Beware of fixed income pitfalls

Most of the last five years have seen unconventional, aggressive monetary policy destroy the traditional trade-off between risk and return of traditional asset classes as low interest rates have dictated investment themes.

Fixed interest has felt the force of quantitative easing, pushing investors to either take more risk for a higher return or completely abandon the asset class. Domestically, we haven’t seen an exodus of bank deposits as investors are still content rolling over term deposits even though deposit rates only just scrape 4 per cent. After inflation adjustments, there isn’t much left over.

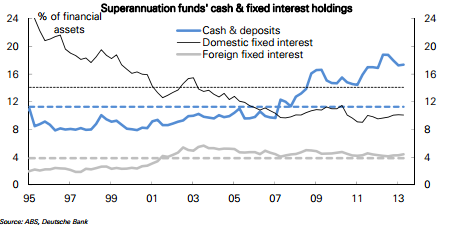

Lower interest rates ultimately force investors to either accept the lower rates or look elsewhere for the desired return. As a per cent of assets within a self-managed fund, cash is climbing higher while fixed interest has concurrently tapered off. Surprisingly, lower cash rates and long term interest rates aren’t driving investment decisions. The net effect of this is an undesirable lower return on funds.

Fresh expectations that incoming Fed chair Janet Yellen will continue with quantitative easing for the foreseeable future means traditional fixed income choices continue to be fragmented. For now, long term interest rates will remain artificially depressed and the search for a return on relative safe investments is colliding with what real rates of return are actually available.

For self-funded retirees where fixed income likely makes up a meaningful exposure within the portfolio is the increasing difficulty to get a return commensurate with the risk assumed, after inflation. This means looking outside of what was once considered traditional investment options.

The problem with looking at alternative offerings across fixed income investments can be the difficulty in deciphering the finer points of such products. Consequently, investors can easily be left unaware of how such investments will respond to movements in interest rates.

Domestically, short term rates will be determined by the Reserve Bank of Australia while longer rates will be determined by the direction of the 10-year US Treasury yield. The reality is Treasury yields are hostage to Yellen and the final decision of the Federal Reserve on when quantitative easing is to be wound back. Unfortunately the question remains when, making ordinary fixed interest investments complicated decisions.

It is important for investors to remember when interest rates rise the price of traditional fixed income investments falls. When making investment decisions, particularly in a diversified fixed income offering, it is critical to understand the strategy being taken to avoid any surprise if the capital value of the investment is impaired.