BHP tips the next commodity to boom

After more than five decades of watching BHP, I cannot recall anything like its 2014 interim report presentation.

Not only does BHP chief executive Andrew Mackenzie give BHP shareholders a tip on where he thinks the next boom might come from, but what is happening on the BHP capital expenditure front is without precedent in BHP’s last half-century.

First: the next boom. It was iron ore that drove the BHP half-yearly profit and cash flow generation way beyond what analysts had anticipated.

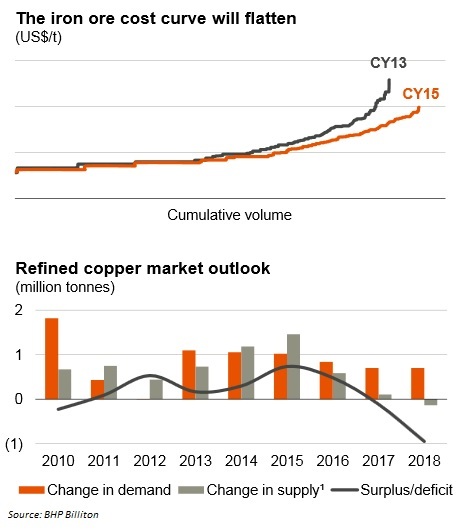

But tucked away in the BHP investor presentation is a graph that shows that global iron ore production is going to rise faster than demand.

BHP says demand will rise but Mackenzie’s graph below shows that while there may not be a crash, high-cost iron ore producers are going to be forced from the market. BHP’s inner Port Hedland harbour is a very economical expansion. Mackenzie scrapped the high-cost outer harbour expansion and wrote off the early expenditure.

The next boom is not going to come from iron ore. Mackenzie clearly believes that copper is a great boom candidate. Mackenzie has submitted a remarkable graph to BHP shareholders. It shows that demand for copper will keep growing, but supply is set to slump. That’s why BHP is expanding and improving Escondida.

If Mackenzie is right on copper, and if the current reports that there is a looming supply shortage of uranium are correct, then the mothballed Olympic Dam expansion will come up for consideration.

Previous BHP CEOs have always seen their mission as increasing the amount of resources their successors had to develop.

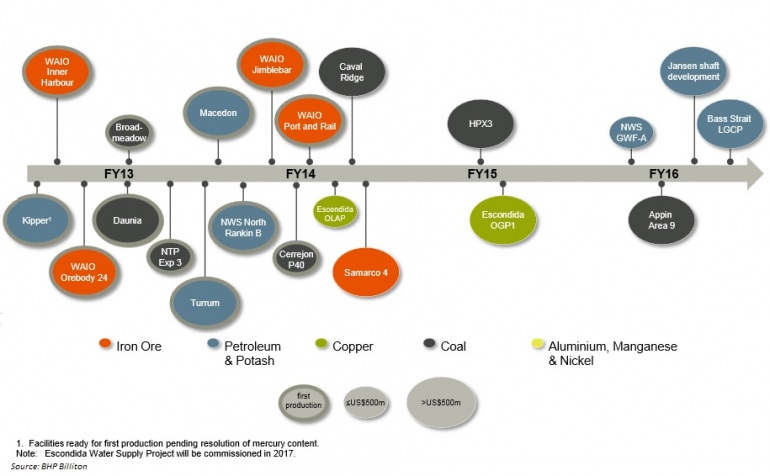

Mackenzie has torn up the rulebook. You can see from my second graph that there will be a lot of BHP projects being completed by next year. Mackenzie’s predecessor Marius Kloppers launched most of them. But cast your eye over the years after 2015 – there will be very few.

The only time that such a situation has arisen in the last 50 years is when there had been a catastrophe and BHP had lost lot of money. That is not the case in 2014. BHP brushed with disaster at Olympic Dam and outer Hedland harbour, plus the Potash Corp and Rio Tinto bids. Because none of them happened, BHP is now very strong.

If Mackenzie is right about the world expanding at a slower pace, BHP is going to return a lot of cash to shareholders.