China, Next bear market, Bad 2018, Smelling coffee, and more

China Slowdown

The Next Bear Market

The West is running out of money

Annus Horribilus

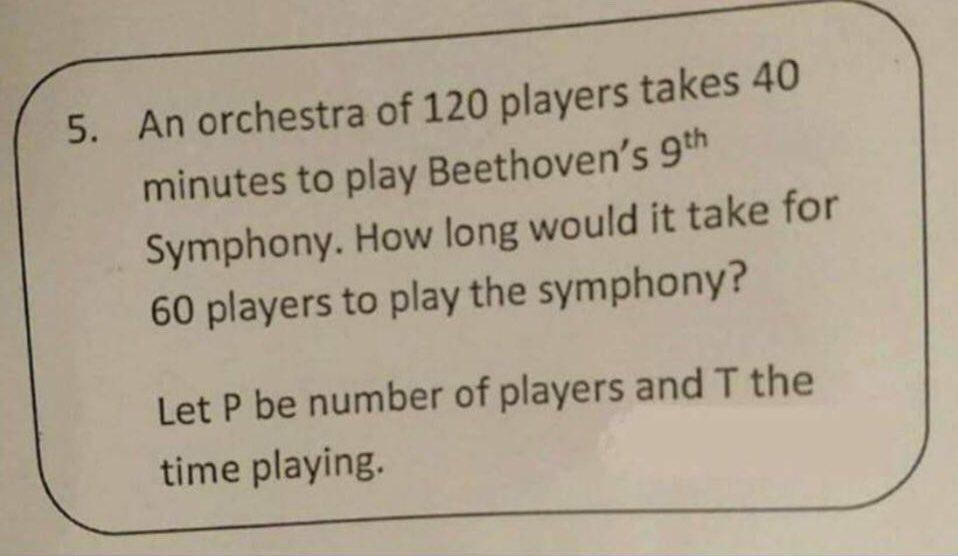

Smelling Coffee

Labor Policies and Investors

Top 20 Franking Balances

Brexit Latest

Franked Platinum

Research and Diversions

Facebook Live

Next Week

Last Week

China Slowdown

Markets everywhere were sold off last night and yesterday because of some shockingly weak numbers out of China for November.

The main one was retail sales growth of 8.1%, down on October (8.6%) and well below market expectations of 8.8%. Industrial production also came in weak: 5.4% versus consensus of 5.9%.

As a result there were 1.5-2% falls on sharemarkets across Asia yesterday, including -1% in Australia, and Wall Street is down plenty this morning.

Those Chinese numbers might still seem fairly solid, and the misses from expectations not that large, but the problem is that it is confirmation of an existing investor bias: that global growth is slowing and will keep slowing in 2019.

Also, the Chinese data are tending to confirm the idea that the trade war is having a serious impact on the Chinese and world economies, because of a significant slowdown in Chinese exports in November, even though exports from China to America still grew quite strongly (9.8%, down from 13.2% in October).

For those who missed it, I showed this chart on the ABC News last night:

.png)

And this chart from NAB last night shows a clear decline in new export orders:

.png)

ANZ’s China economist, Raymond Yeung, calculates that the tariffs will cost about 0.5 percentage points of GDP growth, which he thinks is manageable, but the trouble is the fall in sentiment is much greater.

That’s because it’s generally understood that the fight between the US and China is about more than trade.

@realDonaldTrump tweeted this morning: “China just announced that their economy is growing much slower than anticipated because of our Trade War with them. They have just suspended U.S. Tariff Hikes. U.S. is doing very well. China wants to make a big and very comprehensive deal. It could happen, and rather soon!”

But markets don’t really believe it. As Yeung commented this morning: “We believe the deadlock will likely remain until the US Presidential election in 2020. “

Beijing’s efforts to stimulate the economy aren’t working, partly because of the war but more fundamentally because of structural problems in the Chinese economy.

First, fixed asset investment has slowed dramatically because of the Government’s crackdown on the borrowing that followed the infrastructure boom of 2016-17.

Second, on top of the fall in capital accumulation, the labour force is now contracting, and that trend seems irreversible:

.png)

With both capital and labour slowing, according to Yeung: “China needs to lift total factor productivity to sustain a rising value-add per labour unit, which is in turn critical to supporting wage growth and consumption.”

If Trump is right, and there is a deal “rather soon” then markets will definitely rally hard. But the structural problems with the Chinese economy – too much debt and a contracting labour force – will still be there and so, for that matter, will tensions with the United States, even if there’s a superficial trade “deal”.

The Next Bear Market

Geoff Wilson, of Wilson Asset Management, told me this week that the bear market has begun. We are in it, he says firmly. He doesn’t know how long or deep it will be, but they usually last at least a year.

I think it’s too early to tell. The only thing we can say for sure is that we are no longer in a bull market – it ended this year. We are now either in a period of range-trading, or we are in a bear market, as Geoff asserts.

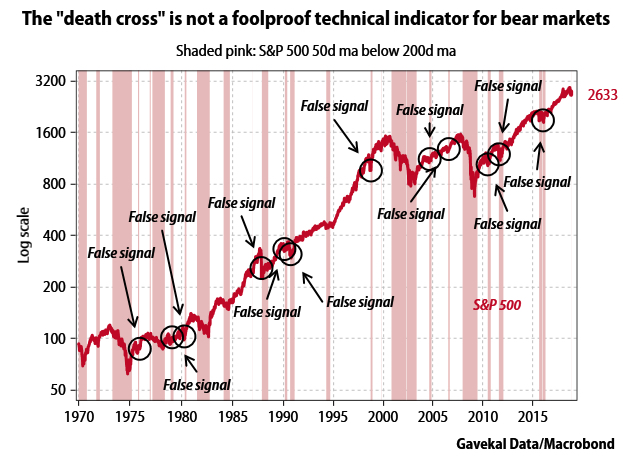

One indicator of the change is the “Death Cross”.

The so-called Death Cross happens when the 50-day moving average falls below the 200-day moving average, and it basically shows that the market has lost momentum.

Despite all the hoo-hah about it, this hasn’t been a very good indicator of bear markets: since 1970 the Death Cross has only predicted further falls 10 times out of 22 incidents, so a dozen false signals.

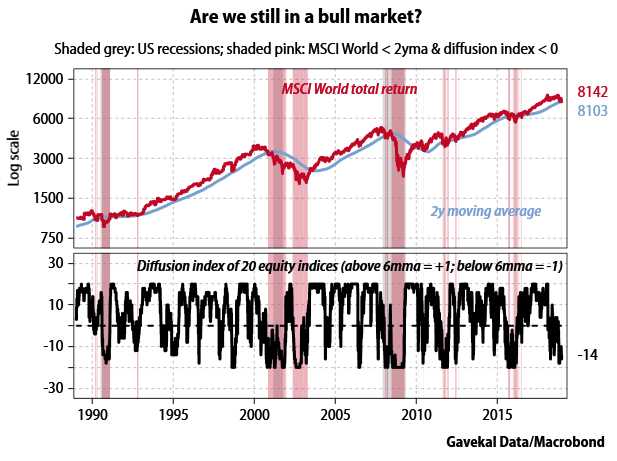

Separately, GaveKal has also come up with a “diffusion index” of 20 large stock markets around the world and found that 17 are below their six-month moving average in local currency terms. Also, the MSCI World Index is right on its 2-year moving average which is another bad sign.

GaveKal’s Charles Gave commented: “In the past, a combination of these two events (graph shaded pink), meant that either a bear market was underway, or global equities went nowhere for an extended period. Thus, of the three possible regimes; (i) bull market, (ii) range trading or (iii) bear market, history points to the latter two options.”

And finally, on a local basis, Percy Allan’s conservative trading strategy in our Sunday Market Timing newsletter went to “Sell” on November 4 after two-and-a-half years signalling buy. In his editorial this week, Percy said he didn’t think the current correction was the start of a crash (bear market) because the yield curve has not inverted, although as I discussed here last week, part of the curve has done that (that is, the 2-5 year rates – the 5-year US bond rate is currently 10 basis points below the 2-year rate).

That often precedes a more meaningful yield curve inversion – the 2s and 10s.

None of the above is confirmation of anything, but it suggests that the bull market is probably over.

Sometimes markets can go sideways for long periods, and while some people describe these as bear markets, the common definition of a bear market is a decline of 20% or more. The thing is that once you get to -20%, and can confidently declare “bear market”, you’re already well into it of course and possibly even near the end.

And despite confident forecasts from smart folk like Geoff Wilson, these are things you can only know in hindsight.

At this point, there are two useful things to do: move to wealth preservation mode and try to understand the cause of the next bear market, whether it has started or not.

The first of those – wealth preservation – is fairly simple: focus on quality stocks that represent good value and that don’t rely on momentum to produce returns. There’s also cash, of course: Geoff Wilson is increasing the cash in his portfolio as opportunities to sell arise.

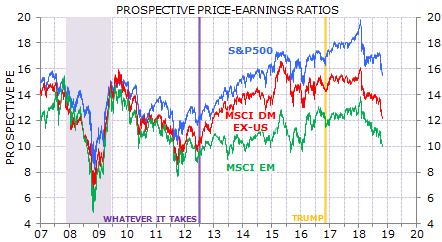

Asian markets, and specifically Japan, are possibly good safe harbours to ride out any storms next year.

Emerging markets as a group (EM) have underperformed, and don’t look expensive…

As for what has brought about the end of bull market, that’s probably not a mystery either: they mainly die of old age. Momentum carries share prices higher till they are overvalued, and buyers melt away.

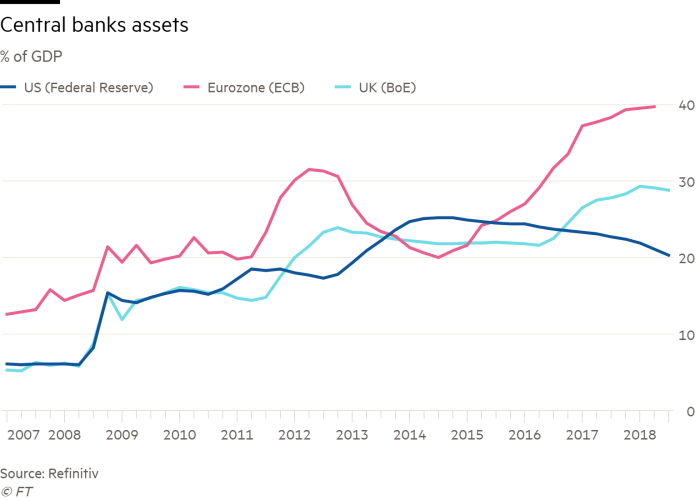

What caused the momentum was low interest rates and central bank liquidity injections after the GFC, the opposite of which is now occurring. It ended two years ago in the United States and is now ending in Europe – the European Central Bank announced on Thursday that it was finally joining most of the world’s central banks in ending crisis-era stimulus programmes and is ending four years of bond buying.

The private sector also withdrawing liquidity, or at least not expanding it sufficiently to offset the central bank withdrawal:

.png)

Next will come rate hikes in Europe, and this will now take over as the key point of discussion.

There are two other, less tangible causes of the end of the bull market, it seems to me, that run deeper and may be longer-lasting: the breakdown of stable politics in the West and a collapse in support for corporations, and corporate capitalism more broadly.

As for the first of those, I wrote a piece for The Australian this week headed “The West is running out of money”, which I’ll reproduced most of below, in response to requests from some subscribers who aren’t subscribers to The Australian.

As for corporations, I was struck by a column in the Financial Times this by Martin Wolf, headed: “We must rethink the purpose of the corporation.” In it he discusses some books on the subject he has read and concludes: “These books suggest that capitalism is substantially broken. Reluctantly, I have come to a similar conclusion. This is not to argue for the abandonment of the market economy, but for better companies and more competition.”

In essence he is saying that the conventional view of the role of companies, dating back to Milton Friedman, is that their sole purpose is to make a profit and to maximise shareholder value, is now passé.

It has been embedded in the remuneration systems of most companies, encouraging executives to focus on nothing more than increasing profits and share prices.

In Australia this year we have seen that system come crashing down in the royal commission on misconduct in financial services, but what Martin Wolf’s column tells us is that it isn’t just happening here.

Wolf wrote: “The idea that businesses pursue profits and only profits, can … only produce bad businesses and dire outcomes.”

That’s because profit is not in itself a business purpose – it’s a result of achieving the purpose, whatever it might be, such as making cars, disseminating information or transporting things.

Second, when regulators allowed limited liability companies to be established – where those who contribute capital are not liable beyond what they have put in – they were thinking not of profits but of the economic possibilities of big accumulations of capital for the purpose of large-scale production and innovation.

The focus on profit and shareholder value means that companies are serving only those who are LEAST committed to them: the shareholders. Unlike employees, suppliers and the communities in which the companies operate, shareholders, says Wolf, “can divest themselves of their engagement in the company in an instant” – that is, sell.

“Moreover, stock markets allow shareholders to diversify their risks across the world, something employees, for example, cannot hope to do with respect to their company-specific capital stock of knowledge and personal relationships.”

There’s also a demographic dimension to this, it seems to me. During the week, I interviewed (for Qantas Radio) Christina Hobbs, the founder and CEO of a new super fund for women, called Verve Super. What does a super fund for women do differently? The answer was all about ethical investing. Millennials feel the same.

What has all this got to do with the bull market?

A profound shift is taking place in the way corporations are viewed and how they view themselves which may lead to a change in the way they are valued.

If companies are no longer viewed, and invested in, purely as profit machines, then the PE and other traditional valuing mechanisms become less relevant.

There is no better example of what’s happening than the “first strike” against Westpac this week.

The vote against the remuneration report was 64.2% in the end, which means a lot of institutional investors joined the “mums and dads” in registering their disapproval of the bonuses to Brian Hartzer and the team.

The bonuses, rejected by shareholders, were based purely on profit; CBA had earlier cancelled bonuses, even though executives may have qualified for them, and did not receive a first strike.

As I move around and talk to large investors, particularly the rapidly growing industry funds, it’s clear that they are interested in far more than profit and are making this known to company boards.

Of course this, in itself, doesn’t lead to a bear market, but along with the withdrawal of central bank stimulus, the breakdown in western political systems, it’s part of the context for what’s going on.

The West is running out of money

This is a slightly edited version of my column for The Australian on Monday.

The riots in Paris over the weekend and going back to November 17 have their roots in the fact that France is running out of money.

President Macron imposed a new fuel tax because France’s budget deficit is running perilously close to the maximum allowed in the EU of 3 per cent of GDP and national debt is 100 per cent of GDP versus the 60 per cent allowed.

The French Government last ran a surplus in 1973. Government spending is 57 per cent of GDP, well over double Australia’s, and successive governments have proved incapable of even stabilising spending, let alone reducing it.

With cars burning the Champs Elysee a week ago, Macron abandoned the fuel tax but that didn’t stop the so-called gilets jaune (yellow vests) movement taking to the streets again this weekend with even bigger, more ferocious protests, this time met with tear gas and rubber bullets.

What’s different about these protests, and the thing that should have every political leader in the western world taking note, is that these are not the leftists who usually do the rioting in Paris: these are ordinary people and workers, organised not by trade unions, or the Communist Party, but by Facebook.

France can’t tax its rich or its companies because they can easily move to Switzerland or Ireland, or an actual tax haven, so the most effective thing for Macron to do was impose a fuel tax, with the result that the nation’s disenfranchised, who live in poor villages and have to drive everywhere, boiled over.

These are the same sorts of people who voted for Donald Trump and for Brexit and like those in the US and UK, their grievances are wide-ranging and not easily dealt with.

That is especially true with their governments deep in debt and unable to do anything other than tax them some more, since companies and the financial elites are becoming untaxable and the demands on government spending are relentless. There simply isn’t enough money available to deal with their problems.

The same applies to the United States, the UK, Italy, Spain and Australia, leading to political turmoil and unhappy electorates in all of those countries.

In the US, the President Trump cut company taxes and blew out the budget by US$113 billion in 2018 to 4.7 per cent of GDP (it would get kicked out of the EU), and there will be a reckoning, if not next year the year after.

Trump is, bizarrely, pushing the idea that tariffs will fix the budget and make America rich again. He tweeted recently: “Billions of Dollars are pouring into the coffers of the U.S.A. because of the Tariffs being charged to China, and there is a long way to go. If companies don’t want to pay Tariffs, build in the U.S.A. Otherwise, lets (sic) just make our Country richer than ever before!”

China doesn’t pay the tariffs, of course, they are a tax on Americans, but leaving that aside the amounts are tiny. Revenue from customs duty in 2018 was US$41 billion, an increase of less than US$7 billion. Every little bit helps, but tariffs won’t turn around the US budget deficit.

Italy’s new populist government is locked in an argument with the European Commission over the budget deficit, while Spain is battling to contain a budget blow-out. And as for the UK – where to start?

As the big Parliamentary vote on Prime Minister Theresa May’s Brexit deal looms, Britain’s budget deficit has risen to its highest level in three years.

In fact, it’s hard to find a western country that is not wallowing in deficits and public debt and with stable leadership. Even Germany, which produced yet another budget surplus this year, has a Chancellor who is in office but not in power – on her way out. Trump, Macron, May and Merkel are all either under siege or leaving.

Annus Horribilus

If you’re wondering how bad 2018 was for investors, it was really bad. This chart from Clime’s newsletter this week, produced by Deutsche Bank, puts it into context. It’s the proportion of asset classes that have posted negative total returns this year, going back to 1901.

.png)

Yep, the worst on record – worse than 1931.

Hey – maybe that means 2019 will be better!

Smelling Coffee

Further to Tony Kaye’s interview with Steen Jakobsen of Saxo Capital Markets this week, the CEO of Freelancer, Matt Barrie posted an interesting series of tweets on Twitter this week after having dinner with Jakobsen.

Here they are:

#1: Just had a private dinner with Steen Jacobsen, Chief Economist of Saxo Bank. “Australia is unaccountable and irrational. I visit 30 countries a year and this economy is by far the worst. You are incapable of smelling the coffee.”

#2: “Nobody is solving any real problems. Instead you regulate everything. You are way too long equities and property. Especially property. House prices are unbelievable. Building codes are regulated by unions. You have the worst quality housing stock of the western world”

#3: “You need investment in education, basic research, etc. you are doing the opposite. There is a wake up moment coming.”

#4: “It doesn’t matter if the RBA tries to cut rates by 1% or 2% to pump the economy, it won’t do anything because the banks are self regulating now to reduce the credit supply”

#5: “It makes sense to get rid of negative gearing but the politicians will not have the willpower to do so. Labor will fold”

#6: “Be as short the Aussie dollar as you possibly can be.”

Well, these comments were a bit stronger than he told Tony, but as we know from Mr Trump, Twitter can bring out the emphatic side of people (especially after dinner). Mind you, Jakobsen wasn’t the one doing the tweeting, but I presume Barrie got his go ahead.

Is Jakobsen right? Yes - mostly.

- We are too long property (not sure about equities);

- We have terrible quality housing stock, apart from what was built a long time ago;

- We need more investment in the basics;

- It won’t matter if the RBA cuts rates because the housing slowdown is caused by a cut in credit volume.

As for negative gearing, Labor is not proposing to get rid of it, just confine it to new properties, although new properties become existing ones as soon as they are sold so not much difference there. And also, it will be grandfathered and delayed to July 1, 2020 (probably).

Will they fold? Maybe. The Hawke Labor Government abolished negative gearing (entirely) in July 1985 and folded two years later – reinstating it in 1987 having come under pressure over a big rise in rents (which may or may not have resulted from the abolition of negative gearing).

I doubt that Shorten will fold before the election unless there is an unlikely collapse in the polls. Whether he folds in two years will depend on what happens to rents and housing prices, but it’s unlikely in my view.

If it prompts a further collapse in house prices, rents would be more likely fall, not rise.

And by the way, falling house prices means that negative gearing no longer works, since it relies on a property investment having a running loss but a capital gain at the end. With no capital gain, there’s no point carrying a loss, even if you do get a tax deduction for it.

However, at some point in the next year or two, you would think, house prices will bottom, so it will be worth negative gearing again.

Labor Policies and Investors

On the subject of the impact ALP policies on investors, Macquarie Wealth produced a big report on this on Thursday.

Here are some of the key points, including on negative gearing:

- We expect the proposed changes to negative gearing to potentially impact the already fragile housing market. While the long-term fundamental effects on house prices are difficult to estimate, should sentiment concerns result in lower house prices and/or turnover, it will put further pressure on the banks. Fundamentally, banks are likely to experience a contraction in credit and earnings growth. We estimate that an additional 10% reduction in house prices vis-à-vis our current estimates coupled with ~10% fall in the turnover activity would reduce cumulative FY19-21 credit growth by ~3.5%.

- The proposed changes to franking credits will affect all shares held by investors in a zero or low-rate tax environment. However, given retail investors’ overweight position to bank shares, we expect the impact to be potentially more significant. We estimate that the relative attractiveness of bank shares would diminish as a result of the proposed change, which may affect their long-term valuations.

- However, we note that investors looking for high yield are likely to remain positively predisposed to bank shares, although the relative attractiveness of infrastructure and REITs is likely to be enhanced.

- For companies that have both material franking balances and surplus capital, we expect they will look for avenues to distribute them through either off-market structured buy-backs or special dividends. Our banking team highlighted both CBA and WBC as having material franking balances, and CBA in particular given its capital surplus, estimating this could be ~1% accretive to CBA’s EPS.

- For utilities, it is the most stark different between Coalition and Labour: near-term 50% renewable target by 2030, zero net greenhouse emission by 2050, and 45% reduction in 2005 emissions levels across the economy. The latter requires not just the NEG but also a broader emissions intensity scheme which Labor seeks to address. Generator/retailers like AGL and ORG are the most likely to suffer.

- For upstream producers, the initial Sept policy announcement raised much concern regarding sovereign risk, nationalisation, and creating an artificial subsidy for gas users. Subsequently, though, the unanimous feedback from industry contacts has been that Labor will adopt a softer approach, as illustrated by the Nov energy policy announcement which forewent any talk of gas prices.

- With infrastructure development featuring prominently in ALP policy, we believe the intent to invest in infrastructure is strong – and likely boosted by the recent election success in Victoria.

- The 2% price cap on the health insurance industry creates significant margin risks for the health insurance industry.

Top 20 Franking Balances

Separately UBS published a list of franking balances yesterday. Here are the top 20, in millions of dollars ranked by percentage of market cap:

|

Company |

Franking balance ($A) |

Share of market cap* |

|

Fortescue |

$2,268 |

17.90% |

|

Caltex |

$936 |

13.20% |

|

Harvey Norman |

$509 |

13.20% |

|

Rio Tinto |

$11,701 |

10.80% |

|

TPG Telecom |

$711 |

10.40% |

|

JB Hi Fi |

$271 |

10.30% |

|

BHP |

$15,139 |

9.60% |

|

Metcash |

$206 |

9.30% |

|

Woodside |

$2,651 |

9.10% |

|

Alumina |

$507 |

8% |

|

Soul Pattinson |

$514 |

7.90% |

|

Mineral Resources |

$211 |

7.90% |

|

Premier Inv |

$198 |

7.70% |

|

B & A Bank |

$394 |

7.60% |

|

Bega Cheese |

$91 |

7.20% |

|

Woolworths |

$2,610 |

6.80% |

|

Flight Centre |

$306 |

6.50% |

|

Brickworks |

$147 |

5.70% |

|

ANZ Bank |

$3,965 |

5.40% |

|

IOOF |

$77 |

4.80% |

Note that the only one of the big four banks on the list is ANZ at 19th, with 5.4% of market cap. NAB’s franking credits are $1,160 million or 1.8%, Westpac’s $1,357 million or 1.5% and CBA $1,464 million or 1.2%.

Brexit Latest

Theresa May survived the vote of no-confidence pretty easily and promptly went to Brussels to try to get more concessions so the British Parliament might approve her deal when she takes it back for a vote, probably early in the new year.

She’s mainly trying to renegotiate the “backstop”.

What’s this? It’s the safety net arrangement for Ireland – specifically the border between the Irish Republic and Northern Ireland.

At present goods are traded between the two Irelands with no restrictions because the UK and Ireland are both part of the EU. Goods don’t need to be inspected for customs or standards.

After Brexit all that changes because the two sides of the border will become part of different customs and regulatory regimes, so products will have to be checked, which nobody wants to happen – especially the Irish.

The EU proposed a backstop that would mean Northern Ireland staying in the EU customs union, large parts of the single market and the EU VAT system, but they insisted that this would only apply to Northern Ireland (not Scotland, which also wanted it).

But if a backstop only applies to Northern Ireland, that effectively means the border between the UK and Europe runs down the middle of the Irish Sea, which the Brexiteers say would mean the break-up of the UK.

Theresa May rejected the EU's proposal saying it would threaten the integrity of the UK and suggested a backstop that would see the UK, as a whole, remaining aligned with the EU customs union for a limited time after 2020.

Her proposal, published in June, contained nothing about single market regulatory issues, which are probably more important than customs in terms of maintaining a soft border.

Anyway after months of wrangling, on November 14, Theresa May got her cabinet to back a draft deal between UK-EU negotiators that included a backstop that would see Northern Ireland staying aligned to some rules of the EU single market, if another solution cannot be found by the end of the transition period in December 2020.

That would mean that goods coming into Northern Ireland would need to be checked for EU standards, which effectively keeps the whole of the UK in the EU customs union - unless and until both the EU and UK agree that it is no longer necessary.

That’s when the thing fell apart because Cabinet ministers started resigning like ninepins, because it was no longer a clean Brexit. Meanwhile Northern Ireland’s Democratic Union Party, on which Theresa May relies for her Parliamentary majority, also came out against her backstop - abstaining on a key budget vote as a shot across the bows.

Basically May is now trying to get some further assurances about the temporary nature of the backstop, but it does look a bit like the British Parliament simply will not accept a negotiated Brexit of any sort that includes a transition for the Irish border.

If May’s deal is rejected, as seems likely, there will be no withdrawal agreement and no transition period – a “hard Brexit”, most likely chaotic. Last month the Bank of England warned that a disorderly Brexit would be worse for the UK than the GFC.

The stakes for Britain could not be higher.

Franked Platinum

In the Facebook Q&A on Thursday, Gerard asked this question:

“I note that Platinum Asia (PAI) is paying a high fully franked dividend. How is this so? I thought franking only applied to Australian companies?”

I said it was a mystery to me as well, and that I would ask them and get back to him, and you.

Here is the company’s answer:

“Platinum Asia Investments Limited (ASX: PAI) is an Australian resident company and so its earnings are taxed in Australia (at 30%) and as a result of paying Australian tax, PAI is able to generate franking credits and distribute these to investors.”

So there. Platinum Asia is an Australian company and pays full Australian tax and thus gets franking credits. Simple.

Research and Diversions

Research

Quote of the day:

“Democrats can’t find a Smocking Gun tying the Trump campaign to Russia after James Comey’s testimony. No Smocking Gun...No Collusion.” @FoxNews “That’s because there was NO COLLUSION. So now the Dems go to a simple private transaction, wrongly call it a campaign contribution...”

- Tweet by Donald Trump on Monday that went viral, with global mirth at “smocking gun”.

The latest filing from Robert Mueller may not yet be the full story, but what we now know … is at once shockingly corrupt, blatantly unethical, probably illegal, and yet, at the same time, shabby, small, and ineptly executed.

It sure looks like Saudi Arabia used veterans to funnel money to Trump.

New data has opened a small window into Trump’s social media machinery, and in particular the role played by the now-defunct Cambridge Analytica.

This is on Fox News: Trump is very likely to be indicted on charges of violating Federal campaign laws.

Here are some interviews with some of the many illegal immigrants who work for Trump (even though he said he doesn’t employ any, of course).

The stock market has become the ultimate Donald Trump bullshit detector, and according to the markets, the risk of The Donald no longer justifies the reward of The Donald.

"President Trump lives—and thrives—in the world Newt Gingrich made."

(And yes, if you think I’m obsessed with Trump and read everything I can about him – you’re right. It is, by far, the best story in the world right now, absolutely gripping. Even better than the Australian Liberal Party).

Protection visa applications have blown out to record numbers on Peter Dutton’s watch. The people smugglers are doing more business than ever. The difference is that their clients are arriving by plane rather than boat and are less likely to be genuine refugees.

About the Liberal Party’s new rule change, requiring a two-thirds majority of MPs to sack a Prime Minister. Here is something I hadn’t thought of: what if something just short of 66% votes to sack him/her? A clear majority of the Party wants the PM gone, but he or she doesn’t go. What then?

Historic debt is at the core of America’s (and Australia’s?) economic decline. “Debt is a drug. The banks have known this for quite some time, and have exploited the opiate of easy money to leverage entire nations and cultures into servitude or self-destruction.”

About AlphaZero, a generic reinforcement learning and search algorithm. In other words, true artificial intelligence.

The secret to true artificial intelligence. With his “free-energy principle,” the neuroscientist Karl Friston believes he has discovered the organizing principle of all life. Unfortunately, no one can understand it.

Kara Swisher: can the US stop China controlling the next internet age? “Tech executives worry China will turn to tit-for-tat arrests of Americans in response to the detention of Meng Wanzhou. And the worries don’t stop there.”

Last February the Conservative Political Action Conference (CPAC) held its convention in Washington, D.C. This annual gathering is a kind of right-wing Davos where insiders and wannabes come to see what’s new. The opening speaker, not so new, was Vice President Mike Pence. The next speaker, very new, was a stylish Frenchwoman still in her twenties named Marion Maréchal-Le Pen.

Each of the cryptocurrencies explained in one sentence. This is actually quite useful, although I don’t really know how accurate the descriptions are. But they’re pithy, and a bit amusing.

Australia has made itself a global guinea pig in testing a regime to crack encrypted communication. The mind-bogglingly complex law, more than a year in the making, passed the Australian parliament on Thursday. The opposition Labor party shelved its plans to improve the scheme and waved it through.

The US Vs China: a great experiment versus a great civilisation (the experiment is America).

Connecting the insurrections in France, the financial crisis of 2008, inequality, and identity politics. “Since 2008 governments have been pumping new money into the system, which has tended to accrue overwhelmingly to those who already hold financial assets, and their technocratic allies.”

From Clime Investment Management – a good analysis of the poor returns of 2018, and why they happened.

Diversions

This an excellent Brexit explainer by Hugo Rifkind, a columnist for The Times, entirely as a thread on Twitter. Here’s how it starts: “The thing is, the best way to understand Theresa May’s predicament is to imagine that 52 percent of Britain had voted that the government should build a submarine out of cheese.”

This is a good joke, by Clement Freud. One minute well spent.

Pop music in 2018 was a beautiful mess: “The charts changed, reliable stars flopped, and bizarre newcomers triumphed. It was a weird year, but a promising sign of what’s next.”

Using melatonin as a sleeping pill (as I do) is like using an AK-47 as a club to bash your enemies’ heads in. It might work, but you’re failing to appreciate the full power and subtlety available to you. This piece is everything you’ve ever wanted to know about sleep and melatonin, and some stuff you didn’t.

“In 10 years of political reporting I’ve met a lot of intense, oddly dressed people with very specific ideas about what the perfect world would look like, some of them in elected office—but none quite so strange as the ideological soup of starry-eyed techno-utopians and sketchy-ass crypto-grifters on the 2018 CoinsBank Blockchain Cruise.”

“Breaking my knee was an interesting mix of pain. It wasn’t the most intense pain I had ever felt, but certainly the most profound. The sheer duration of the pain, and the intellectual anguish that came from realising that my life had changed for the worse in irreversible ways, made this one of the most traumatising experiences of my life.”

A divorce lawyer’s guide to staying together. (Seriously, this useful.) “I think you fall in love really fast, then fall out of love slowly. And if you want to keep your love alive, you have to be attentive to all the little things that go wrong along the way, and constantly course-correct. If you can do that, you’ll never set foot in my office.”

The value of attention. We think of attention as a limited resource, to be used in the service of some goal. But that misses the fact that attention is not just useful. It’s more fundamental than that: attention is what joins us with the outside world. ‘Instrumentally’ attending is important, sure. But we also have the capacity to attend in a more ‘exploratory’ way: to be truly open to whatever we find before us, without any particular agenda.

51 tips for a successful life. (10) Make sudden, unexpected changes in your appearance every few year. (11) Allow yourself to admire (some) people to the point where you feel really bad about how much you fail to measure up. (13) Listen to music all the time, but have no taste in music. (51) If you encounter some evidence of impairment to your health, anything from the flu, to a food allergy, to mental illness of some kind--dismiss it and give yourself the benefit of the doubt. Avoid medical treatment, and just go ahead and eat what you want.

This is what climbing to the summit of Everest is like. Horrifying. (Thanks Tim for sending this in.)

Jeanette Winterson: ‘I couldn't finish Fifty Shades. Are straight women really having such terrible sex?'

Tomorrow is Beethoven’s birthday, born December 16, 1770. He was undoubtedly the greatest musician of all time (in my view). No one comes close. Two examples: Moonlight Sonata, so delicate, and the powerful 4th movement of the 9th symphony, written when he was deaf.

Happy Birthday Tony Hicks, 73, also tomorrow. He joined The Hollies in 1963 a few years after Allan Clarke and Graham Nash formed the band. Here they are doing their signature, He Ain’t Heavy, He’s My Brother. Hicks is the guy standing immediately behind Clarke, the lead singer.

And finally yet another birthday tomorrow: Benny Andersson, one of the B’s in ABBA, who turns 72. So many hits to choose from. OK, let’s pick one – Winner Takes It All, with Benny on the piano.

.png)

.png)

Facebook Live

If you missed #AskAlan on our Facebook group this week (or if you don’t have access to Facebook) you can catch up here. And we’ve just given the Facebook Livestream its own page where you can also opt to just listen to the questions and answers.

If you’re not on Facebook and would like to #AskAlan a question, please email it to hello@theconstantinvestor.com then keep an eye out for the Facebook Live video in next week’s Overview.

Next Week

By Ryan Felsman, Senior Economist, CommSec

The long wind-down to Christmas and the New Year is underway.

In Australia, the CBA releases its Business Sales Index, the Federal Government hands down its Mid-Year Review, the Reserve Bank Board issues its December monetary policy meeting minutes, while population and jobs data round-out the week.

In the US, the Federal Reserve Bank takes centre stage with its final interest rate decision for the year. There is a data delude on ‘Super Friday’ with economic growth (GDP), personal income & spending, durable goods orders, the Philadelphia Federal Reserve manufacturing index and consumer sentiment data all issued.

Last Week

By Shane Oliver, Head of Investment Strategy and Chief Economist, AMP Capital.

Investment markets and key developments over the past week

- Share markets were mixed over the last week with nervousness around trade and global growth continuing, not helped by weak Chinese economic data. US, Eurozone and Chinese shares rose but Japanese and Australian shares fell. Despite a rise in material stocks over the last week the Australian share market was particularly dragged down by telcos, consumer staples, utilities and financials – seeing defensive sectors getting hit so hard (not helped by regulatory risks) makes this a rather confusing downswing! Bond yields rose in the US and Europe but were little changed in Australia and Japan. The oil price rose on the back of supply cuts from Saudi Arabia to the US (flowing from next year’s oil production cuts) with iron ore prices also up. The $A was little changed

- Notwithstanding market nervousness, the past week has actually seen more positive news on the US/China trade front with a the round of negotiations kicked off by a phone call between Chinese Vice Premier Liu and US Treasury Secretary Mnuchin and Trade Representative Lighthizer, Chinese officials reportedly travelling to the US to negotiate, China reportedly moving to cut its trade war tariffs on imported US cars and purchasing US soy beans, President Trump indicating he would intervene in the Huawei case if it helped get a deal with China on trade, China reportedly preparing to give foreign firms greater access along with reports that it’s working to soften and replace its Made in China 2025 plan. This is all far more positive than markets appear to be allowing for. But scepticism is understandable after the experience back in May. Our view remains that there is a strong incentive for both sides to make a deal to resolve the issue before it weakens their economies (which won’t be good for Trump’s 2020 re-election). It may take more than 90 days, but we expect a deal to be reached in the next six months.

- US Government shutdown risk delayed to December 21. While US Government funding was extended from December 7 it was only out to December 21 and, as a meeting between President Trump and Democrat Congressional leaders highlighted, their remains the risk of a shutdown then as Trump seeks to get funding for his wall. That said, much of this looks to be posturing for the cameras, we have seen all this before, its hard to see either side allowing a Christmas shutdown as the public doesn’t like them. It’s still a risk though – but note that 75% of funding has already been passed into law so it would only be a partial shutdown and only non-essential services would shut so it wouldn’t have much economic impact at all. The big one to watch is the coming fight over the debt ceiling sometime after March 1 next year – as the Democrats could try and force Trump to lift the corporate tax rate in return for raising the debt ceiling

- It’s still too early to say we have seen the low in shares. Here’s a possible road map though. Shares have a nice Santa rally over the next two weeks or so, but we get more weakness in early 2019 as global growth indicators remain softish. Which in turn prompts more stimulus in China, the Fed to pause, the ECB to provide more cheap bank funding and a bit of fiscal stimulus out of Europe (was Macron’s concession over the last week to the “yellow shirts” a sign of things to come for fiscal stimulus in Europe?). US/China trade negotiations make progress. Shares then bottom around March. Economic data starts to improve, and it looks like 2015-16 all over again (albeit a bit more compressed in time). Who knows for sure – but while I remain confident that a “grizzly bear” market (where shares fall 20% only to be down another 20% of so a year later) is unlikely because a US/global recession is unlikely anytime soon, a further leg down in shares turning the correction we have seen so far into a “gummy bear” market (down 20% or so from top from but up a year later) is a high risk.

- Speaking of the Santa rally, it normally kicks in around mid-December on the back of festive cheer and new year optimism, the investment of any bonuses, low volumes and no capital raisings. Over the last ten years the period from mid-December to year end has seen an average gain of 1% in US shares with shares up in this two week period 7 years out of ten, albeit it’s been less reliable in the last few years. In Australia, over the last ten years the average gain over the last two weeks of December has been 2.2% with shares up 8 years out of ten, including in all of the last six years. Which is why December is normally a strong month.

(1).png)

- The British always do good comedy and Brexit keeps getting funnier with PM May delaying a vote on her deal to avoid certain defeat before then facing a confidence vote from her party. While she survived the vote more than one third of her party voted against her leaving her weakened and she is now a bit of a lame duck as she won’t be leading into the next election. She still faces an uphill battle to improve her deal with the EU and then win parliamentary support. All of which is leading to an increased risk of a new election and a no deal Brexit in March (which risks plunging the UK into recession). As Lance Corporal Jack Jones kept saying in Dad’s Army “don’t panic! don’t panic!”. This is all bad news for the UK and UK assets with the British pound taking most of the hit, but despite reports to the contrary it remains a second order issue for global markets.

Major global economic events and implications

- US data releases over the last week were strong. Job openings and hiring remain robust, small business confidence fell in November but remains very high and jobless claims fell sharply back to their lows after several weeks of increases. Meanwhile, November headline CPI inflation fell back to 2.2% year on year helped by lower energy prices with more to go this month and core inflation rose to 2.2%yoy but short-term momentum in inflation is running around 2%. The November CPI is consistent with the core private final consumption deflator at 1.9%yoy. Core inflation stabilising around 2% gives scope for the Fed to pause/go slower next year after it hikes in the week ahead.

- The European Central Bank remains dovish. While it confirmed that its quantitative easing program will end this month, it was really a dovish tightening with Draghi seeing the economic risks as “broadly balanced” but “moving to the downside” consistent with downwards revisions to the ECB’s growth and inflation forecasts, a hint of more cheap financing (or LTRO) for banks, a continued reference to rates being on hold through summer 2019 (we can’t see a hike until 2020 at the earliest) and a commitment to continue reinvesting maturing bonds for an extended period. Next to watch will be another round of cheap bank financing early next year.

- The further downwards revision to Japanese September quarter GDP growth to -0.6%qoq was bad news, but various business surveys seem to be holding up at reasonable levels including the Tankan business survey and machine orders rose in October.

- Chinese economic data for November was on balance soft with weaker growth in imports, exports, industrial production and retail sales, but a slight pick-up in investment growth, stronger than expected growth in lending and credit and lower jobless. The overall impression is that growth is continuing to slow, which will likely drive more decisive policy stimulus in the months ahead.

Australian economic events and implications

- Australian economic data releases over last week were nothing to get excited about. The ABS reported that house prices fell 1.5% in the September quarter, but this just confirmed declines already reported by private sector surveys which show an intensification over the last two months. Housing finance rose in October, but this could just be a statistical bounce after several weak months. Consumer confidence was little changed in December, but business confidence continued to slip below consumer confidence after running above it since the 2013 election. The problem is that neither are particularly strong and with house prices falling and wages growth likely to remain weak its hard to see consumer confidence rising much and a continuing slide in business confidence may threaten business investment. Finally, the CBA’s December business conditions PMIs slowed slightly.

What to watch over the next week?

- In the US, the focus is likely to be on the Fed on Wednesday which is expected to raise the Fed funds rate by another 0.25% to a range of 2.25-2.5% but its likely to be a “dovish hike” with the Fed dropping the reference to further “gradual” rate hikes and replacing it with language that signals a greater data dependency. Basically, with the Fed Funds rates getting close to neutral, US core inflation stabilising around the 2% target, interest sensitive sectors like housing and auto demand slowing and various headwinds to the US economy next year the Fed is likely to signal that its open to a pause on interest rates or at least moving more slowly in raising them. Our base case is that the Fed will hold the Fed Funds rate flat during the first half of next year and only raise rates once or twice in the second half.

- On the data front in the US expect flat to softish readings for the NAHB home builders’ conditions index (Monday), housing starts (Tuesday) and existing home sales (Wednesday) and Friday data to show a rise in durable goods orders, solid growth in personal spending and a rise in inflation as measured by the core private consumption deflator of 1.9% year on year.

- The Bank of Japan is not expected to make any changes to monetary policy when it meets Thursday, with core CPI inflation (Friday) likely to remain stuck around 0.4% yoy and providing one reason why this is likely to remain the case for a long while yet.

- The Bank of England is also expected to leave its cash rate at 0.75% when it meets Thursday with Brexit uncertainty likely to weigh heavily on its thinking.

- In Australia, the Mid-Year Economic and Fiscal Outlook to be released on Monday is likely to show that the Federal budget is running around $9bn per annum better than expected – thanks to higher than expected commodity prices and employment driving stronger tax revenue only partly offset by fiscal easing measures. This year’s budget deficit projection is likely to fall to around -$6bn (from a projection of -$14.5bn in the May Budget) and the 2019-20 surplus on unchanged policies will be projected to be around $11bn (up from $2.2bn in May) with future surpluses looking even stronger. This is likely to enable the Government to announce around $9bn in income tax cuts and other pre-election goodies ahead of next May’s election and still maintain a surplus projection for 2019-20. The big risk of course is that the revenue windfall is not sustained as slower Chinese growth weighs on commodity prices, jobs growth slows, and wages growth remains weak. The Government’s growth forecast for this financial year of 3% is expected to remain unchanged but it may lower forecasts for 2.25% inflation and 2.75% wages growth as both look too optimistic.

- The minutes from the RBA’s last meeting (Tuesday) will likely repeat the mantra that it expects the next move in rates to be up although there is no strong case for a near term move, but investor interest is likely to be on what the Bank has to say about the housing market and credit conditions with recent speeches suggesting that it may be getting a bit more concerned about the risks. On the data front expect November labour force data (Thursday) to show a 10,000 gain in jobs and unemployment remaining at 5%. June quarter population data (also Thursday) will likely show some slowing in population growth to around a still strong 1.5%yoy.

Outlook for markets

- Shares remain at high risk of further short-term weakness (notwithstanding any Santa rally), but we continue to see the trend in shares remaining up as global growth remains solid helping drive good earnings growth and monetary policy remains easy.

- Low yields are likely to drive low returns from bonds, with Australian bonds outperforming global bonds as the RBA holds and the Fed continues to hike (albeit at a slower rate next year).

- Unlisted commercial property and infrastructure are likely to see some slowing in returns over the year ahead. This is likely to be particularly the case for Australian retail property.

- National capital city residential property prices are expected to slow further with Sydney and Melbourne property prices likely to fall another 10% or so in 2019, but Perth and Darwin property prices at or close to bottoming, and Hobart, Adelaide, Canberra and Brisbane seeing moderate gains.

- Cash and bank deposits are likely to continue to provide poor returns, with term deposit rates running around 2.2%.

- Beyond any further near-term bounce as the Fed moves towards a pause on rate hikes next year, the $A likely still has more downside into the $US0.60s as the gap between the RBA’s cash rate and the US Fed Funds rate will likely push further into negative territory as the RBA moves to cut rates. Being short the $A remains a good hedge against things going wrong globally.