Bonds and the Swinging Sixties

The Week in Review by Shane Oliver (AMP Capital)

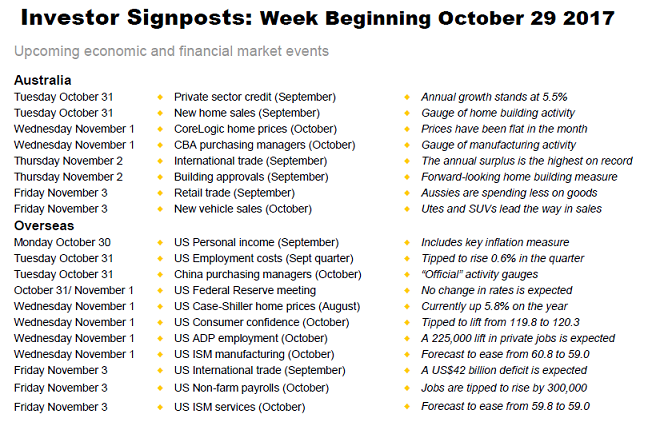

Investor Signposts by Craig James (CommSec)

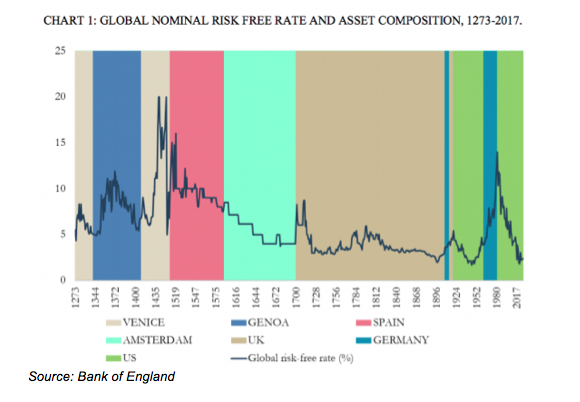

“This paper presents a new dataset for the annual risk-free rate in both nominal and real terms going back to the 13th century.”

Now that's a line to get the heart pumping on a Saturday morning. (I read these things, so you don't have to). But it does reveal something about its author, the Bank of England, which thinks in timeframes longer than the rest of us.

Given the last few years have marked the biggest bull market in bonds for the last 500 years, dating back to 1237, the bank's research paper does have some uses. Especially when rising global share prices have less to do with burgeoning economic growth, increasing productivity and higher wages – none of which are present in the real world – than they do with central banks spreading the love with historically low interest rates.

How low? Real low. The paper's abstract captures the spirit: “The global risk-free rate [the bond yield] in July 2016 reached its lowest nominal level ever recorded. The current bond bull market in US Treasuries, which originated in 1981, is currently the third longest on record, and the second most intense.”

Putting it visually:

Why should we care? If you've ever discussed the bond market with Intelligent Investor Research Director James Carlisle, you'd know bonds are arcane, impenetrable and, for value investors, barely relevant. Most discussions on the subject, especially with Carlisle, are best avoided. But if historically low interest rates explain much of the rise in share prices over the last few years, what do you think might happen if rates start to rise?

The Old Lady of Threadneedle Street, as the Poms refer to the Bank of England, categorises bond market reversals in three ways. First, there are the “monetary (mis-) communication reversals”, when a central banker removes a shoe and stuffs a foot in their mouth. The “taper tantrum” of 2013 might be a good example, after which the Fed quickly donned its standard attire and the bull market resumed.

Then, there are the “curve steepening reversals”. This happened in Japan in the early 2000s when, in response to the bursting of the Japanese asset bubble, the first occurrence of quantitative easing put pressure on the domestic banking industry.

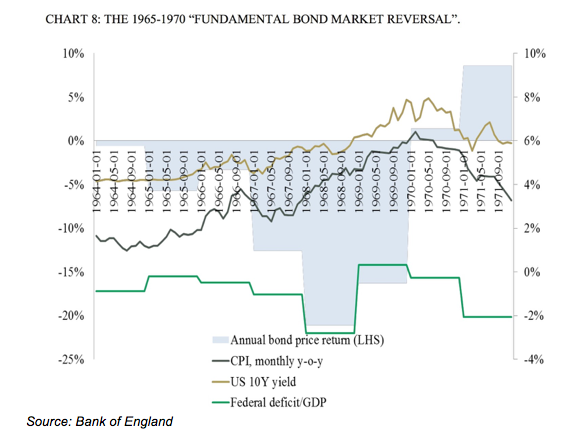

Finally, there are “fundamental” reversals, usually driven by an inflation breakout, of which this was the most recent:

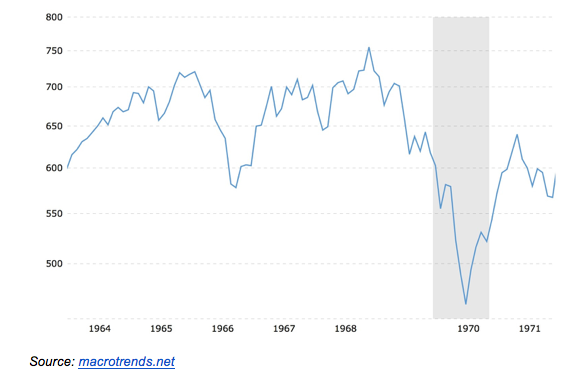

The Old Lady cites this period as a current parallel, saying that “observers in 1965 were certainly trapped in a ‘lower- for-longer inflation rate consensus belief' (Mertens, 2016).” Here's what happened to the S&P 500 during that period:

Between November 1968 and June 1970, the index fell almost 40 per cent when inflation really started to get away from the Fed (the shaded area is the recession). Could it happen again?

There are similarities. Right now, inflation is low and most people expect it to remain that way. Unemployment is also near record lows. Tick and tick. What's different is the absence of wages pressure. Average US hourly earnings growth rose from 3.8 per cent year-on-year in 1966 to 6.3 per cent in 1969, pushing inflation uncomfortably higher.

There's no sign of that in the US now, where inflation currently sits at 2.2 per cent, up from 0.7 per cent in 2015 but hardly out of control. Nor is wages growth rising at anywhere near the rate it was 40 years ago. Tight employment conditions are not producing higher wages.

It's the same story here, too, as this week's inflation figures revealed. Despite a big jump in energy prices, core quarterly inflation was below expectations at 0.4 per cent. In fact, the lack of wages growth is a bigger problem than the fear of it leading to an inflation breakout. Treasury Secretary John Fraser this week claimed that wages growth will eventually accelerate but that it "will take some time".

It may take longer than that. The parallels drawn by the Bank of England between bond markets now and the late '60s make sense, but the macroeconomic environment driving them is quite different.

When The Beatles released Eleanor Rigby in August 1966, labour was heavily unionised, technology wasn't driving down prices, and companies found it harder to shift their operations offshore. If we do see an inflation breakout that hits stock prices, I doubt it's going to come from wage-led inflation. The Old Lady might be worried but perhaps she's just showing her age, romanticising the Sixties.

On the globalisation theme, Chinese President Xi Jinping this week donned the dreads, speaking of the "waves of positive energy" from the 19th national congress of the Communist party of China. The meeting may have ended with a drum circle and a group hug for all I know but the intent was clear; China is a willing carrier of the global trade torch if Trump drops it and sets his trousers alight.

This is a theme I'll return to in coming weeks but a few data points from Platinum's Kerr Neilson's recent post on The Rise of Asia give a flavour for the tectonic changes that most investors, at least in a portfolio sense, are failing to acknowledge.

In India, where queuing for a train ticket can take as long as the journey itself, the country is building 25km of highway a day. The country also produces 2.6 million STEM graduates each year, many of whom find their way to Silicon Valley. Round my way in Byron Shire, it takes 18 months to build a roundabout and another year for the drivers to understand how it works. If this is evidence of India following in China's footsteps, the axis of global power will fall ever more quickly east.

Last year, over 117 million Chinese travelled abroad; services now account for 50 per cent of GDP, indicating the transition to a consumption-led economy is happening; and the country has $US3 trillion in currency reserves. In 2016, China lodged almost as many patents as Japan. Admittedly, this was about 30 per cent fewer than the US, but in a country where you can patent a method to cut up a chicken, the comparison is hardly fair.

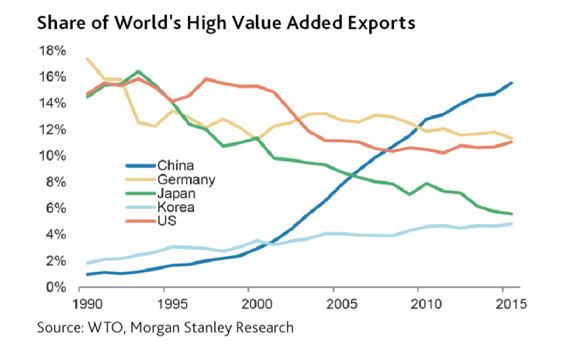

Then there's this:

China isn't just ripping off everyone else's good ideas in hilarious ways (Dolce & Banana being my favourite), it's moving up the value chain, building integrated circuits, aircraft, and smartphones. How can this be happening in a top-down, centrally planned economy, when there's no historical precedent for it?

Well, it isn't. Xi Jinping may fancy himself as the new Mao but decades of reform have produced an inventive, entrepreneurial culture with less state planning than one might imagine from a governing body of many, many men all wearing the same suit. At the turn of the century, 80 per cent of the country's GDP originated in the public sector. Now it's just 20 per cent.

As long as you don't cross the party, you can do pretty much as you like, as the success of Alibaba and Tencent indicate. Neilson concludes that many Chinese companies “are on a par with the best of the West in their respective fields, and are delivering excellent returns on capital.” The shift in geopolitical power has been underway for a while; maybe investors will soon wake up to it.

Finally, let's not let the week pass without a dig at ASIC. It took Greg Medcraft a few years to wake up to the fact that his docile organisation was locked in the cupboard by the companies it was supposed to regulate (see Why ASIC lets the big fish go).

Medcraft may have opened the doors a little but the docility remains. Rio Tinto and two former executives were recently charged with fraud by the US Securities and Exchange Commission, which alleges Rio inflated the value of its coal assets in Mozambique while conducting a capital raising.

In the UK, where Rio is also listed, the matter has already been resolved via a £27.4m fine. Where's ASIC in all of this? It's been working with the SEC “from day one” according to Medcraft, who told the recent Senate Estimate, “As I always say it's a journey; the journey hasn't finished yet.”

If a Rio employee had defrauded the business, they'd probably be in jail. But the higher up the chain you go, the lesser the possibility of doing time. Instead, shareholders foot the bill and the culprits refine their LinkedIn profile. Our Greg meanwhile is on a journey, via London and New York, to make the fine happen. Go Guru Greg. #ASIC joke (say it quickly).

Enjoy the weekend.

The Week in Review

Investment markets and key developments over the past week

- While US shares fell slightly over the last week on some mixed earnings results, most share markets rose with Eurozone shares particularly helped by a dovish ECB. Bond yields rose in the US and UK but fell elsewhere. While iron ore prices fell, oil and copper prices rose. The $US had another leg higher on strong US data and ECB dovishness and this saw the $A break below $US0.77.

- As widely expected the ECB announced a further extension of its quantitative easing program at the reduced rate of €30bn a month from January 2018 for nine months and “beyond, if necessary” with ECB President Draghi saying it won't suddenly stop next October. In doing so the ECB reiterated that interest rates will not be raised until “well after” QE ends which implies not until 2019 at the earliest. Continuing QE and low rates in the Eurozone is a big positive for Eurozone shares and at a time when the Fed is undertaking rate hikes and quantitative tightening points to downwards pressure on the euro. The continuation of QE in Europe at a time when Japan remains locked on QE and zero 10-year bond yields and the US is only tightening gradually highlights that global monetary conditions will remain easy for a long while yet.

- The focus on Catalonia may ramp up a bit going forward if the Spanish Government moves to take control of Catalonia. Negotiations would seem a better way to proceed, but we remain of the view that it's not a major European (let alone global) issue: a Catalan independence declaration will have little meaning; although there will be some resistance Catalans are unlikely to rise up en masse and resist a central government takeover; and the issue is not about the survivability of the Euro with Catalonia wishing to remain in it.

- China's Communist Party Congress saw an enhanced authority for President Xi Jinping as evident in the new seven-member leadership team, the absence of any heir appointed in the team and his “Thoughts on Socialism with Chinese Characteristics for a New Era” being enshrined in the Party's constitution. However, we continue to expect a continuation of the recent direction in policy rather than a big shift in direction. But there will be more focus on sustainable growth – supply side economic reforms, rebalancing towards more consumption driven growth and measures to deal with financial risks, pollution and inequality – and less focus on growth for growth's sake. While there may be less emphasis on growth targets the objective to double 2010 GDP by 2020 implies GDP growth of 6-6.5 per cent pa. So expect growth to remain solid, even though there will be more focus on sustainability.

- Is President Xi “recklessly building China on a foundation of sand” as a well-known US hedge fund manager suggested, presumably as a reference to rising debt? Not that I can see. Yes, debt levels have gone up rapidly but it borrows from itself, it hasn't blown it on reckless consumption and it is aware of the problem. If anything it saves too much and has the problem that a big chunk of that saving is recycled through its banking system (which means it gets called debt). Yes, it has problems with unequal development and pollution – but so have all rapidly developing economies. Is it fair to criticise China on the grounds that “true developed economies do not impose severe capital controls or move short term interest rates hundreds of basis points overnight in attempts to manipulate their own currency” as the same hedge fund manager also said? Again I don't think so – China is still a developing economy and most developed economies (the US and Australia included) have had phases of heavy market regulation often well after China's current level of development.

- Progress continues towards tax reform in the US with the House passing the Senate's 2018 budget which will allow tax reform to proceed under the so-called budget “reconciliation” process. Our assessment is that it now has a 70 per cent chance of getting up by early next year. The biggest risk is that the package loses the support of more than two GOP senators (for ideological reasons, feuds with Trump, poor health or a loss to the Democrats in the Alabama special senate election). Trump's fights with various Republican senators highlight this risk but it must be remembered that tax cuts/reform are a fundamental Republican objective (ie, it's much more than Trump) and Republican's need a big win on something like tax reform ahead of the 2018 mid-term Congressional elections. (It's worth noting though that some Democrat senators may support tax reform – as they did in relation to the Bush era tax cuts.) There is also uncertainty about the size of the fiscal stimulus tax reform will provide – e.g. will it rely on a growth dividend (called “dynamic scoring”) to make it revenue neutral over time or will the tax cuts expire after ten years like the Bush era tax cuts? Out of interest the Senate budget allows for a $1.5 trillion net deficit increase due to tax reform over ten years which if spread evenly is about 0.1 per cent of GDP a year but it is likely to be more front loaded.

- But at a big picture level, tax reform in the US will mean a small boost (maybe 0.2 per cent to 0.3 per cent) to 2018 GDP growth, a likely additional Fed rate hike (four hikes in 2018 rather than three) and more upwards pressure on US bond yields and the $US. For Australia, US tax reform would mean a lower than otherwise $A, more flexibility for the RBA and more pressure to lower our corporate tax rate (given the risk some companies may choose to relocate their headquarters to the US).

- And finally, it was a sad week for the Australian music scene with the death of George Young. Most Australians would know of Lennon and McCartney or Bacharach and David or maybe even Tennant and Lowe and I reckon the song-writing partnership of George Young and Harry Vanda that started with The Easybeats and ran through songs for John-Paul Young, Ted Mulry and others is Australia's answer to them. Anyway “do yourself a favour” and check George Young out here.

Major global economic events and implications

- US data remains strong with strong business conditions PMIs, a rebound in new home sales, solid gains in durable goods orders pointing to solid business investment and ultra low jobless claims. After a soft hurricane affected September quarter growth looks to have rebounded in the current quarter. September quarter earnings reports have continued to surprise on the upside with 79 per cent beating on earnings and 68 per cent beating on sales. However, earnings growth estimates for the quarter have fallen to around 2.5 per cent year on year from 4 per cent after being dragged down by GE and insurers.

- Eurozone business conditions PMIs remain strong (up for manufacturers and down for services) and the German IFO has almost reached its highest level since 1969.

Australian economic events and implications

- Australian inflation surprised again on the downside for the September quarter and so rate hikes are still a way off. Our view remains that the RBA won't raise interest rates until late next year as it will take a while for a gradual pick-up in economic growth to flow through to wages growth and higher underlying inflation. RBA Deputy Governor Debelle's reference to sizeable spare capacity in the labour market and flat Phillips curves implies ongoing RBA concern about low wages growth.

Shane Oliver is the chief economist at AMP Capital.

Investor Signposts

Key measures of economic activity

- The key monthly measures on economic activity are scheduled for release in Australia, US and China in the coming week.

- The week kicks off in Australia on Tuesday with the Reserve Bank releasing private sector credit (or outstanding loans) data. In August, credit rose 0.5 per cent to be up 5.5 per cent on the year with business and home loans driving the gains while personal lending continues to retreat.

- Also on Tuesday, ANZ and Roy Morgan release the weekly survey of consumer sentiment. The data can be volatile so it is best to monitor longer-term trends. Consumers can be best described as nonplussed at present.

- The Housing Industry Association also releases new home sales data on Tuesday, a closely-watched measure of home demand.

- On Wednesday CoreLogic releases its October data on home prices. Based on daily data released so far, Australian home prices were flat in October. But while Sydney home prices eased by 0.3 per cent, Melbourne prices moved higher by around 0.3 per cent. The data should add to the case for leaving interest rates unchanged.

- Also on Wednesday, Commonwealth Bank and Australian Industry Group produce their separate gauges on manufacturing activity. And the Australian Bureau of Statistics (ABS) releases inflation data for different groups in the economy like pensioners and self-funded retirees.

- On Thursday the ABS releases September data on international trade and building approvals. In August the trade surplus rose from $808 million to $989 million. And the rolling 12-month surplus rose from $14.0 billion to a record $16.8 billion. In addition the data showed that Australia's annual exports to China lifted from $96.5 billion to a record high of US$98.6 billion in the year to August.

- In terms of council approvals to build new homes, they rose by 0.4 per cent in August after falling 1.2 per cent in July and soaring by 11.1 per cent in June. In trend terms, approvals rose for the seventh straight month, up by 1.1 per cent.

- On Friday, the ABS issues the September retail trade figures – including not just the monthly data but the quarterly results of the volume of goods purchased. Sales fell 0.6 per cent in August but retail trade only accounts for 30 per cent of household spending, so it is more focussed on sales of goods rather than services. As a result the data may be highlighting a shift in the sorts of things that consumers are purchasing.

- The October data on new vehicle sales is released by the Federal Chamber of Automotive Industries on Friday.

Overseas: A big week for economic events

- There is a packed schedule of economic data releases in the coming week including data on US employment, gauges of Chinese economic activity and a meeting of Federal Reserve policymakers.

- The week kicks off on Monday with the release of US personal income and spending. While spending is tipped to lift 0.7 per cent, ahead of a 0.4 per cent lift in income, most interest will be in a key inflation measure. The Federal Reserve's preferred inflation measure – the core personal spending deflator – is tipped to lift 0.2 per cent, keeping the annual rate low near 1.4 per cent.

- On Tuesday in the US is the quarterly measure on employment costs. Economists tip a mild lift in the growth pace from 0.5 per cent to 0.6 per cent in the September quarter. But this may not be a big enough lift to worry policymakers.

- Also on Tuesday in the US is the S&P/Case-Shiller home price index, consumer confidence data and the Chicago purchasing managers index.

- Over Tuesday and Wednesday the Federal Reserve policymakers meet to decide interest settings (Thursday 4am, Sydney time). Economists don't expect a move this month but December is seen as an each-way bet.

- In China on Tuesday the National Bureau of Statistics releases purchasing manager survey results for both manufacturing and services sectors.

- On Wednesday in the US there is a gamut of economic indicators to be released including new vehicle sales, the ISM manufacturing index, the ADP survey of private employment and data on construction spending.

- On Thursday, the usual weekly gauge on the job market – new claims for unemployment insurance (or jobless claims) – will be issued together with the Challenger survey of job cuts and quarterly data on productivity and labour costs.

- On Friday, the all-important employment data is released in the US (non-farm payrolls). After a hurricane-affected 33,000 drop in jobs in September, job growth is tipped to power ahead by 300,000 in October. Average earnings (wages) may have lifted by 0.3 per cent in the month.

- The US ISM services index, factory orders and international trade data are also slated for release on Friday.

Craig James is the Chief Economist at CommSec.

Readings & Viewings

The news just gets better and better for online juggernaut Amazon, which should have Australian retailers quaking in their boots. Amazon has just reported third-quarter sales figures that eclipse the annual revenues of most other companies on the planet.

Founder Jeff Bezos has scored the biggest ever pay rise in history, and it happened yesterday.

Meanwhile, a Florida Amazon customer and her fiancé received a large surprise after opening a package order that contained nearly 30 kilograms of marijuana.

The latest results coming out of the US tech sector are nothing short of phenomenal. Google parent Alphabet has also reported monstrous sales from the latest quarter, and its share price has jumped above $US1,000.

Staying online, Uber is getting into the credit card business.

The City of Vancouver is looking to close the door on Airbnb short-term rentals.

California's battle against climate change is being fought more fiercely in fast food restaurants than in Tesla Inc.'s car factory in Fremont.

A new mega-factory in Shanghai could help Tesla shift into second gear.

It seems consumers are spending, but a worrying trend has developed among Federal Reserve officials in the past month: They claim to no longer have a working theory of inflation in the economy.

London firms will begin activating their Brexit contingency plans unless the Government provides clarity over a transition period by the end of the year, the City of London Corporation has warned in a letter to the Chancellor.

UK PM Theresa May has signalled there will be no transitional deal to prevent a “cliff-edge” Brexit unless the UK settles its final trading relationship with the EU next year.

But going against the trend, Michael Bloomberg expects his financial information company to hire thousands of workers after opening its new £1 billion European headquarters in the City of London.

Global liquefied natural gas (LNG) markets will remain oversupplied into the 2020s due to a surge in production.

Agricultural chemicals maker Nufarm Ltd is buying up a range of European crop protection product lines for $US490 million to strengthen its position in Europe.

Stock up your wine cellars. Experts are warning that global wine production is to fall to its lowest level in more than 50 years.

Fancy a private flight? This passenger booked herself on a normal commercial flight and had a huge surprise.

The French butter crisis is beginning to bite, but some are profiting from the shortage.