Betfair gets its day in the sun

Betfair reported good half-year results in December. Steve Johnson discusses the current business model, the proposed growth opportunities and why he believes this is a good business to own....

“There are few sunny days in the life of a CFO. But this is one of those days”. Betfair Chief Financial Officer Alexander Gersh was obviously happy with himself upon release of the company's half-year results in December. Those in attendance laughed and investors in the business agreed, sending the company's shares up 8% on the day.

Betfair has also been a bright spot in an otherwise not so sunny half for the International Fund. Previously undisclosed, the Fund bought shares in August at an average price of ₤10.43 per share. By year end, the price had risen 51% to ₤15.72 (it's since fallen back a bit), and represented roughly 4% of the Fund at the end of the year.

The value on offer today is less obvious. But it's still pretty good value. Below we share the thought process behind the investment.

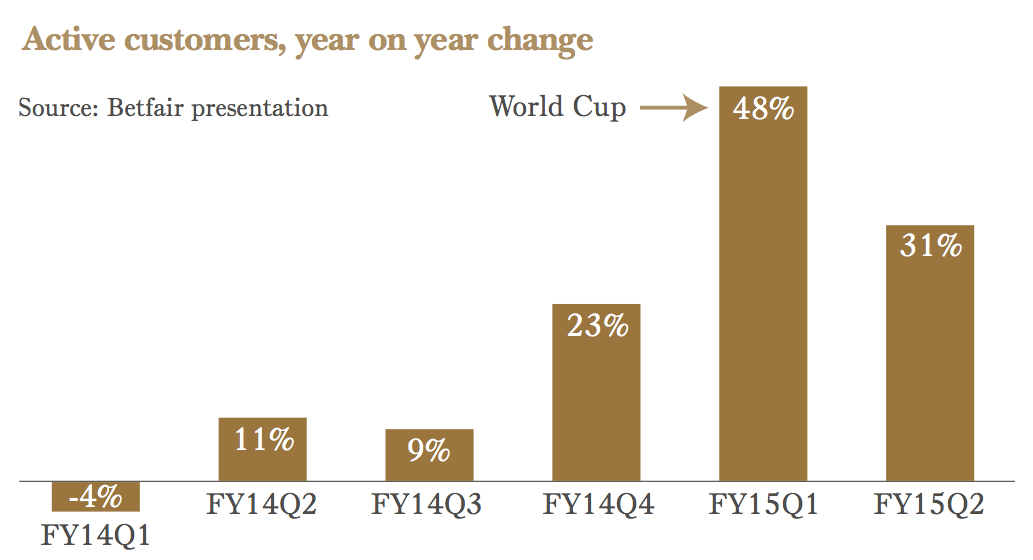

Helped by the soccer World Cup and a favourable run of luck, the half yearly result reported on Gersh's sunny day showed an increase in sales and operating profit of 26% and 51% respectively. But it's not just the profits that have him salivating. Not long after their appointment in 2012, he and CEO Brett Corcoran presented a new strategy for the struggling company. The latest results provide ample evidence that it is being executed brilliantly and, importantly, profitably.

This online gambling company has always had a unique business model and a very significant moat. Like other bookmakers, online and offline, it offers punters the ability to bet on horse racing, sports and anything else they think there will be a market for. The difference is that Betfair doesn't take any of the risk.

It operates an exchange – similar to a stockmarket – that allows two punters to bet with each other. Whereas a traditional bookmaker needs to earn a 'risk margin', to compensate it for potential losses, Betfair provides a platform for two people who want to take opposing sides of a bet and takes a percentage of the winner's profit. Traditional bookmakers typically require a margin of approximately 10%. Betfair's take averages 3.7%, meaning the punters are getting significantly better value.

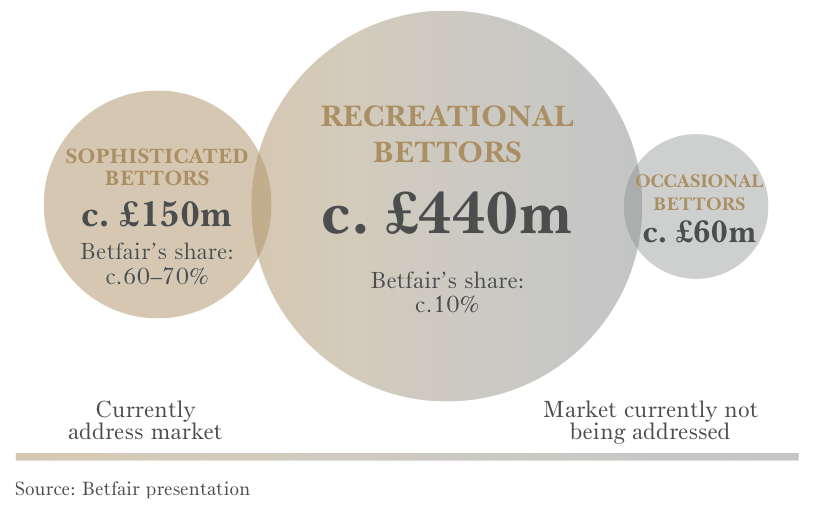

These better prices attracted a significant number of customers from the day Betfair was founded in 2000. For those who earn a living from gambling and are very price sensitive, using the exchange is a no-brainer. In a recent presentation using 2011 data, Betfair estimated it had 60–70% of the total UK market for 'sophisticated bettors'.

The bigger an exchange is the better. The one downside of the model is that, on small or obscure events, there is often not enough liquidity for punters to bet the volumes they would like. An astute merger with the only other player of note in 2001 gave Betfair significant first mover advantages and it is now the world's largest exchange with an estimated market share in excess of 90%. Liquidity is so important that this position is essentially unassailable.

Ten years of rapid growth led to the company listing on the London Stock Exchange at £13 a share. The fact that it is now turning up in a value investor's portfolio should suggest to you that something went wrong from there. Indeed, it took more than four years for the stock to trade at its listing price again.

Betfair's post-listing problems fell into two broad categories. The first was regulatory. Betfair is a controversial business. Some of the controversy is effective propaganda from the threatened established players, some of it legitimate. The ability for people to short, or bet against something, makes it more susceptible to corruption and match fixing – it's much easier to rig a loser than a winner. Betfair has always claimed it is not a bookmaker, so hadn't been paying some taxes and industry fees. And the whole business model has been unwelcome in some countries. There's been a crack down in Australia, Spain, Cyprus, Greece and Germany, forcing it to leave some markets and pay a lot more tax in others (Germany, for example, introduced a 5% tax on turnover, wiping out all of Betfair's profit and forcing it to leave the market).

Secondly, the guys who founded and grew the business in the early days were not the right ones to run a large listed company. Betfair made £39m of profit on £300m of revenue in 2009. Even on an underlying basis, it was £30m of profit on almost £400m of revenue in 2013. This should, in theory, be a business where marginal revenue falls straight to the bottom line, but it was being run by entrepreneurs without much concern for the cost base.

The share price fell below £6 in 2011 and was still trading at less than £8 in 2012 when Corcoran and Gersh were parachuted in and tasked with planning the company's turnaround. The strategy presented to market in early 2013 contained three key elements: run the business more efficiently; focus exclusively on markets with regulatory certainty; and seek growth in the market for recreational punters.

The first two prongs were obvious and relatively easy to execute on but it was the third that really piqued our interest.

Taking cost out makes the business more profitable and focusing on well regulated markets makes it more reliable. Even though the share price had been beaten up, growth was still necessary to justify the share price. And, with up to 70% market share among its key clients – those sophisticated bettors – and regulatory risk causing the company to withdraw from a number of international markets, it wasn't obvious where that growth was going to come from.

Which is why cracking the market for recreational punters – three times as large as that for sophisticated bettors – is so important. The recreational punters (Betfair wouldn't say it but we can – mug punters) are not price sensitive and they find the Betfair exchange model complicated and confusing. Betfair's market share here was only 10% in the UK, according to its own estimates.

Its plan for increasing that market share involves taking the benefits of the exchange model and packaging them in a user-friendly way that the mug punter can understand. The new interface looks like any other bookmaker's interface and Betfair is actually running a traditional bookmaking operation offering fixed price odds.

But it uses its unique exchange to offer features such as “Price Rush” and “Cash Out”. The first involves providing the benefits of better prices by giving punters a bonus higher price at the time they place their bet (seamlessly matched on the exchange). The second allows them to cash in a bet that is in the money prior to the event finishing. For example, a bet on Manchester United before a game starts is going to be in the money if the team is leading 2–0 at half time. Cash Out allows the bettor to take their money and run if they think the situation is at risk of reversal. The simplified product is much easier to market to mug punters, while retaining the benefits of the exchange and leading to higher retention and higher turnover.

That's the theory and it seems to be playing out in practice. In the second quarter of its financial year, the number of active customers was 31% higher than a year earlier and retention rates were improved.

If the plan keeps working there is plenty of room to grow. That's why the CFO is so excited and why we bought the stock.

His and our enthusiasm should be tempered. While gambling is a resilient and growing industry, governments always have their hands out for a larger share of the spoils. The UK's new 15% point-of-consumption tax, introduced on the 1st of December, will have a significant negative impact on Betair's profitability.

The company still generates 20% of its revenue from unregulated markets and, given they don't spend any money on this part of the business, it is presumably more profitable than the rest of Betfair's revenue. In the UK, like Australia, competition for new mug punters is fierce. And, of course, there's that 51% share price rise since the Fund's initial purchase. But the Betfair model is unique, hard to replicate and difficult to compete with. Our bet is that there are plenty of sunny days ahead for Gersh and his shareholders.

Prices correct as at 31 December 2014.

The article is an extract from Forager's December quarterly report. Download the full report or register your email address to receive it in your inbox every three months.