Carbon tax mindless blindness

Rio Tinto has announced that it intends to close the Gove Alumina Refinery in the Northern Territory’s remote Arnhem Land. It will now just export the raw bauxite mined at the site. According to Rio, the decision to close the refinery was a function of a high exchange rate and low global prices for alumina.

Others, however, seem mindlessly determined to link it to the carbon tax.

The reality is far more messy and difficult. While there was not a decisive, explicit decision that you could point at, Australian politicians and their public servant advisers have made a choice. They have chosen the path of getting rich selling energy and raw materials overseas at top dollar. But this choice comes at a price – it means the steady demise of energy-intensive manufacturing that had previously been supported by preferential access to Australia’s raw materials, based on a strategy of value-adding.

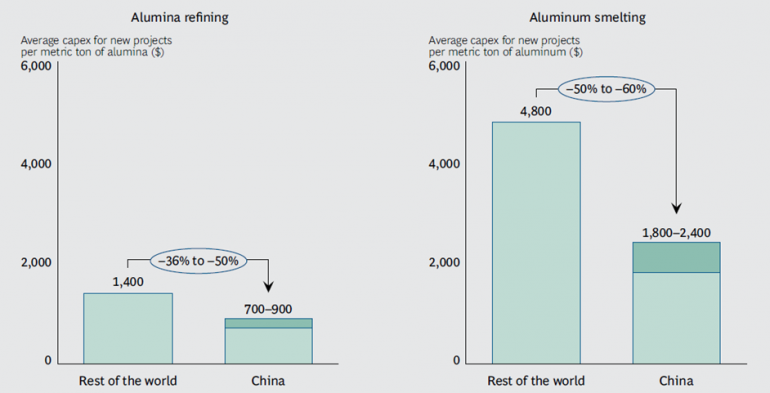

This strategy that Australia could benefit from further processing its metal ores has been ripped to shreds by China’s relentless and low cost construction of refineries and smelters. The chart below, prepared by Boston Consulting Group, illustrates how the Chinese are capable of constructing alumina refineries and aluminium smelters at as little as 50 per cent of the cost of other countries. Even though the Chinese have noticeably higher raw material costs than competitors, they keep expanding production capacity, destroying the profitability of metals processing.

China’s advantage in alumina and aluminium plant construction costs

Source: Boston Consulting Group (2013)

This demise of Australian energy-intensive manufacturing will continue relentlessly in spite of an Abbott repeal of the carbon price.

Gove represents an excellent case study but with the Pilbara as the positive flipside to this structural change.

Gove has a fantastic bauxite deposit but it is not an ideal location to refine bauxite into alumina. Refining bauxite into alumina requires lots of heat and that requires lots of energy. Because Gove lacks infrastructure giving it direct access to either coal or gas, it has to ship in fuel oil which is very easy to transport but extremely expensive.

If we look at another major Australian bauxite deposit in remote northern Australia, Weipa on Cape York, it doesn’t refine it into alumina. Instead it is shipped a few thousand kilometres all the way around Cape York and down to Gladstone.

Why the difference in approach?

Well, firstly it’s important to recognise that neither situation is entirely logical – Indonesia has large amounts of indigenous energy and is far closer to the bauxite deposits and to final end customers of aluminium. But governments have insisted that for miners to get access to the bauxite they have to refine a large proportion of it into alumina on home soil. In the case of Weipa, it can be shipped to Gladstone that has huge trains of cheap coal regularly visiting (and now gas pipelines) and still keep the Queensland government happy. This is available at probably less than $3.50 per gigajoule. But for Gove they rely on fuel oil at something around $14 per gigajoule. For Gladstone that means an energy cost of about $35 per tonne of alumina, while for Gove the cost is closer to $140. This is cost difference of about $100 for a product that is only selling for $320.

Even if taxpayers had paid for a gas pipeline to deliver gas to Gove’s door, because there is an LNG plant in Darwin, the going market price for gas is about $8 per gigajoule. This still leaves an energy cost differential of about $45 relative to Gladstone. By way of comparison Gove would have been paying a carbon cost per tonne of alumina of no more than $1.50 after 90 per cent free permits, once trading commenced in July next year (assuming a carbon price of $10t/CO2).

Now, let’s consider the Pilbara. A day before Rio announced the closure of Gove it also announced a major expansion of its iron ore mining in the Pilbara. This comes on the back of several billion dollars Rio had already committed to expanding its Pilbara operations.

Now several moons ago, a Mr Lang Hancock was fighting with the Western Australian government to allow him to mine a huge iron ore deposit he’d found in the Pilbara. At the time the WA government insisted that domestic iron ore needed to be processed into steel and couldn’t be exported as raw material. They ultimately changed their mind.

In the end, steel making is losing money hand over fist thanks to China’s predilection for building steel mills, while iron ore mining is reaping a windfall.

The closure of the Gove refinery is a body blow to the town. But blaming it on the carbon tax blinds us to further tough but necessary restructuring ahead.