Capitol Health & Integral Diagnostics: barking mad

For many people, a trip to the radiologist brings a special kind of anxiety. There's something about being force-fed into a gigantic magnet or standing naked in front of a ray gun that makes us shy ... or perhaps it's the thought of what the doctor might find.

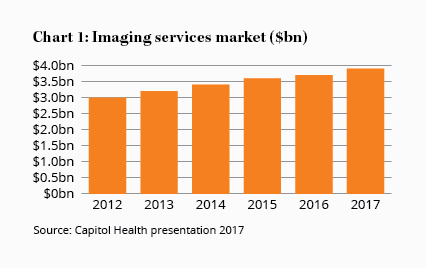

Nonetheless, people are getting more tests than ever before. The number of imaging services performed each year – such as X-rays and MRI scans – has grown at around 5% a year over the past decade, well above the 1.5% growth in population (see Chart 1). That's 40% more tests per person.

Key Points

-

Imaging volumes should grow significantly

-

Pricing, revenue and margin headwinds

-

Share prices offer no margin of safety

With Australia's population aging, diagnostic imaging services are expected to balloon further, which provides a welcome tailwind for providers Capitol Health and Integral Diagnostics.

Dog training

Mergers in the imaging industry are nothing new – 20 years ago it was mainly composed of stand-alone independent clinics; today it's highly corporatised, with around 41% of volumes controlled by the three largest players – I-MED Network (18%), Sonic Healthcare (12%), and Primary Health Care (9%).

What makes the proposed Capitol Health and Integral Diagnostics merger interesting – or, shall we say, ‘cute' – is that it's akin to a Chihuahua picking on a Doberman. Capitol has made an unsolicited takeover offer for Integral despite the latter being 50% larger and in far better shape from an operating standpoint.

The merger is by no means over the line and Integral's board is yet to make a formal recommendation to shareholders. For the sake of argument, though, let's assume that shareholders accept Capitol's offer of 6.9 Capitol shares and 36 cents cash for every one Integral share ($2.29 equivalent).

Management forecasts the combined company would have $328m in revenue for the 2018 financial year. With 94 clinics, it would have a national market share a tad over 8%, putting it on more equal footing with the big-league players. A larger company also means a stronger arm when it comes to negotiating prices with private health insurers and equipment suppliers. For the most part, this is one industry where bigger is better.

The rock and hard place

Unfortunately, an unfavourable regulatory climate makes medical imaging low-margin work. The Government has had a 19-year freeze on Medicare rebates for the sector. In other words, without indexation, the fees imaging providers receive have been falling in real terms for the better part of two decades. Operating costs have grown faster than revenue, so margins are at all-time lows. Sonic's imaging operating margin, for example, has fallen from 27% to 18% over the past 15 years – and that's despite growth in patient out-of-pocket costs, which now average $100 per scan for X-rays, ultrasounds, CTs and MRIs.

Shrinking margins and growing out-of-pocket costs raise a scary prospect for smaller imaging operators like Capitol and Integral (or even the combined group).

Shrinking margins and growing out-of-pocket costs raise a scary prospect for smaller imaging operators like Capitol and Integral (or even the combined group).

Being larger, Sonic, Primary and I-MED benefit from various economies of scale and have higher margins than small networks (at least in theory, but we'll get to that hot potato in a moment). As patient out-of-pocket expenses grow, one of these competitors may be tempted to lower prices towards the rebate amount to increase their share of the market.

Think of it this way, when the Medicare rebate copiously covers expenses, every operator can bulk-bill. But if the rebate is only half of the cost of providing the service, it favours the larger operators who have a lower average cost due to operating efficiencies. The big guys can then charge lower prices, attracting yet more patients, in a virtuous cycle.

This might actually be the preferred outcome. If out-of-pocket expenses continue to rise, affordability becomes an issue, which discourages patients from getting tests and anchors volume growth.

This is just one risk we see to investing in these companies. The Government has agreed to end the freeze on indexation in 2020, which should help to stabilise margins. However, a lot can happen between now and then. It was only a couple of years ago that this same Government was proposing Medicare fee cuts to imaging services and co-payments for GP visits, which hammered imaging and pathology stocks (see Sonic hit by government cuts).

Our main point of contention with diagnostic imaging is that, to a large extent, providers are at the mercy of a single paying customer – the Government – and one that's hell-bent on cutting costs and reducing the number of unnecessary tests.

Vision-esque

To make matters worse, Capitol and Integral rely on an elite, highly-trained workforce – the radiologists. Around 60% of the companies' costs are salaries for technical staff, which have been rising due to a limited supply of doctors.

Less than 100 radiologists complete the specialist training program each year. The total number of radiologists in Australia has been growing at around 4% a year – which is below the 5% needed to keep up with volumes. That sort of imbalance means the doctors can do plenty of arm-twisting when it comes to salary negotiations (just ask the ex-shareholders of Vision Eye Institute how that turns out).

A large, powerful cost base and a single paying customer makes declining margins over time highly likely. Because around 80% of imaging company costs are fixed, small declines in revenue would probably translate to much larger falls in profit. With profit margins in the mid- to high-single digits, it wouldn't take more than a few percent in Medicare fee cuts or a little extra arm twisting from the doctors to shave 10–20% from net profit.

With this in mind, it was another cute moment to find in Capitol's formal offer for Integral that management forecasts the combined entity will make $69m in earnings before interest, tax, depreciation and amortisation (EBITDA) in 2018, for a margin of 21%. This compares to the 17% earned by Primary on its imaging operations and Sonic's 18%. Capitol itself only managed a margin of 13% in 2017. Believe us when we say these much larger companies know how to find efficiencies – and they also have their own GP networks to fuel referrals. We're highly sceptical that Capitol and Integral would be able to hang onto a 21% margin for any length of time.

Final thoughts

Both companies' share prices are a long way from offsetting these concerns. Capitol and Integral currently trade on free cash flow yields of 3.6% and 3.3% respectively, while, at today's share prices, the combined entity would have a market cap around 17 times the generous 2018 forecast profit figure.

The long-term outlook for imaging volumes is attractive but neither stock strikes us as being particularly undervalued given the risks. We'll keep an eye on the companies should they merge as it could make for an interesting future opportunity, but for now we'll be watching from the sidelines.