BHP and Rio's fossils kicker

Summary: Rio Tinto is quitting coal, while BHP is under pressure to sell its shale oil assets. Each sale will net billions, presenting the opportunity for new investments and capital returns for investors.

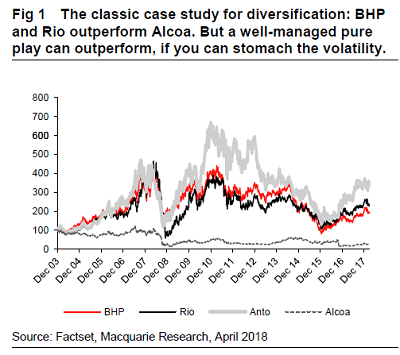

Key take-out: Expectations are that both sales will deliver higher-than-expected returns. Does that mean the buyers are seeing something that Rio and BHP don't?

BHP is in the process of selling its onshore US oil and gas assets. Rio Tinto is selling all of its coal assets. Two deals and two seemingly different commodities, that is until you consider the common threads of coal and oil being politically incorrect fossil fuels.

For most investors what's happening raises an interesting question – to stick with the fossil family or consider whether they could become financial burdens as regulatory controls rise and renewable energy eats into profit margins.

Rio Tinto's move to quit coal altogether is a very significant development, as it means it has become the first of the world's four big diversified miners (alongside Anglo American and Glencore) to have no coal assets.

But the other side of the coal exit for a reported $US7.7 billion over a three-year sales campaign is that Rio Tinto is likely to become the first of the majors to achieve the unusual status of being debt free, perhaps sometime around the end of the year.

Even if it is coincidence that their fossil fuels are being sold, the shale and coal disposals by BHP and Rio Tinto lead to a second question – what will the companies do with the capital being liberated? Invest it in new projects or return it to shareholders?

A bright future for coal?

More questions are being asked than answered by the fossil fuel asset shuffle underway in the world's mining industry, since an associated issue is that both sets of assets seem likely to fetch higher prices than expected. In other words, some resource companies see a bright future in coal and oil.

That point about willing coal buyers was explored in the article: Coal, cash and questions last week, but when BHP finalises the sale of its onshore US oil and gas assets it will remain under pressure from activist investor Elliott Management to sell the rest of its oil portfolio.

That means exactly the same issues come to light at BHP as they have at Rio Tinto, as it seems that the sale price will be more than originally expected.

The energy sea-change

Australia's top two resource companies are either quitting fossil fuel assets at a perfect time and getting high prices in the process, or they're misreading the demand outlook at selling to buyers who believe coal and oil prices are more likely to rise than fall.

There appears to be a sea-change rolling through the resources sector which could potentially lead to a fundamental change in the structure of the big diversified miners.

Quitting fossil fuels and achieving debt-free status means the ground is being prepared for something new – either expansion of existing business units, development of new projects, or growth by acquisition. Rio Tinto's coal sales have been well explored, which means the next deal is BHP's oil sale.

A financial surprise

Based on a similar recent deal in the onshore US oil and gas industry, we may see a number of investment banks handling the sales process deliver a nice financial surprise.

What's got bank analysts interested is a $US9.5 billion takeover of a company called RSP Permian by Concho Resources – a deal which could deliver a windfall of several billion dollars if BHP gets the same terms.

Citi, one of the banks to use the Concho/RSP deal as a yardstick, said that it notionally valued the BHP assets at between $US10 to $US14 billion, with the lower number close to double the $US5.4 billion value Citi put on the BHP assets earlier this year.

Macquarie has lifted its estimate for the BHP oil and gas sale to between $US8 and $US14 billion. RBC Capital Markets has raised its estimate from $US7 billion to $US8 billion.

The liberation of such large amounts of capital by both Rio Tinto and BHP was always going to generate a debate about investment options and capital management. But the timing of the two deals could hardly be more thought-provoking, since they're occurring at the same time as the resource sector investment cycle turns towards takeover time.

In a report published by Morgan Stanley last week, the merger and acquisition (M&A) activity ‘will become an increasingly important tool for reinvesting capital next financial year.'

RBC agrees, telling clients in a similarly-worded report that the resources sector was in its best financial health for a decade with debt down, commodity prices edging higher and a lack of new projects to swamp demand as happened after the last project-building boom in 2012.

“We believe M&A is all about when you deal, not what you pay,” RBC said, adding that it was “better to pay more at the bottom of the cycle, than to pay less at the top of cycle.”

Morgan Stanley's case for a burst of M&A activity centres on the amount of cash likely to build up in the mining sector over the next four years.

Free cash flow for the major miners out to the year 2022 is tipped to be a cumulative $US294 billion. Of that, $US162 billion is expected to be paid as dividends, leaving $US132 billion of excess cash for management to deploy.

According to Morgan Stanley M&A “is likely to play an increasing role” in capital allocation, partly because the miners do not have a long list of projects ready to develop but also because they're likely to be concerned about adding excess supply, as has happened in earlier periods of recovery.

A third issue is the uncertainty about the sustainability of the current conditions given the threat of a US-China trade war.

It's the cocktail of issues which point to a period of significant change in resources over the next few years, with issues that include:

- The wholesale exit from fossil fuels by Rio Tinto and BHP – if Elliott's demand to sell all oil assets is successful.

- What will replace coal and oil?

- And how the large amounts of capital being liberated will be allocated.

In effect, the fossil fuel asset sales could be laying the groundwork for important changes in the resources sector.