Bonds: what the hell, Trump Theatre, Europe’s Banks, Phoslock, AMP, and more

Last Night's Markets

Bonds: what the hell?

Trump Theatre

Europe’s Banks

Phoslock

Does AMP have a point now?

Marcello Has Moved

Research and Diversions

Ask Alan

Next Week

Last Week

Last Night's Markets

| Name | Price | % Change |

|---|---|---|

| Dow Jones Industrial Average | 26,287.4 | - 0.35% |

| S&P 500 | 2,918.6 | - 0.67% |

| Nasdaq Composite | 7,959.1 | - 1.00% |

| The Global Dow USD | 2,967.8 | - 0.61% |

| Gold | 1,509.60 | 0.01% |

| Crude Oil WTI | 54.38 | 3.50% |

| Australian Dollar / US Dollar | 0.6785 | - 0.28% |

| Bitcoin / US Dollar | 11,845.16 | 1.95 % |

| U.S. 10-Year Bond Yield | 1.733 | 1.0% |

Bonds: what the hell?

Two weeks ago I wrote here in my Saturday Briefing “Bonds: it’s a bubble”. Since then the yield on the Australian 10-year bond has bubbled from 1.23% to 0.9425% yesterday, having dipped below 1% for the first time on Tuesday.

Yesterday’s new low was prompted by the RBA basically giving up on inflation and unemployment, forecasting that unemployment will rise by 2021 and that inflation won’t hit the target range (2%) until mid-2021. Unsurprisingly, given that, Governor Phil Lowe is muttering about zero interest rates and quantitative easing. And unsurprisingly the bond bubble had another bubble.

What the hell?

It has been an extraordinary couple of weeks in the global bond market:

- On top of the Aussie 10-year yield going below 1%, the US 10-year bond yield fell below 2% last week and is now 1.699%, approaching the all-time low of 1.36% in July 2016;

- The stock of global bonds trading on negative yields broke through $15 trillion;

- Every single German government bond, from one month to 30 years, now trades on negative yields;

- The Austrian 100-year bond, face value 100 euros, now sells for 185 euros, 68% higher than in December – easily outperforming the Nasdaq (up 29%).

- Countries totalling 30% of the world’s GDP currently have an inverted yield curve;

- 16 central banks have now cut interest rates this year by a total of 1060 basis points, the latest being New Zealand, India, and Thailand this week.

There are basically two schools of thought about all this: mine – that it’s a bubble – and the also common, more pessimistic view that the bond market is heralding a global recession. As Gluskin Sheff’s resident pessimist Dave Rosenberg wrote on Thursday: “At this stage, it’s a question of when, not if.”

On the other hand John Authers, writing in Bloomberg, thinks this might be the bond market’s equivalent of the Nasdaq in early 2000 … its dot com moment.

If you’re wondering which scenario would be worse for investors in equities, there’s no doubt about that: global recession of course.

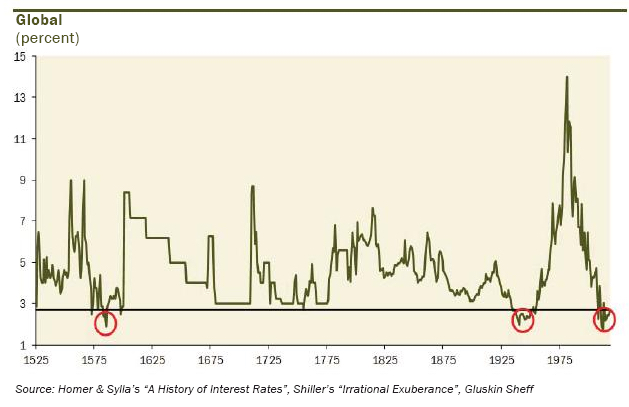

Let’s have a look at history (this chart was put together by Dave Rosenberg’s staff from a few different sources):

GLOBAL BOND YIELDS

As you can see global yields have been this low only twice before – in the late 1500s and the 1930s.

Deflation was pretty common before the 20th century, usually because of huge bursts of new supply and/or productivity. That’s what happened in the 16th century, after the Portugese explorer Vasco de Gamma first linked Europe and Asia by sea and kicked off the age of Asian colonialism, with huge increases in the supply of all sorts of products.

The Spaniard Francisco Pizarro then arrived in South America in 1502 and did the same thing there. Also Francis Drake and his cousin John Hawkins kicked off the African slave trade in 1563, which had a big impact on labour costs.

This is generally called “good” deflation because it involves increased supply – of goods and labour (not so good for the conquered nations and the slaves).

That sort of thing continued periodically through the 17th and 18th centuries, culminating in the Industrial revolution producing periodic “good” deflation in the 19th century through dramatic improvements in productivity.

The deflation and super low yields of the 1930s, on the other hand, were due to a deficiency of demand caused by the Great Depression, which is, of course, “bad” deflation.

Did the yield curve predict the Great Depression? Well, yes: the difference between the 10-year bond and 3-month Treasury notes fell from positive 2% in 1924 to minus 1.45% in May 1929, five months before the Great Crash.

By the way, it also predicted the 1921 depression, inverting in June 1920.

The period 1921 to 1946 is regarded as the first great bond bull market, although as you can see there were a few earlier ones, with the US 10-year yield falling from 5.67% to a low of 1.55, due first the Great Depression and then the manipulation of yields during WW2.

So here we again, minus both depression and war. It’s hard to get one’s head around what’s going on, but I’ll have a crack.

First, let’s acknowledge that I could be wrong, and the bond market really is predicting a stock market crash and global recession. After all, when the US yield first inverted in December 1927, the Dow Jones was around 200. It sailed on oblivious to the danger to peak at 381.17 on September 3, 1929, before bottoming at 40 two years later. It took a generation to regain that 1929 peak.

But things are far more complicated now than in the past, and it is no longer a simple question of whether bonds or equities are “right”. They are probably both wrong – that is, there’ll be no recession/depression and no inflation.

One of the most respected bond traders in the market, Joachim Fels of Pimco, wrote a blog post on Tuesday in which he discussed the “deeper fundamental drivers” behind low and negative interest rates.

“The two most important secular drivers are demographics and technology. Rising life expectancy increases desired saving while new technologies are capital-saving and are becoming cheaper – and thus reduce ex-ante demand for investment. The resulting savings glut tends to push the “natural” rate of interest lower and lower”.

He didn’t talk in detail about technology, but you know what he means.

To that he added three cyclical factors at work:

- The slowdown in the global and U.S. manufacturing sector has started to spill over into the U.S. labor market. …Six-month average net monthly payroll gains have now slowed to 140,000 from 225,000 last year and, more importantly, aggregate hours worked for production and non-supervisory workers are now contracting on a six-month annualized basis

- President Trump’s surprise announcement to introduce a 10% tariff on the remaining $300 billion or so of imports from China effective September 1, and China allowing its currency to depreciate against the dollar and possibly penalising U.S. agricultural products, raises uncertainty and is likely to induce companies to postpone or slash investment spending (and hiring) further, thus reducing the demand for investible funds.

- With the natural rate of interest likely falling fast due to all of these developments, the Federal Reserve risks lagging behind, thus effectively tightening the monetary policy stance (measured by actual rates minus the natural rate) rather than easing it.

He concludes that the fed will now cut rates back to zero and start quantitative easing again, with US bonds going into negative yield.

And then Adrian Orr, the governor of the Reserve Bank of New Zealand, shocked the markets by not only cutting the cash rate there by 50 basis points, but also raising the prospect of negative policy rates.

I have long thought that a big part of the problem is the failure of central bankers to adjust their thinking for the modern world, in which secular, non-economic factors are bearing down on inflation, as mentioned above by Joachim Fels. They are stuck in the Milton Friedman mindset, that inflation is always and everywhere a monetary phenomenon. That was a mistake.

Technology and globalisation are not transitory side-effects, they are fundamental exogenous shocks, a bit like the oil shocks of the 1970s except the other way.

And just as Paul Volcker took the Fed funds rate to 20% in June 1981 to crush inflation, sparking another great bond bull market, central banks are belatedly trying to crush disinflation (not deflation – there isn’t any of that).

The problem, as I see it, is that all of these economic and market developments are coinciding with unsettling geopolitical and social events.

It feels a bit like 1968, with a rising tide of protest and popular revolts. An (anonymous) Macquarie strategist wrote the other day: “The world regularly loses its mind due to economic and generational causes, but ultimately sanity prevails.”

It took a while for sanity to prevail after the late 60s, though, and in the meantime we got terrorism (IRA, Baader-Meinhof etc) and finally the oil shocks and recessions of the 1970s. This time we have Donald Trump and Boris Johnson, not to mention Orban, Salvini, and Duterte all asserting a populist mandate, and the rise of white supremacy terrorism.

The result of all this is uncertainty, and therefore lower investment and consumption, and higher savings. Growth is also being held down by “zombie companies” – non-viable businesses kept alive by low debt servicing costs.

For good businesses, the lower cost of capital is not sufficient to offset the resulting lower growth.

The challenge facing investors is to keep your head while all those around you are losing theirs.

Every day we read about rising tensions in Hong Kong and the Persian Gulf, North Korea letting off missiles, no-deal Brexit threatening trade dislocation and return of the Irish Troubles, mass shootings in the US, rising inequality due to the declining marginal pricing power of labour, negative interest rates and apparently panicking central banks and overlaying it all the obvious rising threat of climate change.

What should investors do? How to react?

Well, certainly not by shifting all your money into gold bullion and stocking the wine cellar with cans of baked beans.

It is a time to focus on core themes of investing in scarcity and defence (which doesn’t mean fixed interest or the military – it means businesses that have a defensive moat).

The cost of capital is going to zero, and in some cases negative (some corporate bonds already trade at negative yields and, as discussed, US$15 trillion worth of global bonds are in negative yield already).

Only businesses with an -opoly after their description (monopoly, duopoly, oligopoly) will have pricing power, no matter what business they are in.

Borders in the west will remain porous and populations will continue to expand. Someone said the other day that there are 450 million people in Africa who want to go to Europe and hundreds of millions in central America who want to go to the US. They will be harder and harder to keep out. Australia’s population is going to keep growing at the present rate.

Also the ageing of the population is inexorable, although immigration is distorting the average demographic picture.

It means infrastructure and healthcare must remain sound investments. It’s not a time for cyclicals, and value investing (low PEs) will remain challenging because low interest rates have changed the rules.

In general, you should buy “anti-fragile” assets and avoid leverage and cash-burn, which is to say financials and tech start-ups that will need to raise more cash. That probably does mean investing in some gold, short-dated Australian government bonds as well as infrastructure and property.

Eventually the world will come to its senses, but the moment the world has gone mad.

The best strategy is to not go mad yourself.

Trump Theatre

A quick note on the trade/currency war, and this week’s events.

I think the thing to bear in mind is that Trump is conducting it entirely on Twitter, along with his attacks on the Federal Reserve and Jerome Powell.

This means it’s not serious, but theatre. If you were serious about a trade deal or getting the Fed to do something, you’d do it in private.

Twitter threats are designed not for those being tweeted about but for those reading the tweets, that is his 62,856,087 followers as well as the media that amplify his every tweet. As I’ve written here before, that makes him one of the world’s biggest media outlets himself.

Markets haven’t really gotten used to this – probably never will – and therefore can’t really tell when to panic and when to ignore him. When in doubt markets tend to panic just in case, especially when prices are stretched as they were last week.

So please keep two things in mind:

- We’re in a theatre watching a play that will go at least till November 2020 (the next election) and markets will be bumpy, and occasionally might have to be rescued by the Fed;

- Selling into every panic, apart from 2007 and early 2008 has been a big mistake. There was a panic in July-August 2007 and another in January 2008, each of which would have been good to sell into, although a lot of people who did that probably bought back in the subsequent “dead cat” rallies.

It’s true that 2007-8 and 1929-30 did happen, so it’s not impossible, but they don’t happen very often and there’s usually a certain smell about them.

Europe’s Banks

In the midst of all this, while everyone is watching Washington and Beijing, and the Trump/Xi Punch and Judy show, there’s a bit going on with European banks.

The Euro STOXX Bank share index is back at 80, which is where it got to in each of the 2009, 2012 and 2016 crises. Usually it rebounded after the European Central bank intervened with a rate cut, but this time – not yet.

Charles Gave of GaveKal, who I’ve been following for years, wrote a piece this week headed: “The death spiral of Eurozone banks”.

“For months I have been telling anyone who will listen that the real threat to global markets is not the US-China trade war, but the slow-motion implosion of the eurozone’s banking system. The best indicator of this is the region’s banking equity benchmark, which tells a sorry story going back more than a decade. Each time the index has hit a critical threshold an intervention has caused it to bounce off and delay the reckoning. The size of these rebounds has been waning and there are reasons to think that this time there may be no respite at hand.”

Are Europe’s banks in a death spiral? I don’t know, but they are mostly too big to fail and I dare say both the ECB and the EU would step and in rescue those that stopped circling the drain and went down it.

Charles Gave goes on: “In a world where 80% of equity transactions are made by computers and algorithms, there must be concerns that any decisive break below becomes disorderly. In such an event, it is easy to see the euro declining further, which could induce a further burst of trade protection by the US against Europe.

“An interesting question is how would the ECB try to stop the rot? Most likely it would end up buying eurozone bank shares directly. The result would not so much be nationalization as Europeanization. This may be barred under European treaties, but, let’s be honest, it has not stopped the technocrats before. What matters for them is the dream of integration, not the means.”

Phoslock

Speaking of anti-fragile investments, if you haven’t done so already, you really should have a read of my interview with Laurence Freedman, chairman of Phoslock Environmental Technologies, posted on Tuesday.

This is a mid-cap ($800m) ASX-listed global business that sells a product invented by the CSIRO that removes phosphorous from lakes and starves blue-green algae. It has no debt and is cash-positive. The big market is China, but it’s also selling into the US, Europe and Brazil. The share price was 40c in May and is now $1.50, but that doesn’t necessarily mean it has become expensive – although it’s likely to consolidate around this level for a while.

In any case, this is a long term proposition that is already producing cash. I have known Laurence Freedman for many years and trust him, but all I have done is interview him, so please bear in mind that I haven’t done any independent analytical work on the company, so I’m not formally recommending it as a “buy” in the way of my colleagues at Intelligent Investor.

But I am recommending that you check out the interview.

Does AMP have a point now?

In April last year, when AMP’s share price was around $4.80 and the managing director and chair had both just been defenestrated by the royal commission, I wrote a column for The Australian headed: “What is the point of AMP?”

Yesterday the share price jumped 11.56% to $1.93 when it came out of the trading halt that followed its strategy and capital raising announcement. Now it has only fallen 63% per cent since it was hit by the truck known as the banking royal commission.

Here’s part of that April 2018 column:

“But at some point soon, AMP’s hapless directors will need to look up from all the reviews of conduct, culture, governance, systems and processes and ask a more existential question: is the business model broken?

“More fundamentally: what is AMP? For 23 years, the answer has been that it’s a financial conglomerate — life insurance, wealth management, superannuation, financial advice, banking.

“Nice sounding idea, but it never worked. And it really doesn’t work now. The banks are all getting out of wealth management, superannuation can no longer be sold on commission alongside with life insurance by office-bearers of Rotary and the Lions Clubs, and financial advice needs to be independent, not the company’s “distribution” arm, as it always has been.”

I went on to discuss the impending appointment of a new CEO, “if they can find someone prepared to do the job”, I said, which of course they could, since the base pay is $180,000 per month, which is tough to spend, and there was another $5.7 million on offer for getting the share price up $5.25 (it was $3.40 when a beaming Francesco di Ferrari was eventually appointed in August).

The share price is now $1.73, exactly half of what it was then, and about $4.6 million has been lopped off Mr di Ferrari’s potential bonuses.

A year his appointment, Francesco di Ferrari has now unveiled his plan, which bears a striking resemblance to his predecessor’s plan, that is: sell AMP Life, focus on AMP Capital, remake the advice and wealth management business.

The new bit is that adviser numbers are to be slashed and the buyer of last resort (BOLY) multiple to be paid to advisers is to be lowered to 2.5 times revenue. As Chanticleer wrote in the Financial Review, it’s brutal. In summary, the plan is to shrink the advice business to greatness, and good luck with that, and shift capital to where it earns the best returns, which is AMP Capital.

Does AMP have a point now?

Only through AMP Capital. It is a very good global asset manager with solid long-term performance and, wait for it, $200 billion under management, and rising.

Hamish Douglass’s Magellan Financial Group has $89 billion under management and is capitalised at $10 billion, with a PE of 31 times. The whole of AMP is capitalised at $5 billion.

That really shows what a difference well-regarded management and a clear strategy can make. Hamish Douglass is not only a good CEO, but a brilliant and articulate investor. He leads the company with an intellectual vision that inspires confidence in his investors.

Does anyone even know who runs AMP Capital? (It’s Adam Tindall, a former Macquarie executive who joined AMP property 10 years ago and rose through the ranks).

AMP has been hopelessly managed for almost its entire 21 years as a public company (and most of the 149 years before that, although it didn’t matter as much then). It’s never had a clear believable strategy and the success of AMP Capital happened by accident.

Yet AMP Capital has more funds under management than the largest super fund, Australian Super, and more than IFM Investors, the industry super infrastructure fund. It is Australia’s biggest investment house.

According to Thursday’s earnings release, it made a half-yearly profit of $120 million, up 28%. If it was separately listed and valued at the same PE as Magellan, it would be capitalised at $7.5 billion, 50% more than the whole of AMP is now.

And if it was valued at the same fraction of funds under management as Magellan (11%), it would be worth $22 billion.

All of which is hypothetical because as things stand it is saddled with another under-performing wealth management and advice business that really doesn’t have any point, and a bank that nobody wants or cares about.

It seems to me the strategy outlined on Thursday doesn’t go far enough.

AMP should be broken up, with the bank and the advice businesses sold or hived off and AMP Capital retained as the core of the listed AMP vehicle, and probably renamed (or maybe not – the name doesn’t seem to have held the business back).

AMP Capital would be a business worth investing in; the rest, not so much.

Marcello Has Moved

A couple of weeks ago I linked to a very nice short film about Marcello, who used to run a restaurant with no name in Carlton that I went to regularly with an Italian friend. I lost touch with it, and with Marcello, and was delighted to see someone had honoured him with a video.

Well, subscriber Henry Laskowski was moved to go in search of Marcello and came up empty. He then went to the Tattslotto shop nearby and was told that Marcello had left six months ago and set up in an Italian club in Sydney Road, Brunswick. He doesn’t know the address.

It could be the Vizzini Social Club which is actually in Coburg, or perhaps the Abruzzo Club, although that’s in Lygon St Brunswick. Or maybe it’s Café Marcella – sounds right.

Anyway, should be an interesting search. Thanks Henry, I’m on it!

Research and Diversions

Research

13 investment insights from Hamish Douglass. For example: “The power of network effects. The network effect describes the process whereby an additional user of a product or service makes that item more valuable to all users. Facebook’s social network is a classic example”.

Good read: China’s hand is stronger than Trump thinks: Beijing is less concerned about capital flight than in the past and could easily let the yuan weaken further.

The top 10 risks to the global economy, according to the Economist Intelligence Unit. Not too many surprises, but worthwhile as a record, to remind us I guess.

For years, America has enjoyed the benefits of a strong and dependable dollar in many ways, including amassing $22 trillion of government debt without any spike in borrowing costs. Losing that advantage would be America’s worst nightmare.

The automobile job apocalypse. “…as global auto sales slow after a decade of growth, carmakers are girding for a deeper downturn by slashing payrolls.

Is the end of globalisation the end of global investing? Nah. “…the end of globalisation could actually be positive for active investors, investing on a global basis. (Although) the very near-term outlook is unambiguously bleak.”

Interesting: Scotland wants to create an ethical stock exchange. Listed companies would be required to report on their “purposeful and positive impact on the communities where they operate.” The bloke behind it says it will be the first exchange in the world to set such rigorous standards for impact reporting.

Populism was not caused by the GFC. “If there has been a rupture or inflection point in the postwar history of the republic, it was the Vietnam war, with its compound traumas of bloodshed abroad and rancour at home. Next to this, the crash, at least in its impact on public trust, hardly registers.”

How digital advertising markets really work. It’s all about data, that is knowing stuff. “Say Michael goes to CNBC’s website each morning to follow the markets, and to the New York Times each evening for book reviews. CNBC knows that Michael follows the markets, and might monetise his view at a $30 CPM. The Times knows that Michael reads books, and might monetise his view at a $10 CPM. If the Times can find out that Michael is reading CNBC in the mornings, then when Michael visits the Times books section in the evening, the Times can monetise him at $30 too”.

The endless, invisible persuasion tactics of the internet. A team of Princeton researchers is cataloging the deceptive techniques, using data pulled from 11,000 shopping sites, to identify 15 ways sites subtly game our cognition to control us.

This is a brilliant, forensic article about how Ireland can stop a no-deal Brexit.

Dual containment of China and Russia by the United States is having a predictable effect. Sino-Russian entente is now morphing into strategic alignment aimed at the US.

As John Mauldin (and me) keeps saying, the world is awash in debt. Some of it is productive, but much is not. Here is a handy BIS chart combining government, household, and corporate debt relative to GDP.

Roger Montgomery: the economics of enough. “People have borrowed enough, they’ve bought enough stuff, and eventually growth slows, and that’s where you get deleveraging occurring in the economy, where credit growth is slower than economic growth.”

Here’s the full text of banking royal commissioner, Kenneth Hayne’s speech to the Melbourne Law School this week that got some well-deserved publicity, but you might have noticed that none of the stories about the speech actually linked to it, and I don’t know about you but that drives me crazy! Anyway, here it is – worth reading.

Terrific piece by Katharine Murphy on politics this year: “The 46th parliament is beginning to ease into itself. The Coalition’s collective shock at winning the election is transforming, bit by bit, into swagger. While this settling was happening, while the chambers were grinding through the parliamentary fortnight, the division bells ringing, harried staff and principals racing in and out of offices, I had a couple of discomfiting encounters with truth.”

Gannett sells for $1.4 billion. To put that in perspective... Gannett owns 100 daily and 1,000 weekly publications. 19 years ago, CNET bought ZDNet (1 online-only publication) for $1.6 billion. At that time, Gannett was worth $20 billion.

Why solar, wind and EVs will be the death of the petroleum industry. “A stunning new report from French-based global banking group BNP Paribas signals the death toll for the petrol industry – a mixture of solar, wind and electric vehicles can deliver more than six times the “mobility” returns on each dollar invested than oil.”

Advisers must step up and articulate their value. Couldn’t agree more. What is it, exactly?

.jpg)

Diversions

This website lists every question known to have been asked at a JP Morgan job interview. For example: How many people set foot in the Roman Colosseum on an average day in August? How many times does a ball get hit in the average game of tennis? What's the probability that a pregnant woman has a baby boy? How many matches take place during the Wimbledon tennis championship? How many people set foot in the Vatican during an average day in July?

French inventor Franky Zapata has succeeded in crossing the English Channel on a jet-powered hoverboard.

When George Villiers, the Duke of Buckingham wanted to impress the wife of King Charles I, Henrietta Maria, he thought it’d be a great idea to give her a dwarf. In November 1626, Jeffrey Hudson was only seven years old and 46cm tall when he was dressed in a tiny suit of armour and served to the Queen in a pie.

The unbelievable story of the plot against George Soros - How two Jewish American political consultants helped create the world’s largest anti-Semitic conspiracy theory.

The use of antifungals in food production is hastening an increase in drug-resistant infections, putting millions of people at risk. “Food is no longer valued for its ability to sustain life, but only for its ability to generate profits.”

Nothing wrong with landfills. Landfills are clean, cheap and sustainable — so long as they are well sited, well managed, do not leak, and get earthed over when full. “The Earth is huge and we are good at digging deep holes”.

It’s not clear whether anyone can ever really make money by delivering meals.

A science-backed defense of not sleeping in the same bed as your partner. “It’s a widely accepted social norm that couples sleep cozily together every night in one bed. If they aren’t, well, you might assume the relationship is on shaky ground. But this togetherness isn’t some hallowed ancient tradition, and many couples are ignoring it for the sake of better sleep.”

Innocence lost: what did you do before the internet? “Quite soon, no person on earth will remember what the world was like before the internet. There will be records, of course (stored in the intangibly limitless archive of the cloud), but the actual lived experience of what it was like to think and feel and be human before the emergence of big data will be gone.”

Is artificial intelligence the next big climate change threat? (Because of all the energy it uses). We haven’t got a clue.

The fight for the future of YouTube. "Bullshit is infinitely more difficult to combat than it is to spread," Micah Schaffer, a technology adviser who wrote YouTube’s first community guidelines, said. "YouTube should have course-corrected a long time ago.”

Paul Krugman, excellent: “the G.O.P. has become a systematic enabler of terrorism. Why? Follow the money.”

This is a really good, but really depressing piece about America’s gun problem. “The sheer number of guns is part of the challenge. The United States has the largest civilian-owned stock of guns in the world. At the end of 2017, the Small Arms Survey reported there were an estimated 393 million firearms in the United States — and that's not even counting guns owned by the police and military. That represents 45.8 per cent of the world's civilian-owned guns.”

Interesting counter piece about American gun violence: “Americans have accepted a trade-off, between permissive gun laws and the high incidence of death by shooting. It is a trade-off that regards El Paso and Dayton, and Columbine, Stoneham Douglas and the rest, as a high, but largely tolerable, price for what is seen as the ultimate in personal freedom. This view will persist well after Donald Trump has left the White House, and probably for a long time after that.”

“What’s happening, to put it bluntly, is that (some) downwardly mobile white American middle-class men — at least some of them — are being radicalized. Not by ISIS, by communism. But by a seductive, grandiose kind of authoritarianism. To become something like true believers in the Russian model of society.”

Old Paris is no more. Baron Haussmann’s mid-19C razing and rebuilding of the city was widely considered at the time to be one of history’s great acts of vandalism. “He tore down nineteen thousand buildings, including thousands of homes constructed in the medieval era. He erected thirty-four thousand new buildings, twenty-seven parks, eighty-five miles of new boulevards, and numerous landmarks. After Haussmann, few medieval vestiges remained.”

How Lyft and Uber use gaming tools to manipulate and motivate their drivers. “Your rate of pay does not increase for being a highly-rated driver. And yet, I wanted to be a highly-rated driver. On weeks that I am rated highly, I am more motivated to drive. On weeks that I am rated poorly, I am more motivated to drive. It works on me, even though I know better”

Hmmm, not sure about this: ‘I don’t smell!’ Meet the people who have stopped washing. A growing number of people are eschewing soap and trusting bacteria to do the job instead – and an entire industry has sprung up to accommodate them.

This a brilliant, kind of beautifully surprising advertisement.

An interesting piece about Joy Division, to commemorate 40 years since their album Unknown Pleasures was released. There was apparently a memorial concert involving Peter Hook at the Sydney Opera House that I didn’t know about! I would have gone. I often still listen to them, bringing back memories of living in North Fitzroy and working with Bob Gottliebsen on Chanticleer in 1979, which is when I discovered the grimly marvellous, band from Manchester.

And for those unfamiliar with Joy Division (because you’re new to my Weekend Briefing perhaps) here they are with Day of the Lords from Unknown Pleasures.

Happy Birthday Ian Anderson, lead flautist (and singer) of Jethro Tull, 72 today. Younger than I would have thought, actually, but who can forget Thick as a Brick, one of the great albums of the 70s.

.png)

.jpg)

.jpg)

.jpg)

.jpg)

.png)

.jpg)

.jpg)

Ask Alan

This week, Alan answers your questions on investing in the 5G network, further explains the Hostplus IMF fund for SMSFs, and debates whether cash still holds some value.

Don't forget the weekly Facebook #AskAlan livestream has migrated to a new platform on the InvestSMART website which can be found here. And if you would like to #AskAlan a question, please email it to askalan@investsmart.com.au.

Next Week

By Ryan Felsman, Senior Economist, CommSec

Australia: Jobs and wages data dominate

- In the coming week there will be more insights into the post-federal election economic environment in terms of business conditions and consumer sentiment. But the Reserve Bank’s laser-like focus on developments in the labour market gives the jobs and wages data top billing for investors.

- The week kicks off on Monday when the Reserve Bank releases June data on credit and debit card lending.

- On Tuesday the weekly series of consumer confidence will be released by Roy Morgan and ANZ. The weaker value of the Aussie dollar and recent sharemarket volatility are front-of-mind for Aussie consumers.

- Also on Tuesday the NAB business survey is issued for July. Business confidence lifted following the federal election and the interest rate cut in June.But conditions have deteriorated, sitting below the long-run average for the first time in five years.

- Also on Tuesday, Reserve Bank Assistant Governor (Financial Markets) Christopher Kent speaks.

- On Wednesday, monthly consumer confidence data is released by the Melbourne Institute and Westpac. Confidence fell to a 2-year low July, but the receipt of tax refunds and improving property market conditions could boost sentiment.

- Also on Wednesday the Bureau of Statistics (ABS) releases the quarterly Wage Price Index for the June quarter. Commonwealth Bank Group economists forecast wages growth of 0.5 per cent in the quarter and an annual growth rate of 2.2 per cent. Subdued wages growth has been associated with low inflation outcomes, while restraining consumer spending.

- On Thursday, the all-important jobs report for July is issued.The unemployment rate is expected to remain steady at 5.2 per cent for a fourth consecutive month with 20,000 jobs added.

- Also on Thursday, the bi-annual average weekly earnings figures are released by the ABS, providing dollar estimates of wages in the economy across states and industries. June tourism data is released. And Reserve Bank Deputy Governor Guy Debelle delivers a speech: “Risks to the Outlook”.

Overseas: China activity data in the spotlight

- The summer lull in US ‘Fedspeak’ and the re-intensification of the US-China trade war elevates Chinese July activity data to the top of the data dais in the coming week. US retail spending and inflation will be in focus too.

- The week begins on Monday when the US July budget statement is issued. A deficit of US$116 billion is forecast.

- On Tuesday, the regular weekly reading on US chain store sales is due together with data on small business sentiment and consumer prices. Shelter, furnishings, used vehicles and clothing costs all lifted in June.

- On Wednesday, falling US import and export prices are expected to reaffirm that inflation remains tame. Weekly mortgage applications figures from the US Mortgage Bankers Association are also due.

- On Wednesday in China, the July activity data is due. Following the upside surprise in June, a ‘give-back’ is widely anticipated as policy support fades. Local government bond issuance - a key support for infrastructure spending - has been dialled back. And retail spending may ease after strong online sales during the mid-year shopping festival. New emission standards are also expected to weigh on car sales.

- New home price data follows on Thursday in China. Annual home price growth decelerated from 11.3 per cent in May to 10.8 per cent in June. New home prices rose in 63 cities in June.

- On Thursday in the US, the weekly figures on jobless claims are issued, along with retail sales, factory, industrial production, homebuilder sentiment, unit labour costs, productivity and business inventories data. Solid consumer demand and confidence is driving retail spending, keeping the US expansion intact. But factory sector health is fragile with industrial production subdued and regional manufacturing readings buffeted by trade tensions.

- On Friday, US housing starts, building permits and consumer confidence data complete the week. US consumer sentiment is near cyclical highs, supported by low unemployment and solid wages growth. The imposition of tariffs on Chinese-made consumer goods effective September 1, could eventually hit US consumers in the back pocket.

Financial markets

- Around 80 Aussie companies are scheduled to announce earnings results in the coming week as the reporting season cranks up a gear. Companies reporting on Monday include Ansell, Argo Investments, Aurizon, Bendigo & Adelaide Bank, GPT Group and JB Hi-Fi.

- On Tuesday: Arena REIT, Challenger and Magellan.

- On Wednesday: Aveo, Computershare, CSL, Dexus, Tabcorp and Vicinity Centres.

- On Thursday: ASX, Ausdrill, Blackmores, Breville, Evolution Mining, Iluka Resources, QBE Insurance, SEEK, Super Retail Group, Sydney Airport, Telstra, Treasury Wine Estates and Whitehaven Coal and Woodside Petroleum.

- On Friday: Cochlear, Domain, Kogan.com, Newcrest Mining, Nick Scali, Spotless Group and Star Entertainment.

Last Week

By Shane Oliver, Senior Economist, AMP Capital

Investment markets and key developments over the past week

- The past week saw a roller coaster ride in share markets with sharp falls after China responded to Trump’s latest tariffs by letting the Renminbi fall in value and ordering state owned enterprises to halt agricultural imports from the US and the US responded by labelling China a currency manipulator, followed by a rebound as China limited downside in the Renminbi and more central banks eased. But this still left most markets down for the week and this included the Australian share market. Australian shares may not be directly affected by the trade war but they are vulnerable to the threat it poses to demand for our exports and the plunging iron ore price and an earnings miss by the CBA didn’t help, but perversely the largest falls were seen in IT, health, utility and industrial shares. This saw the share market down for the week despite some help being provided by expectations for more interest rate cuts. Bond yields continued to plunge on safe haven demand and as expectations for further monetary stimulus ramped up with the Australian 10-year bond yield hitting a record low of 0.94%. That means if you hold it for 10 years you get a 0.94% return! Gold continued to rally on safe haven demand but prices for oil, metals and iron ore fell with the latter down nearly 10%. (Fortunately, iron ore at $96 is still way above Australian Government budget assumptions.) The $A remained around $US0.68 with the $US falling over the week.

- Why all the fuss about the Chinese Renminbi and the US labelling China a currency manipulator? A depreciation in the Renminbi is an inevitable outcome of the US imposing more tariffs on China’s exports because it has the effect of making China less competitive. But the break above 7 Renminbi to the $US dollar has psychological significance because it’s a big round number and the $US has not been above it since 2008. This has several implications.

- First, the US is not happy because a falling RMB offsets the impact of its tariffs and so it has labelled China a “currency manipulator”. This is mostly symbolic but it does provide cover for more protectionist measures against it. Its ironic that the real concern to the US is a lower Renminbi and yet China’s intervention is actually aimed at limiting the RMB’s fall which is a natural outworking of US tariffs on its exports. While the US will engage with the IMF on the issue its doubtful the IMF will back them as it recently concluded that the RMB was around fair value. This won’t necessarily stop the US from using the labelling as a pretext to take more measures against China though.

- Second, as we saw in 2015 a falling Renminbi is not good for emerging markets that compete with China and will put more downwards pressure on their currencies which leads to renewed concerns about $US debt servicing costs.

- With the trade war escalating central banks are getting nervous and swinging into action – and this is the big difference compared to last year when central banks were seen as moving towards tightening. Given the threat to global growth this is not surprising and was clearly evident over the last week with New Zealand and India easing more than expected, Thailand unexpectedly easing and the Philippines cutting rates as expected. The 0.5% cut from the RBNZ and talk of negative rates there looks a bit over the top though given the NZ economy’s recent performance and the RBNZ’s own forecasts. But it highlights how dovish central banks are becoming. A 0.5% cut from the Fed next month is now possible.

- The RBA provided no surprises leaving interest rates on hold, but RBA Governor Lowe retained an easing bias and the RBA’s own forecasts leave it on track to ease again. Given the increasing global risks we have brought forward the timing of our forecast next two RBA rate cuts to September and November. The RBA’s August Statement on Monetary Policy yet again downgraded its forecasts for this year with GDP growth cut to 2.5% (only last November it was forecasting 3.25%) and underlying inflation cut to 1.5% (last November it was forecasting 2.25%) and it revised up its unemployment forecasts to 5.25% out to December next year and to 5% through 2021. What’s more, these forecasts are predicated on market forecasts for the cash rate to fall to around 0.5%, suggesting that if the RBA does not cut again the outlook will be even worse and it will be even further away from meeting its inflation objective! So with the RBA a long way from achieving its desire for unemployment to fall below 4.5% in order to meet its inflation objective we remain of the view that more rate cuts lie ahead and continue to see the cash rate falling to a low of 0.5%. We had pencilled in two 0.25% cuts around November and February but given the increasing threat to the global outlook we have moved them forward to September and November.

- I agree with Governor Lowe that more fiscal stimulus and structural reform is needed (in fact it’s a no brainer) but the debate around quantitative easing is also set to hot up as the cash rate heads nearer to zero. A far more efficient and equitable approach than the quantitative easing practiced in the US, Europe and Japan would be for the RBA to directly finance fiscal expansion (ie real helicopter money). This could be targeted to achieve a boost to growth in a far fairer and more efficient way than conventional QE.

- It’s possible but unlikely that the RBA will go below 0.5% in the cash rate as there will be little point as the banks will struggle to pass it on to borrowers as they won’t cut their deposit rates into negative territory. Its also unlikely that the RBA will move to pay negative rates on bank reserves with it as there is little evidence from Japan and Europe where that has been deployed that it actually works. In fact, negative rates risk damaging the banks and their ability to lend. If the RBA wants to encourage banks to lend more it could always work with APRA to ease up on lending standards again!

- With the trade war still escalating, global and Australian share markets are at risk of further weakness through the seasonally weak August to October period. In fact, share markets may need to fall further to convince President Trump of the need to make a deal as he is unlikely to get re-elected next year if the share market goes into a major bear market associated with recession and rising unemployment. But providing recession is avoided as we ultimately expect – either because a deal is reached and/or as further policy stimulus is unleashed – then shares are likely to be higher on a 6-12 month horizon helped by reasonable valuations – particularly against low bond yields and bank deposits and as global growth eventually improves.

- In terms of relative valuation, an Australian investor in Australian shares can get a cash flow from grossed up dividends of around 5.7% compared to a cash flow from bank term deposits that have crashed to 1.7% or less.

.png)

Source: Bloomberg, AMP Capital

- Similarly, the gap of 4.8% between the grossed-up dividend yield on shares of 5.7% and the Australian ten-year bond yield of 0.94% is at an equal record high with where it was at the GFC share market low in 2009.

.png)

Source: Global Financial Data, Bloomberg, AMP Capital

- In terms of something completely different, but arguably of greater importance, the latest Financy Women’s Index is worth a look. Combining metrics for tertiary education, unpaid work, employment, pay, boards and superannuation it shows ongoing progress towards gender financial equality but there is a long way to go before it is achieved.

Major global economic events and implications

- US economic data was softish with a fall in the ISM non-manufacturing conditions index and a decline in job openings. In terms of the later the level of job openings, hiring and quits remain high but they may have peaked warning of some softening in the US jobs market ahead. That said the Fed’s latest survey of bank willingness to lend shows nothing like the sort of deterioration that occurred prior to the last two US recessions.

- Japanese June quarter GDP rose a stronger than expected 0.4% helped by consumer spending and investment but annual growth is just 1%. Meanwhile household spending rose more than expected in June but the Economy Watchers business and household sentiment surveys showed a further fall in July with business respondents citing trade friction.

- Chinese trade data for July was better than expected with an unexpected rise in exports and a smaller than anticipated fall in imports. That said, the rise in exports may reflect front running of anticipated tariffs and imports are still falling which is indicative of weak demand. Chinese underlying inflation remained benign in July.

Australian economic events and implications

- Housing finance commitments saw a small bounce driven mainly by owner occupiers. This could just be statistical noise but its consistent with increased buyer interest post the election and recent rate cuts. Time will tell but we remain of the view that the upside for house prices will be constrained relative to past cycles. Meanwhile, ANZ job ads improved slightly but the AIG’s services and construction PMIs fell with the latter pointing to further weakness in building approvals.

- There was some good news with a record trade surplus in June leaving Australia on track for its first current account surplus since 1975 and with trade likely to support June quarter GDP growth. However, much of the good fortune owes to the surge in the iron ore price to above $US100 a tonne which looks like providing a last hurrah for the trade surplus in July, but it has since fallen sharply as Brazilian production is returning.

What to watch over the next week?

- In the US expect core CPI inflation for July due Tuesday to remain around 2.1% year on year which is consistent with the Fed’s preferred measure of inflation remaining around 1.6%yoy. Meanwhile, expect solid growth in retail sales and industrial production and a rise in home builder conditions (all due Thursday) and an increase in housing starts (Friday).

- Chinese activity data for July is expected to show a slowing in industrial production to 6%yoy and in retail sales growth to 8.6%yoy but a slight lift in investment growth to 5.9%yoy.

- In Australia the focus will be on wages and jobs. The June quarter Wage Price Index due Wednesday is expected to show wages growth stuck around 2.3% year on year and July labour market data (Thursday) is expected to show a modest 10,000 gain in employment but unemployment rising to 5.3% and underemployment remaining high at around 8.2%. Continuing high levels of unemployment and underemployment make it hard to see much of lift in wages growth anytime soon which will maintain pressure on the RBA and the Government to provide more stimulus to the economy. Meanwhile business conditions as measured by the NAB business survey (Tuesday) and consumer confidence as measured by Westpac/MI (Wednesday) are expected to have remained subdued.

- Australian June half earnings report releases will ramp up with about 40 major companies reporting including Ansell, GPT and JB HiFi (Monday), Computershare, Telstra and CSL (Tuesday), QBE, Woodside and the ASX (Thursday) and Domain and Cochlear (Friday). Consensus expectations are for around 2% earnings growth for 2018-19, mainly due to resources.

Outlook for investment markets

- Share markets are at risk of further short-term volatility and weakness on the back of the escalating US/China trade war, Middle East tensions and mixed economic data as we enter a seasonally weak part of the year for shares. But valuations are okay – particularly against low bond yields, global growth indicators are expected to improve by next year and monetary and fiscal policy are becoming more supportive all of which should support decent gains for share markets on a 6-12 month horizon.

- Low yields are likely to see low returns from bonds once their yields bottom out, but government bonds remain excellent portfolio diversifiers.

- Unlisted commercial property and infrastructure are likely to see reasonable returns. Although retail property is weak, lower for longer bond yields will help underpin unlisted asset valuations.

- The combination of the removal of uncertainty around negative gearing and the capital gains tax discount, rate cuts, support for first home buyers via the First Home Loan Deposit Scheme and the removal of the 7% mortgage rate test suggests national average capital city house prices have probably bottomed. Next year is likely to see broadly flat prices though as lending standards remain tight, the supply of units continues to impact and rising unemployment acts as a constraint.

- Cash and bank deposits are likely to provide poor returns as the RBA cuts the official cash rate to 0.5% by early next year.

- The $A is likely to fall further to around $US0.65 this year as the RBA cuts rates further. Excessive $A short positions, high iron ore prices and Fed easing will help provide some support though with occasional bounces and will likely prevent an $A crash.