Bottling Karoon's gas discovery

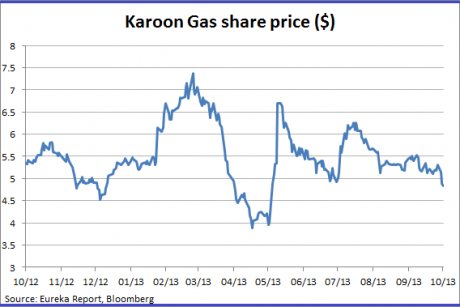

| Summary: The announcement of a substantial gas flow last month from one of its key tenements off the Western Australian coastline should have sent Karoon Gas’s share price rocketing. Instead, the company’s shares dipped – and are still 5% from their closing price on the day of the announcement. But the market sees lots of price upside from Karoon, with further asset-trading deals around the company’s tenements on the horizon. |

| Key take-out: Karoon is being steadily “de-risked” through its discovery and the ability to raise capital by selling equity in its gas fields. |

| Key beneficiaries: General investors. Category: Shares. |

| Recommendation: Outperform (under review). |

There isn’t an official competition to determine the most undervalued stock on the ASX. But a contender for the title is the significantly under-rated Karoon Gas, which has seen its shares fall this week despite making what appears to be a world-class gas discovery off Australia’s northern coast.

At today’s closing price of $4.90, Karoon was 45c, or 5%, below its closing price of $5.35 immediately after it reported on September 17 a big gas flow from its Proteus well, which is the latest test from the wider Poseidon project (no connection to the nickel mine of the same name) in Kimberley waters.

The share-price fall is significant for several reasons, because it appears to be the result of a big American fund management company, FMR LLC (part of the giant Fidelity group) lessening its exposure to Australia, and because the Proteus/Poseidon discovery has the hallmarks of being a “company maker” for Karoon.

Fidelity’s sell-down via on- and off-market trades has been underway for several months and is revealed in substantial shareholder notices filed at the ASX. The latest was on September 19, showing net sales of more than 332,000 Karoon shares – a move which lowered FMR’s stake in the stock from 6.57% to 5.56%, reducing its position from the third to fourth-biggest owner of Karoon stock.

The biggest shareholder, with a 13% stake, is Boston-based fund manager Wellington Management Company LLP. The second-biggest, and the major Australian shareholder, is Talbot Group – the business created by the late Ken Talbot, who died in a plane crash in Africa in 2010.

Why Fidelity is selling at a time when Karoon looks to have created significant value for its shareholders is only a question its managers can answer (and they’re not going to), but there seems little doubt that when an investor the size of Fidelity decides to trim its exposure to a stock it sends a negative signal.

Other investment specialists do not agree with Fidelity’s move. UBS, Citi, Credit Suisse, Deutsche Bank and Macquarie rate Karoon as a stock that will outperform.

In Macquarie’s case, the enthusiasm bubbles over with the local bank tipping a 12-month price target for Karoon of $9, which is close to double today’s closing price. UBS has $8.10 as a target, and Deutsche $7.61. Even the lowest 12-month target price of $6.27, from Citi, is $1.37 (or 28%) higher than today’s close.

It is possible that Fidelity has concerns about the outlook for Proteus/Poseidon, especially the time and cost of converting it from a discovery into a development. This is an understandable position given the routine cost blow-outs, completion delays, and regulatory hurdles dogging the Australian resources sector.

The best way to look at Karoon is as an explorer that has made a significant discovery, and has the potential to make more as drilling continues on its tenements in Australian waters, and off the coast of Brazil.

There is considerable risk in the exploration process, but the stock is being steadily “de-risked” through its discovery and the ability to raise capital by selling equity in its gas fields.

The de-risking process is important for a relatively small stock (capitalised at $1.25 billion), which is playing in the same space as global majors. If not handled carefully, it could be an issue that hurts Karoon’s share price. Another issue, and the one which affects all explorers, is the need for ongoing drilling success – a risk which cannot be controlled. If future holes are dry, Karoon’s share price will fall.

A promising gas flow

What happened last month is that the Proteus well flowed gas at a very respectable 7.3 million cubic feet a day through equipment, which was constrained by size. With more robust equipment able to handle large volumes of high-pressure gas, the flow could have been up to 100 million cubic feet a day.

More important than the daily flow rate was the fact that the Proteus well effectively confirmed the potential for the Poseidon project to contain at least 4 trillion cubic feet of gas – the minimum requirement to support an LNG project with a 20-year life.

News flow from Karoon’s drilling off the Kimberley coast, and from possible asset-trading deals, will continue into next year.

The Grace No.1 well will be the next exploration development to watch, as will potential risk-mitigating sales of equity in some of the tenements the company controls.

The key to Karoon’s Australian offshore assets is their location in the Browse Basin, which is home to some of the country’s biggest gas discoveries including Woodside’s Torosa, Brecknock and Calliance fields (which constitute its stalled Browse development). There is also the Ichthys gas field being developed by Japan’s Inpex and partners, and the Prelude gas field of Royal Dutch Shell, which will be the site of the world’s first floating LNG development.

Bang in the middle of all this activity are three tenements controlled by Karoon: WA-398-P, WA-315-P, and WA-314-P.

The Poseidon discovery, which has had several wells drilled (including the latest, Proteus) lies across the 398 and 315 tenements and has already seen asset shuffles with Karoon’s partner, the US oil giant ConocoPhillips. It recently sold a 20% stake to PetroChina for $US371 million.

That deal was negotiated before the Proteus discovery further boosted confidence in the Poseidon project and the value of the equity stakes in the asset, which should earn Karoon a price premium if it decides to sell more equity in the project.

UBS has estimated that a 10% stake in Poseidon could now be worth up to $US281 million.

Asset-trading is likely to be as big a feature as exploration news in what happens next in Karoon’s Kimberley tenements. This could revolve around the most northern of the company’s acreage, the 314 tenement, in which Karoon currently has a 90% stake. A such, it also means Karoon might have to foot the bill for 90% of the costs of the Grace No.1, which could be up to $80 million. Yet, this is an unlikely event given the risk-mitigation strategies followed by most oil companies in high-cost exploration projects.

As well as news events in its Australian assets, Karoon is expected to next year start drilling in its Brazilian tenements which, like those off the Kimberley coast, are surrounded by major discoveries.

UBS, in its September 17 assessment of Karoon and $8.10 target price, notes that there are “plenty of catalysts ahead for investors.”

For most investors, stocks like Karoon have a high-risk profile but the company has a track record of balancing its exposure to risk, and of being able to leverage off discoveries to generate the capital to pay for ongoing exploration.