BHP's break-up scenario

Summary: BHP now no longer benefits from diversity of assets as it once did, as commodity prices have slid across the board. Analysis from Citigroup Global Markets has suggested a break up of the company could be on the cards given that the exploration, marketing and M&A activity at BHP have all faced problems, while spin off South32 (S32) has outperformed its parent company in the past 12 months. |

Key take-out: While an actual break up is unlikely for now, Citi's analysis has launched a conversation on the miner's future. |

Key beneficiaries: General investors. Category: Commodities. |

Diversity was once BHP Billiton's strength. Not now, which is one reason why break-up talk has resurfaced.

Another reason is that last year's South32 spin-off has outperformed its parent on the stock market, adding to a belief that additional value might be created for investors with more spin-offs to create a series of separate companies.

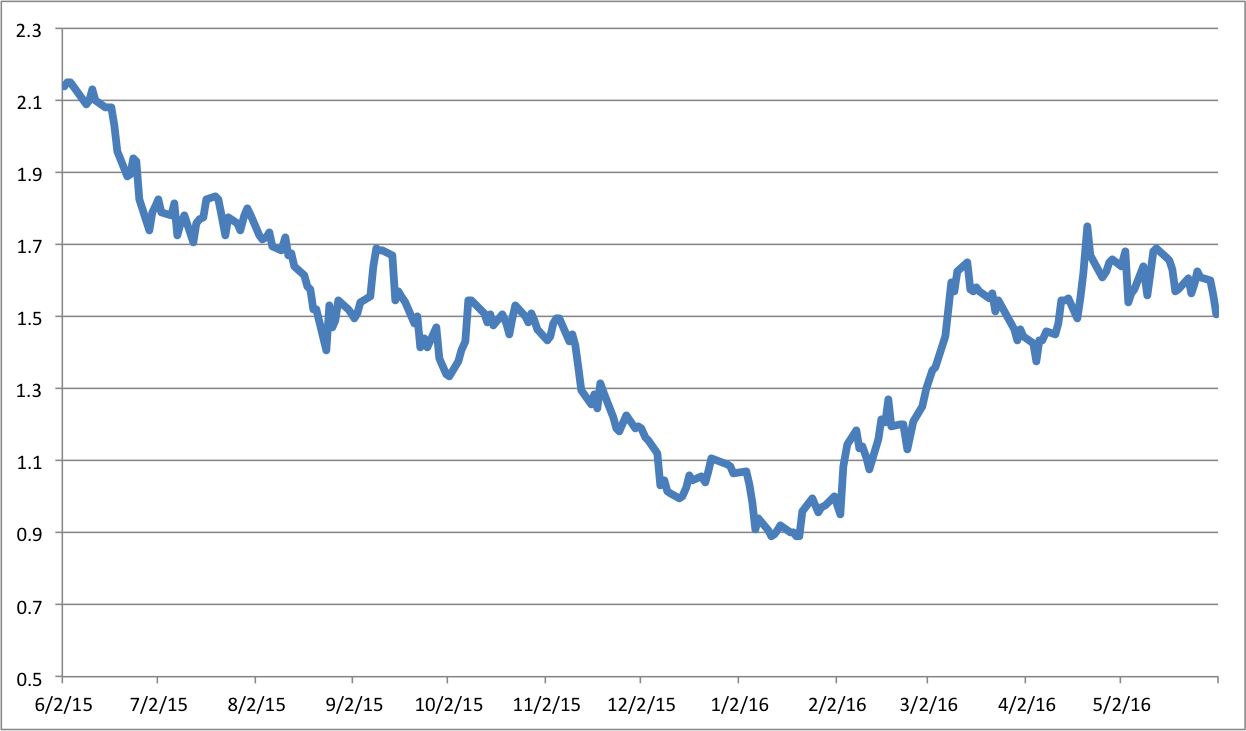

South32 (S32) share price, past year:

Source: Bloomberg

Splitting BHP Billiton into specialised businesses focusing on the core assets of iron ore, copper and coal has been suggested in the past, only to be rejected by management on the grounds that greater long-term value is created by diversity.

Citigroup Global Markets, an investment bank, has trashed the diversity claim in a fresh research report, but not gone the next step and proposed a break-up of BHP Billiton even though the bank said the company “is suffering somewhat of an identity crisis”.

Perhaps even stronger than the tag of identity crisis is another suggestion from Citi, that BHP Billiton is looking for “raison d'etre”, a French expression which translates into “reason for existence”.

The critical comment from the bank's research team is that during the commodities boom, the so-called “super cycle”, BHP Billiton's diversity “was meant to allow the progressive dividend policy to weather any cycle”.

It didn't, as every investor knows, with BHP Billiton forced to renege on its promise of a perpetual steady (or rising) dividend, because it was caught by falling prices for all of its commodities, while also being weighed down by excessively optimistic expansion projects and higher-than-expected debt levels.

“After a capital expenditure and merger-and-acquisition binge return on invested capital has collapsed back to the 1980s level of around five per cent,” Citi said.

Worse still dividends, which had been a major reason for investors buying the stock, are now “exposed to volatile daily prices”.

In effect, the principal appeal of BHP Billiton as an investment, its diversity, has been removed with the company reduced to “four key commodity pillars”: Iron ore, petroleum, copper and coal, and a left-over nickel business that has proved to be unsaleable.

Everything else that once gave BHP Billiton the impression of diversity, with assets such as manganese, aluminium and silver, has been offloaded into South32 which was initially criticised as being a business stuffed full of poor-performing corporate leftovers.

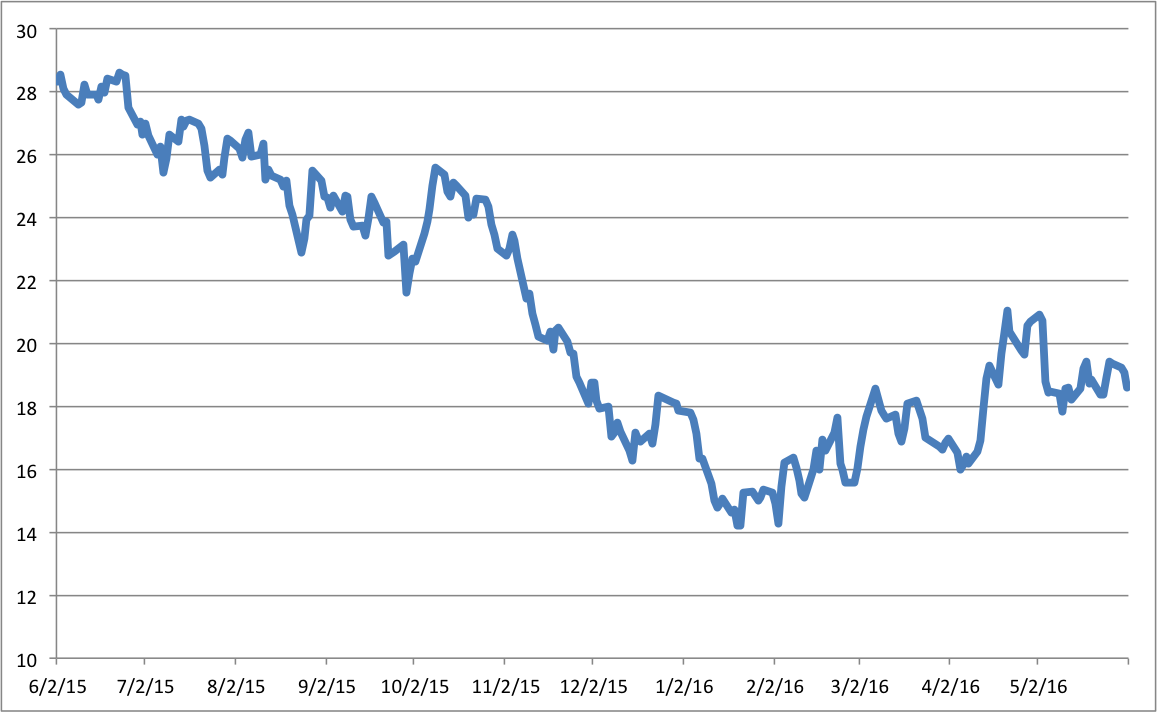

But, since the start of 2016 it has been the spin-off which has starred and the parent which has faded.

After touching a share price low for the year to date of 87c, South32 has traded up to $1.53, a rise of 75 per cent. BHP Billiton over the same time has risen from a low of $14.20 to $18.54, a rise of 30 per cent.

BHP Billiton share price, past year:

Source: Bloomberg

There is no guarantee that South32 will continue to outperform BHP Billiton. Commodities are, if nothing else, cyclical.

South32 has been doing far more than just riding a commodity wave. It has been undertaking a rigorous cost-cutting campaign which has seen layers of former BHP Billiton management stripped out of every inherited business.

At an investment conference in the US city of Miami early last month, South32's chief executive, Graham Kerr, said the company was on track to remove $US300m in controllable costs and reduce capital expenditure by $US218m.

Another focus has been debt reduction, and even though it was launched with a low level of debt by BHP Billiton, its spin-off is now in the luxury position of effectively being debt free with Kerr revealing that South32 had a net cash balance of $18m at March 31. The cash position is expected to grow substantially.

Whether a similar performance could be achieved by separate iron ore, petroleum and coal businesses should they be spun-off by BHP Billiton is the $64bn question which some investors will be asking given the success of South32 in ridding itself of BHP Billiton's gold-plated management structure.

Citi chose to not explore the break-up potential of BHP Billiton, but it was as critical as an investment bank can be of a major company with those two French words, raison d'etre, a bleak suggestion that BHP Billiton, in its current form, lacks a reason to exist.

The analysis by Citi looks at the four critical elements which go into a valuation of BHP Billiton; exploration (the research and development arm of a resources business), construction and operation (of new projects), marketing (of minerals producers), and M&A (mergers and acquisition).

Three of those four foundation elements of BHP are criticised. One earns faint praise.

Exploration, according to Citi, has yielded little by way of mineral discoveries over the past 15 years despite $US6bn spent. Petroleum, which has absorbed $US8bn, has been more successful. On the lack of minerals success, Citi said: “Hidden gems may be lurking, but nothing in the proposed minerals development pipeline was discovered through greenfield (new target) exploration.

Marketing is an area where BHP Billiton has changed the way commodities are traded being a leader in the shift away from long-term contracts to a system of “pricing on the day”. “What is more debatable is what marketing contributed to returns, even if we sidestep the issue of whether the transformation of commodity markets has actually driven higher realised prices,” Citi said.

Construction and Operation, are areas where BHP Billiton has achieved an industry average with one-third of new projects being over budget, and 28 per cent behind schedule resulting in an overall increase on budgeted costs of 11 per cent, or $US6.2bn. “Although on the face of it this does not look like a great track record when you consider the period of capital cost escalation in the mining sector globally it is a reasonable result,” Citi said.

M&A is another poor area for BHP Billiton, but also one where the company dodged two potentially deadly deals. The worst acquisition was the $US20bn US shale oil investment which led to heavy asset-value write-downs. But it could have been a lot worse if BHP Billiton had acquired Rio Tinto in 2007 for $US150bn or Potash Corporation in 2010 for $US40bn given that Rio Tinto is now valued at $US50bn and Potash Corp is now valued at $US13bn.

While Citi does not go as far as to suggest a break-up of BHP Billiton, or more spin-offs similar to South32, it is significant that the bank only has a 12-month price target for the stock of $18.50, which is 95c less than its price on May 27 when the research report was written.

Perhaps even more surprising Citi assigns BHP Billiton a “neutral” rating which is the equivalent of hold despite an expectation that the company's share price is likely to fall over the next 12 months.

The only conclusion from a hold tip on a stock expected to lose value is that other companies in the same sector must be expected to deliver an even worse performance over the next 12 months.

Consensus forecasts for BHP Billiton and South32 are broadly similar with South32 maintaining a modest lead over its parent with investment banks tipping a price target of $1.71 (up 12.7 per cent) versus BHP Billiton's forecast $20.40, which is well ahead of Citi's price target but implies a rise of 10.5 per cent, slightly less than South32.

While a break-up of BHP Billiton is highly unlikely, the seeds of a debate have been sown by Citi and South32.