Canberra honeymoon is over, Trump channelling Oprah, Your job is ‘fine’ and more

Last Night's Markets

Canberra, the honeymoon is over – we have a problem

'You are secure in your job' – you just don't know it

Trump's Oprah move – you get a tariff, you get a tariff, you all get a tariff

Buy now, pay for it very much later – Afterpay smacked by AUSTRAC

Ask Evan

Next Week

Last Week

Last Night's Markets

| Name | Price | % Change |

|---|---|---|

| Dow Jones Industrial Average | 26,148.55 | 0.16% |

| S&P 500 | 2,892.79 | 0.04% |

| Nasdaq Composite | 7,814.66 | - 0.29% |

| The Global Dow USD | 3,001.84 | - 0.30% |

| Gold | 1,345.10 | 0.10% |

| Crude Oil WTI | 52.48 | 0.38% |

| Australian Dollar / US Dollar | 0.6868 | - 0.69% |

| Bitcoin / US Dollar | 8,432.16 | 1.99 % |

| U.S. 10-Year Bond Yield | 2.091 | - 0.005% |

Canberra, the honeymoon is over – we have a problem

We are now well and truly over the ‘miracle’ that was the 18th of May.

Yes, the country isn’t going to see the biggest overhaul to ‘investing’ in Australia (negative gearing, capital gains tax and franking credits) this side of the millennium.

But, the Canberra status quo isn’t going to sustain Australian investment either; just take a look at the post-election business and consumer sentiment numbers.

Let’s start with the NAB business confidence numbers. Conditions hit their lowest level in 5-years of 1, as its ‘profitability’ metric sank into negative territory and ‘trading’ metric slumped to 3 from 8 in April.

Conditions were saved by ‘employment’ jumping out of negative territory to 2, but this is still well below the 20-year average of 6, and it’s still within touching distance of the 4-year low.

Employment quality will remain poor in the coming period if this keeps up.

Business conditions can be summarised in one word: grim.

Now before we jump into the proverbial – business confidence spiked in May.

Remember this survey was conducted in the week post the federal election. To see confidence jump from a 6-year low in the April survey (0) to 7 (which is 1 point above the 20-year average of 6 and the highest read since July last year) is a clear indication of how much of a ‘surprise’ this was.

It also illustrates just how worried the business community was around a federal Labor government. That’s not a political statement, that's just a fact.

But, the ‘miracle’ that was the federal election and its effect on confidence, will be a ‘shooting star’ as business conditions drag down confidence, and fast.

Canberra, we have a problem.

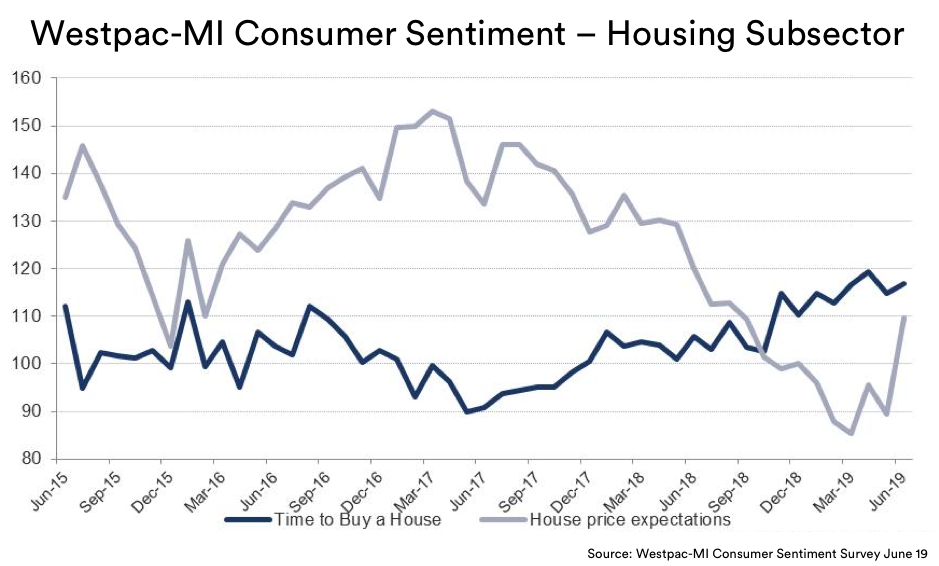

Then we got the Westpac Consumer Sentiment survey for June. This survey was conducted during the week ending June 7.

I think something might have happened during the week, as the movement in the ‘House Price Expectations’ part of the survey showed.

If there ever was a perfect picture to illustrate just how much interest rate cuts are a sledgehammer doing fine art, then this is the one.

The first time the RBA moves rates in a record 32 months with a 25 basis points CUT, and with the prospect of at least one more before the end of August — the instant reaction from the populous is their expectation around house prices, and for them to increase.

This is one part of the economy that could do without stimulus.

There were already signs that house price declines were moderating. As the chart shows ‘Time to Buy a House’ is returning to its April high of 120 but other indicators were picking up: such as auction clearance rates and month-on-month price changes.

However, if we strip out the reaction in the housing subsectors — consumer sentiment was actually disappointing, declining 0.6 per cent to 100.7 meaning we are only just ‘optimistic’.

‘Family finances vs a year ago’ are down 2.4 per cent as we are clearly feeling the pinch in the ‘back pocket’; something the RBA believes it can alleviate through interest rate cuts, however, recent history suggests it can’t.

We also clearly worried about the overall economic picture. The sub-sector around ‘Economic conditions (over the) next 12 months’ fell 4.7 per cent in June.

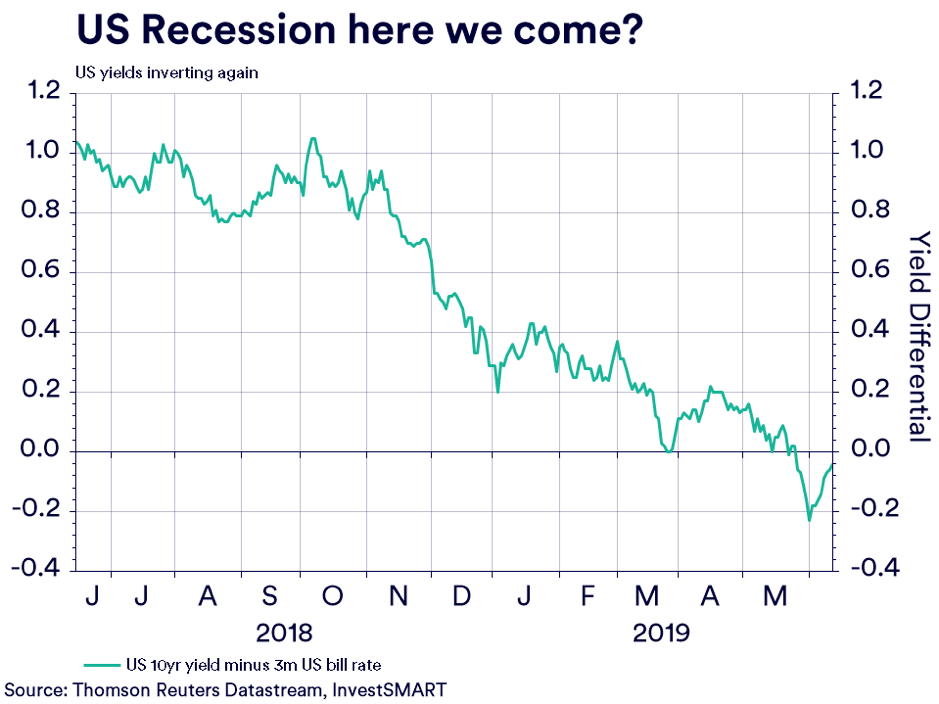

Is it any wonder we are feeling concerned about the economic outlook? The ‘US Recession Index’ is flashing red and is suggesting the US will go into recession inside the next 18 to 24 months – which could make things very interesting as 18 months from now would be right in the middle of the US Presidential elections, but more on that later.

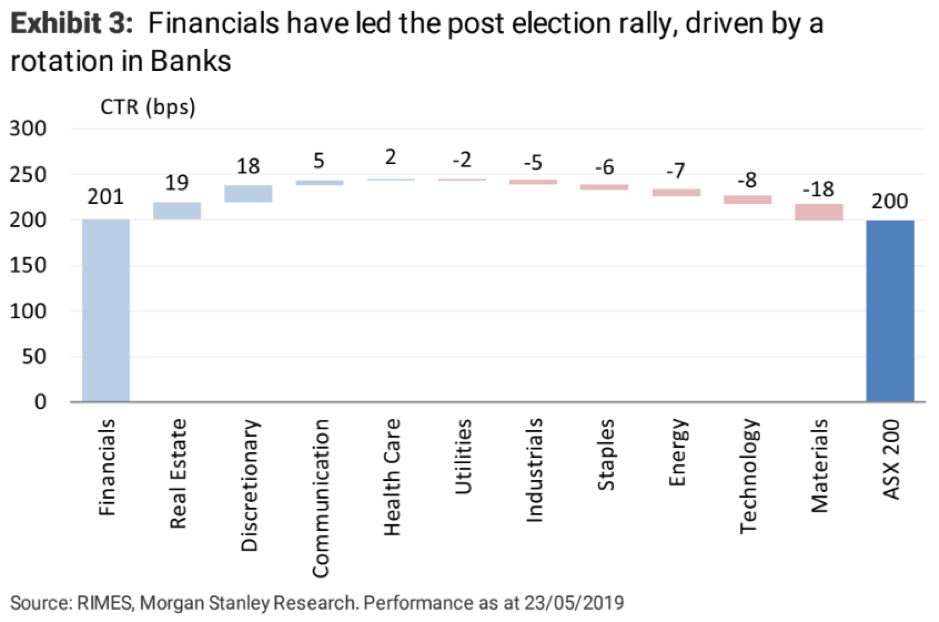

The conclusion out of all of this is the post-election pop (below is a chart of the 5 trading days post-election on the ASX) is fading fast on the economics side.

Just take a look at the weak Q1 GDP figures: sentiment is falling back, employment still has plenty of slack in it, and although there are green shoots in housing, the overall market is still sliding.

Until we see meaningful, targeted reform, one should expect the data slide to continue.

So, here’s looking at you Canberra.

‘You are secure in your job’ – you just don’t know it

If you ever want to break the internet, particularly Twitter – take a leaf out of Deloitte Access Economics Partner Chris Richardson on how to do it.

This quote from his address to the National Press Club this week lit a fuse under the keyboard warrior bigrade.

“Our jobs are becoming more — not less — secure” and follow that up with “[it] is time to dispel myths” about the future of Australian work.

It's an interesting time to be making this point. Particularly in a week that saw the release of Australia’s May employment read and further ‘clarification’ from the RBA about its views on the Australian employment market.

Just on the Australian Labour Force numbers – I can give you a one-word summary on that subject: robust.

But let’s dive into it all a little further – 42,000 jobs were created in May. Year-to-date full-time job creation is well and truly above forecast: above the RBA’s expectations and above part-time job creation.

May also registered a record level of participation – 66 per cent of the workforce population (those aged between 16 – 75) engaged in the labour market.

More and more people are returning to the labour market – particularly women, which registered their highest level of participation in the labour market in April (the May read was the third highest on record).

Another way to look at this is since the September 2016 low, when the participation rate fell to a 4-year low, approximately 300,000 people have returned to the labour market and this can only be seen as a good thing on an economic front.

However, this does mean that the level of unemployed, underemployed and underutilised people has also increased as these people were not included in the work surveys – it is these metrics that the term ‘slack’ comes into the Australian employment conundrum.

The unemployment rate held at 5.2 per cent, the underemployment rate ticked up to 8.6 per cent as did the underutilisation rate and this is the problem the RBA faces.

Until these metrics fall to (in the RBA’s view) 4.75 per cent or less for unemployment, and sub 7.5 per cent for underemployment, Australia can’t reach NAIRU.

What’s NAIRU? Non-Accelerating Inflation Rate of Unemployment which is a very technical way of saying when unemployment reaches and holds at X that inflation will remain constant.

The RBA believes this is 4.75 per cent. Thus for the RBA to stop cutting rates, it needs employment to go past NAIRU as it needs inflation.

So back to Chris Richardson’s comments – do we have more job security? Well, the statistics from Deloitte suggest we do:

“Australians are staying in their jobs longer than ever. And nor is the gig economy taking over. Casual jobs are a smaller share of all jobs than 20 years ago, and that share hasn’t moved in over a decade. The rate of self-employment has also been falling for almost 50 years and is at a record low.”

So that is now, what about the future?

“That today’s jobs are increasingly likely to require cognitive skills of the head rather than the manual skills of the hands won’t be a surprise. More than 80 per cent of the jobs created between now and 2030 will be for knowledge workers, and two-thirds of jobs will be strongly reliant on soft skills."

“Jobs increasingly need us to use our hearts – the interpersonal and creative roles, with uniquely human skills like creativity, customer service, care for others, and collaboration that are hardest of all to mechanise."

“Demand here is set to soar for decades, and this is actually a liberating trend. Much of the boring, repetitive work will be taken care of by technology, leaving the more challenging and interesting work for humans.”

If we marry these points up with the actual employment data, I am not sure one can come to the conclusion that we are ‘more secure’ in work.

Why? Well, one could argue that the increase in the participation rate is down to the increases in cost-of-living and is thus forcing people back to the labour market to get by.

The next part of that point is…what happens if the labour market softened but participation remained elevated?

This would create a huge blow out in the slack metrics, and suggest the RBA would be cutting rates further still and job security would collapse.

Yes, we might need ‘heart’ jobs in the future, but if there isn’t demand to create these jobs – so what!

The statistics may argue one thing, but I fear for the latter.

Trump’s Oprah move – you get a tariff, you get a tariff, you all get a tariff

The G-20 is only a week and a half away, however, it is a sideshow to Donald Trump's and Xi Jinping's ‘proposed’ meeting from a market perspective.

This week, Beijing and Washington held their first high-level meeting on trade since the collapse of talks a month ago.

At the time, this caused the US President to take to his anger-management tool (Twitter), and suggest that China would feel the full force of US tariffs – fun times.

So how are the talks going? US Treasury Secretary Steven Mnuchin described the exchange with China’s central bank governor as "frank and robust…during which we had a candid discussion on trade issues."

Mnuchin also stated that the President and Chinese President will meet, however, the Chinese are yet to confirm such a meeting will take place – now that is a warning sign.

The punitive actions taken over this last period have certainly raised tensions and are complicating a resolution.

Markets certainly need a resolution – look at the reaction in markets to the Mexican tariff threat.

A possible 5 per cent tariffs on Mexico was enough to send emerging markets into a tailspin and emerging market currencies plummeting. And keep in mind Mexico is only a tenth of the size of China on an economic output viewpoint.

If the Trump-Xi meeting was to collapse, all bets are off when it comes to market reactions.

These talks almost appear to be a ‘last effort’ to get it done, making them more significant than the previous issues in the US-China trade war.

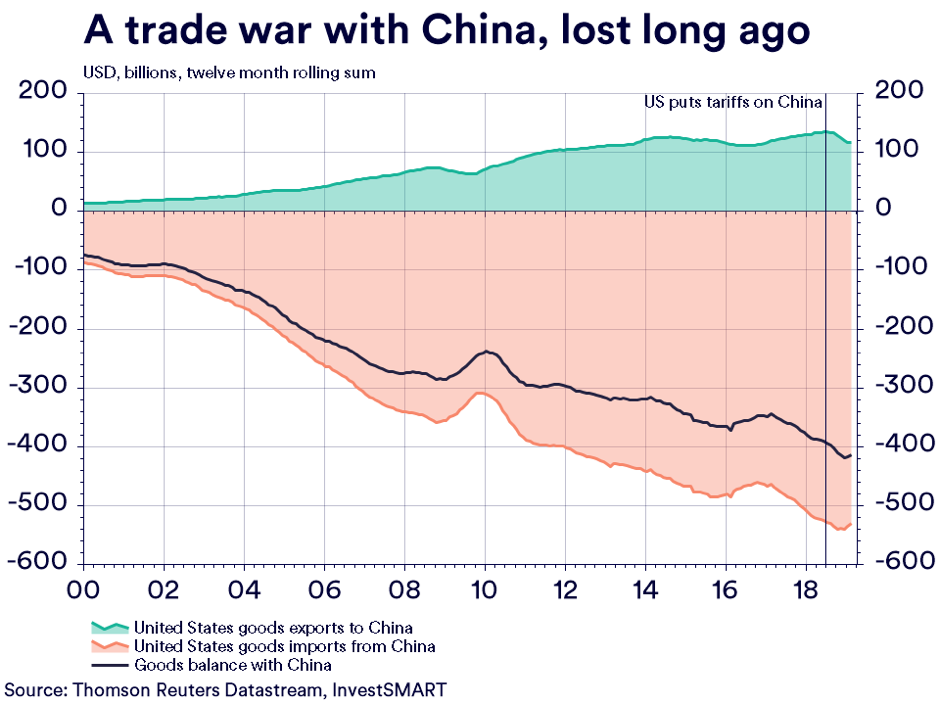

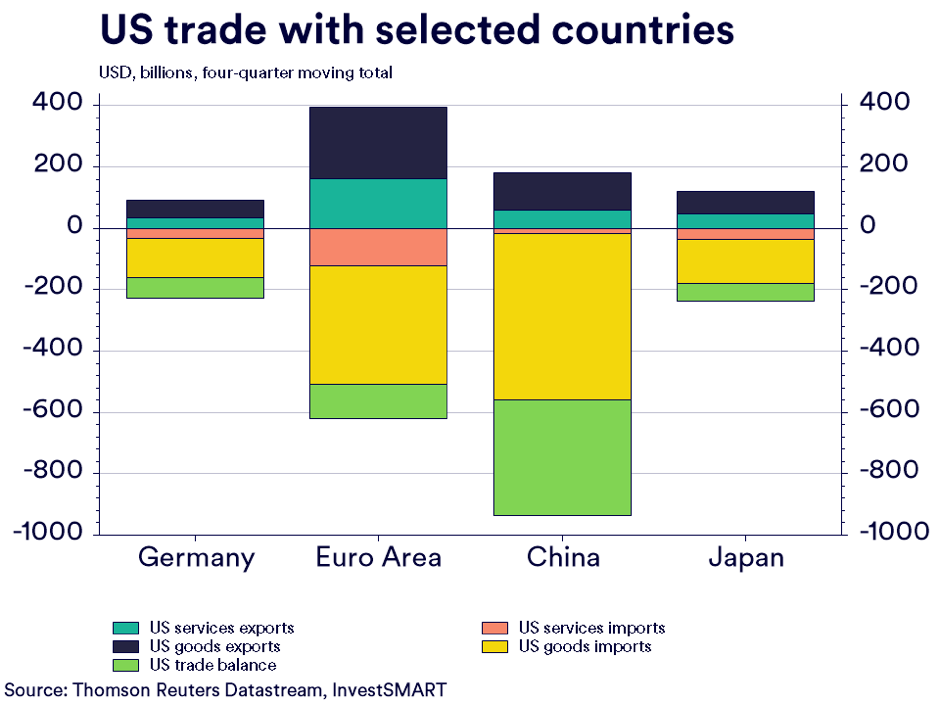

This begs the question, is Trump’s ‘get America winning again’ actually winning? The data suggests not.

This probably explains why Trump hands out tariffs like Oprah hands out cars.

His whole pitch to the US electorate (besides the ‘draining the swamp’ promise) was to rebalance the US’ trade deficits.

This clearly isn’t happening and with just over 18 months until the next election, he needs to get his skates on.

And that might mean channelling Oprah even more

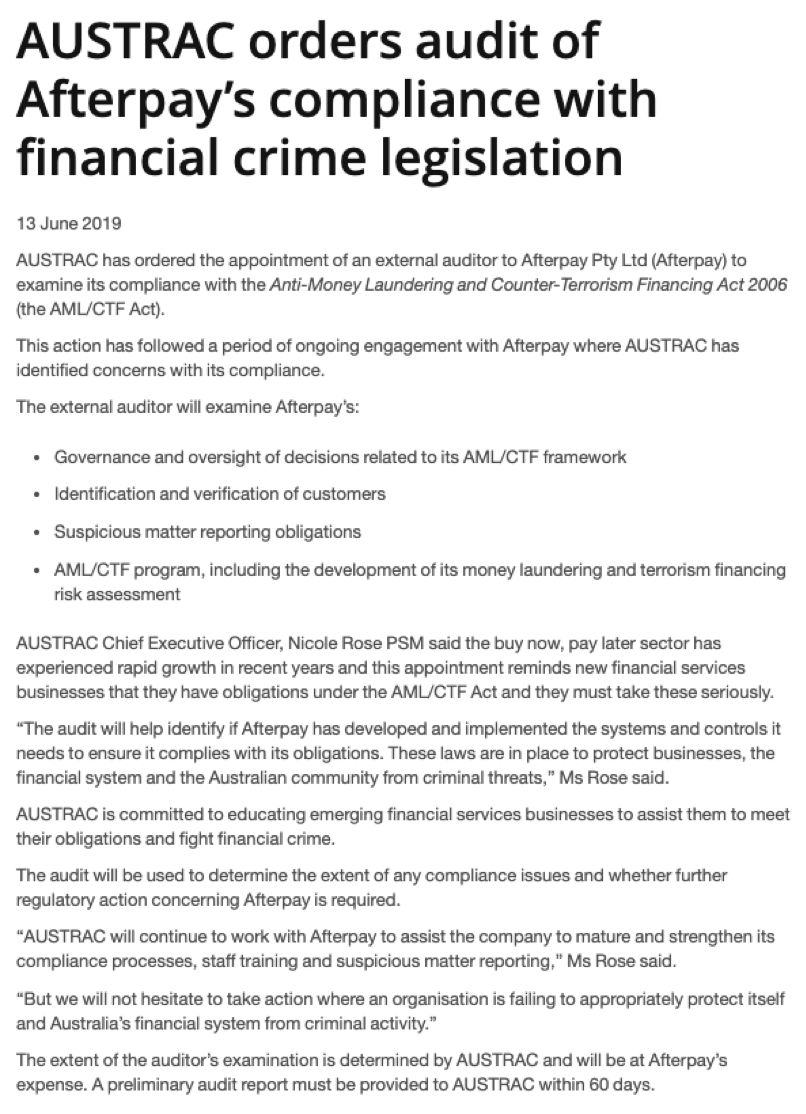

Buy now, pay for it very much later – Afterpay smacked by AUSTRAC

Afterpay – revolutionising the personal credit market one millennial at a time.

Make no mistake, this firm believes it is providing a ‘revolution’ for those on lower incomes that want a ‘better way’ to buy.

Its four easy payment system, with a ‘small’ fail fee for those that are naughty and miss a payment, has seen Afterpay become Australia’s most high-profile unicorn with a share price above $23; up some 680 per cent since listing.

There has always been questions about its internal client identification process and its ‘unregulated’ lending practices, however, the market has managed to turn a very blind eye to these facts, as Afterpay continued to deliver amazing returns and successfully launched in the US.

It's almost like the market was buying Afterpay on a ‘buy it now’, ‘worry about the possible regulatory issue later’.

Well, that ‘pay for it later’ risk may have just been called in as AUSTRAC this week issued an order for an external auditor to evaluate Afterpay’s compliance with financial crime legislation.

I’ll let you decide how much of an effect this will have on Afterpay.

Here is the official AUSTRAC release:

Ask Evan

In this week's live stream (filling in for Alan whilst he is enjoying the Scottish Highlands), I answered your questions about long-term investments for your children, how to find a good financial advisor, and where I see the market heading over the next year.

Don't forget, our Q&A live stream has migrated to a new platform on the InvestSMART website which can be found here - Alan will be back at the helm in July.

Next Week

By Ryan Felsman, Senior Economist, CommSec

Australia: Reserve Bank in focus

- In the coming week, Reserve Bank events dominate. Governor Philip Lowe’s speech in Adelaide on Thursday will hog the headlines. The minutes of the June 4 Board meeting are issued on Tuesday. On the data front, the Bureau of Statistics (ABS) provides updates on population growth, property prices and jobs. Skilled internet job vacancies figures are also issued.

- The week kicks off on Tuesday with a speech by the Reserve Bank’s Head of Financial Stability Jonathan Kearns at the Property Leaders’ Summit in Canberra at 9.15am AEST. And the Reserve Bank Board’s June 4 monetary policy meeting minutes will be keenly observed. At that meeting, rates were cut for the first time in almost three years.

- Also on Tuesday, the regular weekly reading on consumer confidence is published by ANZ and Roy Morgan. And the ABS releases its quarterly publication “Residential Property Price Indexes”. Apart from home prices, there is other data covering the average value of homes and changes in the number of homes in each state.

- On Wednesday the Department of Jobs and Small Business releases the Internet Vacancy Index for May. Vacancies have fallen for four successive months and are down by 5.8 per cent over the year to April – the weakest growth rate in five years.

- On Thursday the Commonwealth Bank issues its Business Sales Index for May. But all eyes with be on Reserve Bank Governor Philip Lowe’s speech at the CEDA luncheon in Adelaide at 11.15am AEST. The July 2 Reserve Bank Board monetary policy meeting is considered a ‘live’ meeting for another potential interest rate cut. Economists, therefore, will be scrutinising the commentary very closely for further clues on the policymaker’s views.

- Also on Thursday, the ABS releases the December quarter population estimates. Annual population growth probably held near 1.5-1.6 per cent – still one of the fastest rates across advanced nations. And detailed estimates on the job market for May are also issued. The data will include industry estimates of employment.

- On Friday, the Commonwealth Bank’s ‘flash’ services and manufacturing gauges for June are issued.

Overseas: US Federal Reserve interest rate meeting dominates

- In the US, the Federal Reserve interest rate decision is the key focus of investors over the coming week. US housing data and manufacturing gauges also feature prominently. Home prices data is scheduled in China.

- The week begins on Monday in the US when the New York Empire State Manufacturing Index is issued together with the National Association of Home Builders’ (NAHB) Housing Market Index for June. Home building sentiment in the north-eastern region of the US rose by 10 points to 65 points in May - the highest level since October 2005.

- On Tuesday in China, home price data is scheduled. Home prices rose 10.7 per cent in the year to April – the strongest growth in two years. Economists are forecasting prices to grow by 12 per cent over the year to May.

- Also on Tuesday in the US, the regular US weekly data on chain store sales is scheduled along with the monthly update on housing starts and building permits for May. Starts rose by 5.7 per cent to 1.235 million units in April, driven by gains in the construction of both single and multi-family housing units. Sentiment was boosted by declining mortgage rates and drier weather in the Mid-west region of the US. A 0.4 per cent lift is tipped in May.

- On Wednesday the US Federal Reserve Open Market Committee (‘FOMC’) hands down its interest rate decision following its two-day meeting. No change in the Federal Funds target rate of 2.25-2.50 per cent is expected in the near term after the FOMC’s ‘dovish’ commentary earlier this year.

- While US policymakers are expected to remain data-dependent, economic growth is expected to slow to an annual growth rate of closer to 2 per cent by year-end as the corporate tax cut stimulus fades. But late-cycle growth remains supported by solid consumer spending on the back of labour scarcity and low joblessness. That said, persistently low inflation and the intensification of US-China trade tensions could necessitate policy action.

- Also on Wednesday, the regular weekly reading on new mortgage applications are released.

- On Thursday, the US current account deficit is forecast to narrow to US$130 billion in the March quarter from US$134.38 billion in the December quarter.

- Also on Thursday, the influential Philadelphia Fed Manufacturing Index, Conference Board Leading Index and the usual weekly data on claims for unemployment insurance are all released.

- The ‘Philly’ Fed factory gauge will likely remain sensitive to negative trade headlines. And growing inventories are also weighing on US output. A weakening in conditions is expected in June after the US increased import duties (tariffs) from 10 per cent to 25 per cent on US$200 billion worth of Chinese goods on May 10. That said, the proposed 5 per cent US tariffs on Mexican goods have been averted for now.

- On Friday, IHS Markit issues June ‘flash’ manufacturing indexes. Factory activity is contracting in Germany and Japan. The final US gauge fell to 50.5 points in May, the lowest reading since August 2009.

- Also on Friday, US existing home sales figures are issued for May. An increase of 1.4 per cent is forecast by economists.

Last Week

By Shane Oliver, Head of Investment Strategy and Chief Economist, AMP Capital

Investment markets and key developments over the past week

- Share markets, rose over the past week with the combination of expectations for rate cuts/policy stimulus and the tariffs being avoided on Mexico offsetting ongoing uncertainty about the US/China trade war and geopolitical tensions in the Middle East and Hong Kong. Australian shares made it to an 11 year high led by resources stocks and defensive sectors like healthcare, telcos and consumer staples. Despite a boost from more ship attacks near the Strait of Hormuz oil prices fell not helped by rising US stockpiles, but metal and iron ore prices rose. The $A fell as the $US rose on safe-haven demand and RBA rate cut expectations increased.

- Trade war uncertainty is likely to ramp up even more over the next two weeks ahead of a possible Trump/Xi meeting at the 28-29 June G20 summit. President Trump, perhaps emboldened by his success with Mexico, is doing his usual Art of the Deal stuff in ramping up the threats of more tariffs, but so far it seems the Chinese are reluctant to play ball and haven’t confirmed whether the meeting will occur or not. Our view remains that a deal will eventually be reached given the damage not doing so will cause to both economies and hence Trump’s 2020 re-election prospects. But the risk is that China really has dug in for another “long march” and will hope that the damage to the US economy will see Trump lose next year and they can negotiate with a new president.

- Weak inflation is well and truly a global phenomenon. May data for inflation showed falling core inflation rates in the US, China, Eurozone, India, South Korea and Thailand. All of which supports lower for longer interest rates and bond yields. Last year’s fears of rising global inflation and interest rates proved yet again to be another false dawn. Just as well the RBA did not raise rates to prepare for higher global rates as some were advocating a year ago. If it had done that we would be facing even weaker growth and inflation and a higher risk of recession.

Major global economic events and implications

- US economic data released over the last week was generally solid with small business confidence rising to its highest in seven months and with job openings, hiring and quits remaining strong suggesting that the weak May payrolls report may be an aberration, albeit jobs growth may be slowing. Mortgage applications to purchase and to refinance have also surged higher implying a boost to household spending power and home buyer demand. Meanwhile, core consumer price inflation fell to 2 per cent year on year in May (implying core private final consumption deflator inflation of around 1.5 per cent yoy) and producer price inflation slowed. Ongoing low US inflation just adds to the probability that the Fed will cut rates this year.

- Chinese imports fell more than expected in May suggesting weak domestic demand growth. Exports surprisingly rose but this may reflect front running of the latest US tariff hike. While rising food prices (partly due to swine flu) pushed up consumer price inflation in May, underlying inflation was soft at 1.6 per cent yoy and producer price inflation fell to just 0.6 per cent yoy suggesting that inflation remains no barrier to further policy easing in China. On the policy front, credit growth edged slightly higher in May consistent with easier monetary policy and the government made it easier to finance infrastructure projects underlining that infrastructure will be a key plank of its stimulus plans.

Australian economic events and implications

- Australian data releases over the last week were messy. While the NAB business survey for May showed a post-election bounce in confidence business conditions weakened further. Consumer confidence softened in June with responses up after the election but falling sharply again after the rate cut and weak GDP data. Australians’ caution in regards to spending and taking on debt is highlighted by a continuing roughly 25 per cent of surveyed Australians in the Westpac/MI consumer survey responding that paying down debt is the wisest use for savings, which is way above the pre-GFC norm.

.jpg)

Source: Westpac/Melbourne Institute, AMP Capital

- And while employment rose solidly in June the details were weak with full-time jobs soft for two months in a row, temporary election workers likely driving the surge in part-time jobs and unemployment flat at 5.2 per cent and the total of unemployment and underemployment remaining very high at 13.7 per cent. What’s more falling job advertisements point to slowing jobs growth ahead. Our assessment remains that unemployment will rise to 5.5 per cent by year-end.

- I am not a great fan of the various “stars” – GDP* or potential GDP, r* or the natural rate of interest, or U* the so called non-accelerating inflation rate of unemployment because they are all hard to measure with much accuracy. They are all useful in making economists look scientific but their value is dubious when you get up close. Look at last year’s crazy predictions that US inflation was about to take off because the US was above GDP*, below U* and below r*. We are still waiting as inflation falls again! And so I have failed to put much effort into working out what U* is in Australia. That said the RBA does so I guess I should pay some attention. Assistant Governor Ellis has reinforced Governor Lowe’s message that U* or NAIRU has likely fallen in Australia to maybe around 4.5 per cent. All of which highlights the problem for the RBA because actual unemployment (let alone underemployment) is well above this and looks likely to rise further as growth remains weaker than necessary to absorb new entrants to the workforce. Which brings us back to our conclusion that the cash rate is likely heading to 0.5 per cent by early next year, more fiscal stimulus is desirable to help the RBA and QE - or better still direct RBA financing of government spending - is increasingly likely.

- There is some good news on the fiscal stimulus front with the Federal Government considering speeding up small infrastructure projects to help the economy and NSW flagging another round of asset sales to fund new infrastructure spending. The suggestion to bring back Joe Hockey’s asset recycling program to encourage state infrastructure spending makes sense. On current plans, public sector capex growth will peak this year so needs to be extended to help offset the housing downturn.

What to watch over the next week?

- Interest rates will be the focus in the week ahead with the Fed meeting Wednesday, the Bank of Japan and Bank of England meeting on Thursday and RBA minutes and a speech by RBA Governor Lowe.

- In the US, the Fed is likely to remain on hold but signal that rate cuts are probably on the way. A rate cut is possible following Wednesday’s meeting but the Fed is more likely to wait for a bit more clarity on the US/China trade war with a possible G20 meeting between Trump and Xi in late June and also wait to see whether the soft payroll report for May was an aberration or not. However, with the rising trade threat to growth, some economic data weakening and inflation running below target it is likely to signal that it is open to cutting rates if needed, its inflation forecasts are likely to be revised down and the so called dot plot of Fed officials interest rate expectations is likely to move lower. Fed Chair Powell also speaks Wednesday and is likely to lean dovish. We anticipate two Fed rate cuts this year.

- On the data front in the US, business conditions PMIs to be released Friday will be watched closely to see if there is any improvement after recent declines which were partly due to trade related uncertainty. Meanwhile, expect a slight rise in home builder conditions (Monday), flat housing starts (Tuesday) and a rise in existing home sales Friday.

- Eurozone business conditions (Friday) are expected to show continuing signs of stabilisation after last year’s fall.

- The Bank of England (Thursday) is expected to leave monetary policy on hold.

- The Bank of Japan is also expected to leave monetary policy on hold on Thursday but with a strong easing bias. On the data front expect core inflation to remain soft (Friday).

- In Australia, the minutes from the RBA’s last board meeting (Tuesday) and a speech by RBA Governor Lowe (Thursday) are expected to maintain a strong dovish bias and reinforce expectations of further rate cuts. On the data front expect March quarter ABS data to show a further 3 per cent decline in national dwelling prices (Tuesday) based on private sector surveys, skilled vacancies to have fallen again in May (Wednesday) and December quarter population growth (Thursday) to have remained strong at around 1.6 per cent yoy. NSW and SA will release their budgets on Tuesday with falling stamp duty revenue likely to impact NSW.

Outlook for investment markets

- Share markets are likely to see further volatility and weakness in the short term on the back of uncertainty about trade and mixed economic data. But valuations are okay – particularly against low-interest rates, global growth is expected to improve into the second half if the trade issue is resolved and monetary and fiscal policy has become more supportive of markets and will likely become even more so all of which should support decent gains for share markets through 2019 as a whole.

- Low yields are likely to see low returns from bonds, but government bonds remain excellent portfolio diversifiers.

- Unlisted commercial property and infrastructure are likely to see reasonable returns. Although retail property is weak, lower for even longer bond yields will help underpin unlisted asset valuations.

- National average capital city house prices are likely to remain under pressure from tight credit, record supply and reduced foreign demand. However, the combination of imminent rate cuts, support for first home buyers via the First Home Loan Deposit Scheme, the relaxation of the 7 per cent mortgage rate serviceability test and the removal of the threat to negative gearing and the capital gains tax discount point to house prices bottoming out by year end and higher than we had been expecting. We see a 12 per cent top to bottom fall in national capital city average prices. Next year is likely to see broadly flat prices as rising unemployment acts as a bit of a constraint.

- Cash and bank deposits are likely to provide poor returns as the RBA cuts the official cash rate to 0.5 per cent by early next year.

- The $A is likely to fall further to around $US0.65 this year as the gap between the RBA’s cash rate and the US Fed Funds rate will likely push further into negative territory as the RBA moves to cut rates by more than the Fed does. Excessive $A short positions and high iron ore prices may help provide some support through and will likely prevent an $A crash.