Blowing down 'as safe as houses'

Investor activity continues to drive the housing market. But is Australian housing a good investment? Not if the past decade is any indication.

The value of housing loan approvals rose by 1.5 per cent in November, following two consecutive months of 7 per cent growth, to be 35 per cent higher over the year. I discussed housing loans in detail on Monday, but today the Australian Bureau of Statistics released the state breakdown for investor activity (The housing boom is on borrowed time, January 13).

In New South Wales, the value of investor activity has climbed by 46 per cent over the year to November and is 33 per cent higher annually. Investor activity continues to be strongest in New South Wales, which has been the hotspot for speculative investment since lending rates hit record lows.

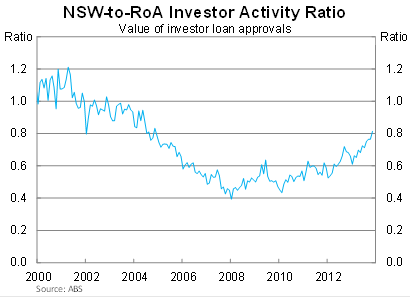

New South Wales accounted for around 45 per cent of all investor activity in November. The graph below shows the ratio of New South Wales investor activity to the rest of Australia. A ratio of 1.0 would indicate that investor activity is equal in New South Wales and the rest of Australia.

Although investor activity is undeniably strong in New South Wales, it is hardly without precedent. Investor activity was much stronger during the early part of the decade when investors had little interest in the other states. But investor activity is the strongest it has been in almost a decade – around the time when real house prices in Sydney effectively stalled.

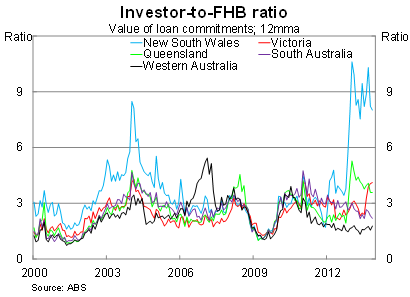

What is different is that the surge in investor activity has come without much interest from the bottom of the market. First home buyer activity has never been weaker, particularly in New South Wales.

The ratio of investor activity to first home buyer activity is at an extremely high level in New South Wales and we really have only one previous episode that comes close. That episode was marked by what has become a decade long correction in Sydney real house prices that saw almost no price growth over that period.

Could that happen again? Perhaps, though perhaps the rules have also changed a bit since 2004. We hear a lot of talk about foreign investors and self-managed super funds speculating in the market and that may have led to a change in market dynamics. But generally if something looks as unusual as the New South Wales line does in the graph below, then the sustainability of that situation should be questioned.

Investors have been active in the other states, albeit to different extents.

In Victoria and Western Australia, investor activity has been quite strong, but first home buyers are far more active in Western Australian than in Victoria. Despite elevated house prices, the younger generation in Western Australia have benefited from a raft of relatively low skilled but high paying jobs throughout the mining boom.

In Queensland, investor activity has been relatively muted during 2013. However, it appears as though that has changed in the past three months with activity now 25 per cent higher over the year to November (though only 10 per cent higher in 2013 as a whole).

Activity in South Australia, whether of the investor or the first home buyer variety, has been fairly weak.

As it stands right now, investors are the major driving force in the housing market. In New South Wales we are seeing activity from investors and first home buyers that is historically unusual and unlikely to persist for a lengthy period. It is one of several reasons why the current level of house price growth in Sydney is unsustainable.

Some will question the importance of first home buyers to the market. But the housing market constantly needs new sources of demand to increase competition and drive prices. New demand is driven by new investors or by first home buyers. The latter is nowhere to be seen, so the obvious question is whether Australian housing is a good investment.

Prices are high relative to most countries and housing hasn’t provided a great return on your investment over the past decade. If you invested in Sydney housing a decade ago, you would only now be making a real return. Money in the bank would have been a better investment than Sydney housing since 2004.

For foreign investors, there will surely be better opportunities for housing investment than in Australia. They will realise this in due course. Right now they may make a quick return and the market may even prove buoyant enough to prove Alan Kohler right (Will the dollar fall and property rise? Yes, yes; January 15).

But it's more likely that this upward swing is no different from the last few that resulted in significant price corrections. We can't be too confident in a market that is being driven by the most skittish of property buyers.