on Friday the first (or ‘advance') estimate of economic growth for the September quarter is released. After a soft June quarter when the economy grew at just a 1.4 per cent annual pace, economists expect that activity expanded at a healthier 2.5 per cent annual rate in the September quarter.

The quarterly data on employment costs is also released on Friday – important for gauging future inflation and thus the implications for interest rates. The University of Michigan releases final estimates of consumer sentiment for October.

Sharemarket, interest rates, currencies & commodities

The US earnings season remains in focus for investors in the coming week. But the US elections will also be top of mind given that there is just over two weeks to go to the November 8 poll.

Commodity prices are also very much in vogue as we highlighted a few weeks ago. Coal, iron ore and oil prices have been lifting but agricultural prices aren't being left behind.

Sugar prices have lifted by 51 per cent since the start of 2016 with cotton up 13 per cent and beef up 4 per cent.

Craig James is chief economist at CommSec.