Bitcoin's market twist

Summary: Bitcoin's price might appear to be moving with no visible correlation to any other asset, but look closer and a peculiar trend emerges.

Key take-out: Speculating rather than investing is driving a new wave of volatility in virtual currencies and on share markets.

The volatility of cryptocurrency markets is well known and, until recently, this volatility was difficult to link with any other asset class or wider index. The past few months have changed this, with bitcoin forming an interesting correlation with one particular index.

Masao Muraki, a Deutsche Securities global financial strategist based in Japan, identified bitcoin's price was inversely related to the S&P 500's near term volatility index, the CBOE Volatility Index, (known as the VIX), with the link going back as far as the start of December.

In the note, circulated to clients last month, Muraki said, “A growing number of institutional investors are watching cryptocurrencies as the frontier of risk-taking to evaluate the sustainability of asset prices. The result is that institutional investors … are actually seeking feedback about the market from cryptocurrency prices”.

Morgan Stanley analysts echoed this view, even saying the bitcoin price had become a key indicator of risk in the equity market for some clients.

“The idea is that as institutional investors seek out increasingly higher levels of risk and return, bitcoin may represent the most risk/potentially highest return available, and hence could be evolving quickly into a primary barometer”.

If institutional investors are looking to speculative trading by retail investors for guidance on risk in markets, something must be up.

The correlation Muraki and his co-authors Hiroshi Torii and Tao Xu observed was that as the VIX rises, bitcoin prices fall. Low VIX values have coincided with bitcoin's rise to record highs. Muraki said the correlation between bitcoin and the VIX had increased in the first three weeks of 2018.

Chart: Bitcoin price (USD, inverted) and the CBOE VIX, December 1 to February 2

.jpg)

Source: Deutsche Securities

The Volatility Rollercoaster

This got people talking back in mid-January, after the biggest cryptocurrencies all fell dramatically on the January 16. Bitcoin was down more than 25 per cent, while the VIX rose above record lows when the S&P 500 opened 0.9 per cent higher to close above 2800 for the first time, but lost all those gains and more to close lower.

That was just a taste of the volatility to come. Last week's turbulence saw the S&P 500 index at one stage down almost 12 per cent on recent highs to enter ‘correction' territory for only the fifth time since the GFC. But wild swings over the week ended with the index down only 5.2 per cent at the close on Friday. The VIX spiked on Tuesday February 6, peaking at 46.08, a 168 per cent increase in just 24 hours. Three hours before the VIX peaked, bitcoin plummeted almost 14 per cent to $US5947.40, its lowest price in three months.

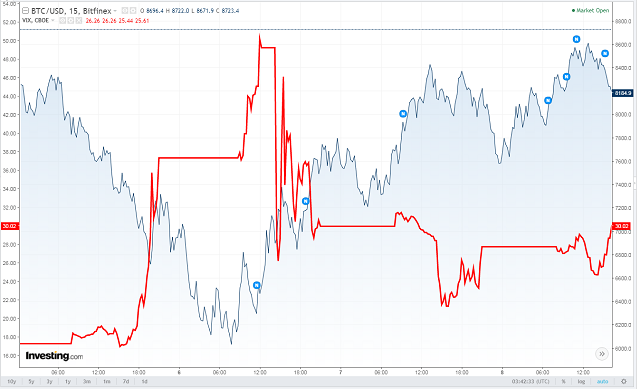

Chart: Bitcoin price (USD, rhs, blue) and CBOE VIX (lhs, red), Monday February 5 to Thursday February 8

Source: Investing.com

What explains this correlation? There have been plenty of other elements influencing behaviour on markets recently. Banks are making it harder to buy virtual currencies using credit cards, with some either banning them or treating the purchases as ‘cash advances' and charging higher interest rates accordingly.

On equities markets, investors were spooked by higher-than-expected wage growth figures, which could translate into higher inflation, forcing future interest rate increases. Bond yields rose and traders ran for the exits.

Speculation Causes Panic

That's where the correlation exists – in a herd mentality of panic. What this means is when volatility enters markets, like it did last week, inexperienced investors will abandon all risky assets like bitcoin and stocks, to seek refuge in safer investments like government bonds. Also see Cryptos deliver nasty burns.

Christopher Harvey, Wells Fargo's head of equity and strategy, described this panicked environment to CNBC's Fast Money program last week, pointing out a lot of trading in cryptocurrencies was by uninformed speculators.

“People don't really understand what's happening in the (bitcoin) market ... as risk gets sold, it adds fuel to the fire,” he said.

Harvey said those speculators would leave the market as bitcoin becomes more regulated, possibly reducing volatility and risk as well. That's still a way off, even with proposed changes.

Simon Ho, managing partner at Triple3 Partners, a division of Grant Samuel Funds Management, told Eureka Report the spike in volatility last week was driven by imploding volatility products, many of which have either been closed or lost much of their value.

Retail investors were originally drawn to these products for the high returns (up to 180 per cent a year) on offer in an environment where they felt safe enough to take risks, in the same way many decided to jump aboard bitcoin's rise.

“We've had quantitative easing, which has effectively inoculated the universe against risk,” Ho says. Perhaps the type of investor buying volatility products was also venturing into the cryptocurrency world.

Ho believes people will now be more wary of assets like bitcoin because, he says, “we don't know what the economic value of it is” and after the losses suffered over the last month, investors will migrate back to safer assets.