Australia's on track for a decade of deficits

Structural changes in the economy are likely to leave governments across Australia facing budget deficits of around 4 per cent of GDP for at least the next decade, according to research released today.

The Grattan Institute paper, Budget pressures on Australian governments, suggests it could be a long time before Australian governments post a collective surplus.

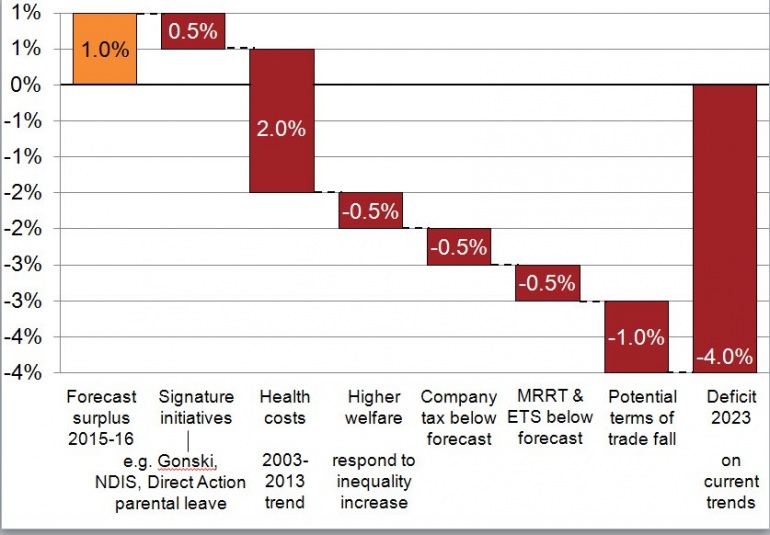

While the budgets of the Commonwealth and the states are forecast to be close to balanced within the next few years, our research shows flagging revenues and continued spending pressures have put them on track to post annual deficits of around 4 per cent of GDP within a decade.

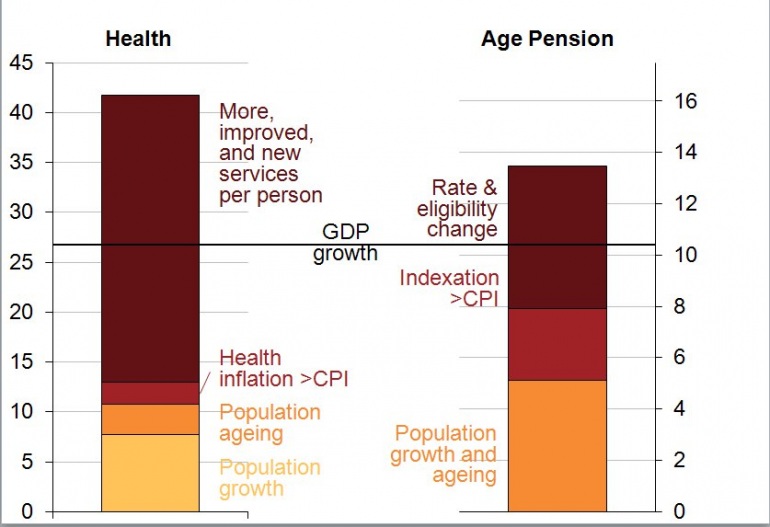

The greatest pressure comes from sustained increases in health spending. Over the past decade, in real terms, governments spent an additional $43 billion on health. At this rate, government spending on health will rise by 2 per cent of GDP over the next decade. Contrary to popular belief, this is not primarily because of the ageing population but is driven by changes to the practice of medicine. Australians of all ages are seeing doctors more often, having more tests and operations, and taking more prescription drugs. They are living longer, better lives, but someone has to pay for it.

Spending on school education also rose substantially in real terms, although to date it has done little to improve student performance. Welfare expenditure grew more slowly, but only because of low unemployment and slow growth in benefits for Newstart, Youth Allowance and parenting payments. The other three large categories of welfare spending – aged and disability pensions and family support – all grew by around 50 per cent in real terms over the last decade.

As with health, demography is not the major driver of increased aged pension spending. Most of the growth above GDP resulted from government policy choices to increase pension benefits.

Real increases in government spending 2003 to 2013 (2013 $ billions)

If these trends continue, they will increase welfare expenditures by another 0.5 per cent of GDP. Welfare spending could also grow if the end of the mining boom brings an increase in inequality and an end to rising real incomes. Overseas these have led to increased pressure for welfare payments.

Increases in costs are not the only pressures on government budgets. Underlying revenues are weaker than they seem. Company and mining taxes, and carbon price revenues are likely to be 1 per cent of GDP – or $15 billion a year – less than current forecasts. Current revenues are also inflated by the mining boom and Australia’s high terms of trade. If, as many predict, minerals prices fall, revenues will fall by another 1 per cent of GDP.

Finally, the federal government and opposition have both raised expectations of substantial new expenditures on the National Disability Insurance Scheme, schools, additional paid parental leave, and carbon Direct Action, among other policies. Even a subset of these could well cost 0.5 per cent of GDP.

Over the economic cycle of boom and bust, balanced budgets are much better than the alternative. Persistent government deficits incur interest payments, limit future borrowings and, as many European countries are learning, drastically reduce the capacity to fund services and programs. Deficits can make it hard for governments to spend to overcome an economic crisis, and can load a debt burden onto future generations. Given all the problems persistent deficits cause, why do they exist? Very often, the answer is politics.

Governments invariably find it hard to run a surplus, even in good times. The temptation to please voters and spend money is just too great. In Australia, voters have come to expect policies that leave no losers.

With these pressures, responsible leaders will need to find 4 per cent of GDP in savings and tax increases to balance their books by 2023. That will require governments to make savings and increase taxes to the tune of $60 billion a year in today's terms. How can they do this and is it likely?

The signs aren't good. At a forum organised by The Australian Financial Review late last week, shadow treasurer Joe Hockey — who pledged in January that a Coalition government would deliver a first-term surplus — acknowledged that such an outcome would be unlikely. Instead Hockey emphasised the importance of being prudent http://www.afr.com/p/national/hockey_hints_there_no_rush_for_surplus_NiWHbiAiuox54X0znjrYCM). “We’re not going to go down the path of austerity simply to bring the budget back to surplus because it would end up being a temporary surplus depending on how big the deficit is that we inherit," he said.

Potential deficit of Australian governments (per cent of GDP)

Smaller government is not necessarily the answer. Australian government spending as a proportion of GDP – 34 per cent – is low by OECD standards. Globally, there are big governments that run surpluses and small ones that are persistently in deficit. While increasing productivity and participation are good ideas, they are also unlikely to solve the problem.

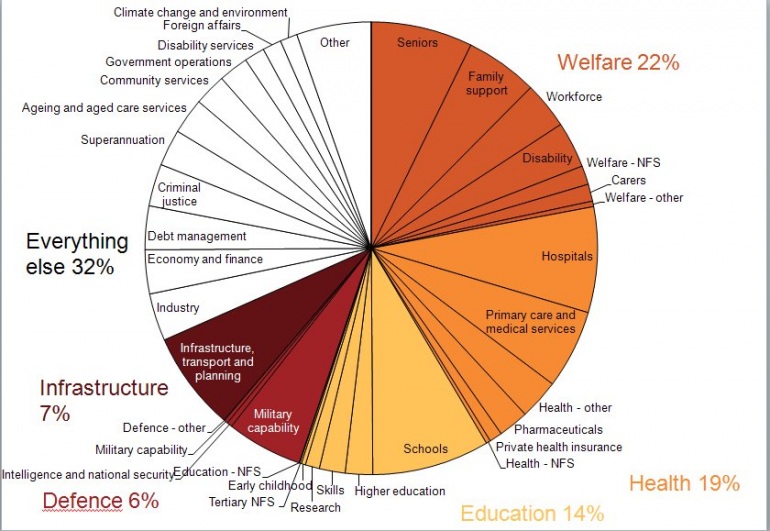

We will have to leave more options on the table. Health, education, welfare, defence and transport account for more than two thirds of government revenue.

Commonwealth, state and territory governments expenditure by policy area, 2012-13

To retrieve a budget deficit equivalent to 12 per cent of government spending, cuts to some (or all) of these areas are inevitable. We cannot afford – as the Gonski reforms are suggesting – to guarantee continued growth in education spending without searching for efficiencies. Similarly, we will need to look harder at how health services can be delivered at lower cost.

History suggests that the only way to improve budgets is through tough policy choices. That does not mean politicians have to slash and burn. But they do have to change political culture.

Over the last decade, governments have tended to ‘buy’ reform, accompanying any budget pain with a budget gain. The GST, the carbon pricing reforms, and school funding all came with promises that all but the wealthiest would be "no worse off". In a decade of rising government revenue, exceptional economic growth, and rising prices for Australian minerals, governments could afford this approach.

The future will be more difficult. Clawing back a budget deficit of 4 per cent of GDP requires that everyone bears some budget pain. Governments will have to sell this message. This will be politically difficult, but the alternative is unsustainable: budget deficits that will be even more painful to reverse in the future.

Australia’s strong economy gives our governments more options than many of their overseas counterparts. But they need to explain to the public why balanced budgets matter, for our current prosperity and that of future generations. Everyone will need to give up something. Which brave leaders will step forward?

John Daley is chief executive of The Grattan Institute.

See the full paper, Budget pressures on Australian governments here.