Battered South32 could be a winner from Glencore's meltdown

Summary: Glencore, under pressure to service its debts, is cutting production. This has a beneficial effect for South32, although building confidence in this business will take time. Prices of its principal commodities have fallen since listing, although the company's light debt load gives it a competitive advantage. |

Key take-out: Investors dumped South32 shares in the weeks after it listed but since have been slowly warming to the company. |

Key beneficiaries: General investors. Category: Mining stocks. |

Glencore's crisis could not have come at a better time for South32, the BHP Billiton spin-off which has so far failed to inspire investors.

While there are only a few commodities where the two big mining companies overlap there is one critical difference between the troubled Swiss-British Glencore and the Australian-South African South32 – debt.

Glencore has it by the bucket load. South32 is debt light.

What's happening at Glencore is a classic example of why mine managers have traditionally preferred equity as a funding tool, avoiding debt and its inescapable servicing requirements whereas dividends on equity can be stopped, even if it annoys shareholders.

Pressure to service its debts, estimated to be as high as $US50 billion if you include short-term loans to fund commodity trading, has forced Glencore to make dramatic changes to ensure its survival, including a fresh capital raising and a series of mine closures and production cutbacks.

It's the cutbacks which have galvanised the mining world because removing excess material from over-supplied markets is often the first step to a recovery in commodity prices.

Over the past three months Glencore has been the leader in cutting production, first removing some of its coal output, then copper, and last week, zinc. Speculation is rife that nickel will be the next division to be trimmed.

For South32, the focus of this article which is not investment advice of the sort that can only come from your licensed adviser, the removal of some coal and zinc by Glencore does have a beneficial effect, as will nickel, if that step is taken.

But, building confidence in a business built on the discards of BHP Billiton will take time, especially after a dreadful start which saw South32 pitched into a worldwide commodity-price crunch and investor flight from risk.

Almost from the day trading started in South32 on May 18, a business in which all BHP Billiton shareholders were issued shares on a one-for-one basis, the prices of its principal commodities have fallen.

Zinc, one of the most easily measurable of South32's portfolio of products thanks to its trading on the London Metal Exchange, was selling for $US1.08 a pound when the new company listed, but fell rapidly to hit a five-year low of $US74c/lb in mid-August, a 31 per cent drop in three months.

Since Glencore announced its zinc production cutbacks totalling 500,000 tonnes a year at mines in Queensland and Peru the zinc price has recovered to US81c/lb with the missing material likely to help flip the global zinc market from a surplus of annual supply to an annual deficit from next year, a change needed to eat into substantial stockpiles.

The problems at Glencore and other miners with heavy debt loads have provided South32 with a competitive advantage. Analysts at investment bank Goldman Sachs estimate that South32's total debt (including environmental clean-up provisions) stands at $US2.4bn.

According to Goldman Sachs South32 only has to generate $US600 million a year to maintain its investment grade credit rating, a relatively easy job as even at recent low metal prices it is generating $US800m a year.

Investors, after dumping South32 shares in the weeks after it listed, have been slowly warming to the company, even if one of its appeals is that looks to be the best of a bad lot.

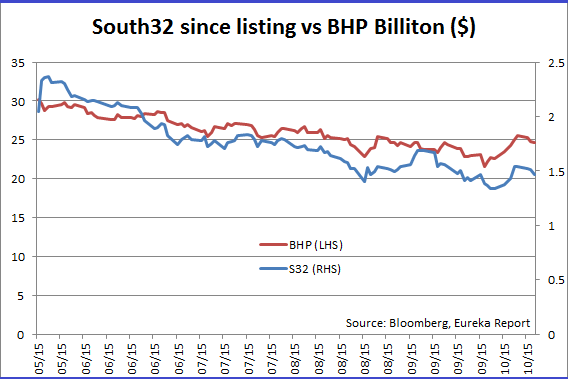

Since October 2, when South32 shares hit an all-time low of $1.33, the stock has reclaimed lost ground to trade around $1.50, though to put that recovery into perspective it is still down 38 per cent from the peak of $2.45 reached on May 21, just four days after listing.

Over the same time the share price of South32's parent, BHP Billiton, has fallen by 19 per cent, exactly half the decline of its spin-off, a substantial variation that probably reflects the higher quality assets retained by BHP Billiton and its more generous dividend policy.

Rio Tinto, which lacks BHP Billiton's exposure to oil, has seen its share price hold up reasonably well, shedding just 8.5 per cent since South32's listing day.

Having been sold off by investors unimpressed by South32 since it was launched into the commodity crash there are signs emerging of a recovery, albeit one partly driven by the misfortune of other companies forced to make production cuts.

The next few weeks could be a turning point for South32 which has deliberately maintained a low profile with the investment community while internal structures are refined.

However, the inaugural annual meeting in Perth on November 18 is a date when South32's management will be expected to reveal more about how its business units are performing as well as plans for the future.

What worries investors about South32 are its exposure to weak commodity prices and exposure to high-cost electricity contracts in South Africa where it has a number of business units producing aluminium, manganese and coal.

Some investment banks also argue that South32 could also be forced to make production cuts, especially in its manganese, nickel and coal operations.

What interests investors is the potential for South32 to use its strong balance sheet to acquire high-quality assets likely to be sold by financially distressed rivals, and the possibility of a capital management program, such as a share buy-back.

The consensus view is that the stock has been over-sold in the rush by investors to quit companies exposed to the most severe downturn in metal prices for decades.

Macquarie has an outperform rating on South32 thanks to its strong cash flows even at a depressed time in the metals market.

“However, at spot (short-term) prices three of its core operations are loss-making (South African manganese, Colombian nickel and Australian coal) and we believe production cuts could occur if commodity prices remain weak,” Macquarie said.

Deutsche Bank also rates South32 as a buy, a view based largely on the sharp fall in the stock's price which has shifted it into value territory.

Goldman Sachs also has a positive view of the stock, partly because it is not exposed to iron ore like its parent, BHP Billiton, but also because it offers limited commodity-price risk with the stock's “under-performance coming to an end”.