Can the Trump bump continue indefinitely?

John Addis

Can the Trump bump continue indefinitely?

The Trump bump has lasted longer than I expected. In fact, it was a surprise to me it even existed in the first place. Despite what appears to be a permanent state of chaos in Washington, investors have maintained their optimism, preferring rising stock prices over the President's Twitter feed. Even North Korean missile tests and skirmishes in the South China Sea appear not to quell their enthusiasm. FBI investigation or not, The Lego Movie's terrifically annoying ditty “Everything is awesome” seems a suitable soundtrack to the last few months.

There's no denying the strength of the numbers, either. The US economy added an impressive 222,000 jobs last month and, although the unemployment rate ticked up to 4.4 per cent, the economy is effectively running at full employment. This is a concern for economists working with outdated models, which could be all of them. At full employment, the theory goes, workers demand greater pay rises. Wage increases then feed into higher prices and bingo - before you know it rates are back into double-digits and everyone's defaulting on their mortgage.

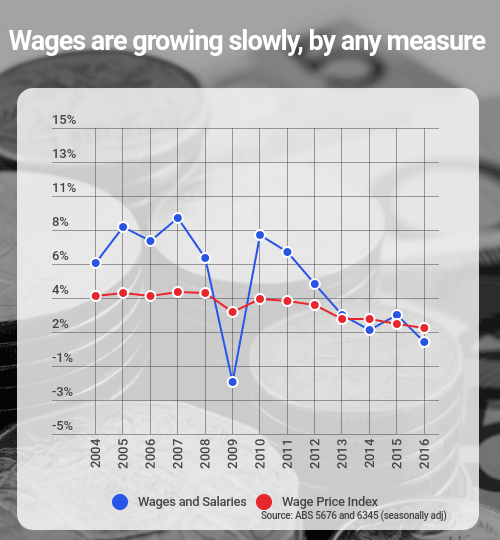

The Phillips Curve, as it became known, looks like an old view of the world, one that existed prior to globalisation when unions had countervailing power with their employers. The more I look, the less I find any evidence of wages growth anywhere. Despite payrolls jumping 220,000, average hourly earnings rose a pathetic 0.2 per cent over the period. That means a strong jobs market is unlikely to spark inflation. The US economy is now in its eighth year of recovery and for most of that time the Fed has undershot its 2 per cent inflation target.

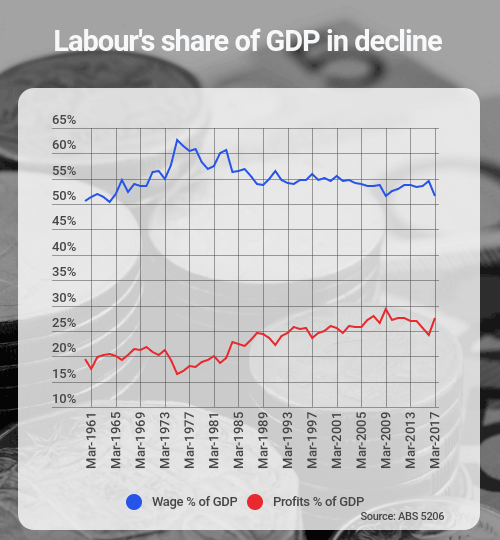

The story isn't much different here. In the year to March, commodity price rises helped push up corporate profits by 40 per cent while wages grew just 0.9 per cent. Last month, RBA governor Philip Lowe identified record low wage growth and labour's declining share of national income as a threat, urging workers to ask for pay rises.

Ain't going to happen Phil. And Lowe recognised it himself, saying that workers feared losing their jobs to “foreigners and the robots” and wouldn't push their luck. The labour share of GDP is now at the lowest level since 2009 while the share going to profits is at a five-year high. Go robots.

The odd thing in all of this is that despite record high corporate profits and flat wages growth, there's no sign of improving productivity. Adam Boyton, chief economist for Australia at Deutsche Bank, told The AFR this week that, “In the heyday of the 1990s and early 2000s, productivity growth in Australia averaged around 2.5 per cent. If we had sustained that it would have taken a little less than 30 years for average incomes across the economy to double after inflation". But over the past decade it has averaged just 1.25 per cent, which means it will take around 55 years for real incomes to double. It isn't just house prices that are stuffing first home buyers, it's the fact their incomes aren't growing at the pace they traditionally have.

These structural issues are something investors appear happy to ignore for the time being because, you know, dividends. That has permitted the stocks caravan to roll along, passing every speed bump as if it were a fly on the road.

The ASX 200 may have dropped 3.2 per cent since the recent high on May 1 but the US S&P 500 has been cracking along, up 17.4 per cent since the recent low on 4th November. The NASDAQ too has soared. We're now in the midst of the second-longest bull market since WWII. In the US, valuations have only been higher before the tech stock crash and the global financial crisis. Gulp.

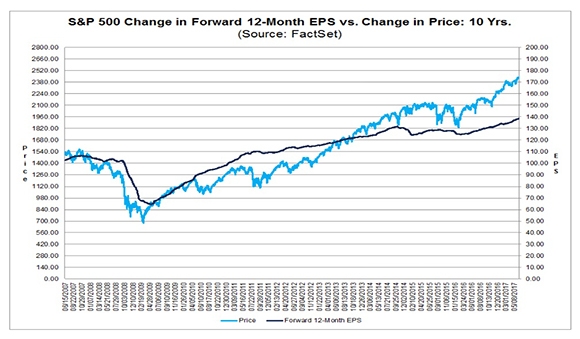

Is this justified? Well, look hard enough and you can find justification for pretty much anything (except the aforementioned lack of productivity growth). The Trump trade - the promise of massive tax cuts and infrastructure investment - is a simplistic placeholder for a more complex truth; that ultimately, higher prices can only be justified by earnings growth.

And there is some of that, here and in the US. Last month, Factset reported that the estimated earnings growth rate for the second quarter of 2017 for the S&P 500 is 6.5 per cent and that the forward 12-month price-to-earnings ratio was 17.7. That's high but not stupidly so. The five-year average is 15.3 and the 10-year figure 14.0.

Sounds reasonable, except for the fact that the energy and technology sectors account for almost all of that earnings growth. Strip out these big winners and a very different story emerges, one that does give US investors some cause for concern, especially those not invested in the FAANGs - Facebook, Apple, Amazon, Netflix and Google - that have accounted for a large part of the rise this year.

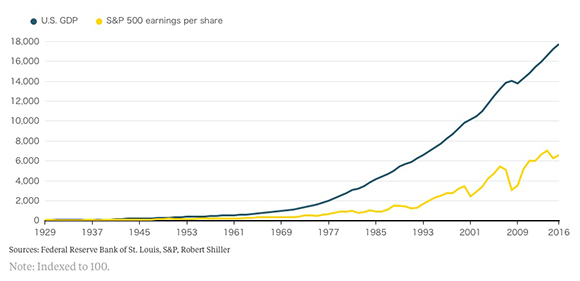

Wall Street has no such hesitation. Since 2008, earnings have risen at about 10 per cent a year but analysts expect earnings growth of 22 per cent in 2017 and 23 per cent in 2018. Blimey. And yet GDP growth has risen at just 2.9 per cent annually over the same period. Is it realistic to expect earnings to outpace GDP growth over a sustained period? Not really. This chart, via Bloomberg, shows earnings per share growth lagging GDP growth over the long term.

That makes a lot of sense. As Jeremy Grantham of GMO is fond of pointing out, corporate profits as a percentage of GDP is one of the most mean reverting numbers in finance. That fact that it hasn't been doing much reverting lately is giving perma bears like Paul Tudor Jones and Jim Rogers all the ammo they need to generate scary headlines.

Jones has said that US stocks should “terrify” Janet Yellen while Rogers is really glad his kids can speak Mandarin because “the Federal Reserve ... has no clue what they are doing. They are going to ruin us all". CEO of Morgan Creek Capital, Mark Yusko, was more measured this week, telling CNBC there was a “huge” bubble in US stocks reminiscent of 1928-29. Righto.

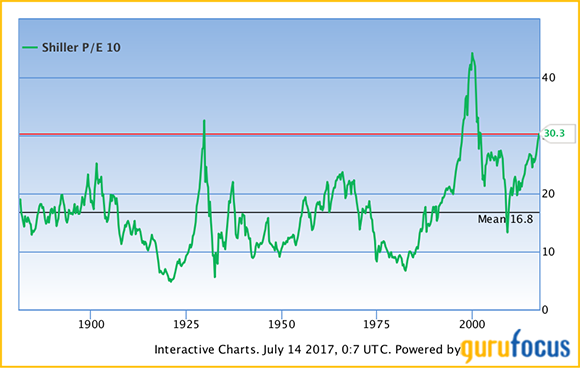

One of the problems with a single metric like the forward 12-month earnings per share figure is that earnings are not averaged over the course of the cycle. In June 2009, which would have been a fantastic time to buy the S&P 500, earnings were at a mid-GFC cyclical low. But the price-to-earnings ratio was still above 23 at the time, which goes to show the limitations of the exercise. The Shiller P/E ratio endeavours to address this by averaging earnings over the preceding 10 years and adjusting for inflation. Currently, the Shiller P/E sits at 30.3, a huge 80 per cent higher than the historical mean of 16.8.

Either way, I wouldn't be buying US stocks now and am thinking it might be time to take some profits on my Apple holding. As a Fidelity fund manager wrote this week, “bull markets are born on pessimism and die on euphoria". US markets seem more than a little heady right now.

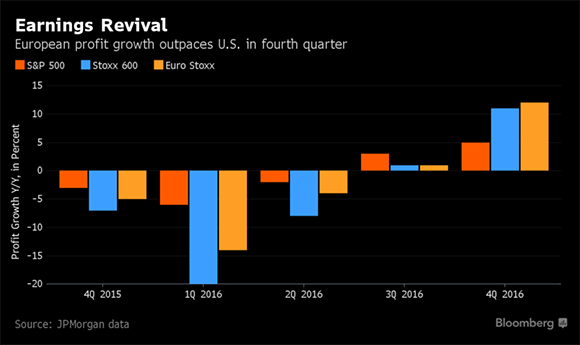

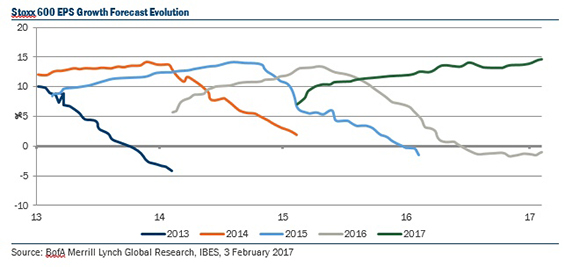

While volatility is worryingly low on US markets there are signs of life in Europe, where the continent's biggest companies are climbing out of the primordial soup and posting earnings upgrades. For Australian investors looking at expensive US stocks and the perpetually worrying data from China, this can't come soon enough.

This week Thomson Reuters reported that the STOXX 600, an index covering 600 large cap listed companies in 18 European countries, was delivering year on year earnings growth of over 20 per cent. We'll know more next week when more companies report second quarter earnings but expectations are for a 9 per cent increase on the corresponding quarter last year. But in the first three months of the year, profit generation was higher than at any time in the preceding six years, especially among Europe's beleaguered banking sector.

Is Europe turning a corner? Well, maybe. Unemployment is falling - the UK and Estonia are the only countries expected to experience an increase in joblessness in 2018; GDP growth among the EU28 was about 2 per cent last year; bond yields have rebounded and credit growth is accelerating. There remain the same old problems with debt and deflation but after such a prolonged recession these are encouraging signs. The euro remains ill-conceived but a continent-wide recovery will increase its chances of just hanging around.

So, there's a little fillip for your weekend. Enjoy the rest of it and make room for a buttered croissant.

Next Week

Craig James, CommSec

Reserve Bank dominates the calendar

- If it wasn't for the Reserve Bank, the coming week would be largely devoid of market-moving events. There are three speeches scheduled by Reserve Bank officials, in addition to the publication of minutes of the last policy-making Board meeting. There are also figures on car sales and jobs to watch.

- In Australia the week kicks off on Tuesday with the Australian Bureau of Statistics (ABS) releasing data on new vehicle sales. The industry data has already been released by the Federal Chamber of Automotive Industries and that showed that sales in June were the highest on record for a June month.

- Clearly both businesses and consumers have been active in buying new vehicles. In June, 52 per cent of sales went to private buyers; 40 per cent of vehicles were bought by businesses; and the remainder were purchased by government or rental companies.

- Also on Tuesday the Reserve Bank releases details (“minutes”) of the Board meeting held on July 4. There was much conjecture that Board members would make take on a more ‘hawkish' posture at the meeting – that is, raise the prospect of higher interest rates ahead.

- Instead the text of the rate decision deviated little from that used in the past couple of months. Still, analysts will look closely at the Board minutes in the hope of uncovering some subtle changes in rhetoric.

- In addition, ANZ and Roy Morgan release the weekly consumer sentiment survey on Tuesday. Lower fuel prices are serving to boost sentiment although offset by on-going political wrangling.

- On Wednesday, the Head of the Reserve Bank's Economic Analysis Department, Alex Heath, will participate at the Women in Economics panel at the Australian Conference of Economists.

- On Thursday, the ABS will release the monthly job report. In May, employment surprised all and sundry by rising by 42,000 in May after rising by 46,200 in April (previously reported as a rise of 37,400 jobs). Full-time jobs rose by 52,000 while part-time jobs fell by 10,100. By contrast, economists had tipped a near 10,000 increase in jobs. And not only did jobs lift, but hours worked rose by 1.9 per cent in May (biggest rise in 11 years) and the unemployment rate fell from 5.7 per cent to a 4-year low of 5.5 per cent.

- In June we suspect employment rose by a more pedestrian 15,000 while the jobless rate probably held stable. Another month of strong job growth would start to generate speculation that higher wages lay ahead. The implication is that this could lead to higher price inflation and higher official interest rates.

- Also on Thursday the Commonwealth Bank will release the June results of its Business Sales Indicator – a measure of economy-wide spending derived by assessing credit and debit card transactions.

- On Friday, there are two speeches from senior Reserve Bank officials. In Adelaide, Deputy Governor Guy Debelle delivers a speech – “Global Influences on Domestic Monetary Policy” – at the CEDA/University of Adelaide luncheon.

- And in Melbourne on Friday Michele Bullock, Assistant Governor (Financial System), speaks at the Melbourne Institute/The Australian Economic & Social Policy Conference.

Chinese economic growth figures take centre-stage

- In the coming week investor attention will be dominated by the release of the Chinese economic growth figures.

- In fact the week kicks off in China on Monday with these June quarter economic growth figures. While some may question the veracity of the data given that it is issued just 17 days after the end of the quarter, it still has the potential to move financial markets, especially currencies.

- In the March quarter the Chinese economy – the world's second largest – grew at an impressive 6.9 per cent annual rate and 6.8 per cent growth is tipped in the June quarter.

- Also on Monday, the Chinese National Bureau of Statistics will release monthly data on retail sales, production and investment.

- In the US on Monday, the New York Federal Reserve releases its influential regional manufacturing survey.

- On Tuesday in China the June data on house prices is released. Annual growth has likely peaked, although growth was still lofty at 10.9 per cent in the year to May.

- In the US on Tuesday, there is a bevy of data to be released – although to be honest, it is unlikely to cause a ripple in financial market pricing. The National Association of Home Builders releases its July Housing Market index. In addition, June figures on import and export prices are released together with May data on capital flows and the usual weekly data on chain store sales.

- On Wednesday, in the US the June data for building permits and housing starts are released. The figures provide early guidance on housing market and retail activity. The problem is that the data can prove volatile from month-to-month. In May, starts fell by 5.5 per cent but an 8 per cent rebound in commencements is expected in June.

- On Thursday, the weekly figures on claims for unemployment insurance are released together with the June leading index and the influential Philadelphia Federal Reserve business index. The leading index may have lifted by 0.3 per cent in June after a similar rise in May. But the Philly Fed index is tipped to ease from 27.6 to 22.9 in July.

- Also on Friday, data on business inventories is issued, alongside industrial production, and the University of Michigan confidence reading.

Craig James is chief economist at CommSec.

Readings & Viewings

Researchers tried to run the numbers on Trump's ridiculously vague tax plan. They're not good. Trump's tax cuts would give the poor $40 each and the ultrarich $940,000.

Vanguard, manager of $US4.4 trillion and leader in the index fund business, is getting a new CEO.

Hedge fund titan Paul Singer scored a big win during the week after NRG Energy surged 25 per cent in a single day.

Qatar Airways is still pursuing a stake in American Airlines after a code share hitch.

Google was spared a $US1.3 billion tax bill this week with a historic victory in a French Court.

BlackRock's top economist thinks Bitcoin and Ethereum look like a bubble.

Giving up the ghost: Investors bail on Snap.

Only in America, but maybe it could work here. Chick-fil-A offers free entrees to cow-dressed customers on Cow Appreciation Day, July 11.

Twitter names former Goldman Sachs banker Ned Segal as CFO.

Meanwhile, a man who checked in a can of beer as luggage has become the toast of Twitter.

Food trumps coal as NSW refunds Shenhua $262 million for its Liverpool Plains licence.

Amazon shares are back above $US1,000 and could be on a crash course to $US3,000.

BoE's Broadbent says he's not ready to hike rates.

Brexit brings house price surge to Frankfurt as commuting London bankers prepare to move.

The rise of robots will 'break the social ladder' and could cost 15 million UK jobs, says report.

Over in New Zealand, the Xero board is grappling with growth and profit tension.

China's export, import growth accelerate in June.

How worried should we really be about security firm Kaspersky Lab's ties to Russia?

How to work side hustles so you don't lose your day job.

The end of cash? Cards now account for more than half of retail purchases, BRC finds.

And that means incidents like this one will be a thing of the past, hopefully. During the week a man trapped inside an ATM machine needed to slip handwritten "please help" notes through the receipt slot.