Beyond the Internet: A look into the past

Economic Six Pack

Investor Signposts, by Craig James (CommSec)

Readings & Viewings

Until 1799, humans believed that electricity was generated by living beings. Alessandro Volta, a creative bloke who discovered methane, put paid to that when he invented the Voltaic pile, the world’s first battery, in 1800.

Despite centuries of human progress since then, in the 1970s my father would rotate the Lanchester 14’s ignition key, wait, then curse before finally reaching for a lump of steel under his seat. He used it to hand crank the engine, returning minutes later sweaty and irritated. I have always assumed this to be the etymological genesis of “cranky”.

The Lanchester Leda: heavier than a herd of rhinos; slightly faster than a guinea pig.

Source: Wikipedia

It takes time, sometimes centuries, before the consequences of a grand invention play out and its economic impact is fully understood. What begins as a replacement for a beeswax candle, itself delivering a huge productivity boost, can lead, hundreds of years later, to a pacemaker in an ailing heart and a dodgy starter motor.

Volta could not have known the inventions his discovery would enable and that without electricity we’d all be watching telly in the dark.

The summary timeline looks something like this:

|

Year |

Invention |

|

1800 |

Volta invents the battery |

|

1831 |

Joseph Henry develops DC motor |

|

1876 |

Bell makes a telephone call |

|

1900 |

Marconi makes a radio broadcast |

|

1929 |

First public TV broadcast in Germany |

|

1936 |

First printed circuit board |

|

1951 |

World’s first nuclear power plant |

|

1953 |

First transistorised computer |

|

1963 |

The VCR and electronic calculator |

|

1991 |

The world’s first website |

This looks like a narrative but it’s a misleading one. The DC motor has little to do with a computer, except that both are made possible by electricity.

Which brings me to the point: what if the Internet isn’t just another invention with a traceable lineage all the way back to Volta? What if the world’s first website shouldn’t be at the bottom of the above list but at the top of a new one? What if the Internet is the new electricity?

Magellan’s Hamish Douglass seems to be of this view, this week claiming that the Internet is “the biggest change for humanity in over 200,000 years”. Big call that, especially for those that didn’t die of measles. Nevertheless, there might be something to it.

Whilst the inventions that followed Volta’s battery have the same genesis, the Internet is different in the way it reorganises everything. Nothing new that emerges online looks much like what it replaces, which is a clue to its transformational power.

A few examples: Cabcharge is being replaced not by a better taxi company, which wouldn’t be hard, but private drivers earnings a few bucks via an app. Newspapers are being replaced by the likes of Carsales.com, REA Group, Facebook and Google, none of which have much to do with journalism.

Hotels now compete with spare rooms and the work of financial advisors is being replaced by algorithms. Even in consumer products, global brands like Gillette are under threat from subscription-based businesses like Cornerstone and Dollar Shave Club.

The Internet has allowed new businesses to unbundle old value chains that were, in effect, middleman operations. The next-to-nothing distribution and transactions costs of online businesses, to paraphrase Billy Bragg, have “cut out the middleman”, making the revolution just a click rather than a t-shirt away.

The impact of Netflix on TV networks offers a good example. The networks bought together advertisers and audiences with programming. Advertisers needing to reach a big audience had no choice but to use TV. And viewers that enjoyed a particular program had to watch at a certain time.

By making its programming library available to stream at any time, Netflix offered a better, ad-free user experience. With lower distribution and transactions costs it was able to aggregate audiences, ignoring advertisers altogether whilst chipping away at the network’s business model. The result is that in June of this year Channel 10 went into administration and a month later Netflix passed 100 million subscribers.

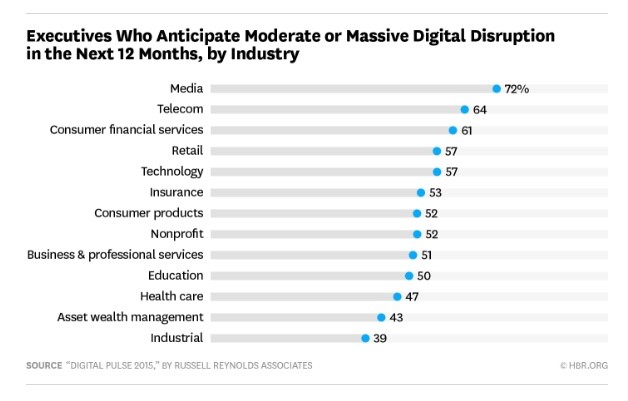

Of course, you already knew that. When anyone talks about the Internet upending business models the media industry is the first to get a mention, mainly because it’s obvious and there’s nothing the media loves to write about more than itself. The chart below offers a different take, indicating why Douglass might be right about the long-term, across-the-board impacts.

Source: HBR.org

All the common examples of disruption are in sectors at the top. But even at the bottom, in healthcare, professional services and education, a substantial minority of executives still expect some form of disruption within 12 months, based on a two-year old survey.

Which is to say that we may be just at the beginning; closer to the point at which Joseph Henry thought the DC motor might be a good idea rather than Elon Musk sliding into a new Tesla 3 and making it look like the future.

Where this might lead is anyone’s guess. The automotive industry, largely unchanged in a century, might simply shift to electric vehicles. Or it could be decimated by ride sharing, which would have further implications. What, for example, would be the impact of the release of no-longer-needed road space on the construction and real estate sectors?

And what might be the effects on the banking sector if services like DomaCom, which crowdfunds mortgages, become commonplace? How would the healthcare sector be affected by digitised, always-available medical records that crowd source diagnoses, and devices that warn of heart attacks and strokes before they occur? Please, come quickly my just-beating heart.

Even new Internet businesses would be challenged. How, for example, might realestate.com.au be impacted by an app that allows users to point their phone at block of apartments and see which units were for sale and the price and contact details of the owner? Might not be pretty.

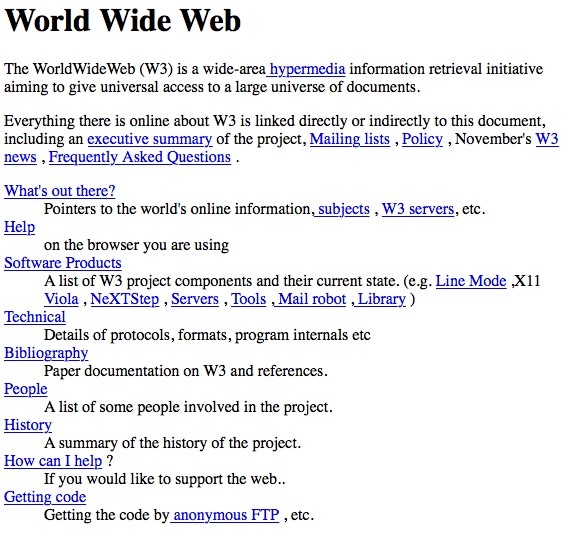

Caption: The world’s first website: http://info.cern.ch/hypertext/WWW/TheProject.html

The Internet is now 25 years-old. If the screenshot of the first webpage above is any indication we’ve come a long way (government websites excepted, obviously). But anticipating what’s next is like expecting Volta to forecast the arrival of the video cassette recorder. It’s just hard to even contemplate, a fish riding a bicycle kinda thing.

For investors, this means complacency is not an option. We cannot assume what has gone before offers a roadmap to the future. The Internet may not be the biggest change in humanity in 200,000 years but most of us are probably underestimating its long-term impact on the businesses in which we invest.

*****************************************************************************************************

Reporting season has now closed and only now are Intelligent Investor analysts staggering out of the abyss. It’s been a busy month alright. Our reporting season wrap will be published on Monday, covering the high and low lights, but one thing struck me as worthy of mention.

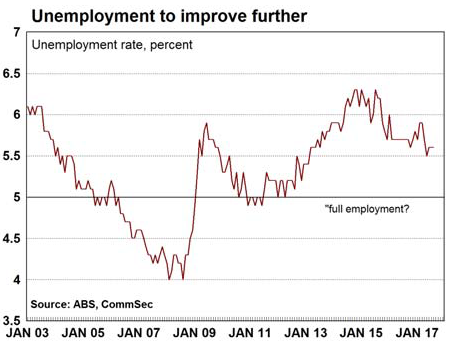

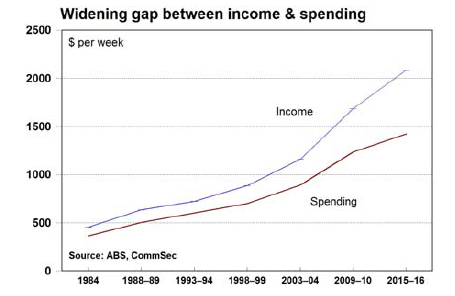

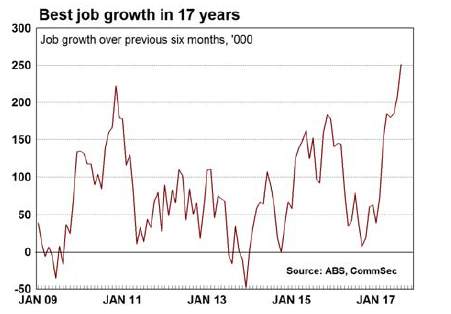

It’s been a theme for a while but this season confirms the trend. Corporate profits are growing, allowing the payment of record dividends — $26 billion in coming months according to CommSec, $4bn more than in the previous period. But wages growth is flat and economic growth weak.

This would please the troglodytes at the Business Council of Australia no end. For the BCA, there is no issue that cannot be solved by lower corporate taxes and lower wages (excluding their own, obviously).

This reporting season offers further evidence that, contrary to the BCA’s claims, rising corporate profits do not lead to higher wages and economic growth.

It’s about time the BCA took a break from unencumbered self-interest and joined the real world.

Wages growth is good for everyone, corporates and their shareholders included. We need more of it.

Enjoy the weekend.

Economic Six Pack

Investor Signposts

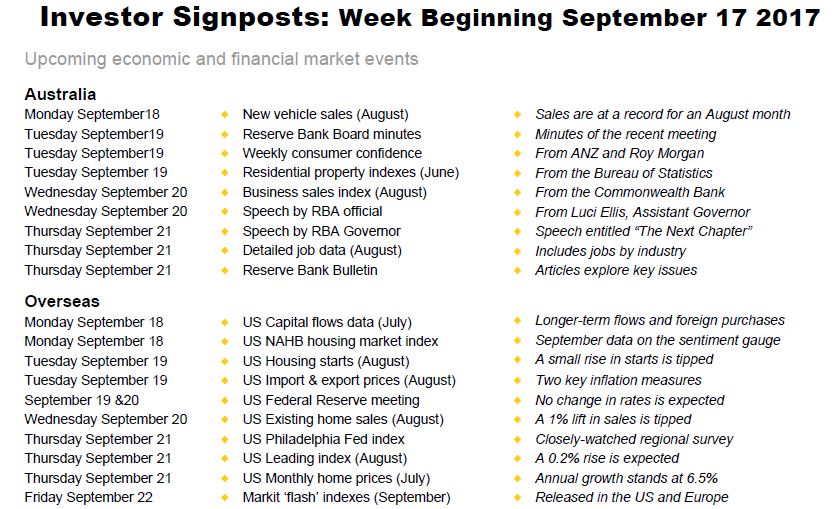

Reserve Bank dominates the agenda

- If it wasn’t for the Reserve Bank, it would be a sparsely-populated Australian economic calendar. There are two speeches from Reserve Bank officials and two key reports from the central bank.

- The week kicks off on Monday with the Australian Bureau of Statistics (ABS) releasing the August data on new vehicle sales. The industry body – Federal Chamber of Automotive Industries – has already released the raw data on sales. And this showed that sales were at a record high for an August month. With car affordability at record highs, it makes sense that we buying more cars. The ABS will recast the data in seasonally adjusted terms.

- On Tuesday the Reserve Bank issues minutes of the last Board meeting held on September 5. The report is useful in getting fresh insights on the economy – especially the reports of Reserve Bank liaison with business and retailers.

- Also on Tuesday the ABS releases the June quarter report on the residential property sector. The data includes price indicators but there are also statistics on the number of homes in Australia and home sales (transfers). From the figures it is also possible to obtain metrics such as the number of people per home.

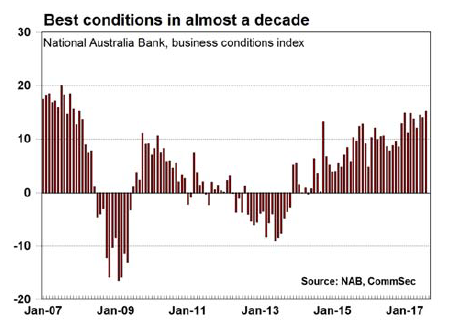

- And the weekly data on consumer confidence is also scheduled for release on Tuesday. Consumer sentiment is soft but that hasn’t stopped people from buying – spending growth is around “normal” levels.

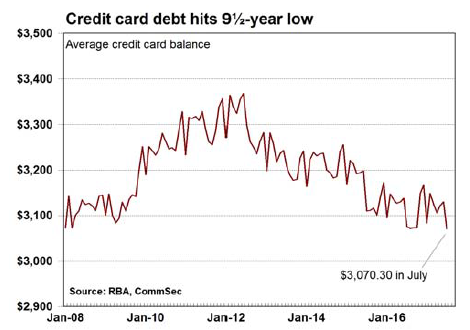

- On Wednesday, Commonwealth Bank releases the Business Sales Indicator – a measure of economy-wide spending derived by looking at credit card and debit card transactions by CBA merchants.

- Also on Wednesday, the Reserve Bank Assistant Governor (Economic), Luci Ellis, speaks at the Australian Business Economists (ABE) conference.

- On Thursday the ABS releases the detailed labour market figures for August. As well as providing key demographic and geographic estimates, the August data contains the quarterly estimates of employment by industry sector and profession. The services sectors have been leading the way in job creation.

- And also on Thursday the Reserve Bank releases its quarterly Bulletin, containing topical articles on the economy and financial markets.

- Also on Thursday the Reserve Bank Governor is scheduled to deliver an address in Perth to the American Chamber of Commerce. The title for the speech is intriguing: “The Next Chapter”. But there are no further details as yet.

Overseas: the US Federal Reserve Open Market Committee (FOMC) meets

- A highlight of the offshore diary in the coming week is the latest policy decision from the US Federal Reserve. There are also some housing indicators to watch. And in China, the only data of note covers home prices.

- In fact the Chinese data on home prices kicks off the week on Monday. Home prices are starting to flatten and the annual growth rate eased to 9.7 per cent in August.

- In the US, the week kicks off on Monday with the July data on capital flows and foreign buying of equity and bond securities.

- Also issued on Monday is the September sentiment gauge on the home building sector from the National Association of Home Builders (NAHB). The qualitative housing market index is not far off the best levels in 12 years.

- The Federal Reserve begins its 2-day meeting on Tuesday with the decision announced at 4am Sydney time on Thursday morning. While no interest rate increase is expected, the policymakers are expected to release details of the plan to reduce the central bank’s $4.5 trillion stock of bond and other assets.

- Also on Tuesday, two of the key measures of inflation are released in the US – the August data on import and export prices. Import prices are tipped to have lifted 0.2 per cent in the month.

- The usual weekly data on chain store sales is also issued on Tuesday.

- On Wednesday the existing home sales data for August is issued (a small 1 per cent lift in sales is expected) as well as the weekly data on housing finance.

- On Thursday the influential Philadelphia Federal Reserve survey results are released together with the leading index and the Federal Housing Finance Agency measure of home prices. Home prices are up 6.5 per cent over the year to June.

- The normal weekly data on claims for unemployment insurance is issued on Thursday.

- And on Friday, Markit releases ‘flash’ estimates on manufacturing and services sector activity in the US and Europe

Craig James is the chief economist at CommSec.

Readings and viewings

As Eureka Report turns the focus to women’s superannuation in Australia this week, lawyers fighting for women in Silicon Valley claim: “It’s far worse than people know”. We’re only hearing about the tip of the iceberg, with 95 per cent of these sexual harassment cases settled behind closed doors. Google is the latest to make the news for the wrong reasons.

Cybersecurity pioneer John McAfee keeps defending cryptocurrency after JPMorgan Chase CEO Jamie Dimon called out bitcoin for being fraudulent. Either way bitcoin took a fall on Thursday after BTC China announced that it will close its operations by the end of September.

That’s it – the UN’s had it. The UN is calling for a new ‘New Deal’ and thinks the world needs a “21st century makeover”.

If the UN’s new pet hate is neo-liberalism, Ireland might have a remedy. The latest Irish Federal Budget is anchored on tax cuts for the middle class. Things aren’t looking so great in India, where the economy is facing “serious downside risks” and the slowdown is looking likely to accelerate.

Australian new dwelling sales continue to decline, but it’s nothing compared to a nationwide slump of 20 per cent in New Zealand house sales just for the month of August.

The President of the European Commission, Jean-Claude Juncker, claims Brexit will cost Britain its international status. Meanwhile, the British pound climbed to its highest level this year on the Bank of England hinting at increasing interest rates in the coming months.

Looks like the pound is appreciating before our eyes. Bibliophiles are going crazy for new £10 Jane Austen notes released on Thursday – people are already selling them for £20 on eBay.

Goldman Sachs can smell the money. The investment bank is certainly optimistic about the UK, planning to expand its Marcus by Goldman Sachs brand over there from mid-2018.

The Brits are putting the handbrakes on another bastion of wealth however – the Murdoch empire. UK culture secretary, Karen Bradley is concerned about Rupert’s “genuine commitment to broadcasting standards”.

Tensions are escalating between the US and the UK over whether to tear up the Iran nuclear deal.

South Africa’s richest man, Johann Rupert, has called out President Jacob Zuma’s ‘radical economic transformation’ as nothing more than theft.

As South Africa tries to stake its claim, Qatar is trying to muscle up against its neighbours too. Moody’s has estimated Qatar Central Bank spent $38.5 billion – the equivalent of 23 per cent GDP – to support the economy during the first two months of the Gulf crisis.

The difference between amateurs and professionals.

Maybe Harvey Norman could get a few tips from this on how to sell a washing machine?

Have a good weekend.

Back to Top